Ideal Tips About Short Term Notes Payable On Balance Sheet

They are therefore categorized differently on the.

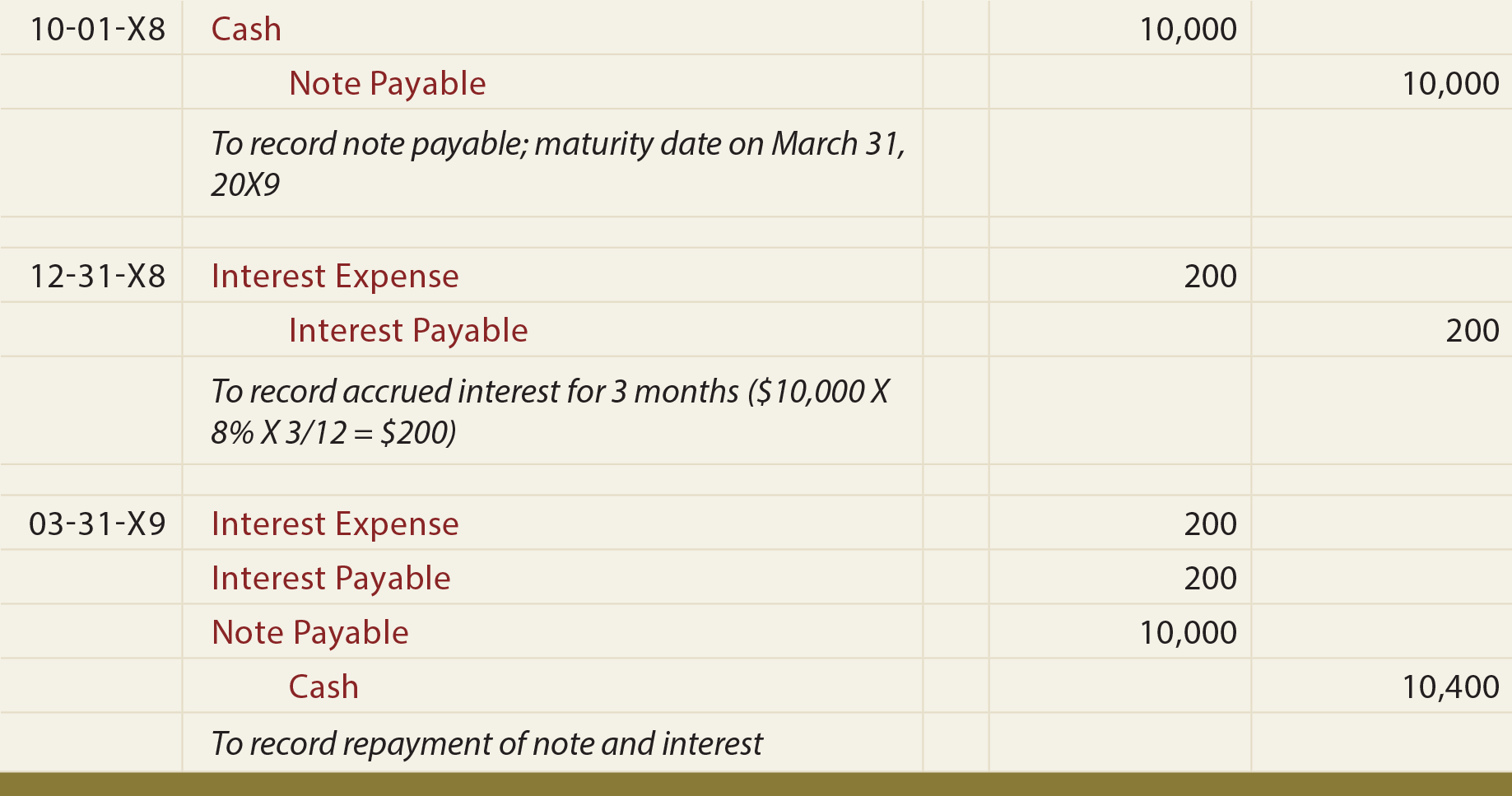

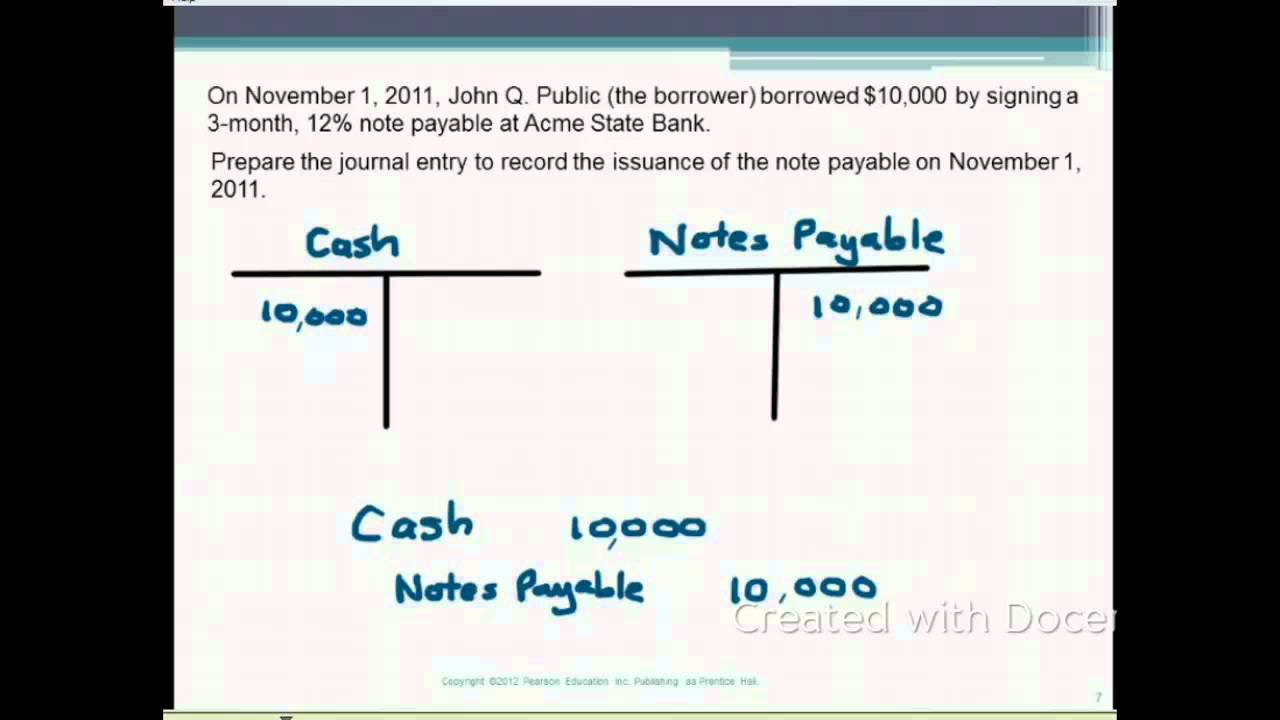

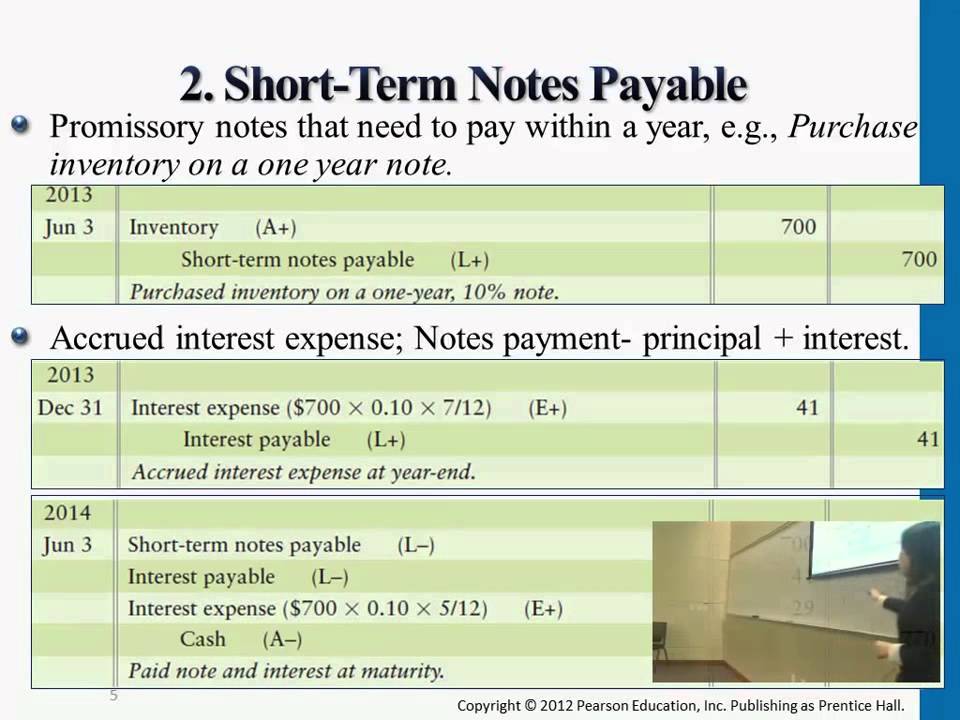

Short term notes payable on balance sheet. Some key characteristics of this written promise to pay (see. The balance in the discount on notes payable. Notes payable is a formal agreement, or promissory note, between your business and a bank, financial institution, or other lender.

There are two types of. 11.3 accounts and notes payable. 30 apr 2022 (updated 30 sep 2022) us financial statement presentation guide 11.3.

