Build A Tips About Wage Expense On Balance Sheet

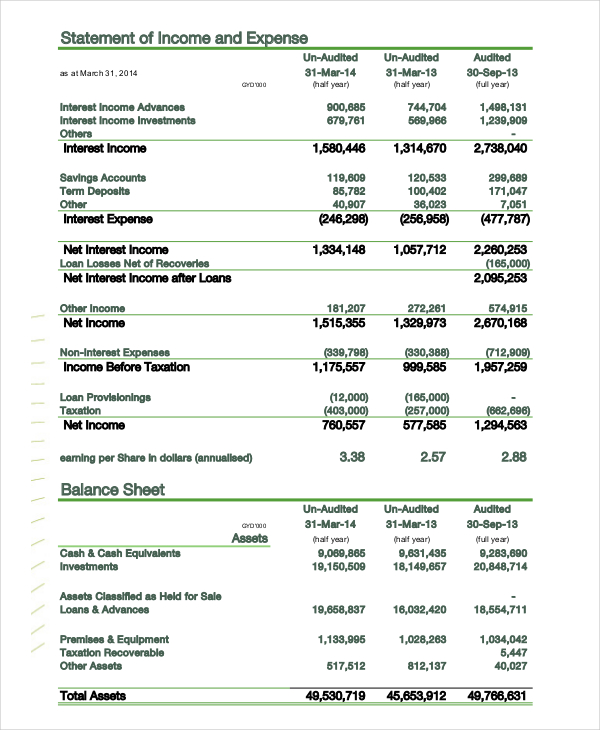

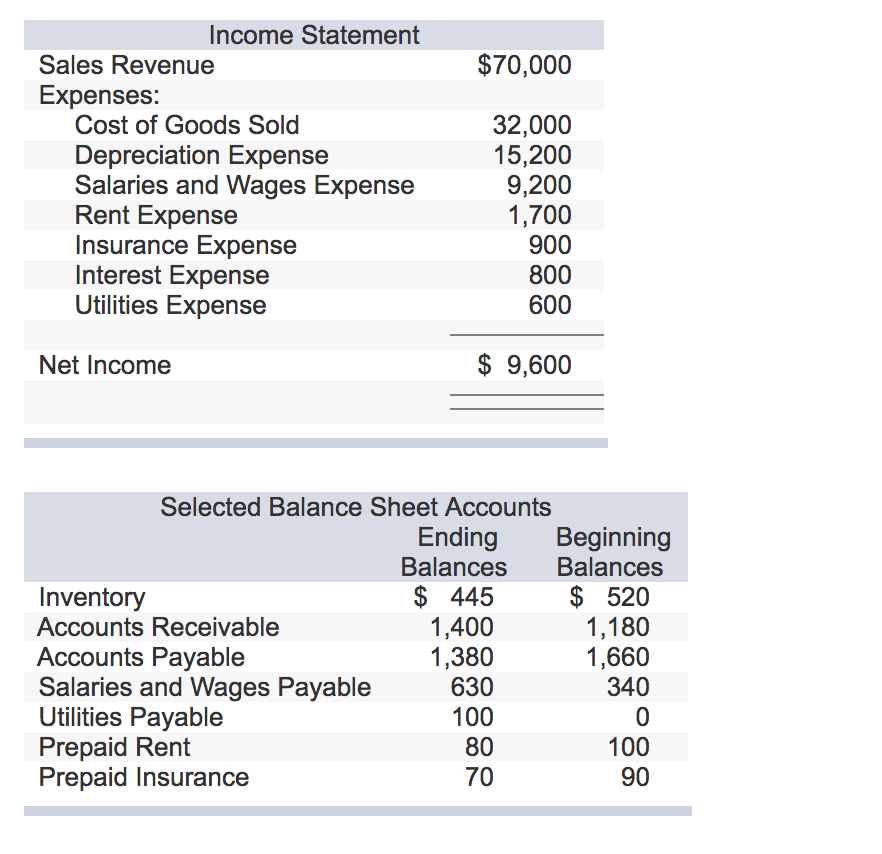

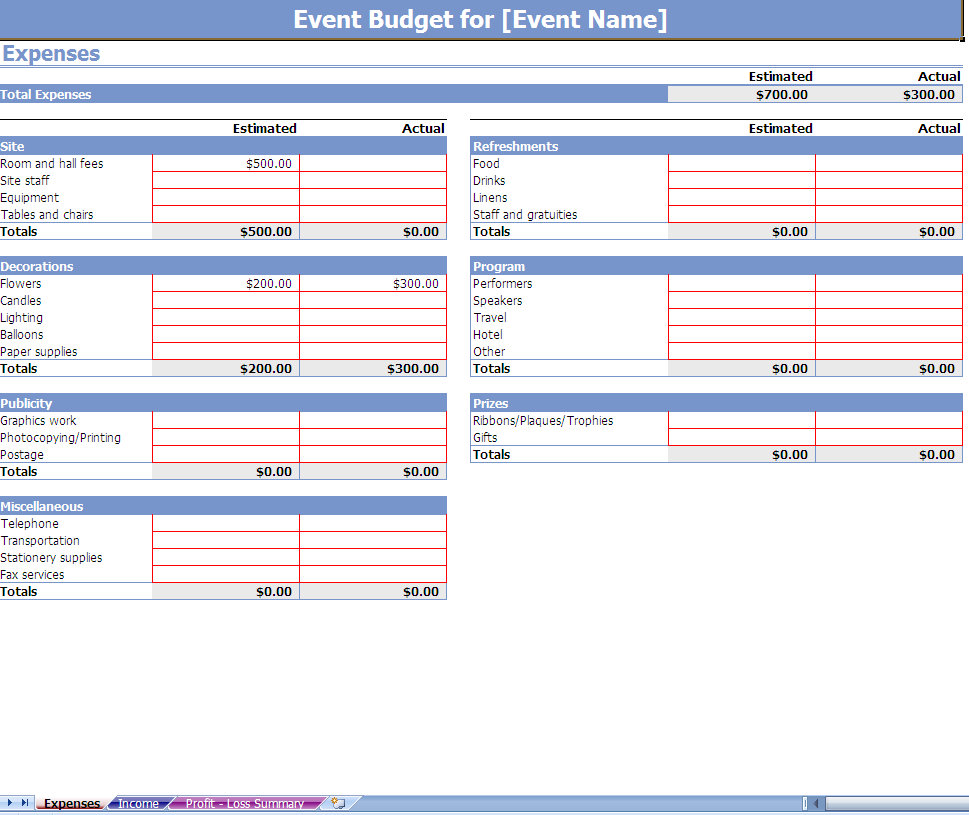

Examples of expenses on the balance sheet, such as cogs, depreciation and amortization, salary and wage expenses, and interest expenses, demonstrate the.

