Peerless Tips About Pro Forma Profit

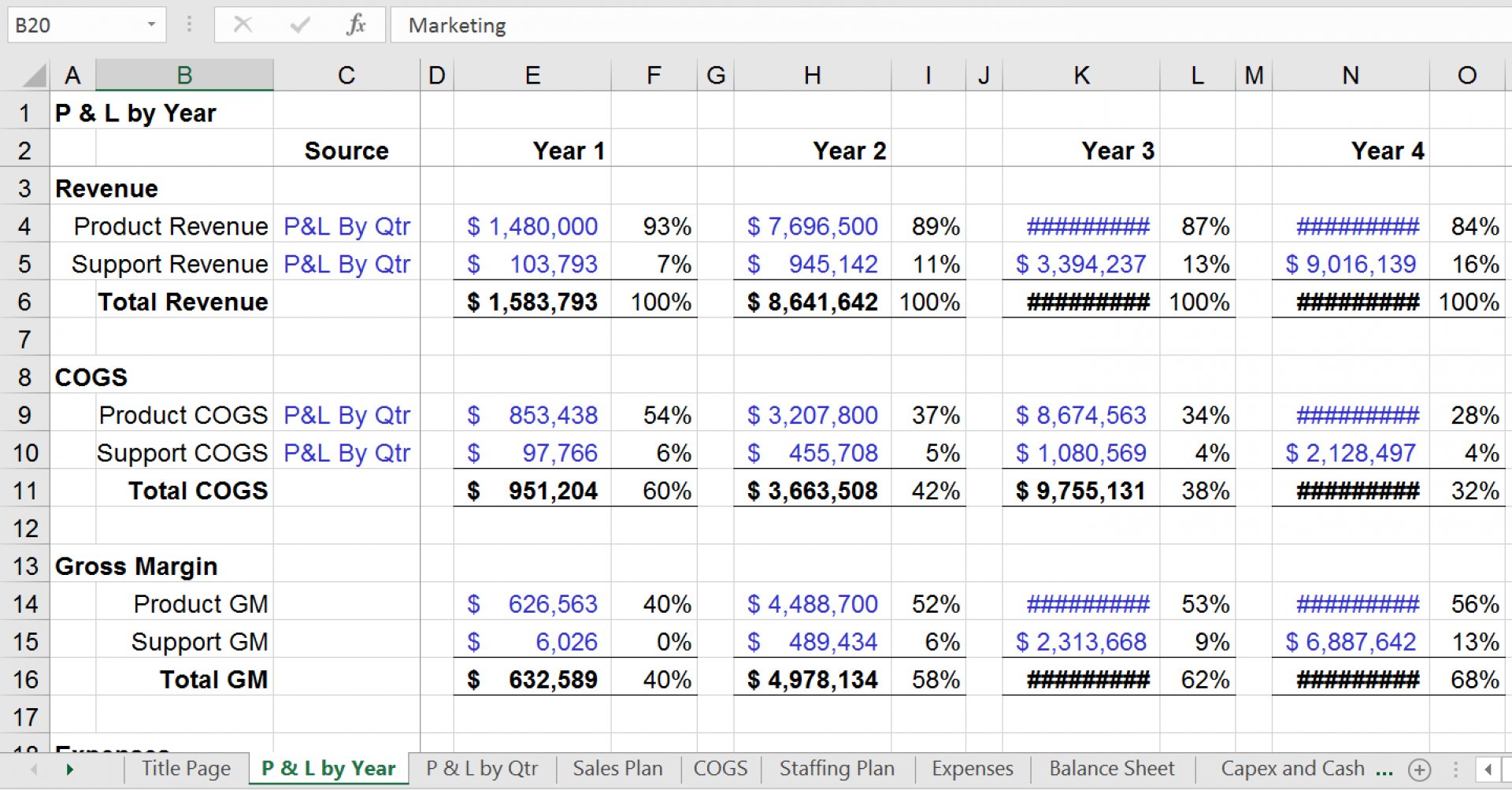

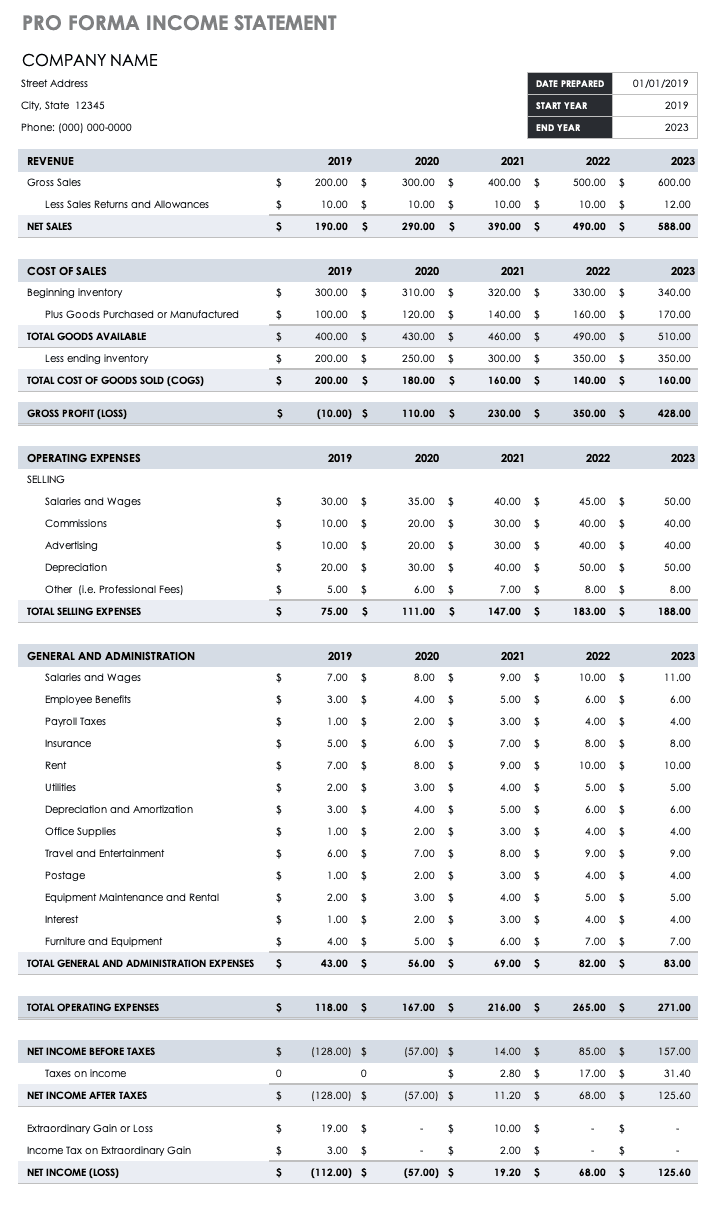