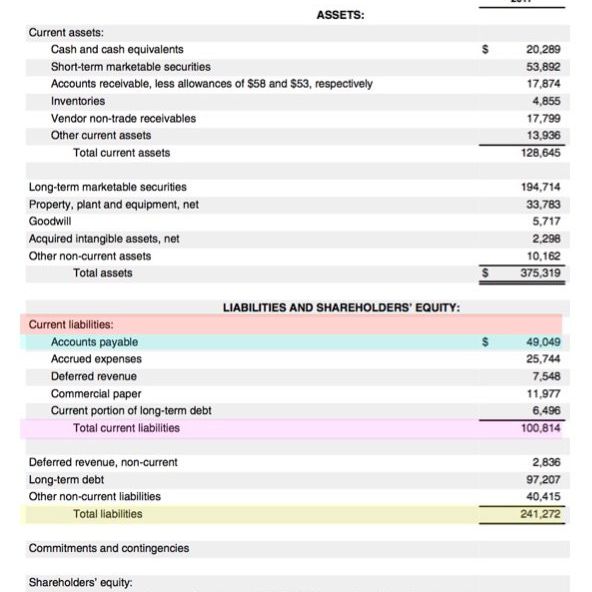

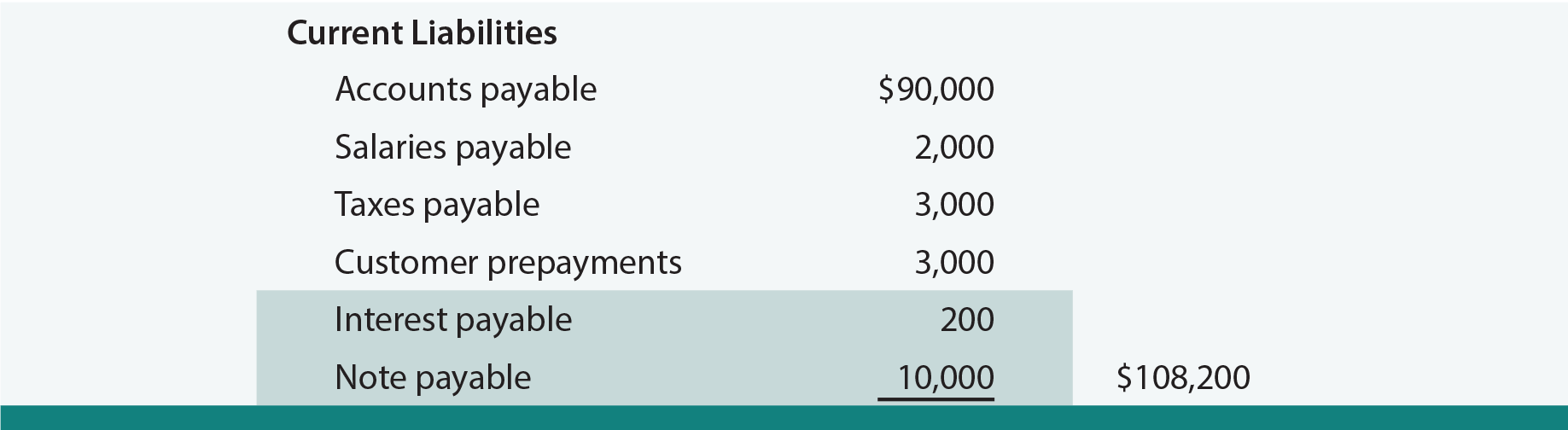

Discount on notes payable is a contra account used to reduce notes payable from face value to the net amount of the debt. Short term notes payable are obligations to pay a specified sum plus interest, within one year. This payable account would appear on the balance sheet.

Notes payable and a capital leases affect different accounts on the balance sheet, each classified differently. Loans may be short term, due to be repaid by the business within one year. A note payable can refer to a current liability or long term debt,.

