Real Tips About Ifrs 16 Transition Adjustment Tax

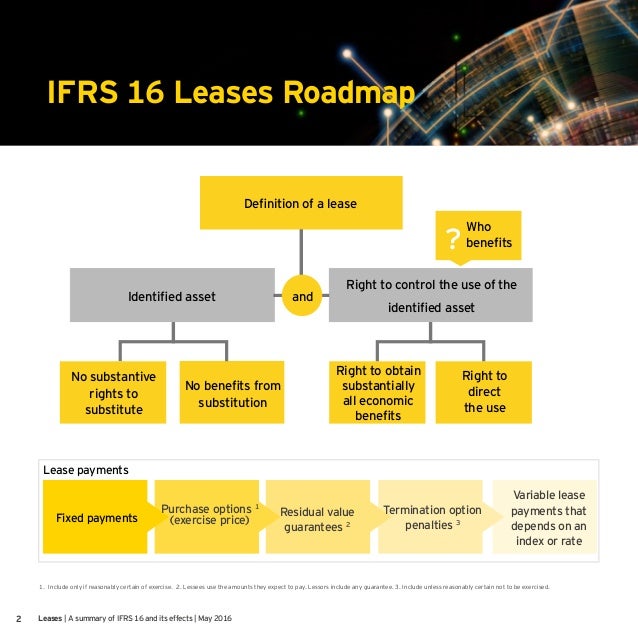

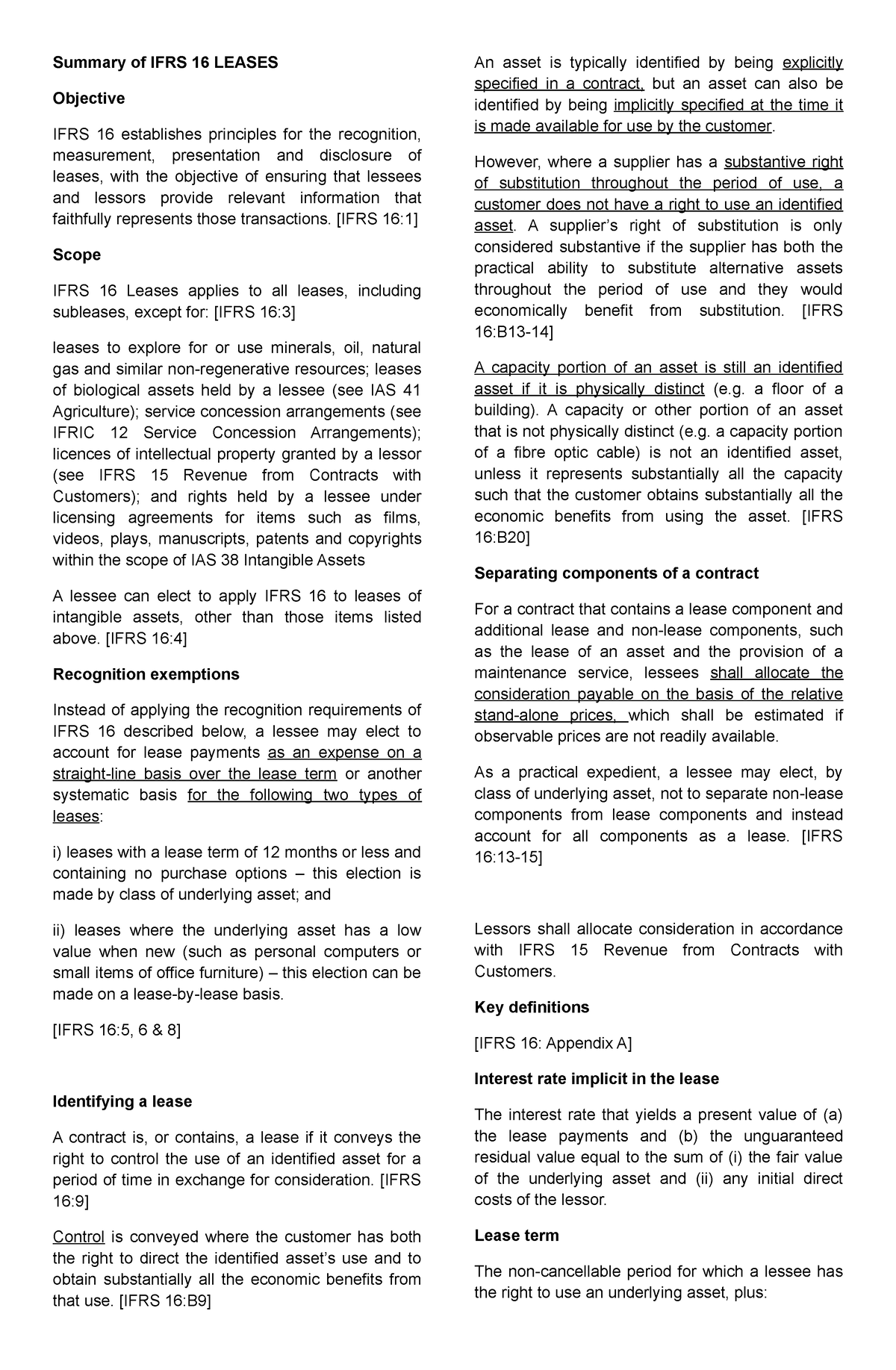

The new normal for lease accounting ifrs 16 leaseshas now been successfully adopted by companies reporting under ifrs®standards.

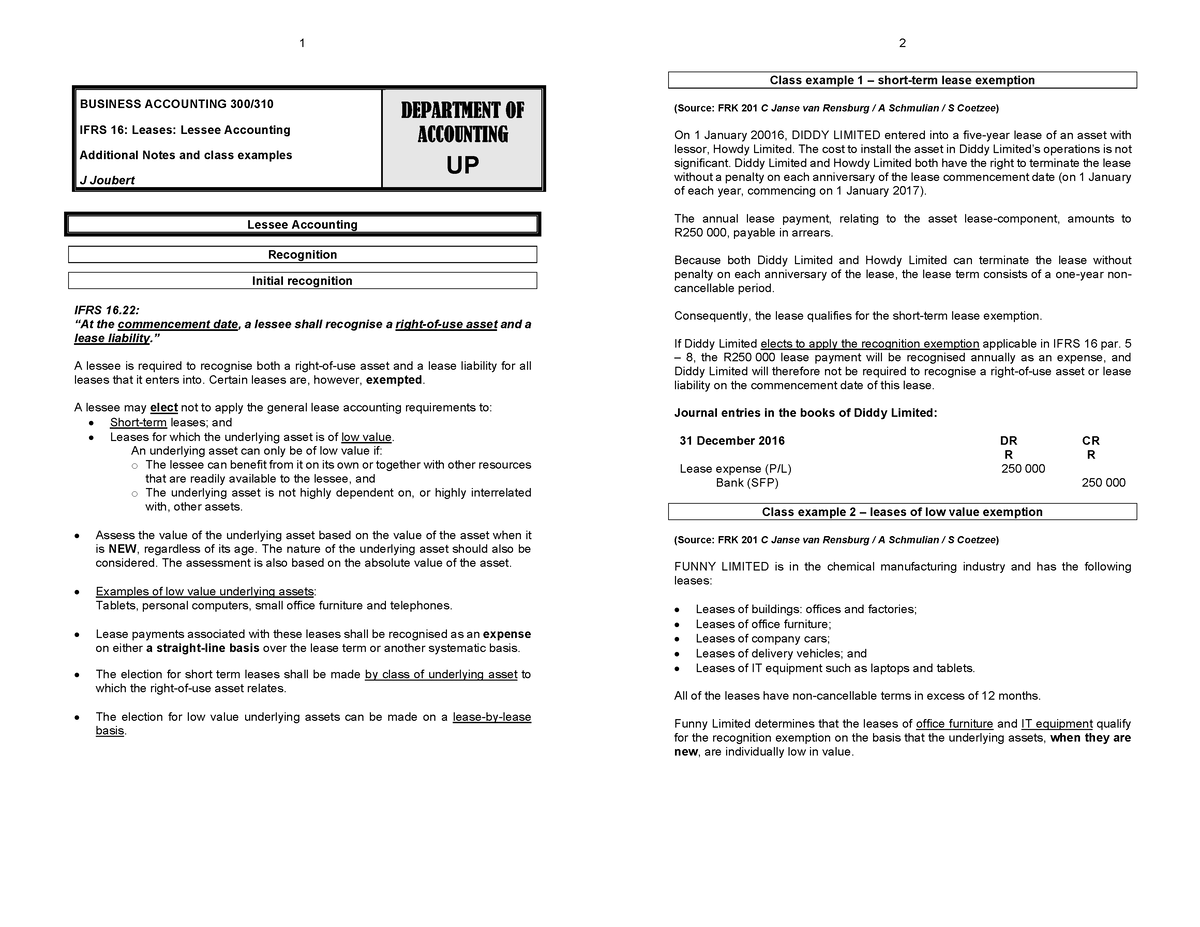

Ifrs 16 transition adjustment tax. Ifrs 16 sets out the principles for the recognition, measurement,. When applying ifrs 16 using the modified retrospective approach, entities must reconcile the operating lease commitments reported under ias 17 with the lease. The legislation in schedule 14 to the finance act 2019 ensures that any transitional adjustments arising following the adoption of ifrs 16 are spread over a number of.