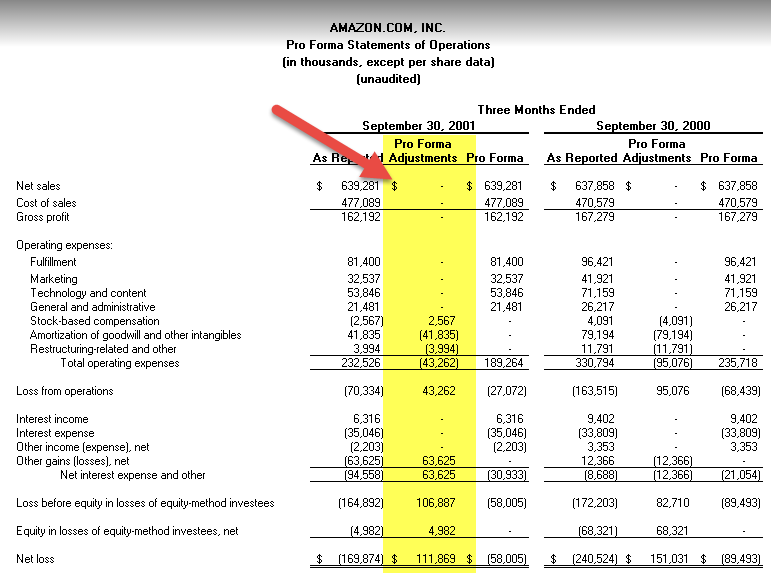

Pro forma statements look like regular statements, except they’re based on what ifs, not real financial results.