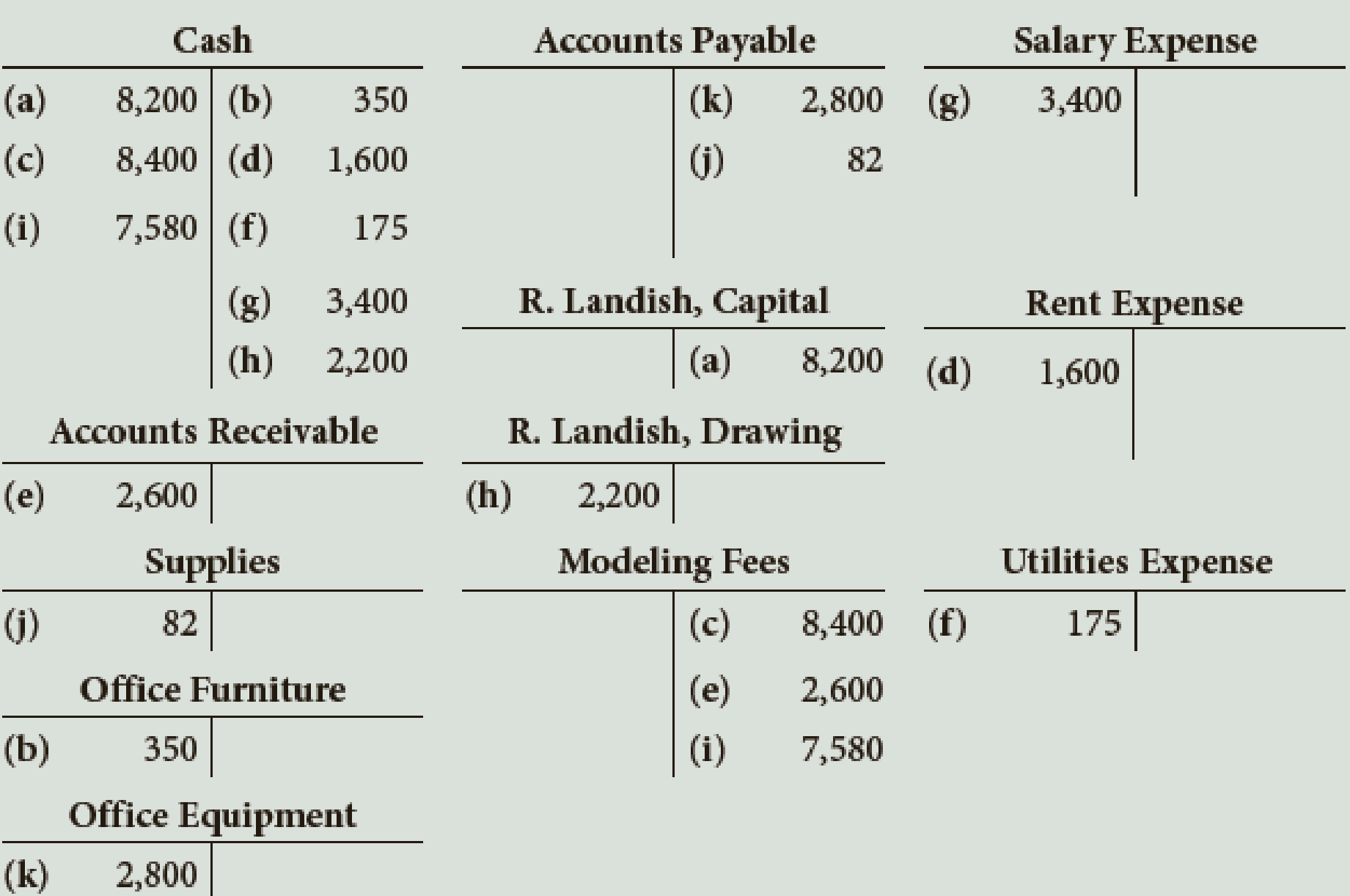

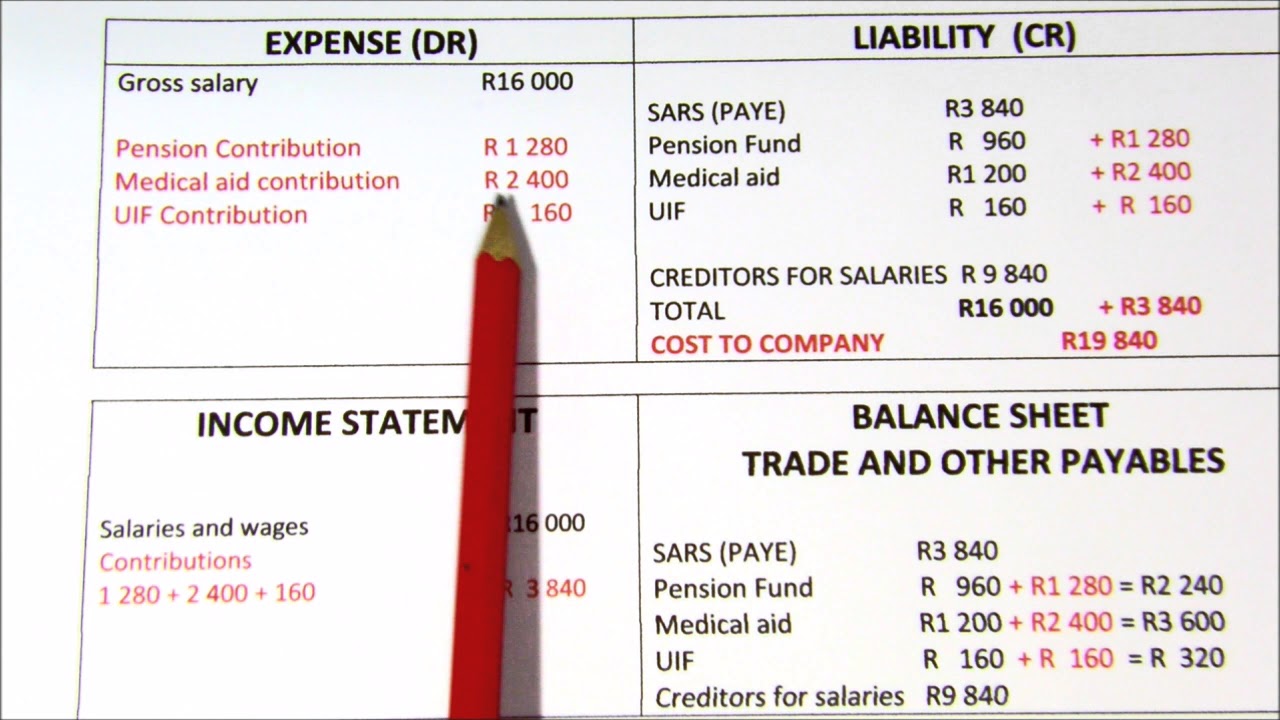

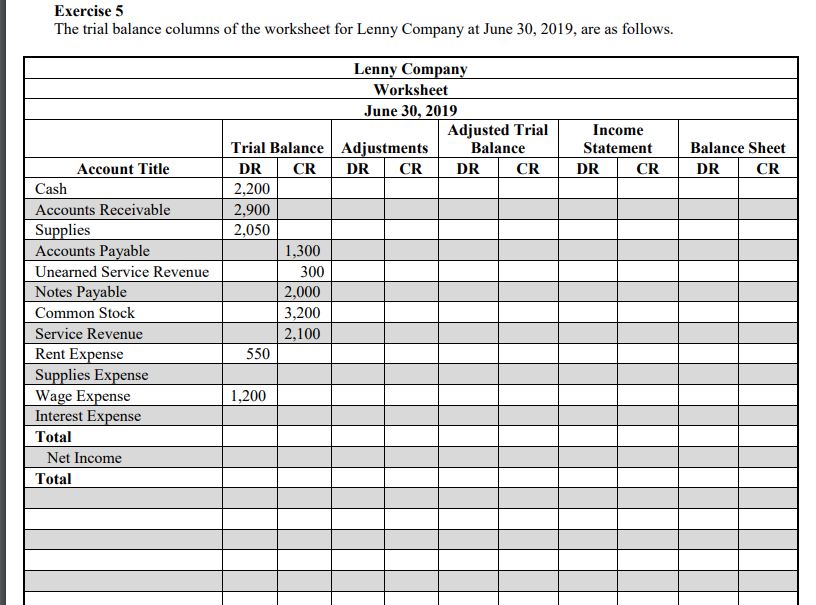

Wage expense on balance sheet. Impact on the financial statements: The income statement shows the financial results of a business for a designated period of time. The account wages and salaries expense (or separate accounts such as wages expense or salaries expense) are used to record the amounts earned by employees.

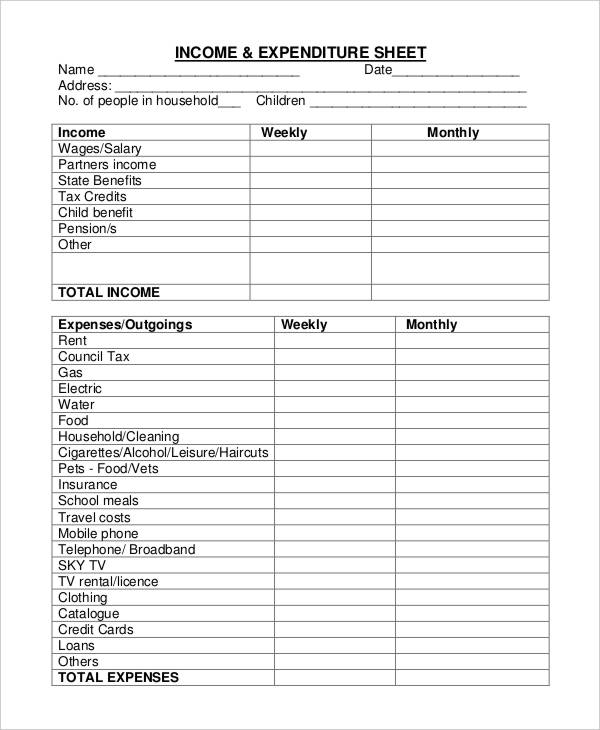

A balance sheet is one of the primary statements used to determine the net worth of a company and get a quick overview of its financial health. Knowing your monthly operating expenses is crucial to managing your cash flow and budget. Accrued expenses appear as liabilities on the balance sheet and are classified as current liabilities if they are expected to be settled within one.

