Casual Info About Normal Costing Income Statement

Gaap cost of revenue was $6.1 billion.

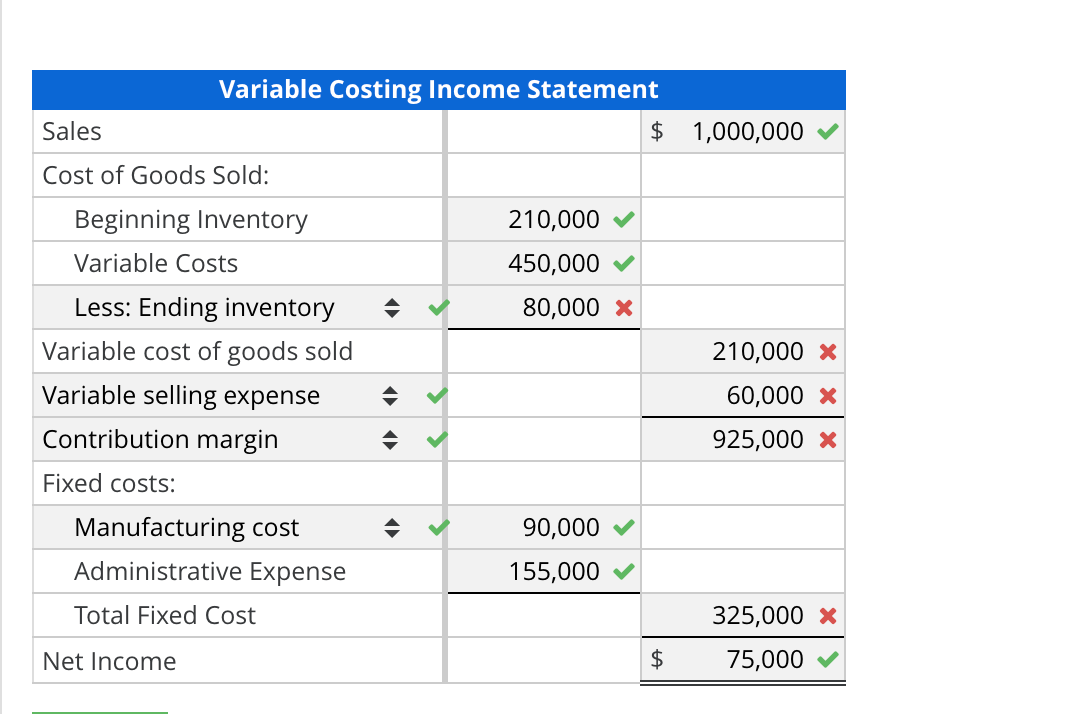

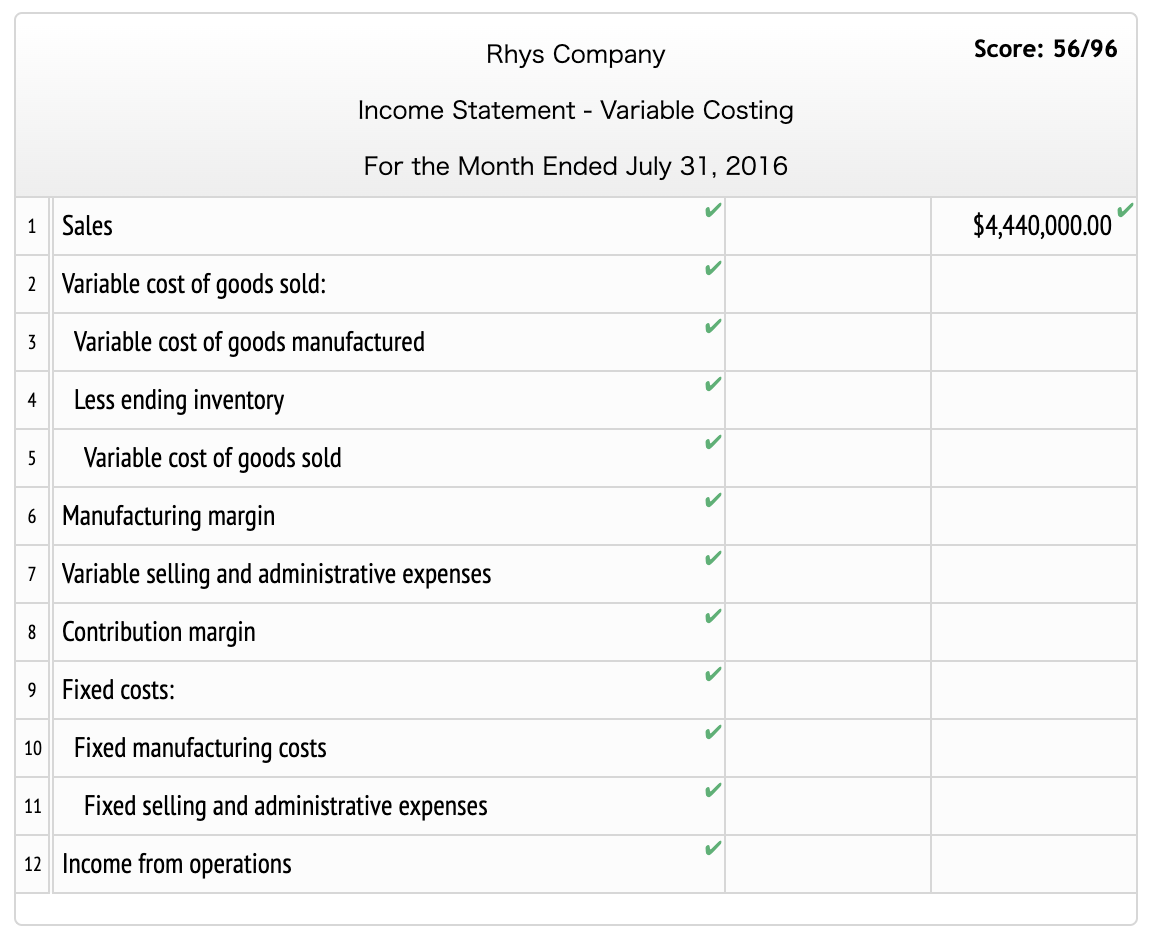

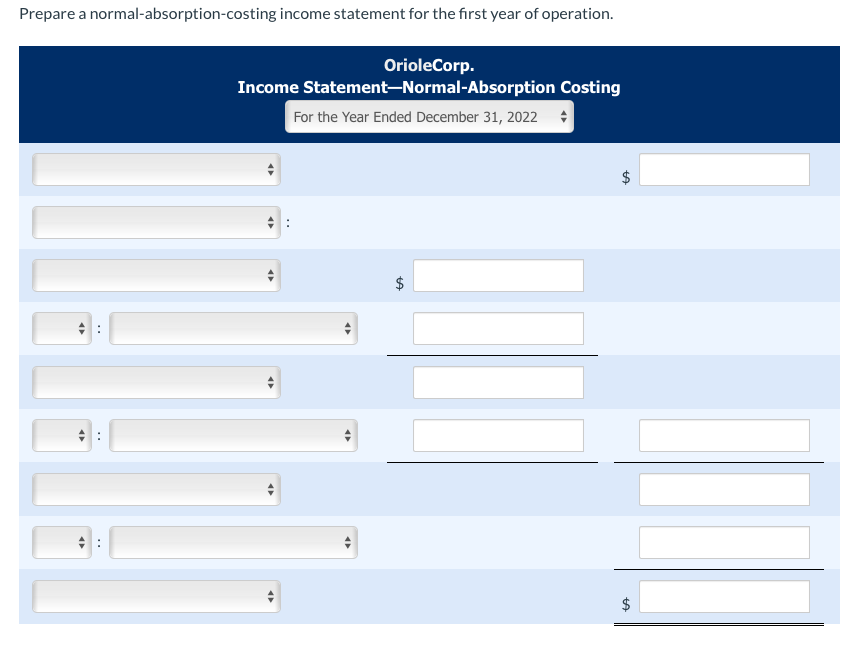

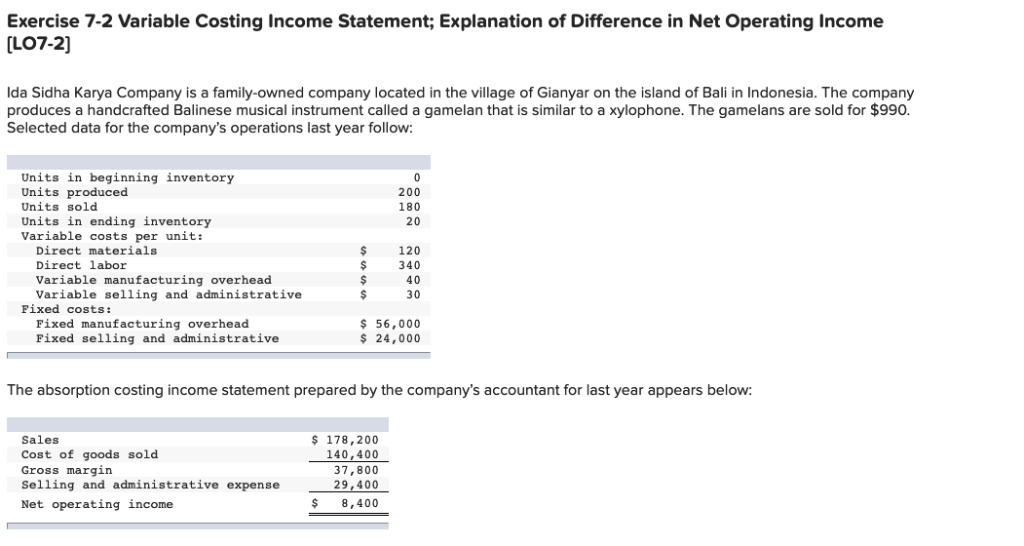