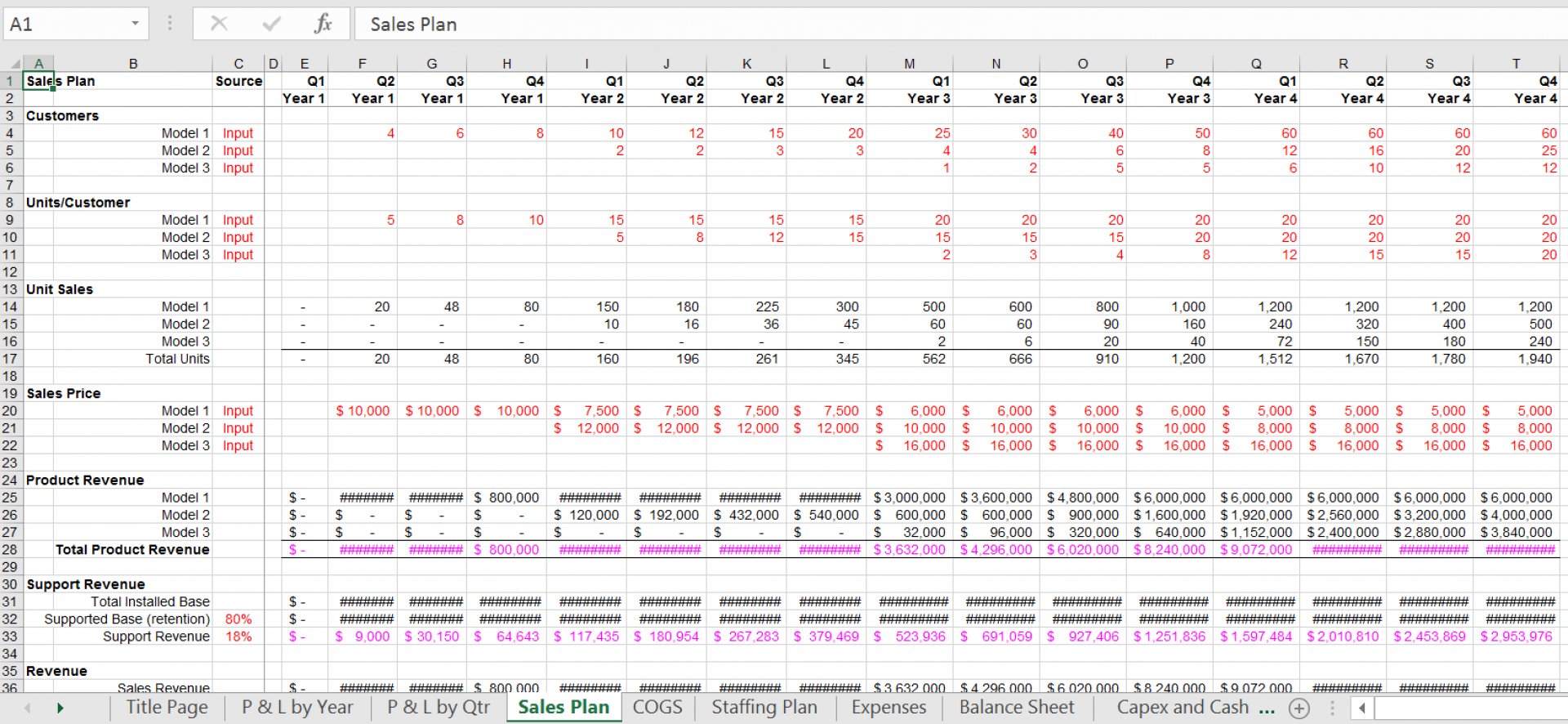

Pro forma profit. Explain the risks associated with a financial forecast. Estimate your sales revenue based on market research, pricing strategies, and sales forecasts. Pro forma financials may not be.

