Peerless Info About Financial Ratios Excel

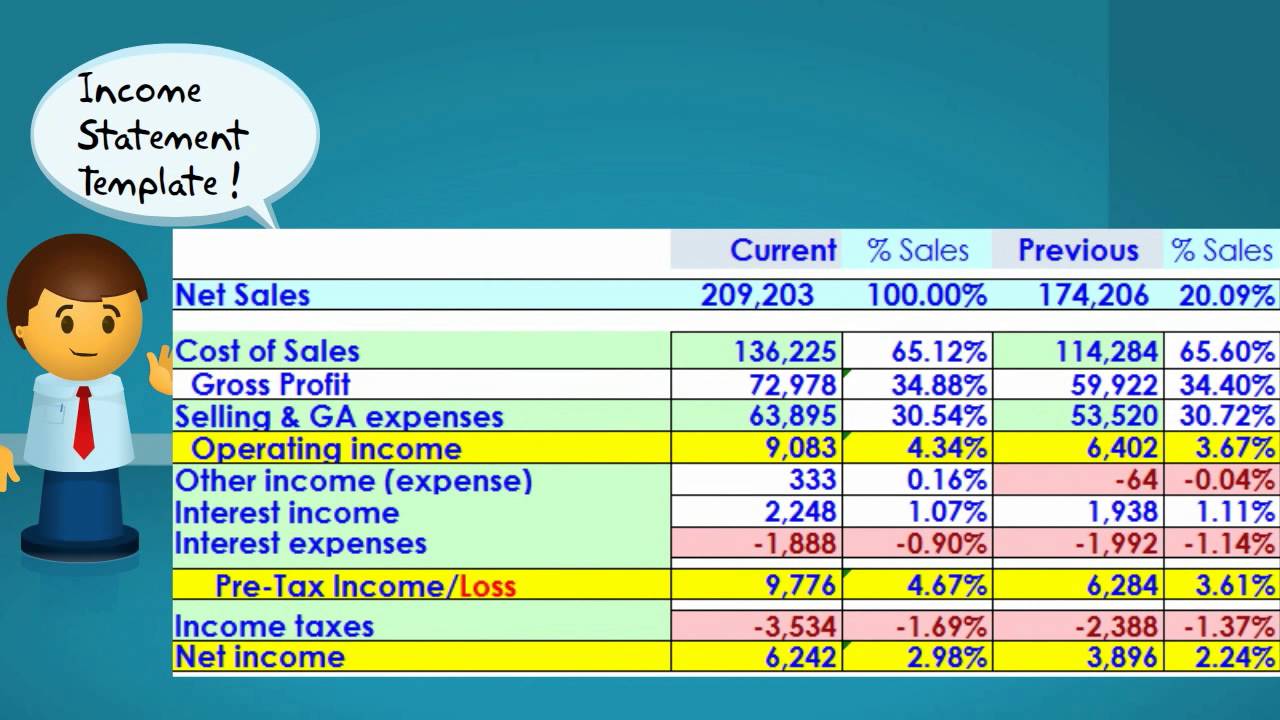

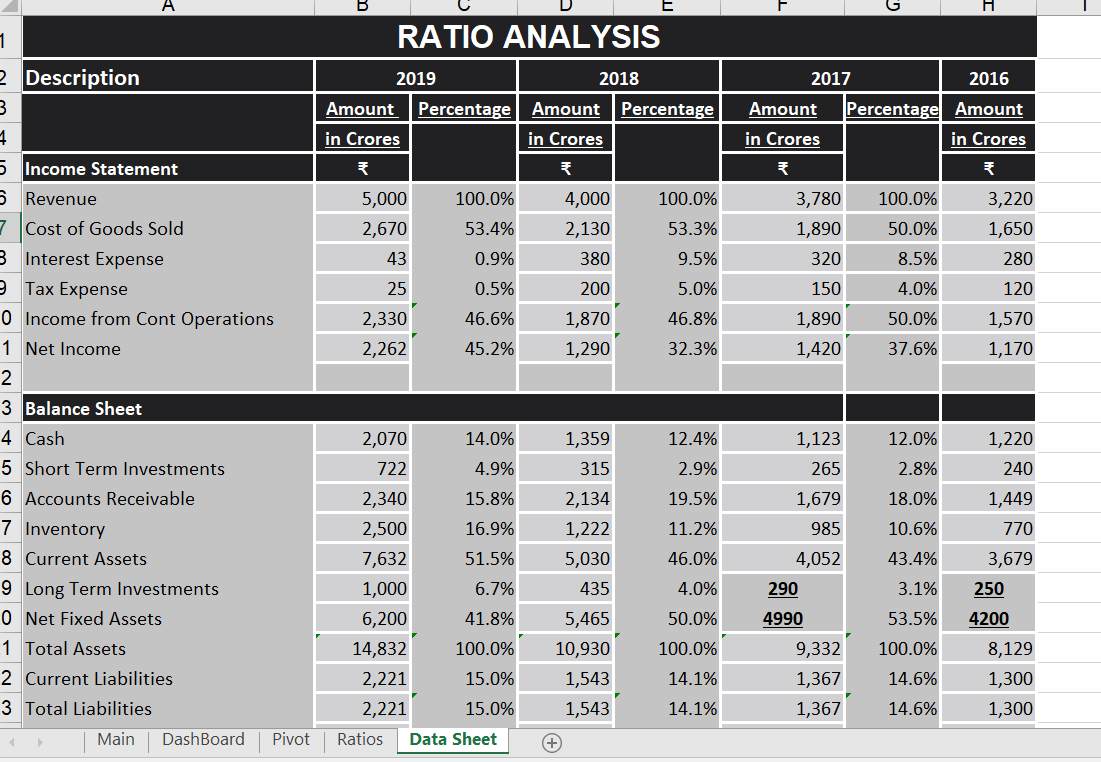

Financial statement analysis ratios in excel.

