Unbelievable Tips About Direct Income Statement

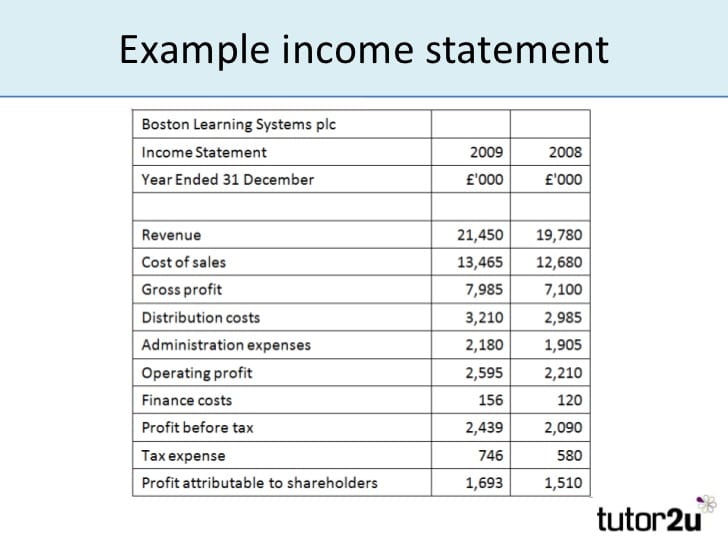

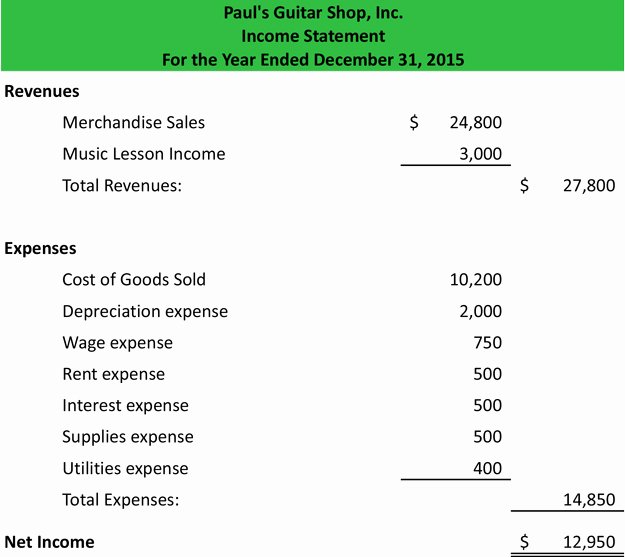

Starting at the top, we.

Direct income statement. The direct method shows each major class of gross cash receipts and gross cash payments. The direct method of presenting the statement of cash flows presents the specific cash flows associated with. An income statement, also known as a profit and loss statement, is a fundamental financial document that provides a snapshot of a company’s financial.

