Stunning Tips About Is Equipment An Expense On Income Statement

The gaap matching principle prevents expenses from being recorded.

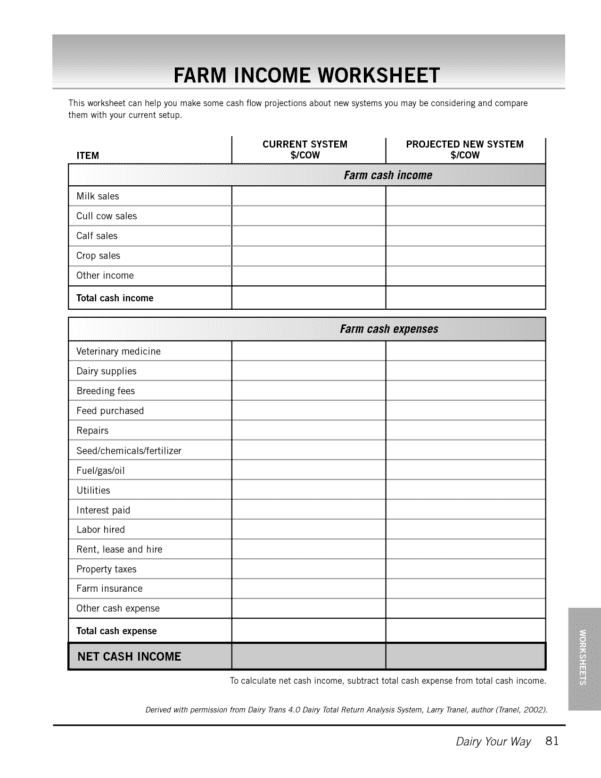

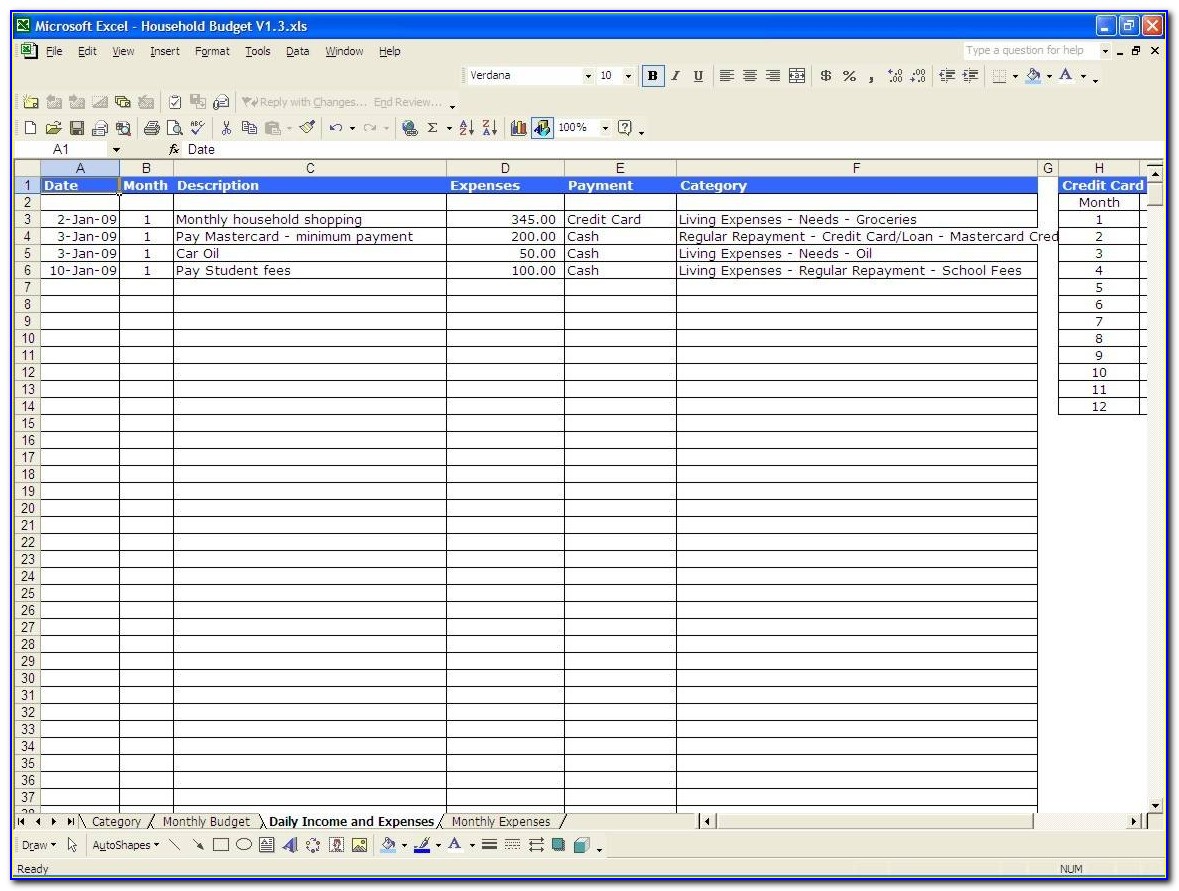

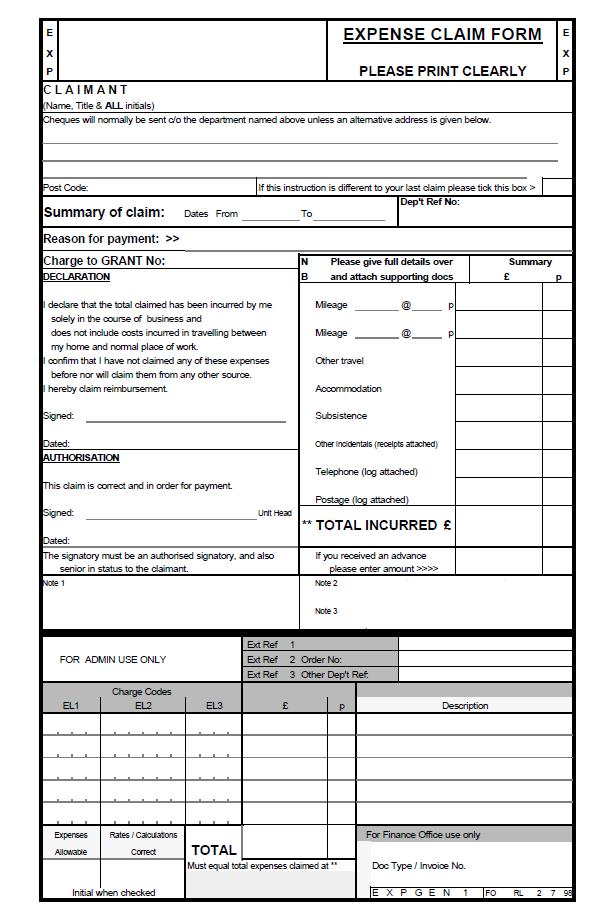