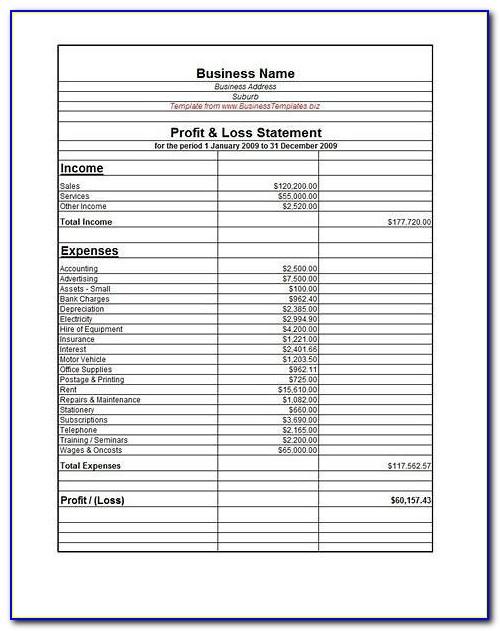

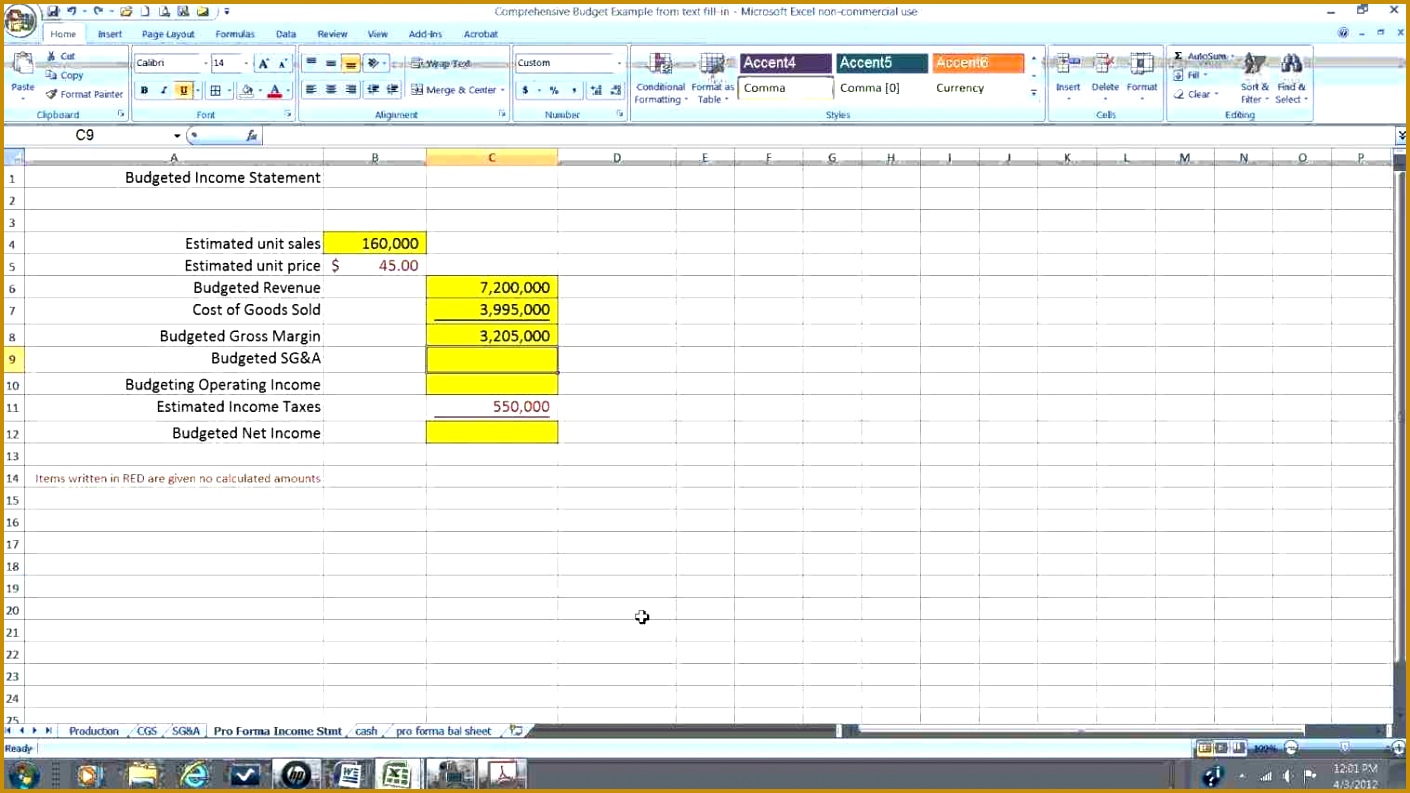

To get the pro forma gross profit: Pro forma profit after taxes is figured by subtracting the pro forma tax bill of $70,500 from the pro forma profit before taxes of $235,000. The firm may make a profit, but if it doesn’t manage the.