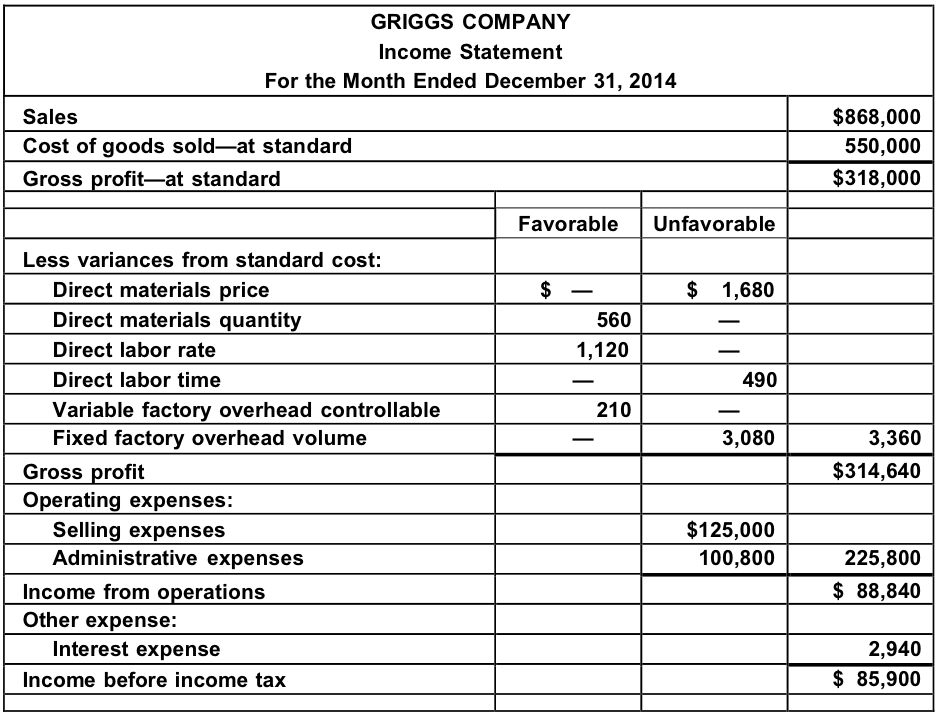

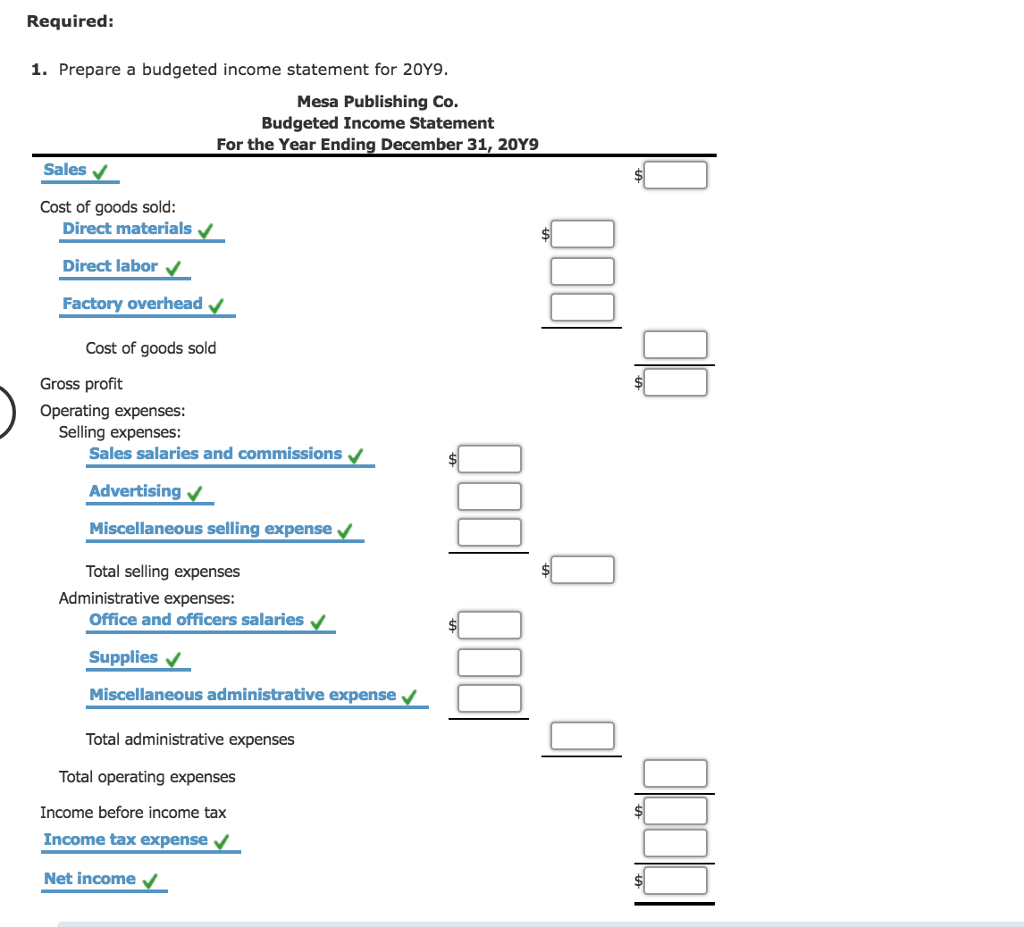

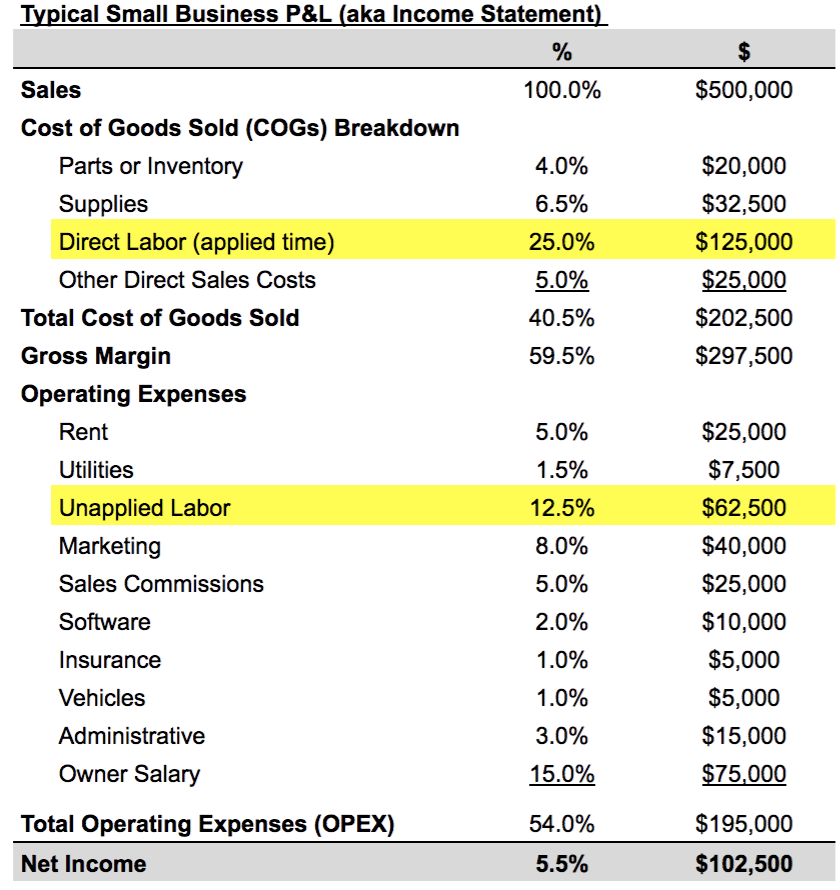

The direct method, the income statement is reformulated on a cash basis, rather than an accrual basis from the top of the statement (the income part) to the bottom (the. Direct and indirect costs can be declared on the income statement as expenditures since a personal service company does not hold inventory. Since income statements for manufacturing companies tend to be more complex than for service or merchandising companies, we devote this section to income.