Each amount credited is due and payable within 12 months. They are classified as current liabilities on the balance sheet. They appear as current liabilities on the balance sheet.

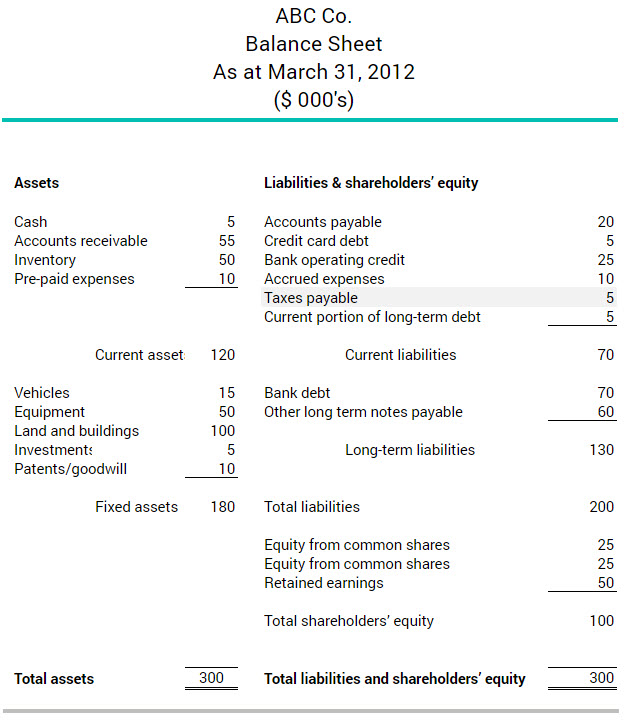

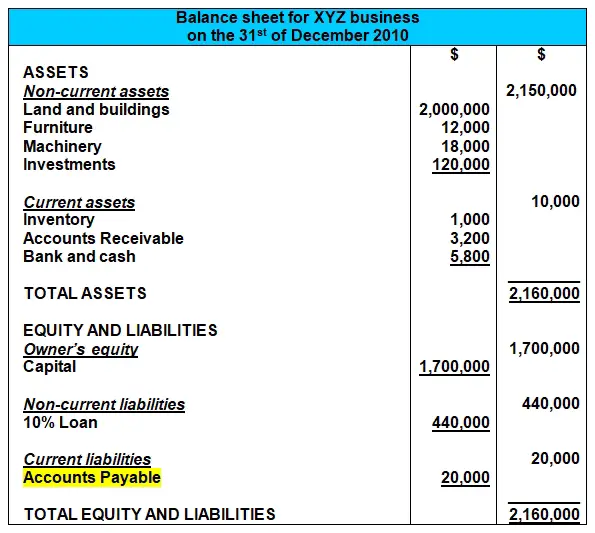

The balance sheet. Essentially, they’re accounting entries on a balance sheet that show a company owes money to its financiers. Short term notes payable are due within one year from the balance sheet date and classified under current liabilities in the balance sheet, in contrast long term.

Notes payable is a valuable financial tool. This means that they fall under current liabilities on a balance. Notes payable usually include the borrowed amount, interest.