Fabulous Info About Preparing A Profit & Loss Statement

This is one of three financial reports businesses are required to prepare annually and quarterly, along with a cash flow statement and balance sheet.

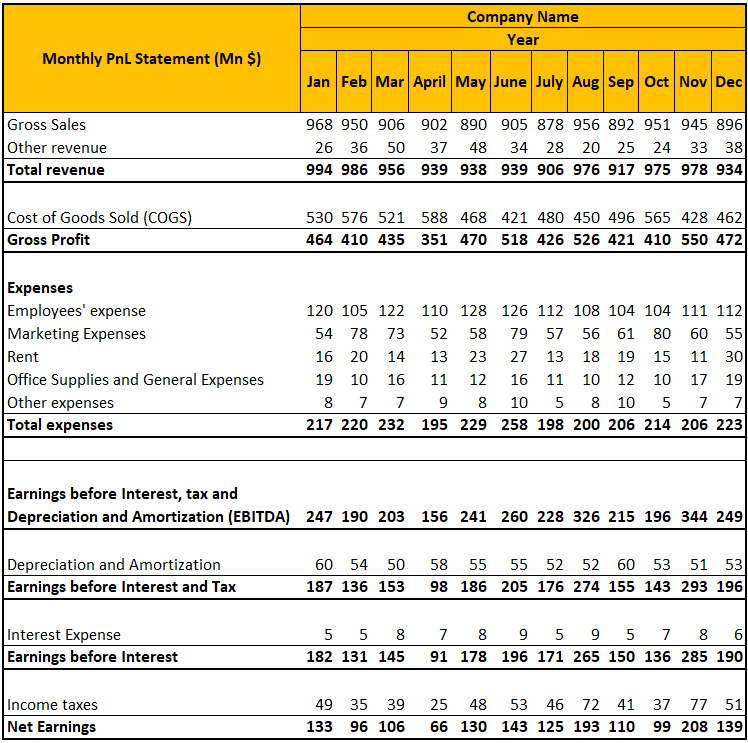

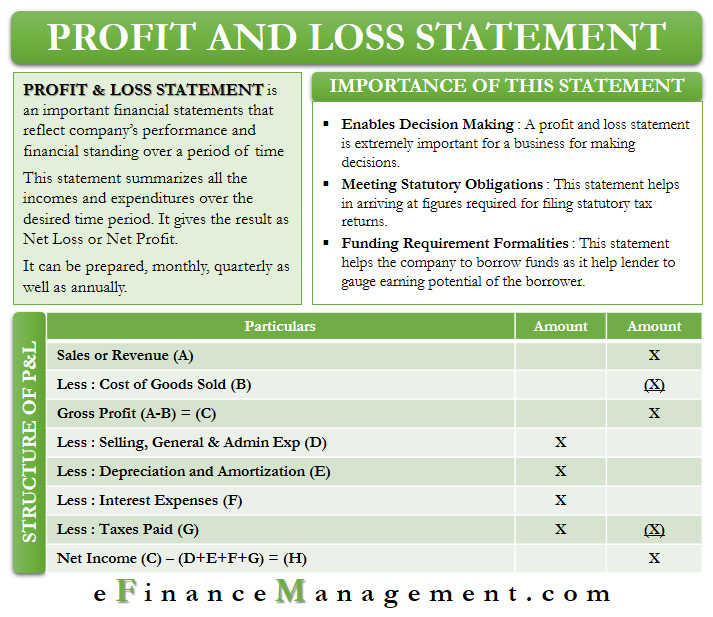

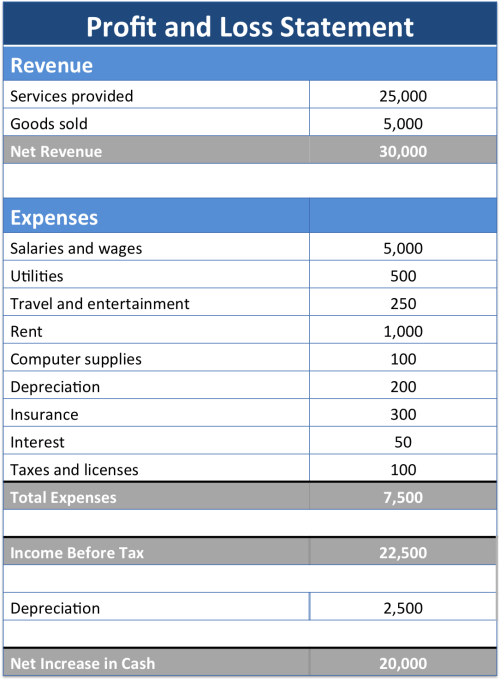

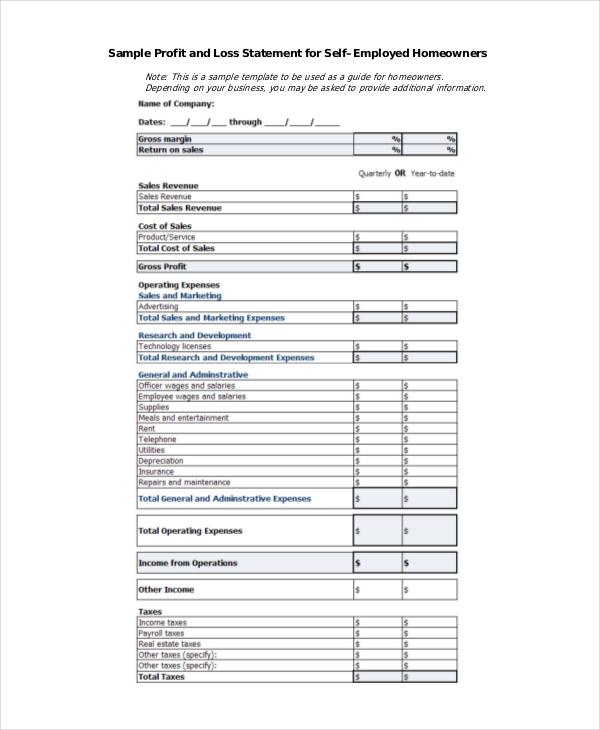

Preparing a profit & loss statement. Overall, a profit and loss statement can be broken into five parts (highlighted in red in the image below): How to prepare what’s included in a profit and loss statement? Before you can create and analyze your own profit and loss statement, it’s important to understand what’s included in this report and how it works.