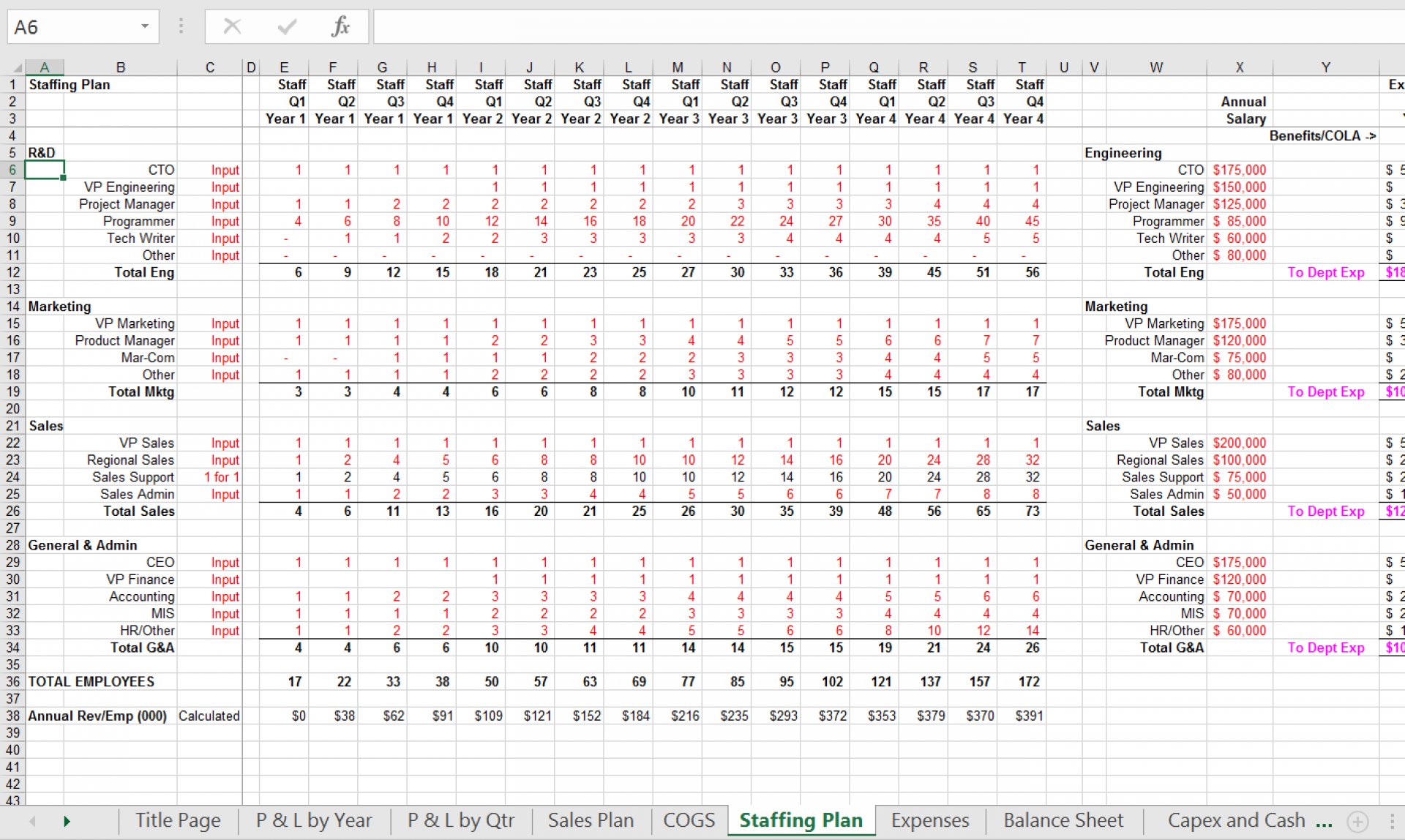

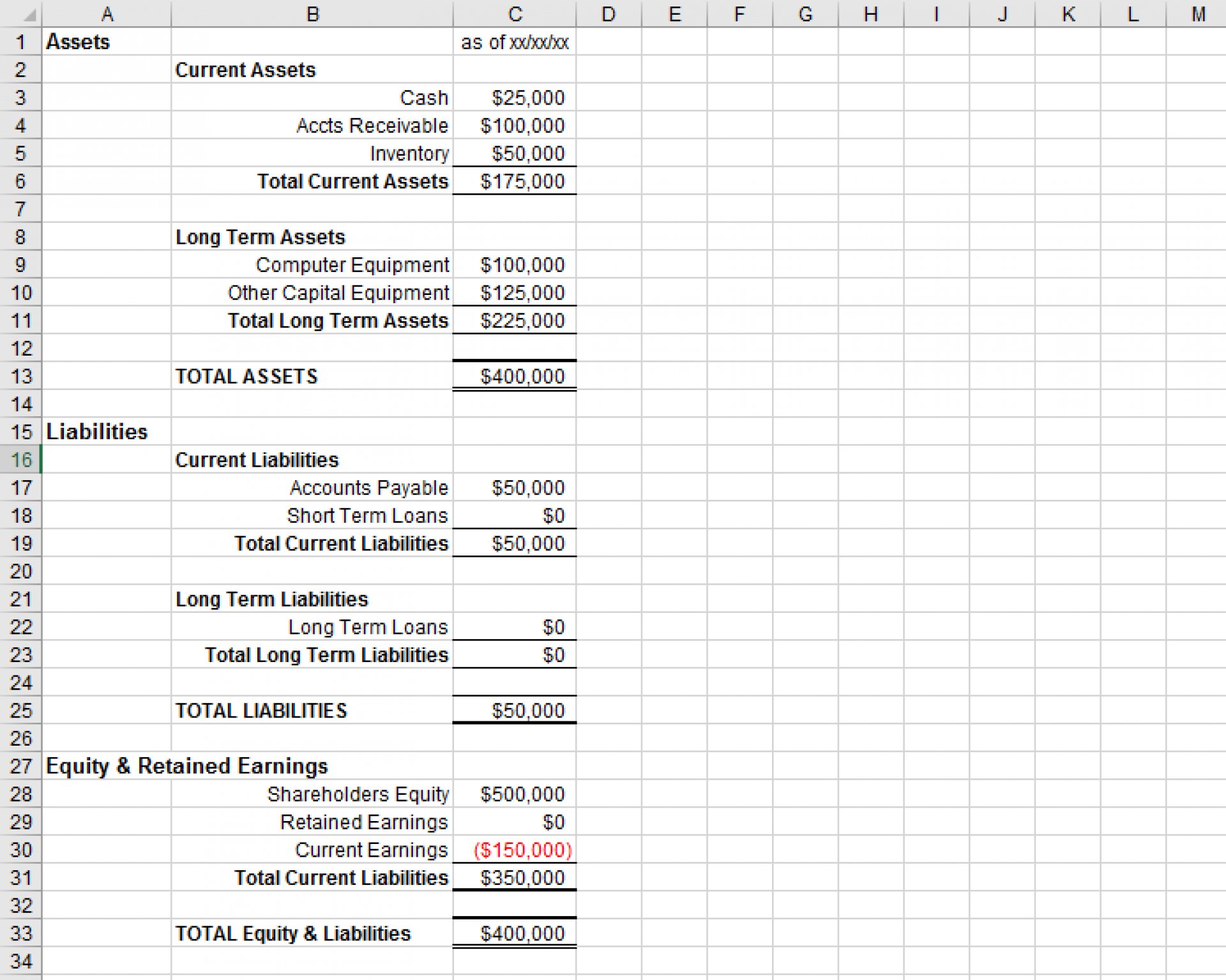

There are three major pro forma statements: The changes can include cutting costs or increasing the price of goods and services.

Definition a pro forma financial statement is a projection showing numbers that do not reflect the actual results from a company’s history. Agora, ele quer mostrar para as pessoas que estava errado. Describe the factors that impact the length of a financial forecast.

The same goes for banks—pro forma statements are often required to secure bank loans for major expansions or new businesses. Key takeaways pro forma financial statements illustrate how a company’s financial position