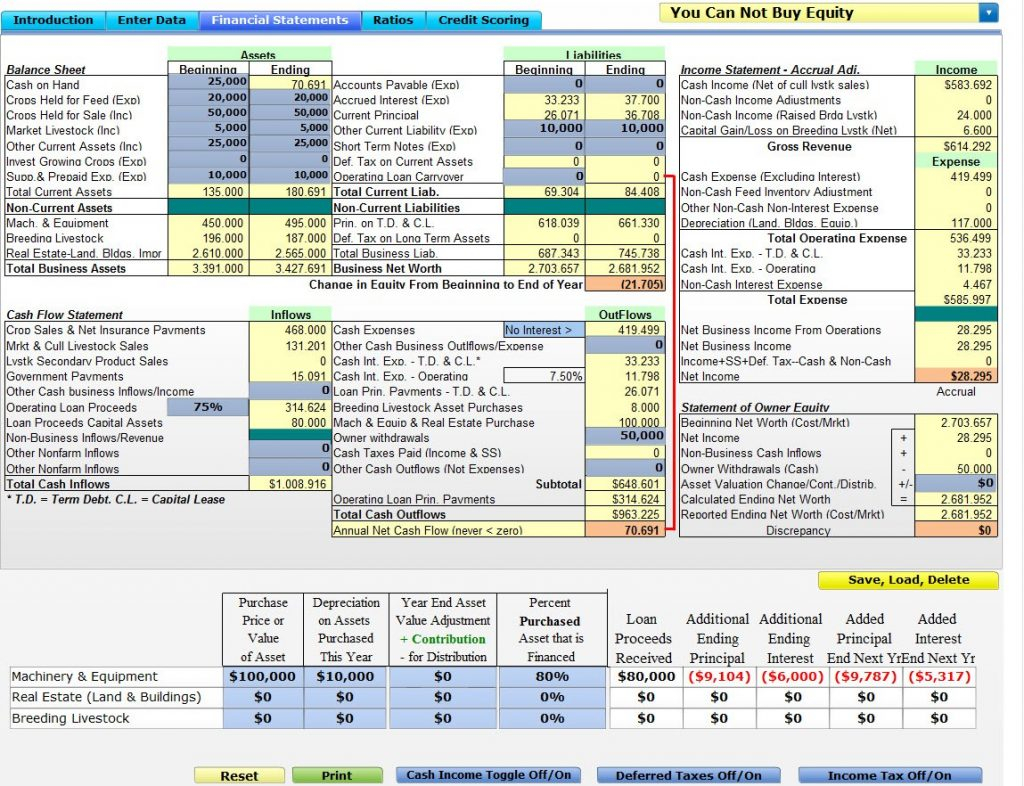

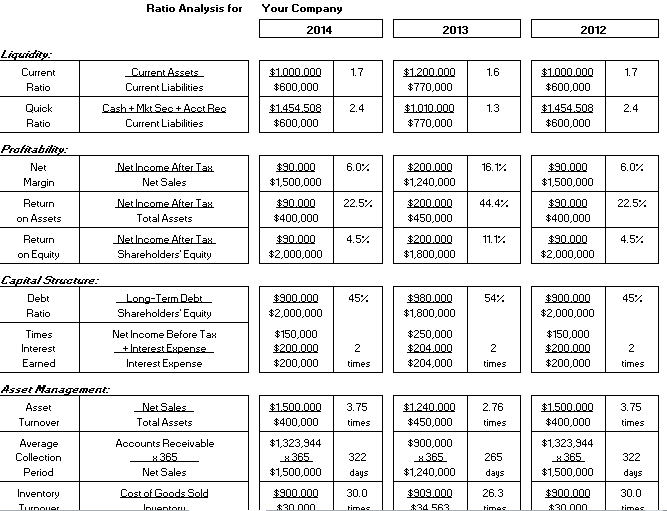

Financial ratios excel. Description financial statement analysis is useful to anticipate future conditions and, most important, as a starting point for developing strategies that influence a company's future course of business. In general terms, a ratio is defined to be the relationship existing between any two variables. As inventory plays a key role in working capital, it also affects the current ratio.