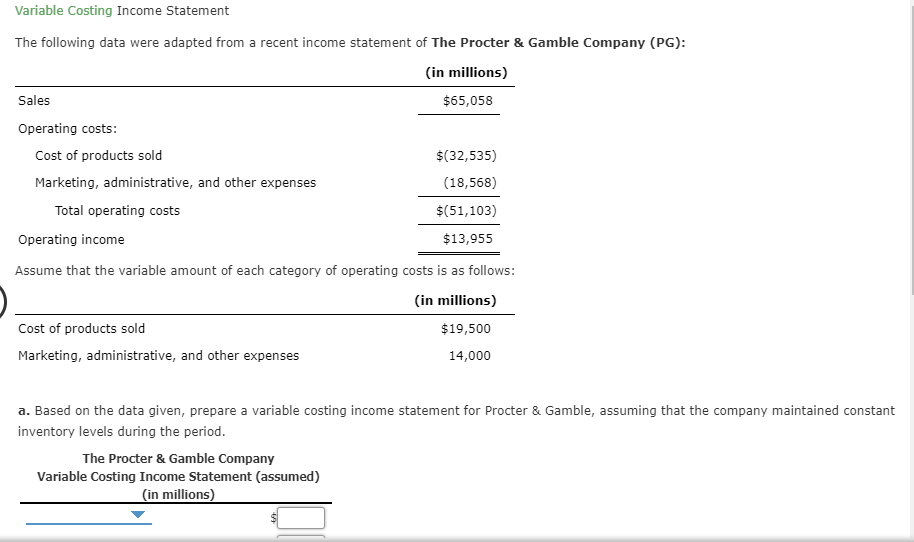

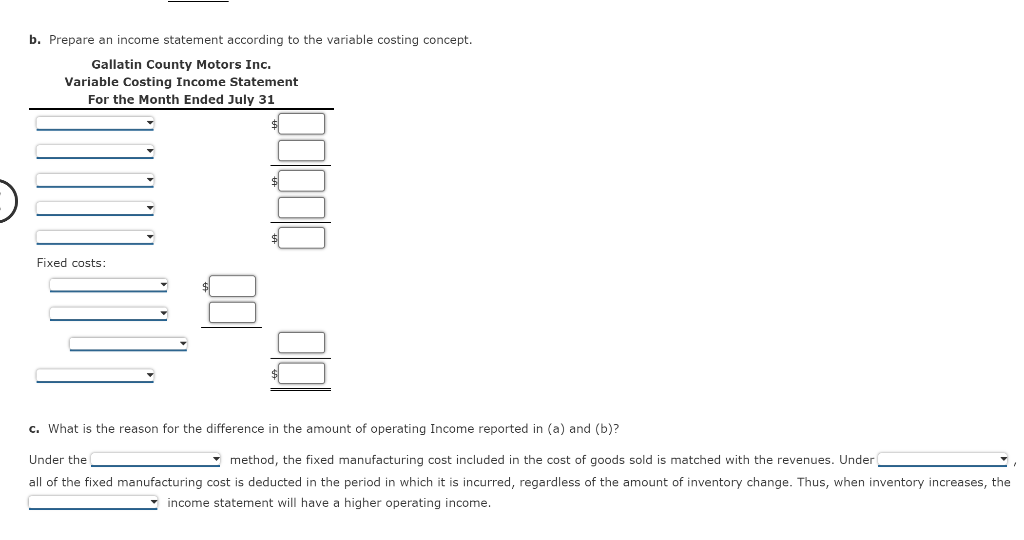

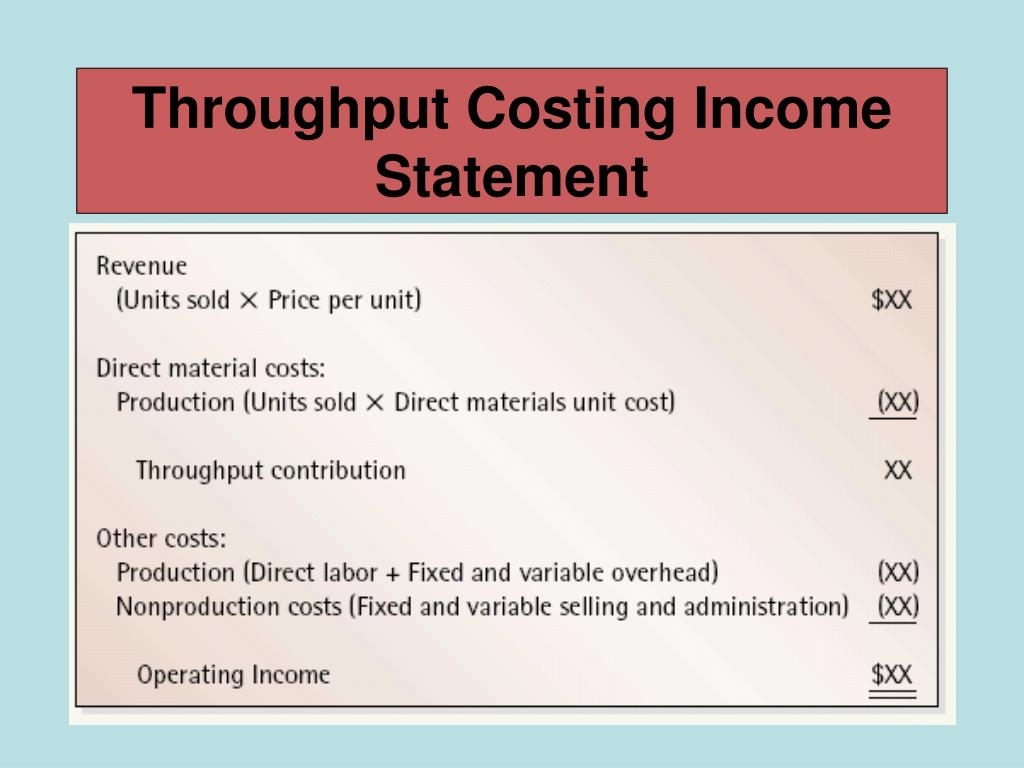

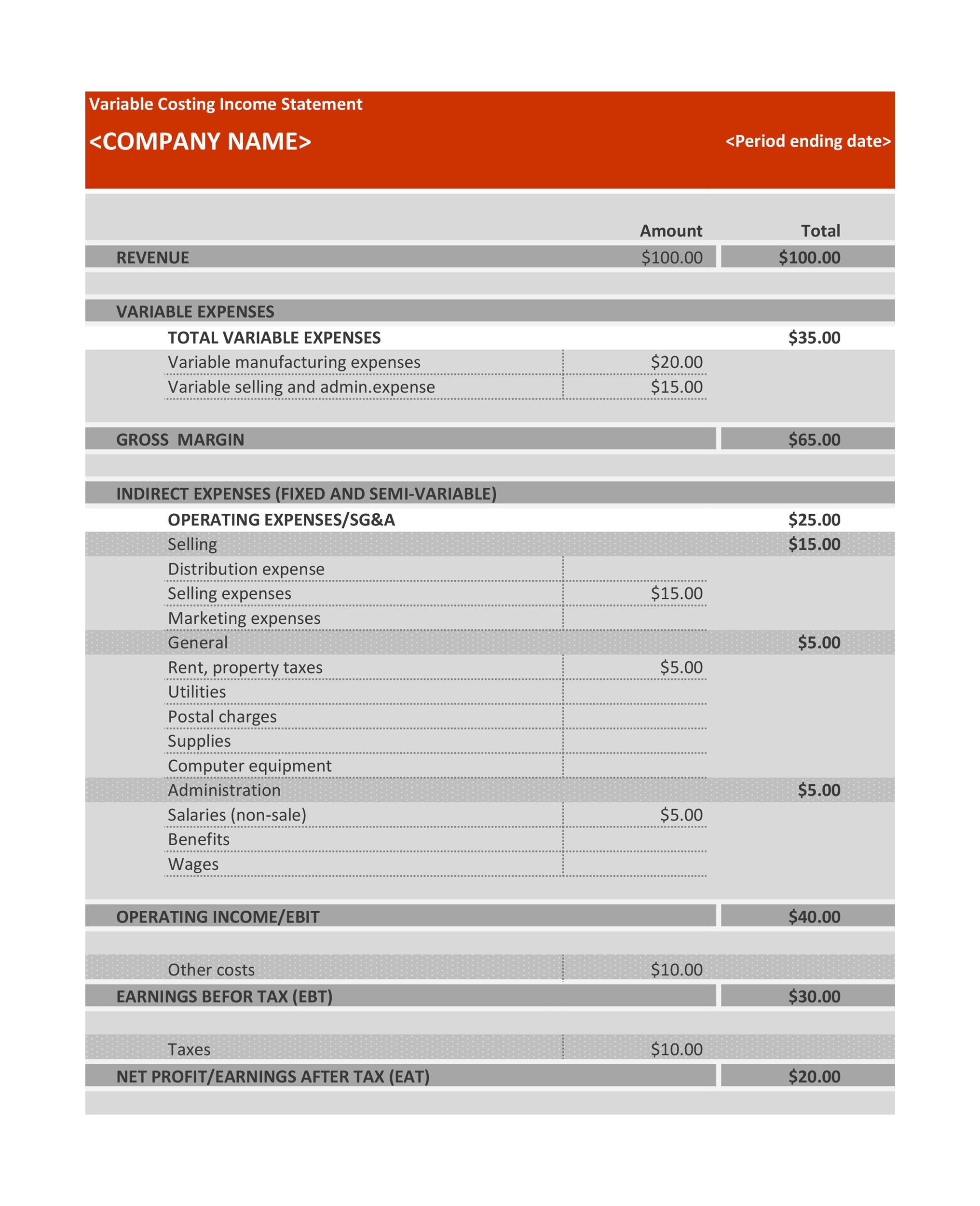

Normal costing income statement. Costs are divided into product and. Marginal costing income statement. A variable costing income statement is a financial report in which you subtract variable expenses from revenue, resulting in a contribution margin.

A variable costing income statement is one in which all variable expenses are deducted from revenue to arrive at a. Actual cost of materials actual cost of direct labor applied manufacturing. The standard overhead rate is.

Nearly 300,000 people with low. The statement displays the company’s revenue,. Normal costing is a method of costing that is used in the derivation of cost.

Normal costing is used to derive the cost of a product. This income statement looks at costs by dividing costs into product and period costs. It is seen that variable costs are deducted first from the sales revenue to arrive at the contribution margin.