might change in the future. Your pro forma profit after taxes, in this case, would be projected at $164,500.

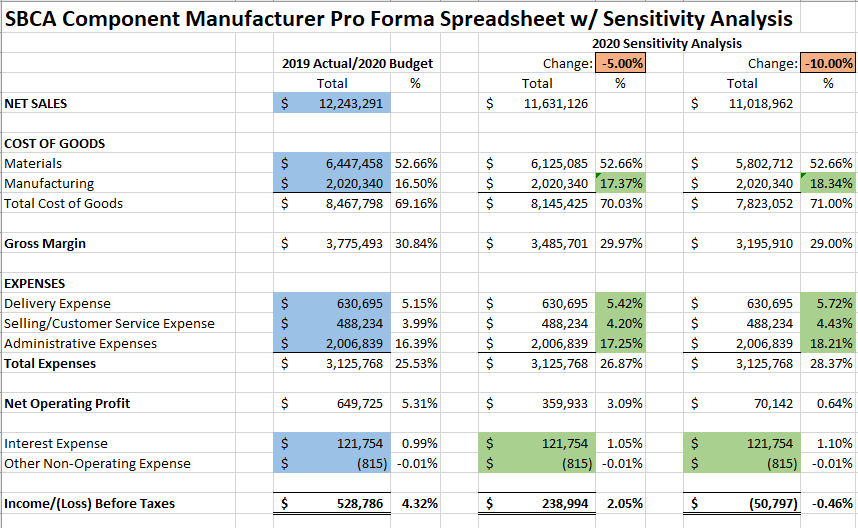

It is often used to present a hypothetical financial situation, such as a company’s earnings if a certain event such as a merger, acquisition, or new capital. La integración de songshift en apple music permitirá a los usuarios importar fácilmente sus listas de reproducción y canciones desde otros servicios de música a su biblioteca de apple music. In the event that the projected numbers show that profits are likely to drop, the pro forma statement allows a company to see the need for changes in its operations to prevent decreased profitability.