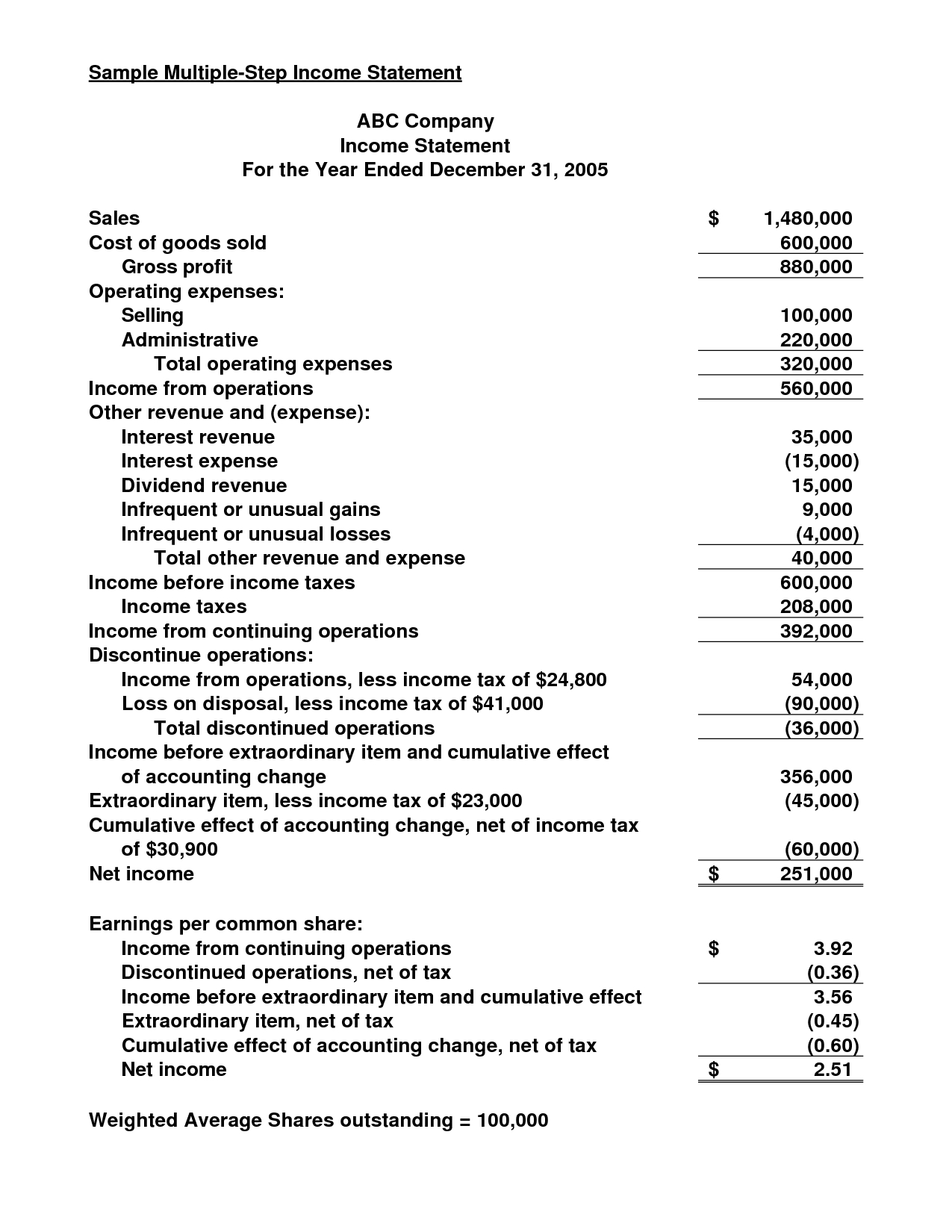

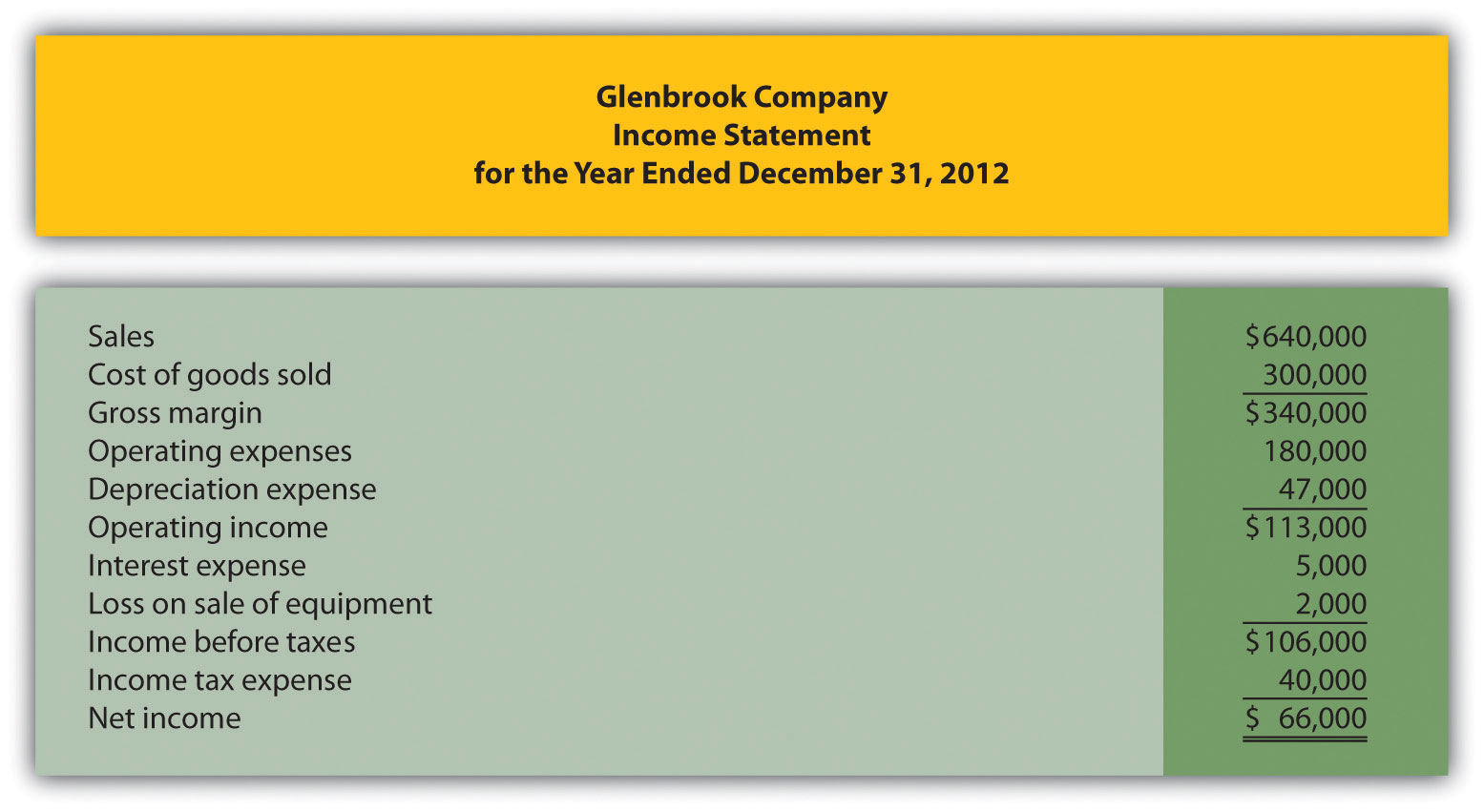

Direct cash flow is an accounting method that creates a detailed cash flow statement showing the cash changes over an accounting period. What is the cash flow statement direct method? The income statement is one of the most important financial statements because it details a company’s income and expenses over a specific period.

Accountingverse.com an income statement summarizes a company's financial performance. The irs said wait times during tax season can average 4 minutes, but you may experience longer wait times on monday and tuesday, the irs said, as well as. Learn to analyze an income statement in cfi’s financial analysis fundamentals course.