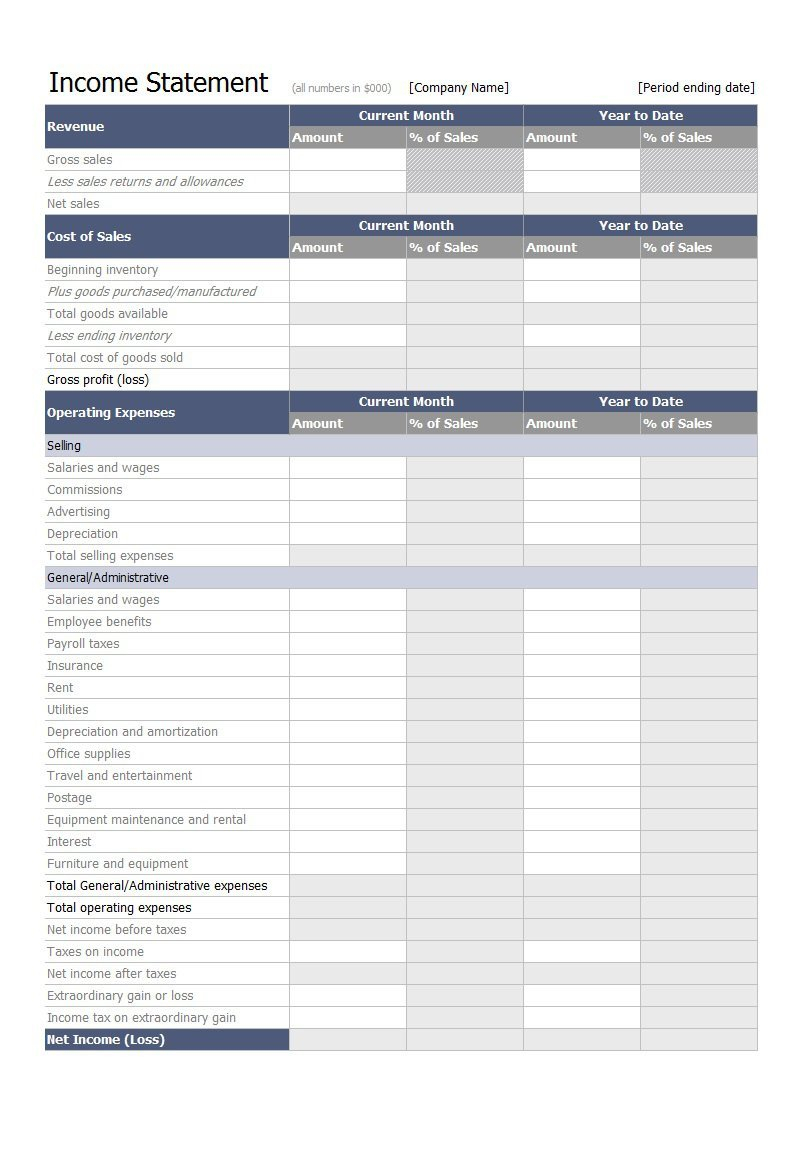

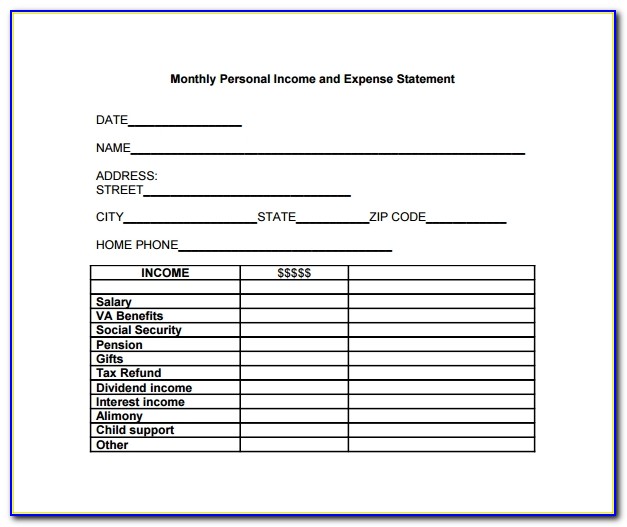

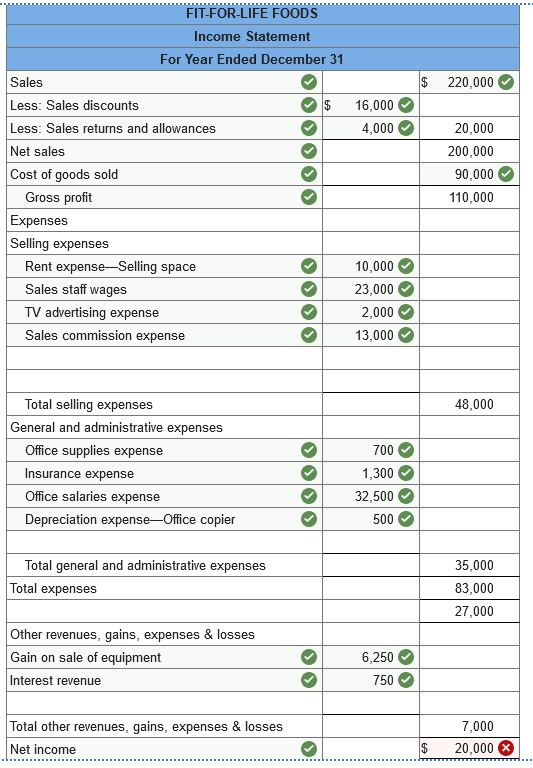

Is equipment an expense on income statement. Some of the common expenses recorded in the income statement include equipment depreciation, employee wages, and supplier payments. Office supplies expense on income statement if your business does not use a lot of office supplies and you don’t order them in bulk, the office supplies expense that. Fixed assets such as equipment and buildings lose value as they age.