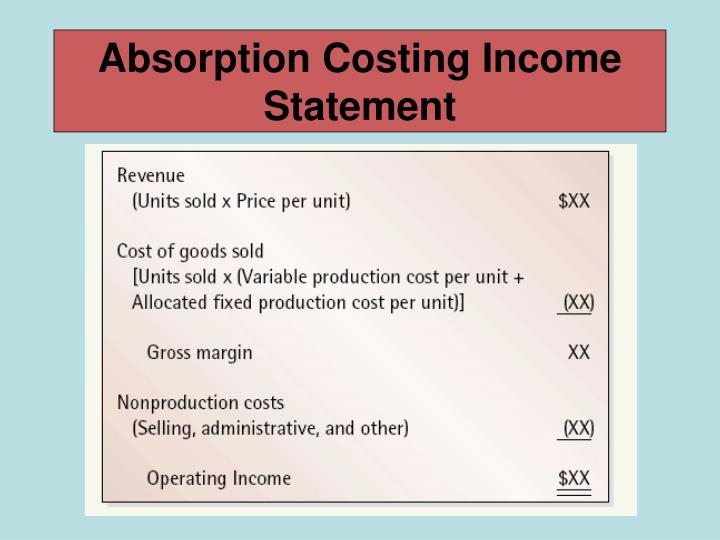

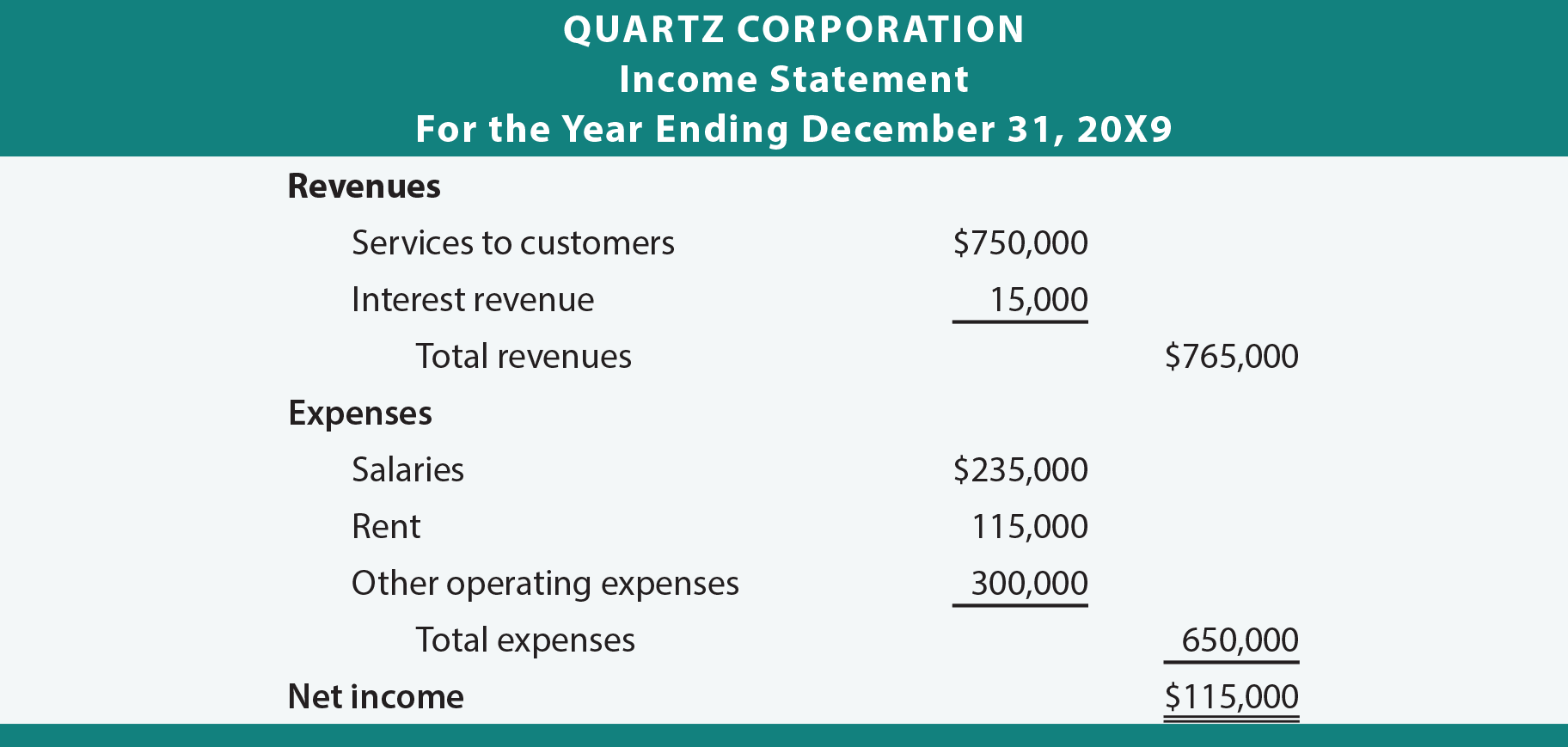

The traditional income statement, also called absorption costing income statement , uses absorption