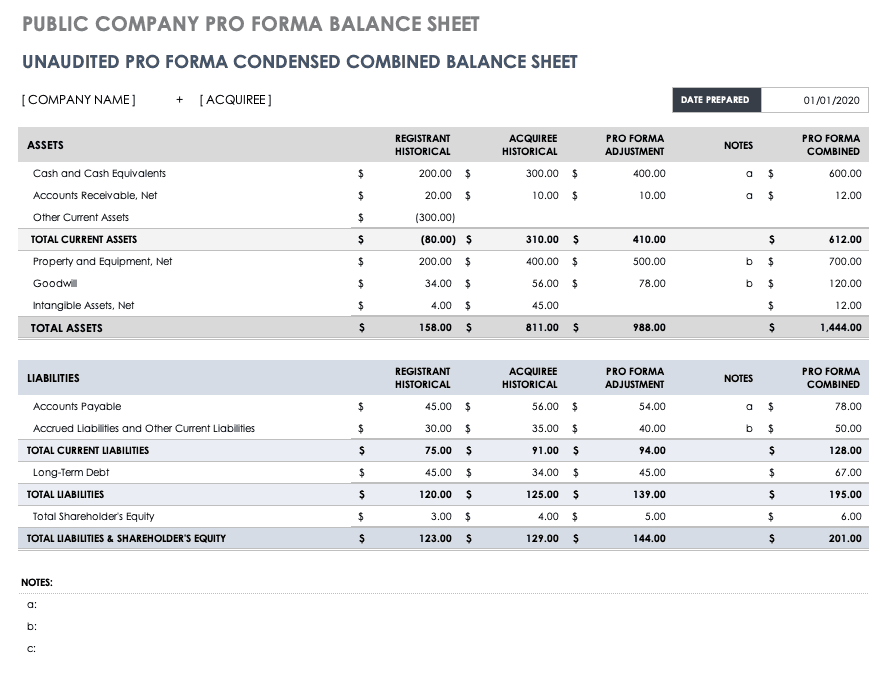

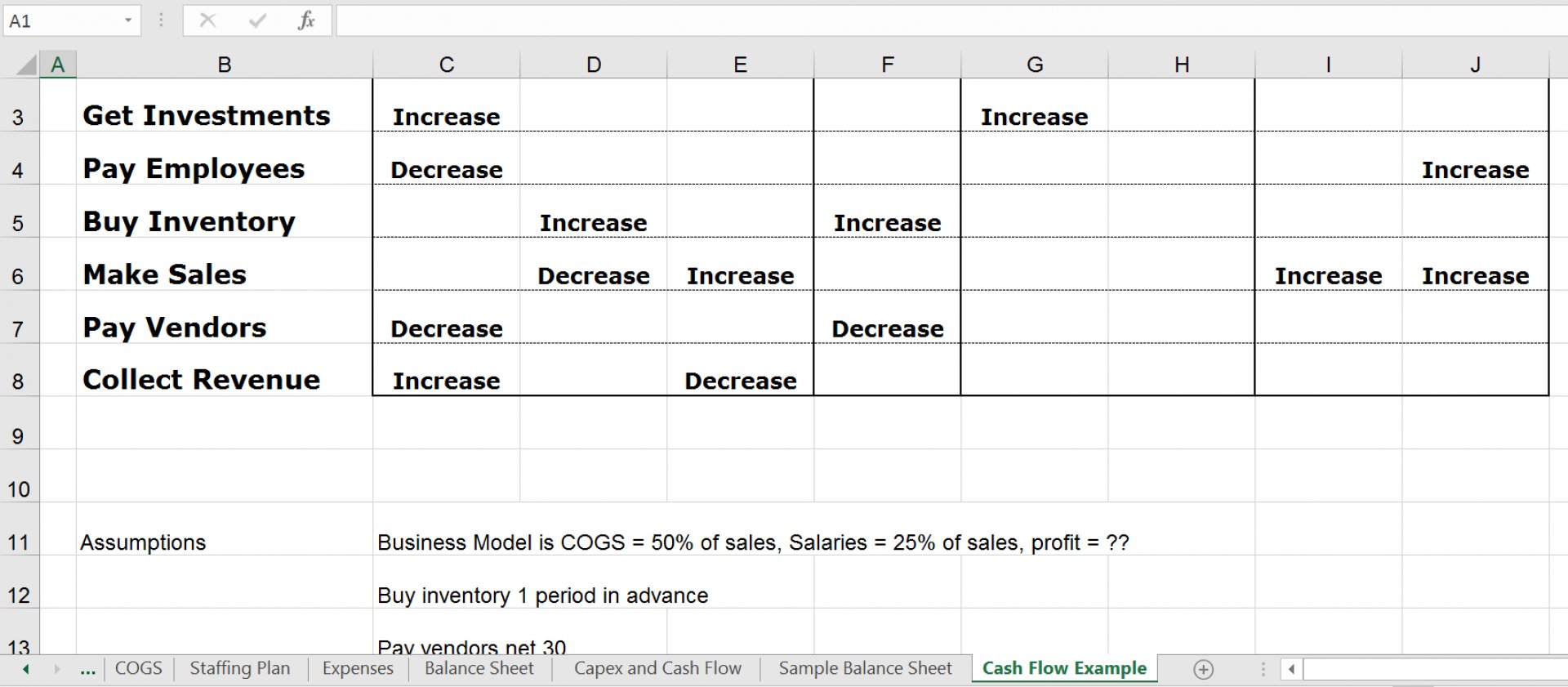

Por seis anos, leandro teve canal sobre a terra plana e acumulou cerca de 150 mil seguidores. The pro forma models the anticipated results of the transaction, with particular emphasis on the projected cash flows, net revenues and taxes. This is similar to a traditional balance sheet as it shows the accounts receivable, your cash flow statements, and other pertinent financial.

Pro forma statements can help boost investor confidence by showing you can generate healthy cash flow and pay down debt. 4 main types of pro forma statements. They can look forward or backward, revealing insights that standard financial statements simply cannot provide.