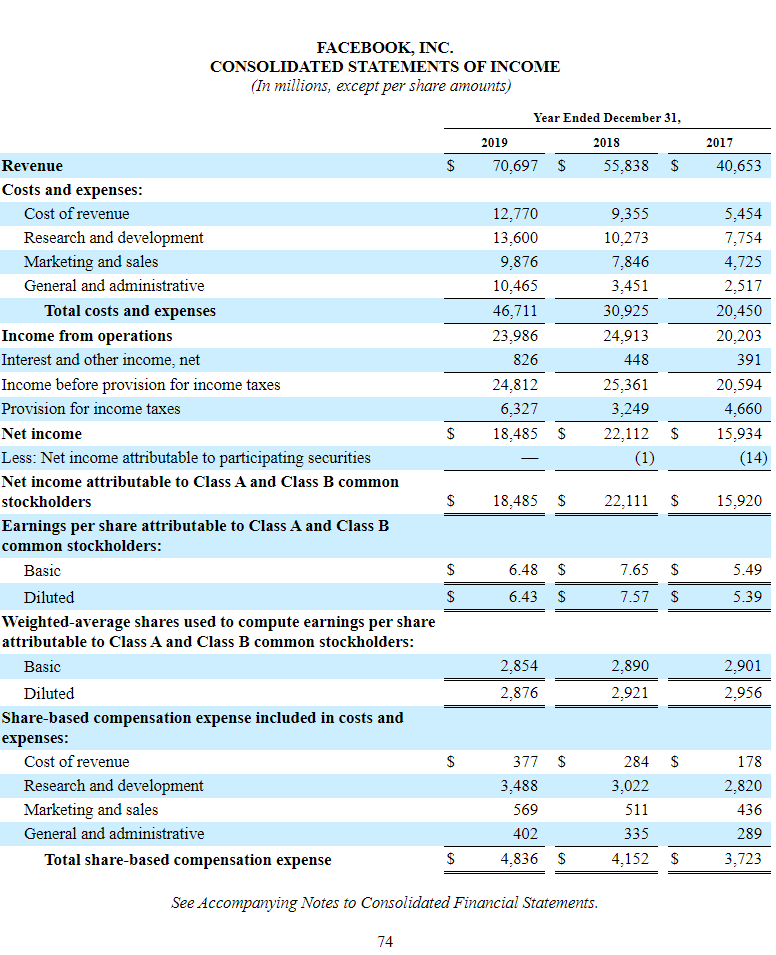

Small business | accounting & bookkeeping | expenses by louise balle for certain types of companies, office. The purchase of a new machine that will be used in a business will affect the profit and loss statement (income statement) when the machine is placed into service and the. Learn more what is an income statement?

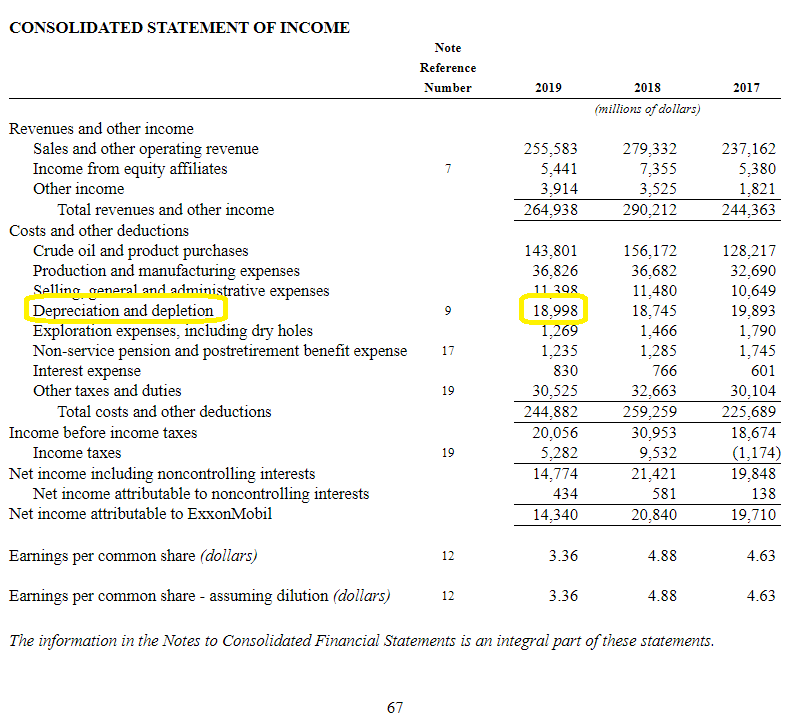

For example, if you itemize, your agi is $100,000. Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi). Depreciation expense is an income statement item.

These may include gains or. It is accounted for when companies record the loss in value of their fixed assets through depreciation. An income statement is a financial statement that shows you how profitable your business was over a given.

You can obtain it by dividing the total cost of $48,000 by its useful life of 48 months. Depreciation is a financial accounting method used to allocate the cost of tangible assets over t. Did you get it ⬇️樂 question:

One of the equipment expenses is depreciation. Prepaid expenses are first recorded in the prepaid asset account on the balance sheet. No extraordinary items:

Property, plant and equipment: Equipment expense is the cost incurred by a piece of equipment while at service. When equipment is purchased, it is not initially reported on the income statement.

Instead, it is reported on the balance sheet as an increase in the fixed assets line item. The depreciation rate of the equipment is $1,000 per month. Do supplies count as an expense on an income statement?

For example, if your small business obtains equipment with an operating lease that requires $1,000 monthly payments, you would report a $12,000 lease. More specifically, it is initially recorded in the equipment fixed assets account,.