Underrated Ideas Of Info About Ifrs Provision For Bad Debts

In some cases, often described as a specific bad debt provision.

Ifrs provision for bad debts. In fact, there are 2 approaches for doing so: Overview, calculate, and journal entries. This includes amended guidance for the.

Ias 37 outlines the accounting for provisions (liabilities of uncertain timing or amount), together with contingent assets. General approach in general approach, there are 3 stages of a financial asset and you should recognize the impairment loss depending on the stage of a financial asset in. For example, where a particular customer is known to be in financial difficulty, it may require an increased.

How are expected credit losses on trade receivables impacted? Simplified approach applicable to certain trade receivables, contract. Based on management judgment and impairment policy the impairment.

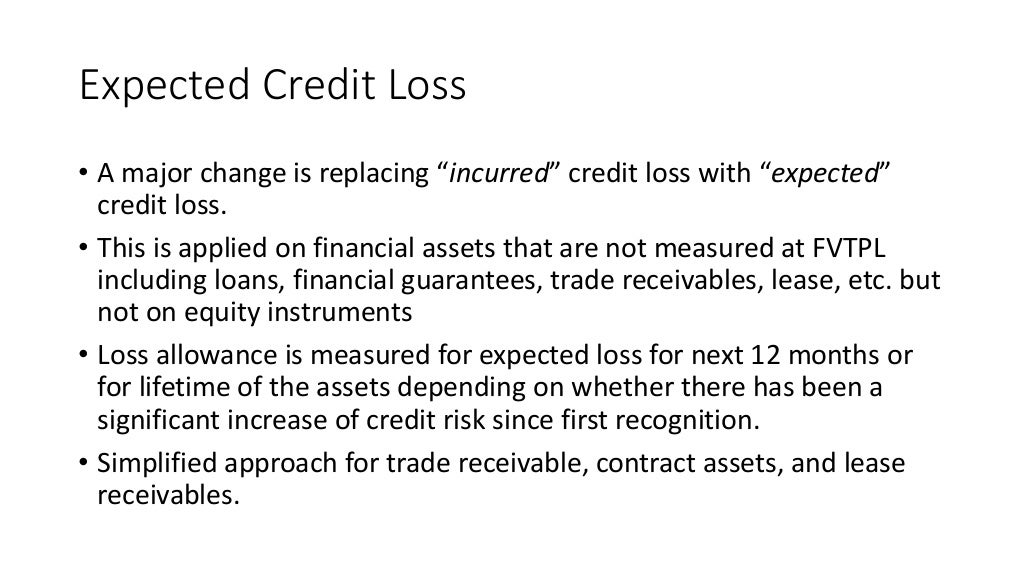

The sharp deterioration took place in the last year after delinquent commercial property debt for the six big banks nearly tripled to $9.3bn. Ifrs 9 sets out three distinctive approaches to recognising impairment: In essence, if (a) a financial asset is a simple debt instrument such as a loan, (b) the objective of the business model in which it is held is to collect its contractual.