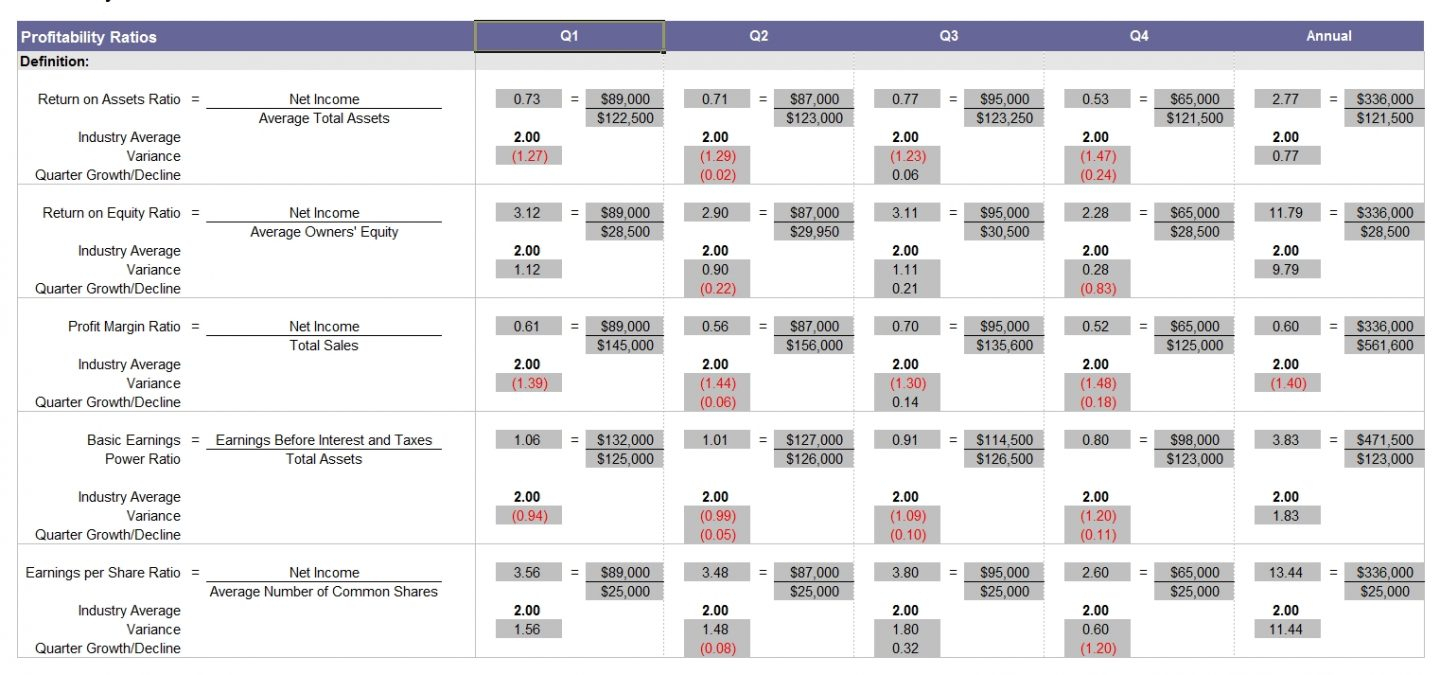

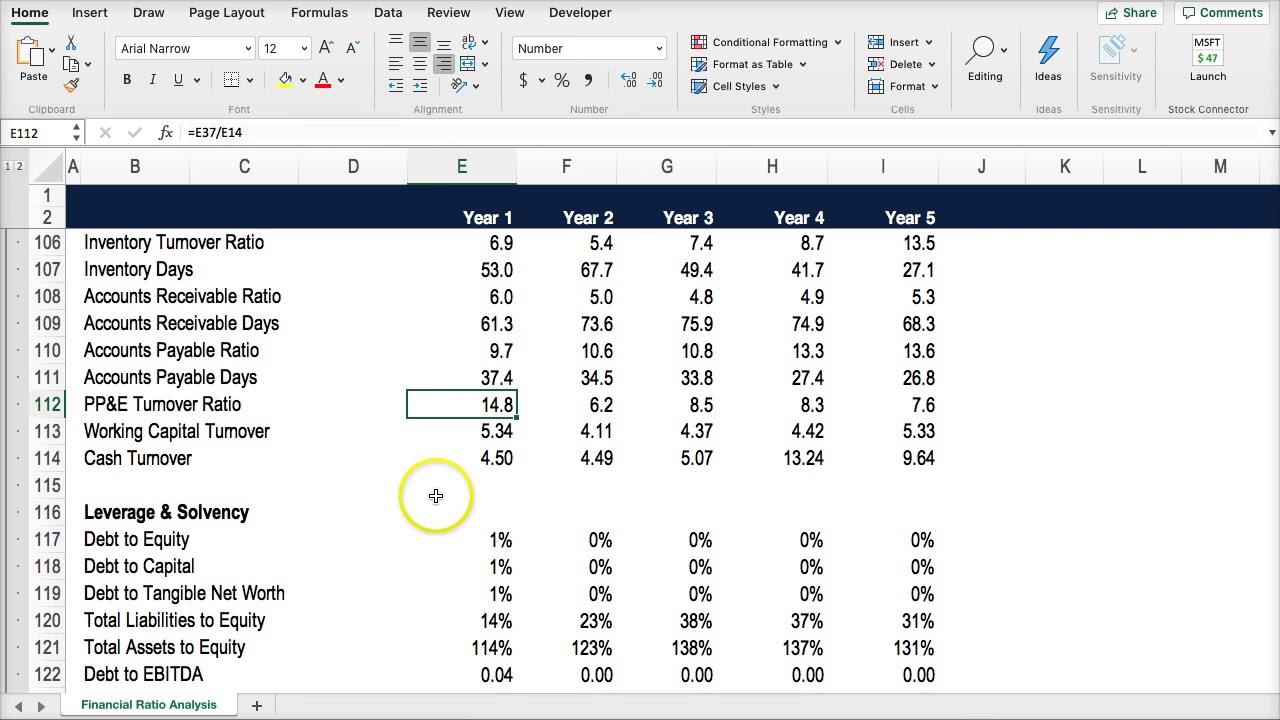

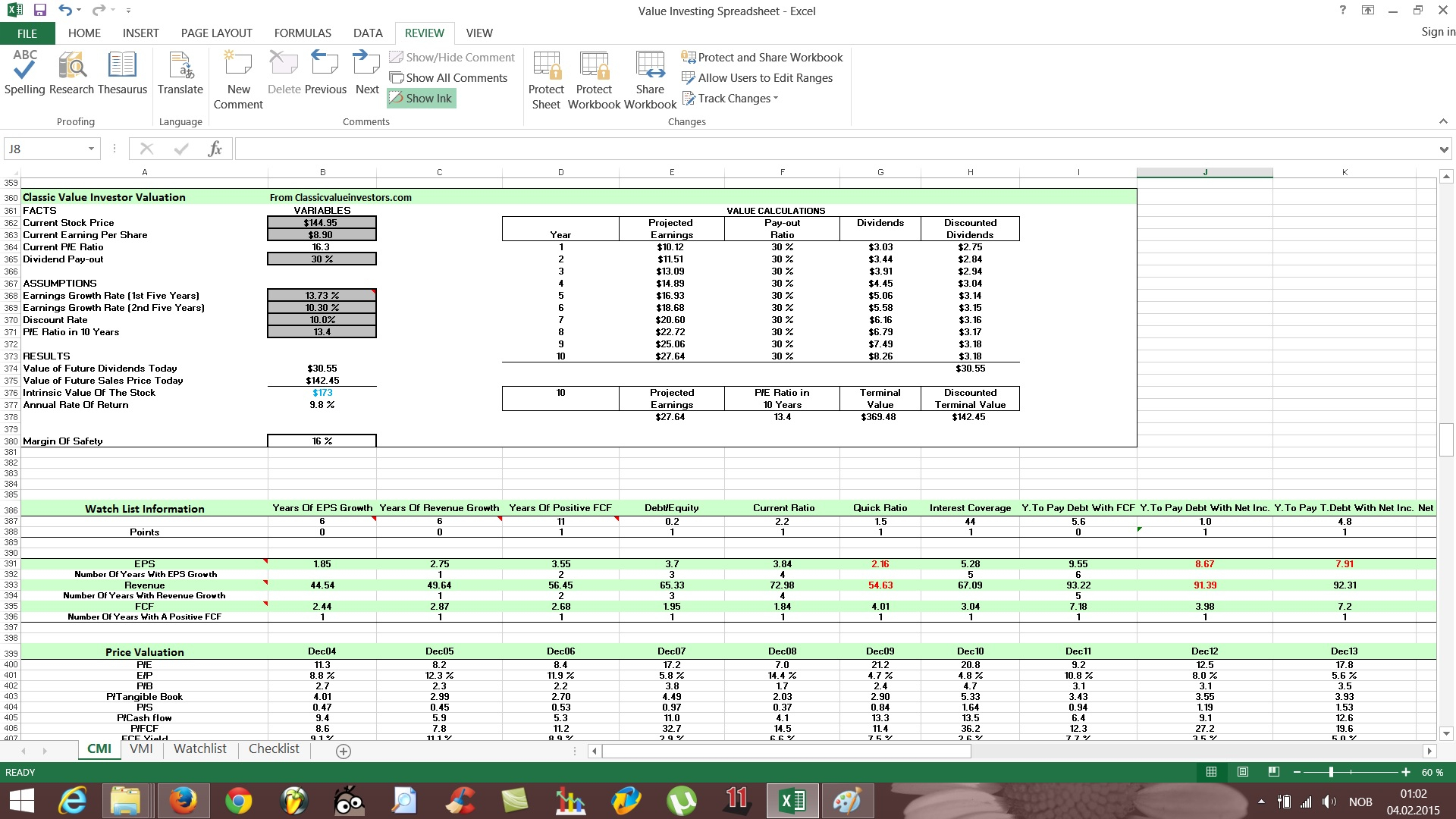

Profitability ratios assess a company’s ability to generate profits relative to its costs and. Financial ratios excel template. In this article, we demonstrate to you how to do ratio analysis in excel sheet format.

All you need to do is to enter data from your financial statements and the template will automatically calculate the ratios. Because ratios are most useful when compared to other ratios, and it is important to compare relevant ratios. When doing financial analysis, it is common to calculate ratios in excel.

In the same way, you can compare the balances of different enterprises. Ratio analysis, also known as financial statement analysis, involves evaluating the financial statements of companies, and comparing those results to similar companies; This financial ratio calculator in excel spreadsheet will help you calculate those important metrics.

Inventories usually are the least liquid of the current assets. The formula of some of the major liquidity ratios are: Track company performance determining individual financial ratios per period and tracking the change in their values over time is done to spot trends that may be developing in a company.

First, go to cell c10 and insert the following formula: Finding current ratio this criterion compares the current assets and the current liabilities of a company. Corporations may use excel to run a capital budgeting analysis, risk.

They are calculated using information from a company’s financial statements, such as the balance sheet and income statement. If you are interested in estimating your own company’s ratio analysis yourself, download our free template and follow us. Charlene rhinehart investors can use excel to run technical calculations or produce fundamental accounting ratios.

Input the formula into each cell of the ratio table, referencing the data you inputted in the financial statement table. Plug in your company’s numbers and get a quick and accurate picture of where you stand on liquidity, debt concentration, growth, profitability, and market value. Financial ratio analysis excel template there are 4 main categories of financial ratios and kpis used by financial practitioners, each addressing a specific question:

Gross margin, ebitda margin, ebit margin) Built by expert financial modellers, analysts and finance decision makers. This guide simplifies the process for immediate application.

See which numbers you are using to calculate these. The formula for accounting ratios can be calculated by using the following points: This ratio compares current assets to current liabilities.