Fantastic Tips About Interpretation Of Interest Coverage Ratio

It’s calculated by dividing a company’s earnings before interest and taxes (ebit) by its interest expenses for the same period.

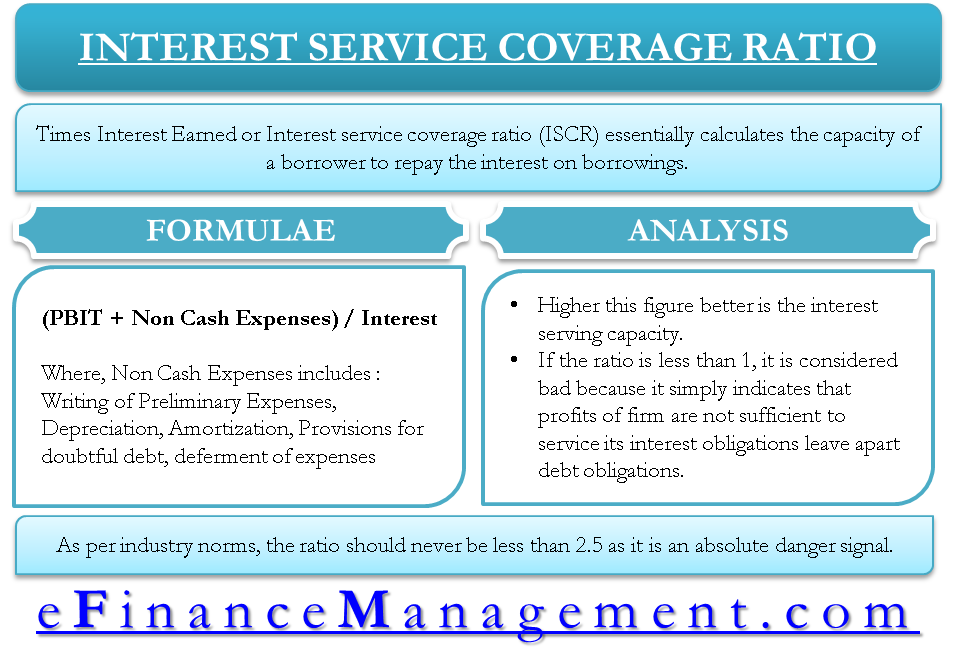

Interpretation of interest coverage ratio. As a general benchmark, an interest coverage ratio of 1.5 is considered the minimum acceptable ratio. However, a ratio greater than 1 is generally considered favorable. If the interest coverage ratio of a company is 1, then it is considered to be efficient in servicing the debts with its earnings.

Meaning of interest coverage ratio any company that borrows debt has to pay interest towards debt servicing. Thus if the interest coverage ratio is 3, then the firm has 3 rupees in profit for every 1. We may find several accounts there, such as interest income, interest expense, and rental expense.

What is the importance of interest coverage ratio? Hence, the company’s interest coverage ratio is 8.0 = $400,000 / $50,000,. A coverage ratio, broadly, is a metric intended to measure a company's ability to service its debt and meet its financial obligations, such as interest payments or dividends.