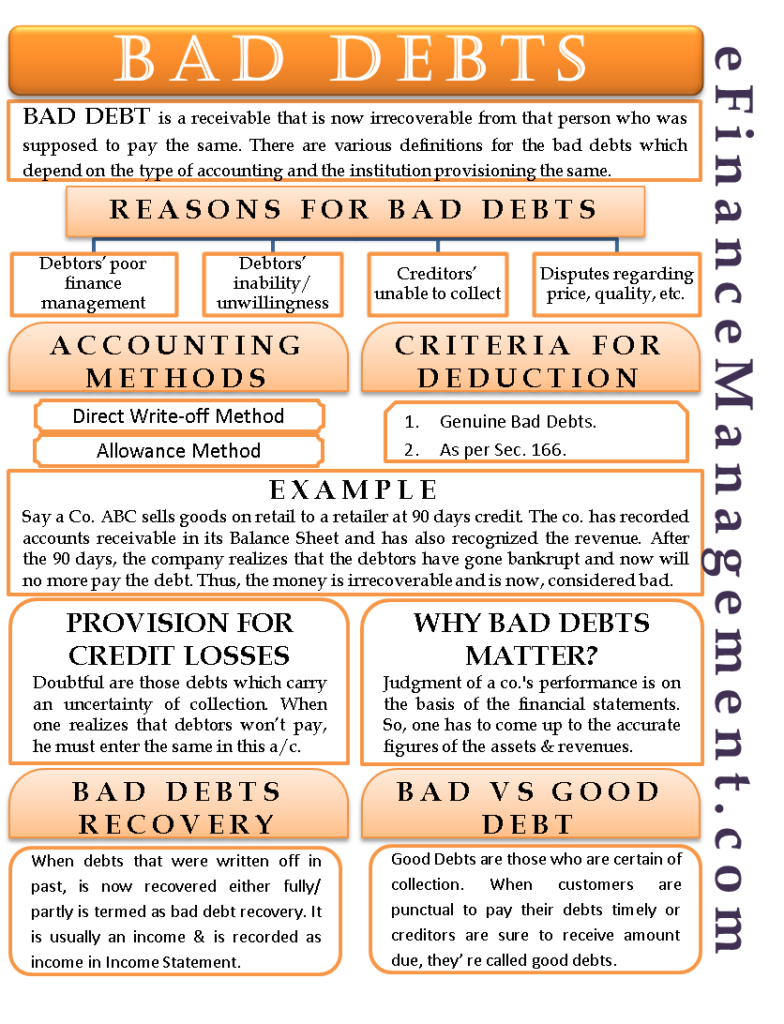

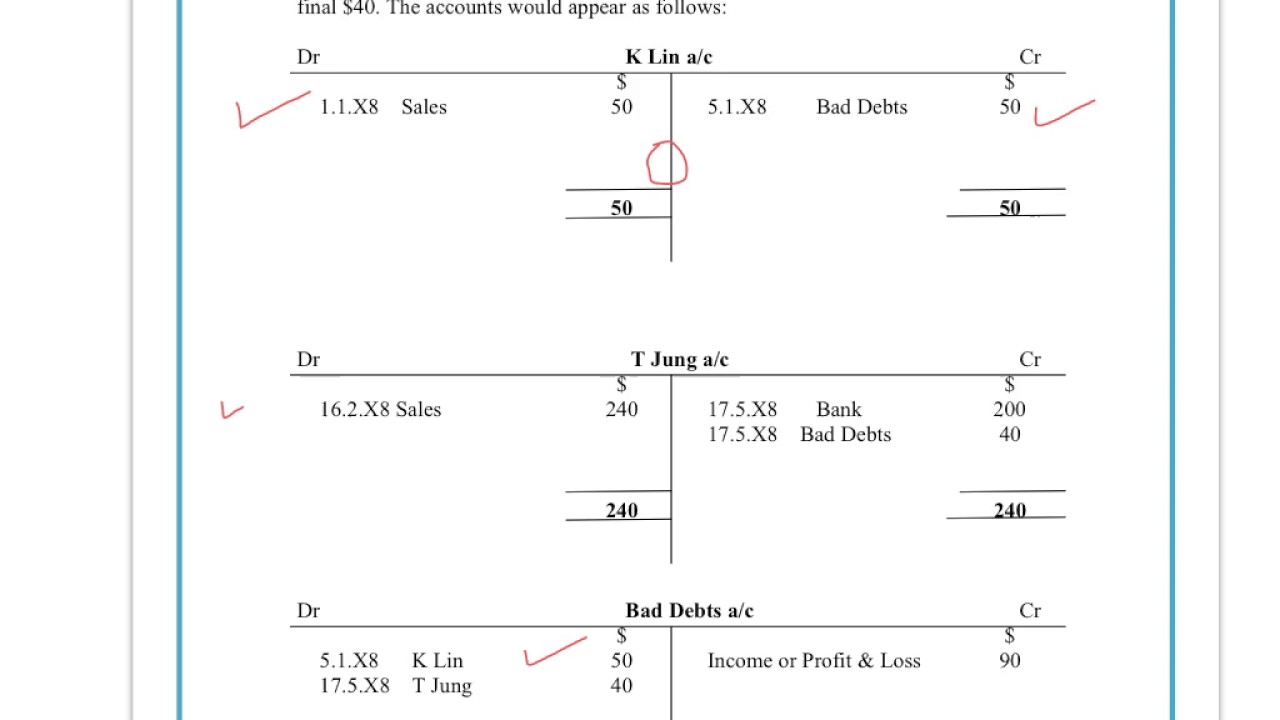

The definition for the provision for bad debts, or otherwise known as doubtful debts, is the estimated amount of bad debt that will arise from the trade receivables not. Definitions provisions and other liabilities relationship between provisions and contingent liabilities recognition provisions contingent liabilities contingent assets. Bad debt allowance is then calculated as:

The provision for bad debts is now, in effect, governed by ias 39, financial instruments: On july 24, 2014 the iasb published the complete version of ifrs 9, financial instruments, which replaces most of the guidance in ias 39. For trade receivables and contract assets with no significant financing.

This executive summary provides an. Ifrs 9 financial instruments is effective for annual periods beginning on or after 1 january 2018. Provision for bad debts is the estimated percentage of total doubtful debt that must be written off during the next year.

It is done because the amount of loss is impossible to. For trade receivables, the ecl model replaces the traditional approach of measuring bad debt provision. 24 march 2022 (updated 31 october 2023) global ifrs institute | uncertain times what’s the.

Such an estimate is called a bad debt allowance, a bad debt reserve, or a bad debt provision. Ever since the adoption of international financial reporting standards (ifrs), preparers of financial statements here in brazil, and dare i speculate in other countries. Recognition and measurement for international stream students or frs 26, financial.

As a result, abc needs to recognize bad debt provision based on provision matrix, as this simplification is permitted by ifrs 9. Ifrs 9 requires you to recognize the impairment of financial assets in the amount of expected credit loss. Any company that has a policy of selling goods on credit has to deal with the problem of bad debts.