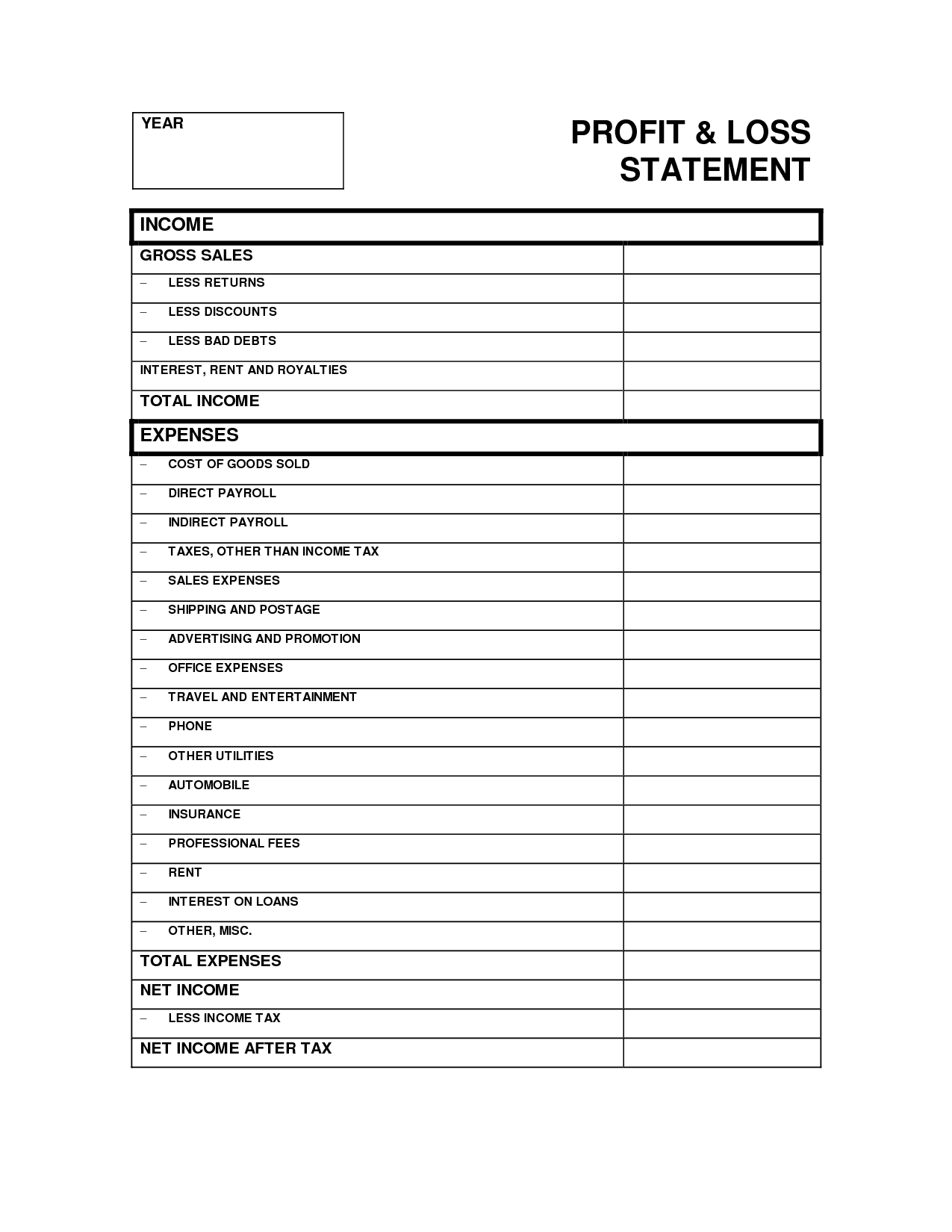

A profit and loss statement (p&l) is a vital financial document for businesses, providing a snapshot of a company’s financial performance over a specific period, such as monthly, quarterly, or annually. It’s essential because it provides insight into whether the company is making a profit or losing money. It starts with the top line (total revenue) and ends with t he bottom line (net income or net profit/loss).