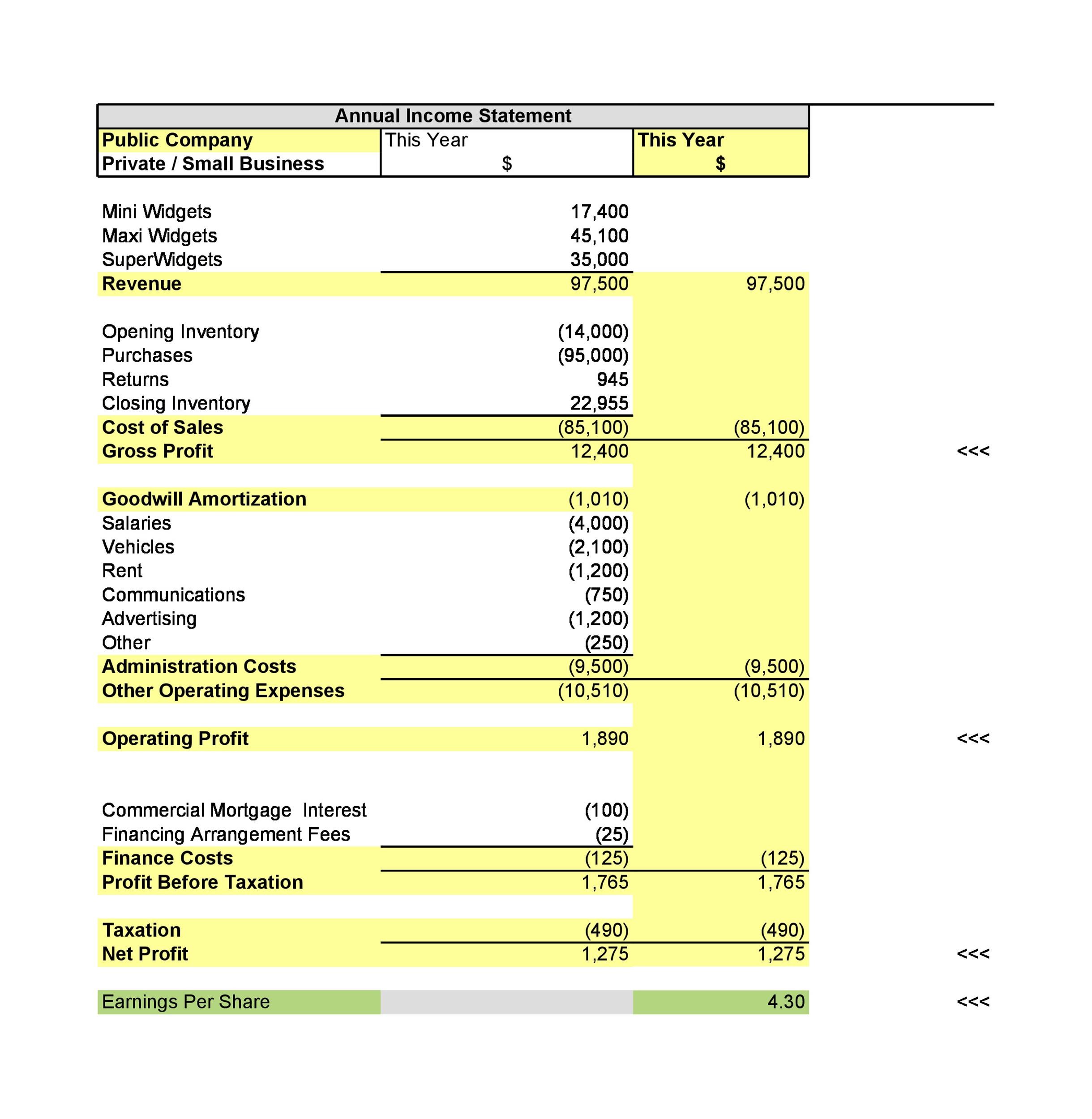

Direct and indirect costs are reported under two separate line items on an income statement: There are two major differences between a segmen ted income statement and a contribution margin income statement. Take a look at the p&l and then read a breakdown of it below.