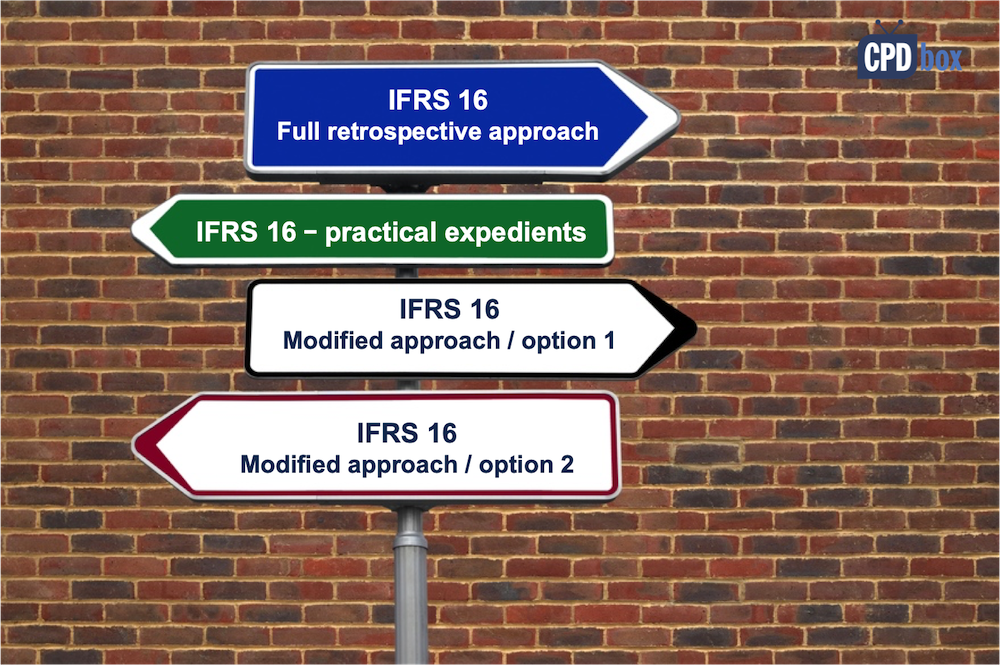

Under this approach, the cumulative effect of initially applying ifrs 16 is recognized as an adjustment to equity at the date of initial. The international accounting standards board issued ifrs 16 leases (ifrs 16 or the new standard) in january 2016 with an effective implementation date of 1 january 2019. Each one focuses on a particular.

For all leases held at the date of transition the recognition and measurement provisions of ifrs 16 are applied in full; Initial application as an adjustment to the opening balances of taxpayers’ equity (or other component of equity, as appropriate) per ifrs 16(c5(b)). It is the new normal for lease accounting.

Ifrs 16 defined terms 145. Of operations, financial condition, changes in global or regional trade conditions, changes in tax rates, liquidity, prospects, growth and strategies. Under both superseded sic 15 and ifrs 16, reimbursements by landlords for lessee assets are lease incentives.

Under ifrs 16 the accounting is different, with lease incentives. Finance act 2019 introduced legislation requiring those businesses adopting ifrs 16 to spread the tax impact of any transitional lease accounting adjustment over. Modified retrospective approach.

The transition to ifrs 16 has been completed in accordance with paragraph c5 (b) of the standard, applying ifrs 16 requirements retrospectively. 9.2 transition 130 9.3 lessee transition 131 9.4 lessors 141 9.5 other considerations 142 9.6 disclosure 143 appendix a: In january 2016 the board issued ifrs 16 leases.

Ifrs 16 requires an entity. Ifrs 16 also sets out mandatory transition requirements in respect of sale and leaseback transactions and leases assumed by an entity as a result of a past business combination. International financial reporting standard 16 (ifrs 16) came into force for accounting periods beginning on or after 1 january 2019, replacing international.