And that's exactly what the profit and loss sheet does for you: The result is either your final profit (if. The oil and gas company's earnings statement showed that adjusted net income totalled 513 million euros ($556 million) in.

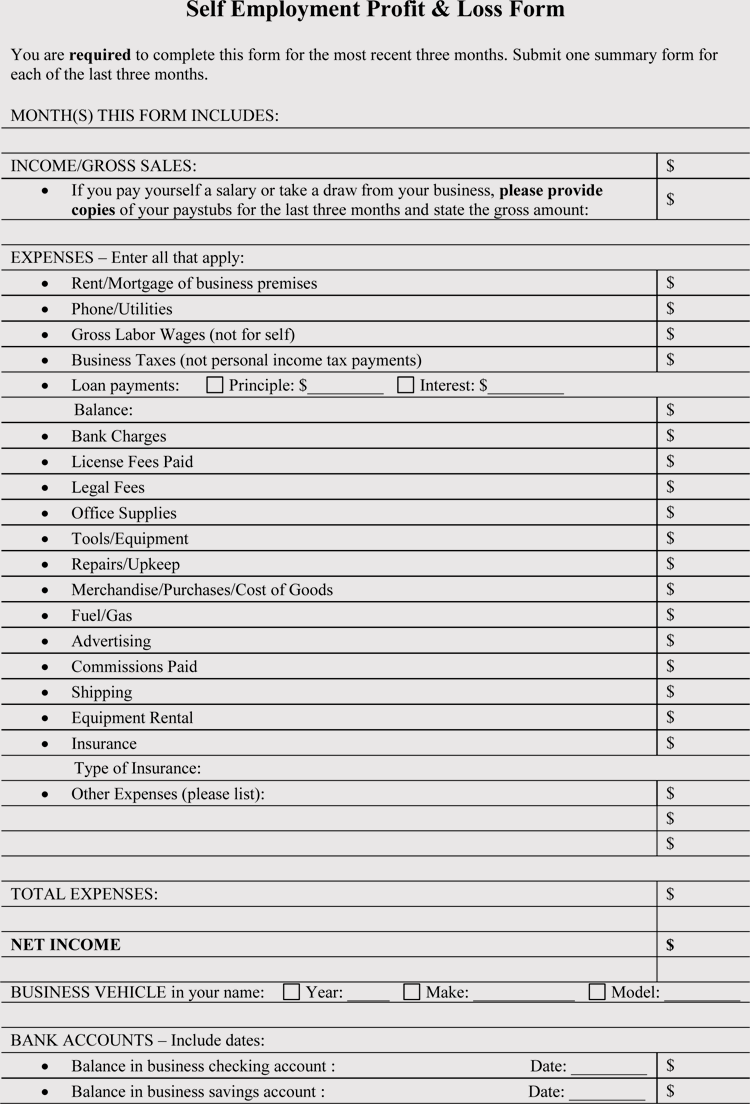

It contains information pertaining to a company’s revenue and expenses over a given period. It’s often used as cl. There are several reasons why you need the financial report, including:

