Looking Good Tips About Investment Property In Balance Sheet

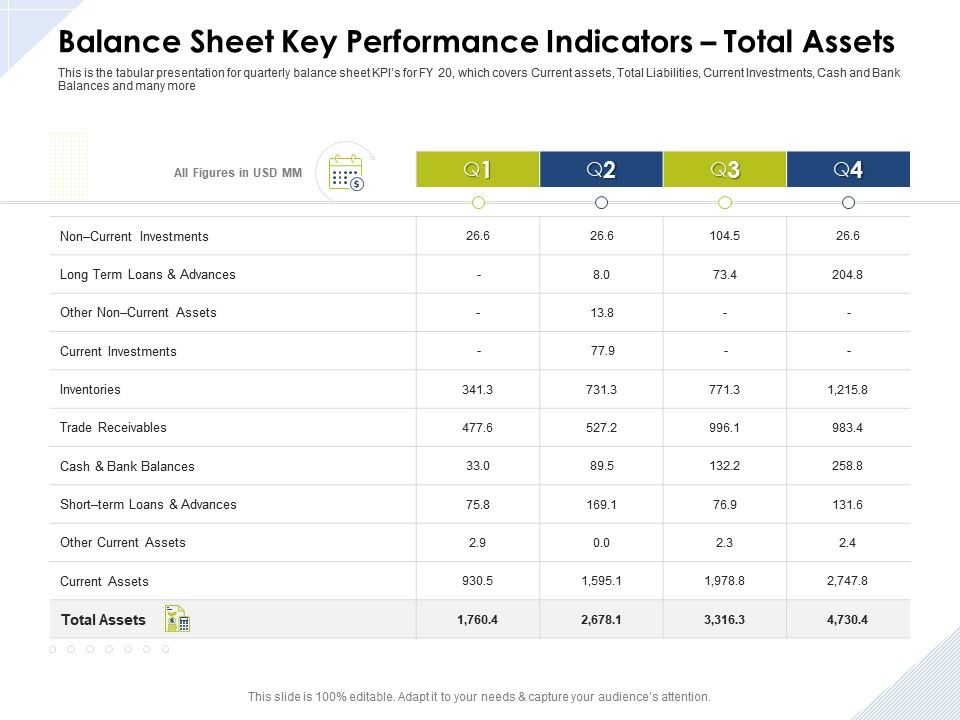

Gain insight into your company’s financial position with balance sheets in smartsheet

