Heartwarming Info About Income Tax Expense In Cash Flow Statement

Section 43b(h) of the income tax act in india deals with the deductibility of business expen. #cadeveshthakur on instagram:

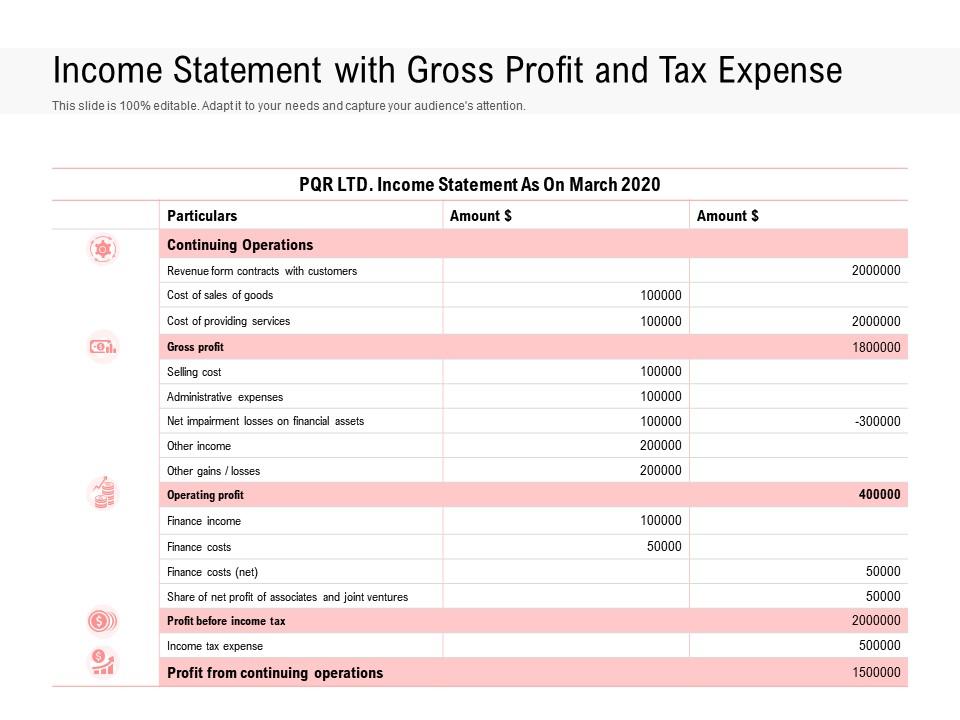

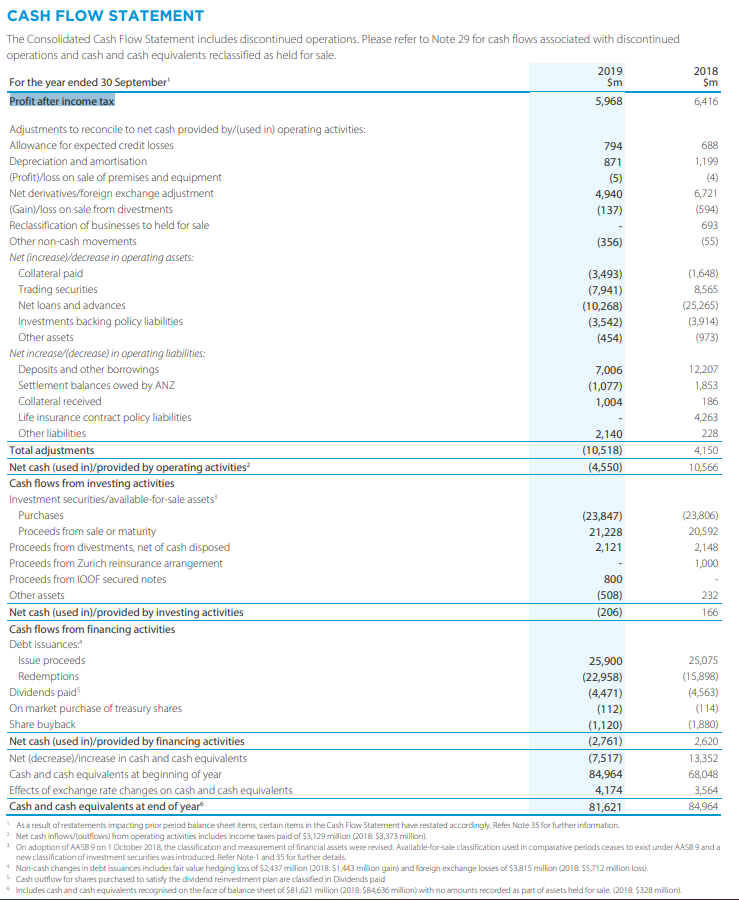

Income tax expense in cash flow statement. Adjusted income statement, balance sheet and cash flow adjusted income statement (in euro million) fy 2022 fy 2023 % change revenue 19,035 23,199 22% other recurring operating income and expenses (16,724) (20,155) share in profit from joint ventures 97 122 recurring operating income 2,408 3,166 31% % of revenue 12.6%. The income statement, or profit and loss statement, also lists expenses related to taxes. Sfas 95, statement of cash flows, classifies income tax payments as operating outflows in the cash flow statement, even though some income tax payments relate to gains and losses on investing and financing activities, such as gains and losses on plant asset disposals and early debt extinguishments.

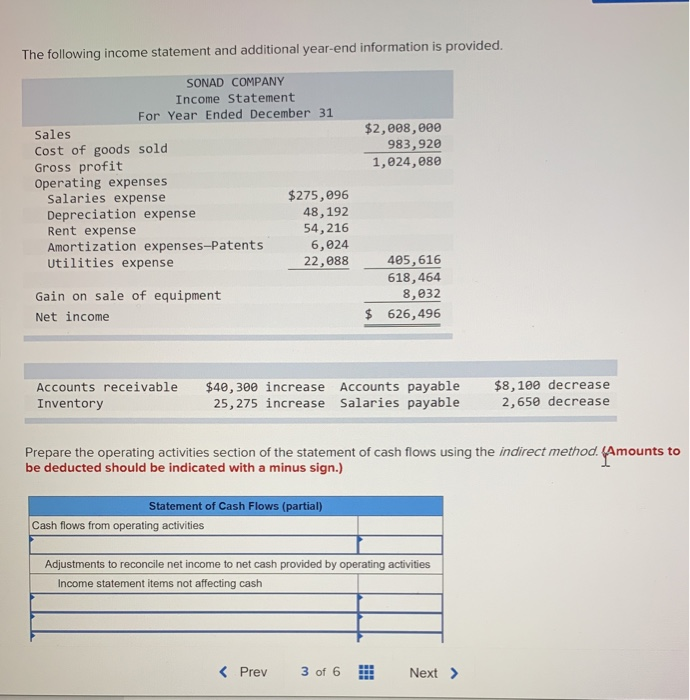

Cash payments or refunds of income taxes, unless specifically associated with financing or investing. Tax expense is always found on the income statement and is the total tax payable on a company’s profits for the given period. February 19, 2020 in this article, we look at the indirect method of preparing a statement of cash flows.

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. The statement of cash flows using the indirect method must separately disclose the cash flows for: The starting cash balance is necessary when leveraging the.

The cfs measures how well a. Though the methods used differ, the results are always the same i.e. Cash flows from operating activities.

Income taxes paid ( 900) net cash from operating activities. Dividends received (dividends paid are reported in the financing section) cash paid income taxes; Think of it as the company's bank account.

An income statement might use the cash basis or the accrual basis. Add back noncash expenses, such as depreciation, amortization, and depletion. The first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period.

An income statement is used to determine the performance of a company, specifically how much revenue it generated, the expenses it incurred, and the resulting profit or loss from the revenue. Income from operations of $652 million; Both methods lead to the same amount of inflow (or outflow) from the cash flow from operations.

Taxes are included in the calculations for the operating cash flow. The income statement is a useful way to see how a company makes money and how it spends it. Operating cash flow, represented on the cash flow statement, refers to the income that flows in and out of a business due to its operational income and expenses.

Following is the completed statement of cash flows, including disclosures, for watson ltd., for the year ended december 31, 2020: Cash flow statement calculation example. There are 2 methods that accountants use to calculate the cash flow from operations.

The direct method and 2. The cash flow statement (cfs) is a financial statement that reconciles net income based on the actual cash inflows and outflows in a period. Record adjusted ebitda margin fourth.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)