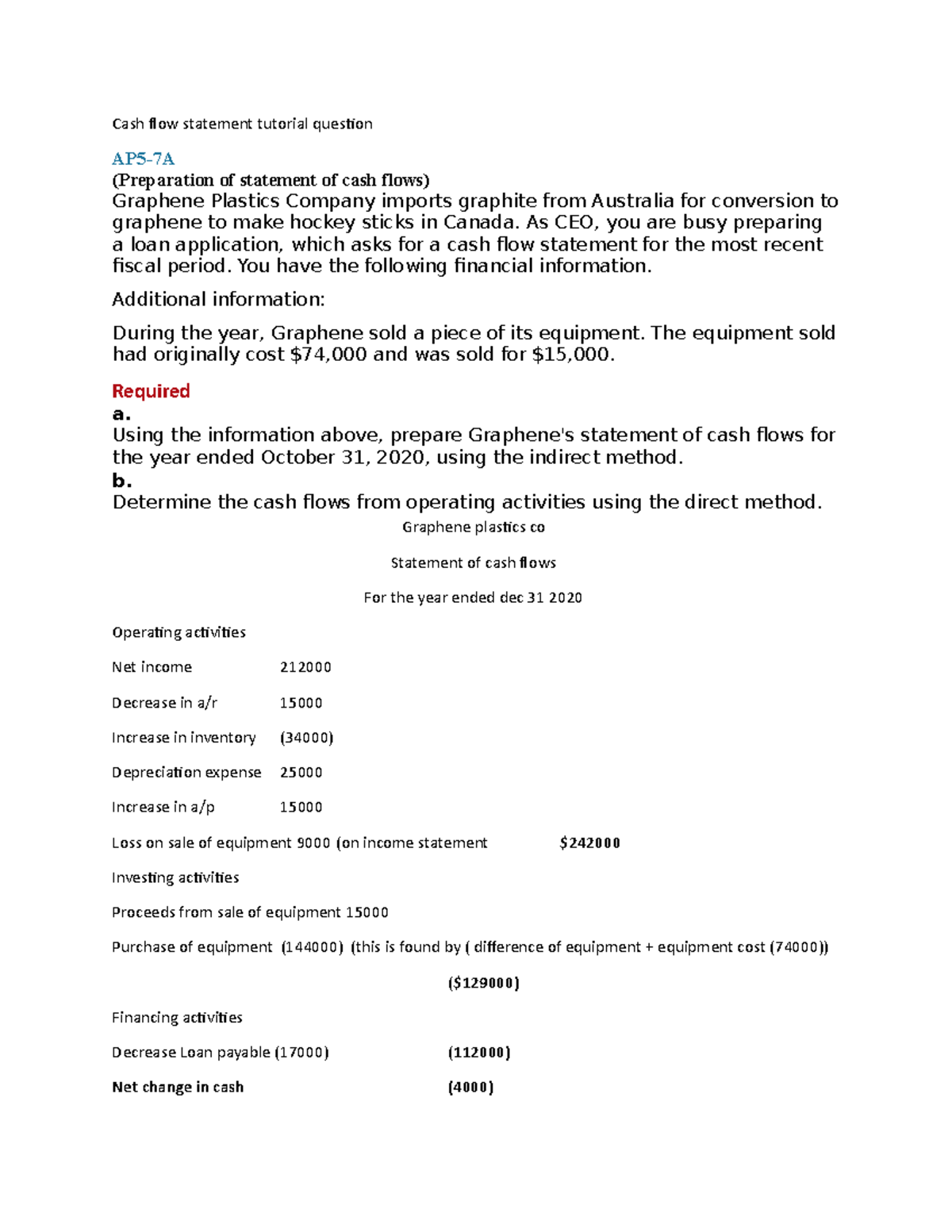

Direct expenses and allocated indirect expenses are reported as costs of. First, contribution margin income statement. Direct method under the direct method, the information contained in the company's accounting records is used to calculate the net cfo.

You can also use an independent. It shows all revenues and expenses of the company over a specific period. The operating cash flows section of the statement of cash flows under.