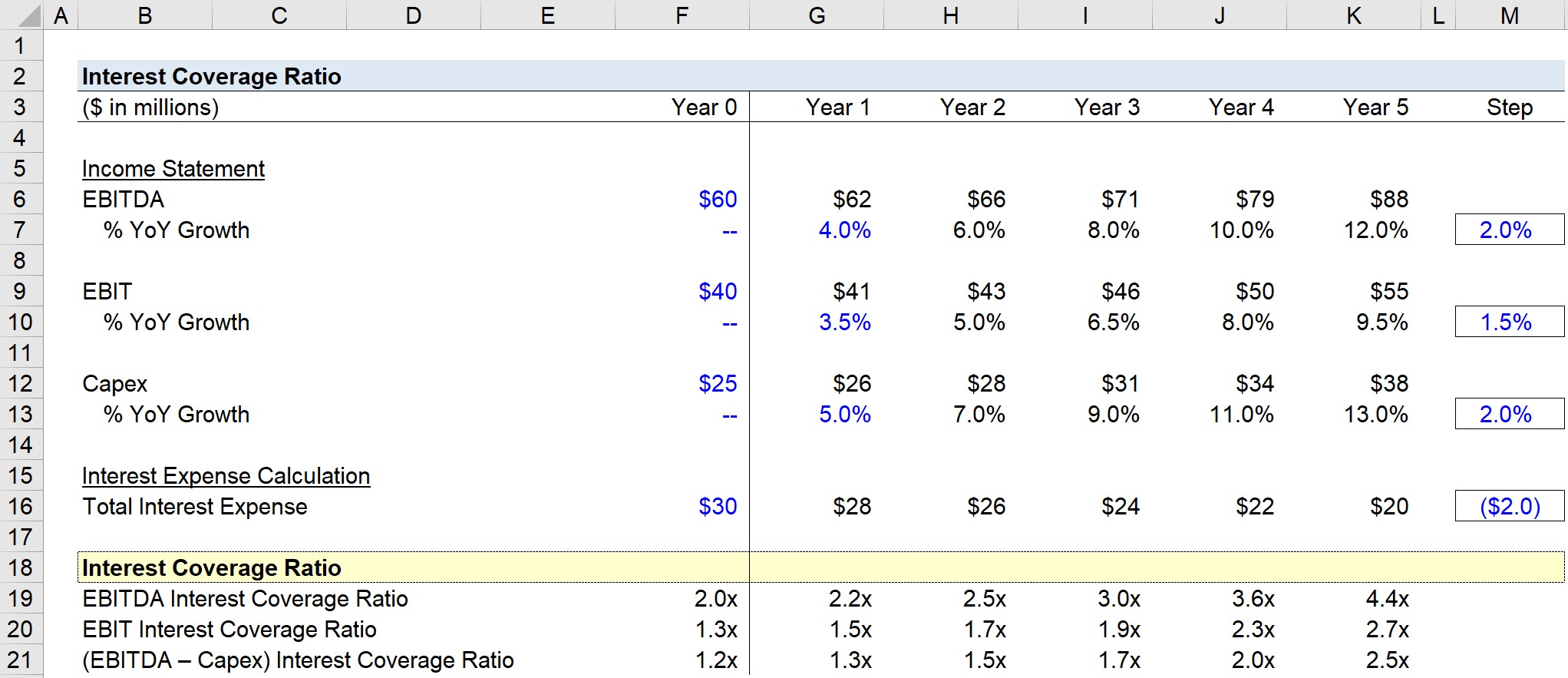

An interest coverage ratio is a metric that helps lenders determine if the borrowing party can easily pay the interests on time. For the full year, the. For the full year, the ratio fell to 1.9 from 2.5.

The interest coverage ratio is a financial ratio that measures a company’s ability to make interest payments on its debt in a timely manner. It usually provides insights into the company’s capacity to cover its interest expenses using its operating earnings. Interpretation of interest coverage ratio.

It helps them understand whether the companies borrowing the money would be able to manage interest payments for multiple borrowings at a time. The interest coverage ratio is a debt and profitability ratio used to determine how easily a company can pay interest on its outstanding debt. Willis, the district attorney overseeing the georgia prosecution of donald j.

The interest coverage ratio (icr) measures the ability of a company to meet scheduled interest obligations coming due on time. Corem's interest coverage ratio, which indicates a company's ability to pay the interest on outstanding debt, fell to 1.7 in the fourth quarter from 2.0 in the same period a year earlier. Essentially, the interest coverage ratio is a measure of a company’s ability to meet its interest payment obligations with its earnings.

The interest coverage ratio, often abbreviated as icr, is a financial indicator that gauges a company’s capacity to pay the interest on its outstanding debt. The interest coverage ratio meaning a financial metric used to assess a company’s ability to meet its interest payment obligations. The company, therefore, is likely.

It is calculated by dividing the company’s earnings before interest and taxes (ebit) by its interest expenses. For example, suppose a company posts an ebit of $400,000 and an interest expense of $50,000. The interest coverage ratio is calculated by dividing a company’s earnings before interest and taxes (ebit) by its interest expense over a specific time period.

The interest coverage ratio depicts the number of times a company can pay its interest expenses within a financial year or quarter using its current earnings. The interest coverage ratio (icr) is a financial ratio that is used to determine how well a company can pay the interest on its outstanding debts. For the full year, the metric fell to 1.9, from 2.5 in 2022.

/GettyImages-1016980902-564d2eee00b64de9b17a1f4c1e76c4ad.jpg)