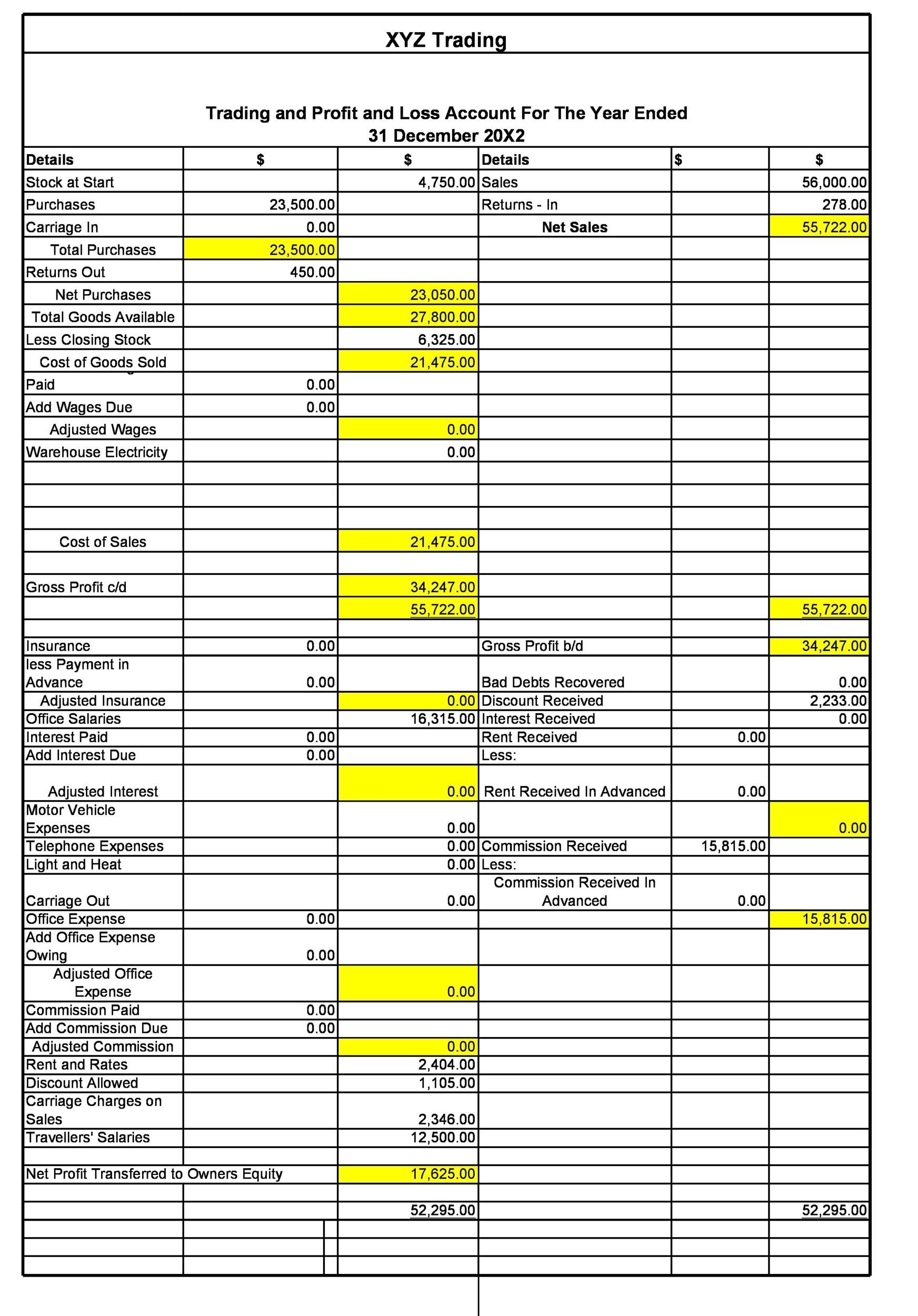

A profit and loss statement, also known as an income statement or p&l statement, is a financial report that summarizes your business’s revenues, costs, and expenses during a specific period. Business tools profit and loss statement template use our free profit and loss statement template to review your business performance, and check out the wise business account as a smart way to cut your bank charges. Lists your total revenue, total expenses, and total equity line by line to show how much cash your business is really bringing in.

All companies require an accounting profit and loss statement (p&l) or income statement for their accounts. It shows your revenue, minus expenses and losses. Accrual accounting recognizes revenue and expenses when they actually occur.

To accurately understand your business's fiscal position, then, you need to calculate both profit and loss to find your total net income. It is one of the critical financial documents companies use to assess their financial performance and profitability. It is important to compare p&l statements from different accounting periods, as any changes over time become more.

A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. Before you start, gather the necessary documents.

A p&l statement shows how much money the company made and how much it spent during a specific period. Preparing a p&l statement is mandatory as per the regulations of acra (accounting and corporate regulatory authority). First, find your gross profit by subtracting your cogs from your gross revenue.

You can obtain current account balances from your. Profit and loss statement vs. Profit and loss accounting is when companies prepare the profit and loss statements to figure out their financial performance for a fiscal quarter or year.