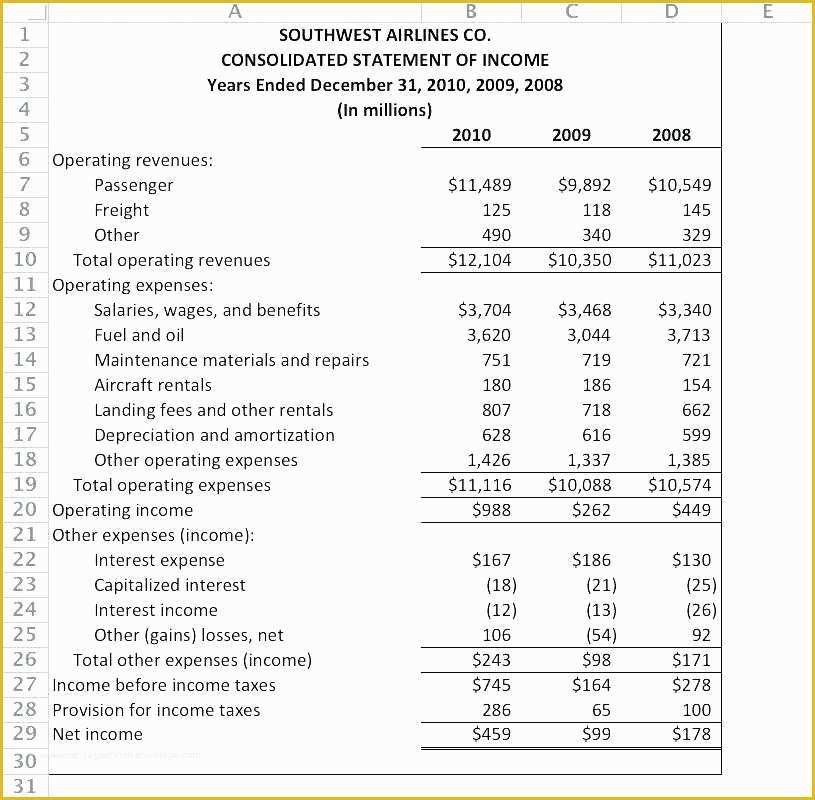

Define pro forma in the context of a financial forecast. What is a pro forma income statement? Pro forma financial statements are a common type of forecast that can be useful in these situations.

Consequently, pro forma statements summarize the projected future status of a company, based on. The same is true of profitable sales that don’t generate enough cash flows at the right time. They are used for business planning, investment decision making, and to show the potential impact of a proposed transaction on the company’s financial health.