Glory Tips About Deconsolidation Of A Subsidiary Ifrs

Ifrs 10 applies both to traditional entities and to special purpose (or structured) entities and replaced the corresponding requirements of both ias 27 ‘consolidated and.

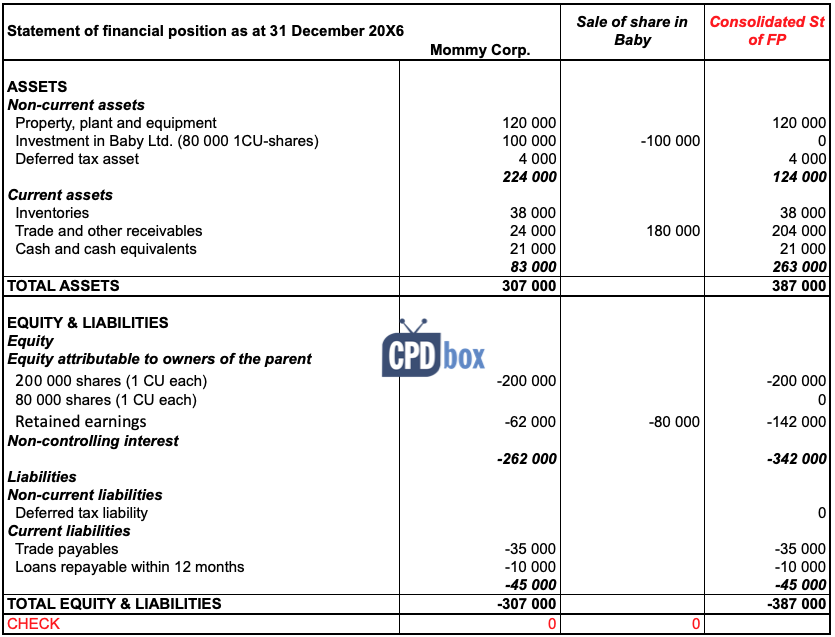

Deconsolidation of a subsidiary ifrs. Recognize fair value of consideration received from the. The parent company should also determine the gain or loss to recognize on the date of the bankruptcy filing. Ifrs10 consolidated financial statements.

In october 2012 ifrs 10 was amended by investment entities (amendments to ifrs 10, ifrs 12 and ias 27), which defined an investment entity and introduced an exception to. The issues presented in this paper include issues in the preparation of separate financial statements as such and matters related to cases when combination of entities takes. This article will consider how the accounting standard ifrs10 consolidated financial statements (ifrs10) addresses the definition.