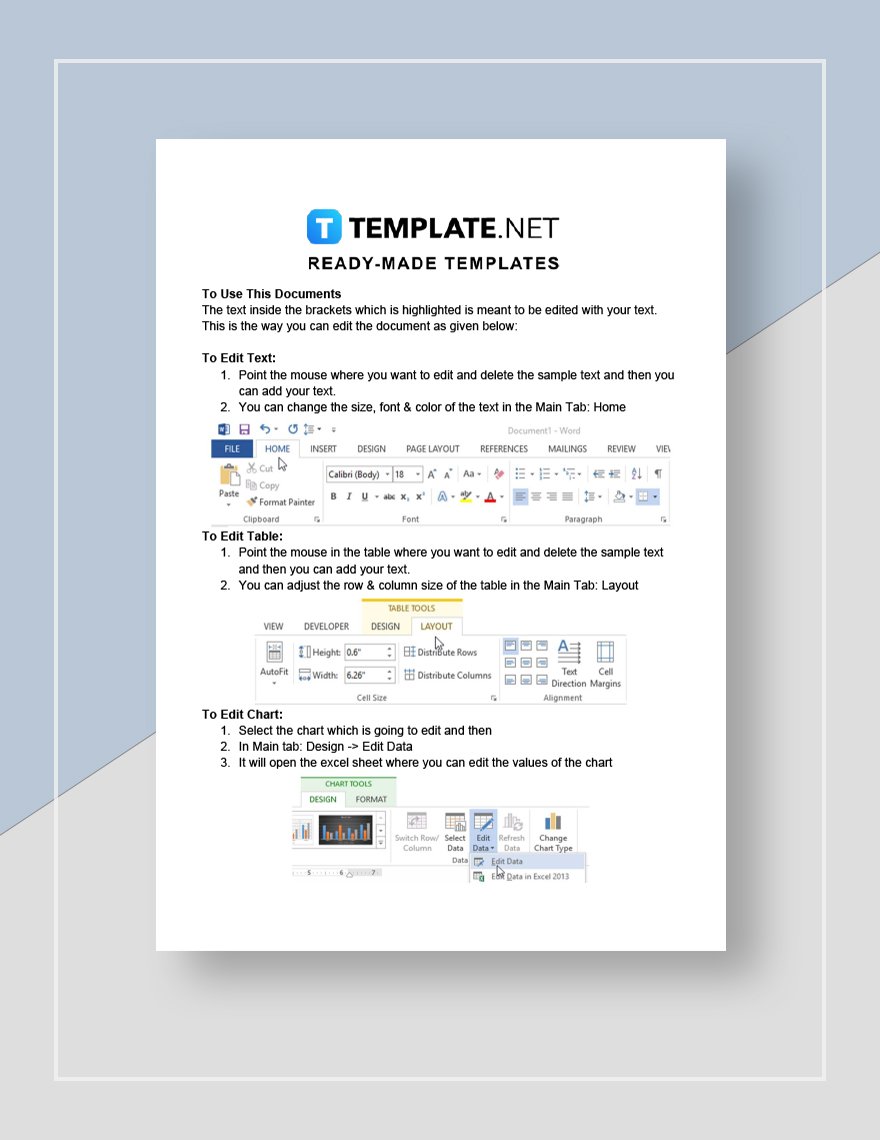

Investment property in balance sheet. Unlike ifrs standards, there is no requirement to disclose the fair value of property, plant, and equipment under us gaap. Let’s discuss the nature of the investments, how investments are measured, recognized, recorded, and presented in. Because assets and liabilities change from time to time, such as when a mortgage is paid down, the balance sheet changes as well.