Salaries, wages and expenses on a balance sheet income statement vs. Salaries, wages and expenses are vital components of your income statement, which. Lawn mowing revenue, gas expense, advertising expense, depreciation expense (equipment), supplies expense, and salaries expense.

An expense appears more indirectly in the balance sheet,. When a business incurs an. However, labor expenses appear on the balance sheet as well, and in three notable ways:

Do salary expenses go on a balance sheet? Wages payable, works in progress, and capitalized expenses. Accrued wages are categorized under the accrued expenses line item, which is a current liability on the balance sheet.

In this video, learn how to compute cash paid to employees by using the wage expense amount reported in the income statement and the change in wages payable reported in. Net income can be positive or negative. Definition the amount of liability that remains unpaid at the end of a financial year for the employees’ salaries is known as accrued salaries.

An accrued wage is incurred and. The balance sheet and the income statement provide distinct yet interconnected perspectives on a company’s financial standing. When the products are sold, the costs assigned to those products (including the manufacturing salaries and wages) are included in the cost of goods sold, which is.

How an expense affects the balance sheet an expense will decrease a corporation's retained earnings (which is part of stockholders' equity) or will decrease a sole. A balance sheet is a financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time. By mark kennan published on 26 sep 2017 balance sheets function like a snapshot of the financial state of the.

For the most part, the more your. Salaries payable is a liability account and will increase total liabilities and equity by $1,500 on the balance sheet.

/GettyImages-186586723-8198a5c6c7d54c95ae0d17687730013e.jpg)