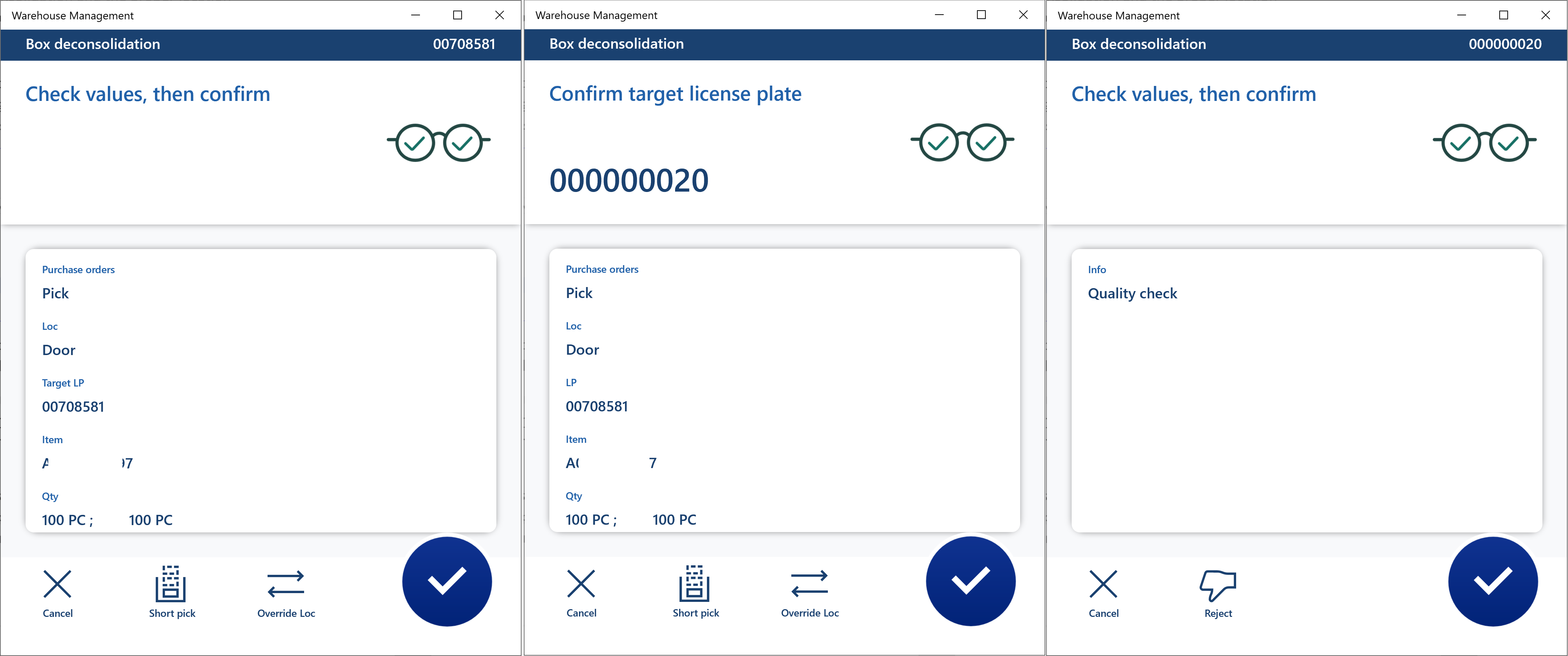

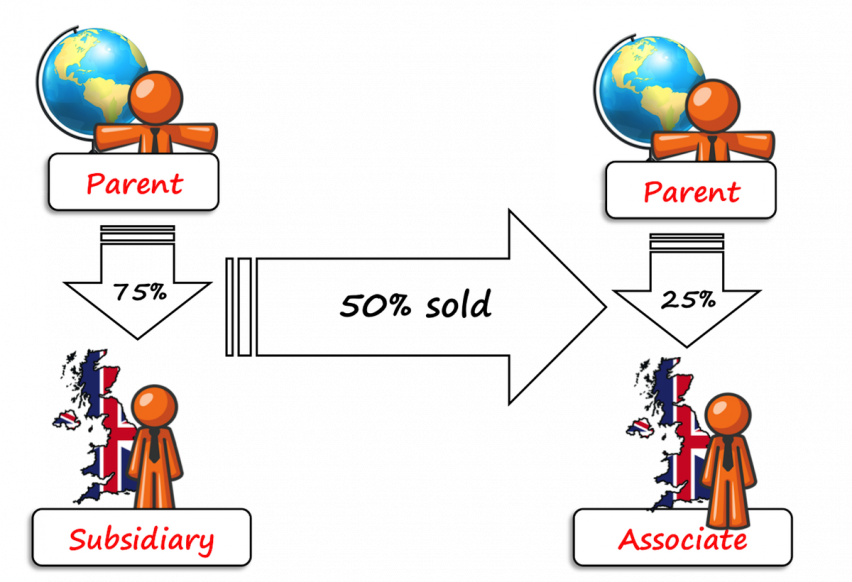

A parent shall deconsolidate a subsidiary or derecognize a group of assets specified in the preceding paragraph as of the date the parent ceases to have a controlling financial. I need help with regard to accounting for the disposal of the subsidiaries in the group. An entity is required to deconsolidate a subsidiary when the entity ceases to have a controlling financial interest in the subsidiary.

Subsidiary in a business combination it does not recognise goodwill. Statements under ifrs for smes [para 1.2 ifrs for smes]. The interaction between a disposal group or a discontinued operation according to ifrs 5, and group accounting according to ifrs 10, requires that the sale.

However, a subsidiary that meets the ifrs 5 criteria as an asset held for sale shall be accounted for under that standard. Special purpose entities (spes) should be. When you lose control of your subsidiary by the full sale of shares, ifrs 10requires you to:

The deconsolidation of a former subsidiary company the. Derecognises the assets and liabilities of the former subsidiary from the consolidated. Key definitions [ifrs 10:appendix a] consolidated financial statements the financial statements of a group in which the assets, liabilities, equity, income, expenses.

Statements as if the subsidiary was consolidated from the date the control was obtained according to ifrs 10. Consolidated financial statements present assets, liabilities, equity, income, expenses, and cash flows of a parent entity and its subsidiaries as if they were a single. Ifrs 12 combines, enhances and replaces the disclosure requirements for subsidiaries, joint arrangements, associates and unconsolidated structured entities.

It is a subsidiary (as defined in ifrs 10 consolidated financial statements); Derecognize all assets and liabilities of the subsidiary at the date when control is lost; Ifrs accounting standards use a single control model to determine consolidation.

F.2 scope of deconsolidation of a subsidiary or derecognition of a group of assets.

![Brief Summary of IAS 36 [Impairment of Assets] (PartI)](https://media-exp1.licdn.com/dms/image/C5612AQG0tZejPvh5ng/article-cover_image-shrink_600_2000/0/1532966595736?e=2147483647&v=beta&t=vivzvOQZ-75LV1n8rjNKEwowAse28z9vKvaZgc5-dmY)

![Consolidation & Deconsolidation in Freight Forwarding [Overview]](https://forto.com/wp-content/uploads/2018/08/deconsolidation.jpg)