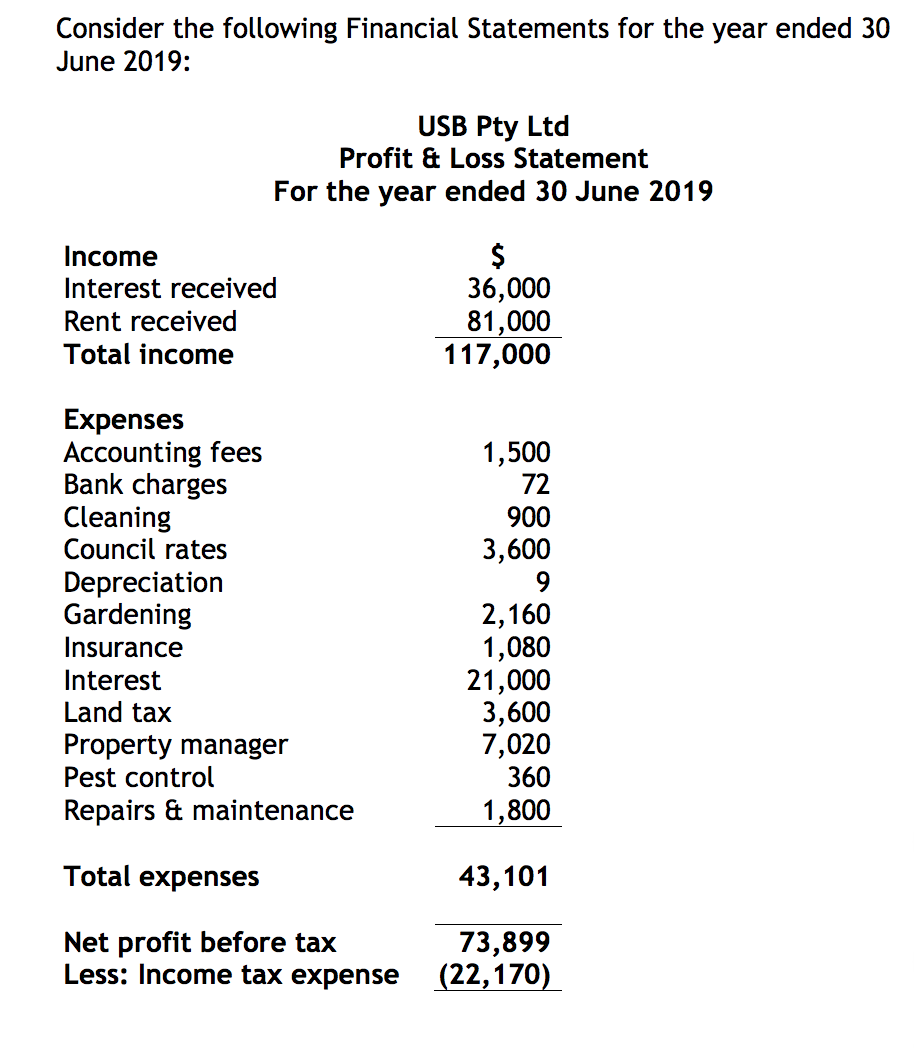

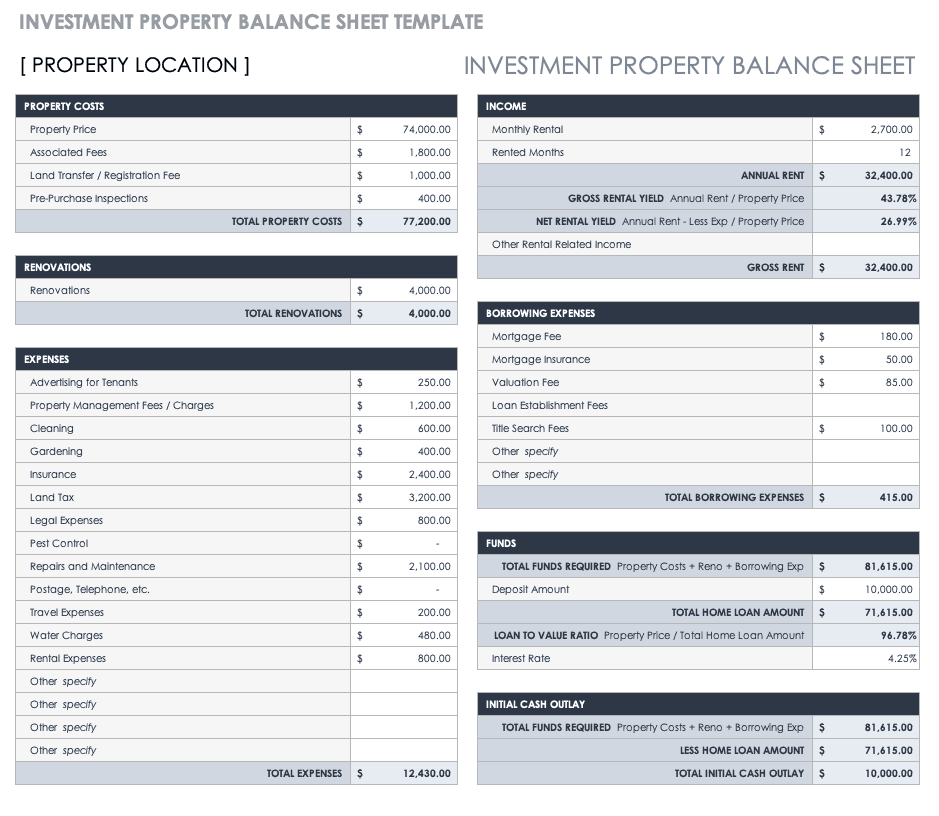

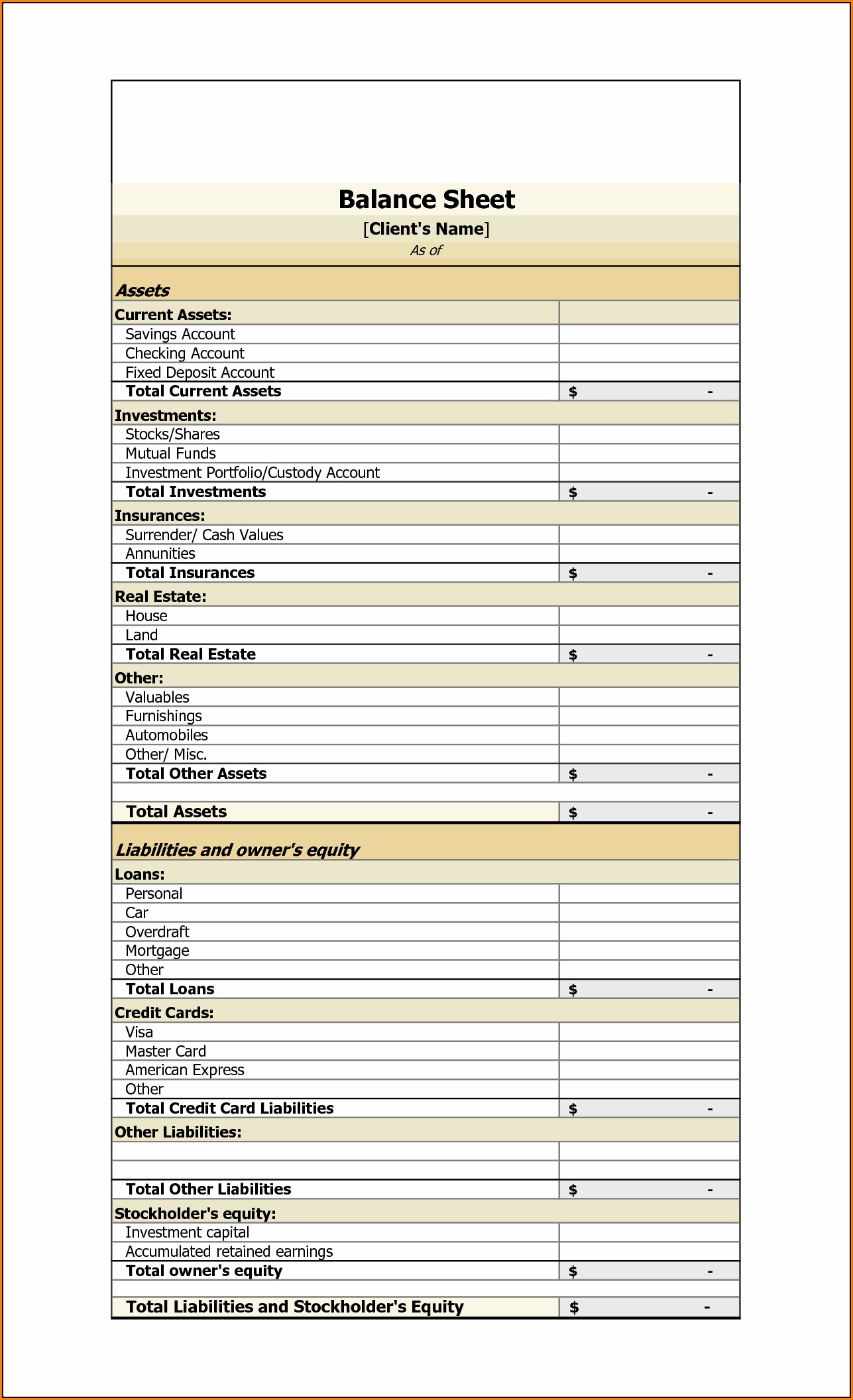

How to record property and investments on your balance sheet Faro ltd has an investment property on its balance sheet as at 1 january 2015 (the date of transition) with a carrying value of £200,000 and an associated revaluation surplus of £80,000. A rental property balance sheet provides a glimpse of your rental property’s finances.

The company can therefore use a rate of 17%, as. Balance sheet templates, such as this investment property balance sheet, allow you to factor in details such as property costs, expenses, rental and taxable income, selling costs, and capital gains. Investment property is property (land or a building—or part of a building—or both) held (by the owner or by the lessee under a finance lease) to earn rentals or for capital appreciation or both, rather than for:

The accounting treatment of investment property under frs 102, the financial reporting standard applicable in the uk and republic of ireland,. Use in the production or supply of goods or services or for administrative purposes, or Use in the production or supply of goods or services or for administrative purposes;

It lists all assets, liabilities, and equity related to your property. Investments might include stock, stock funds, or bonds. Or • sale in the ordinary course of bus.

In general, a balance sheet contains 3 portions. Typically, investments are securities held for more than a year. Then deferred tax is calculated using the tax rates and laws that have been enacted or substantively enacted by the balance sheet date.

Under ssap 19, investment properties are required to be included on the balance sheet at open market value and are not subject to depreciation. If an investment will be sold sooner, it belongs under “cash” on the balance sheet, and is then called a “marketable security.” Categorising investment property on balance sheet how to account for the equity in a fixed asset investment property on the balance sheet?

It is not property that an entity uses to supply goods or services, nor is it used for administrative purposes. Ias 40 applies to the accounting for property (land and/or buildings) held to earn rentals or for capital appreciation (or both).

Industry insights hi, i have just started using accounting software (freeagent) for a limited company property rental business. Or sale in the ordinary course of business. And, these are assets, liabilities, and owners’ equity.

Ias 1 refers to the balance sheet as the statement of financial position. The changes in value should not be taken to profit and loss account but to the statement of recognised gains and losses (and credited to a revaluation reserve) unless a deficit is expected to be. Fixed assets are shown net of accumulated depreciation on the balance sheet.

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Analyze_REITs_Real_Estate_Investment_Trusts_Sep_2020-01-2fa0866796b04bd6af235958b78238ed.jpg)