costing to create the income statement. Income statement under marginal costing. The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting.

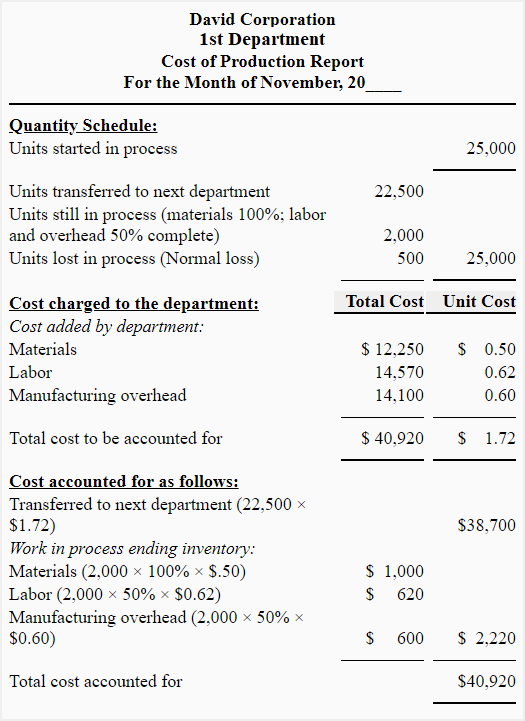

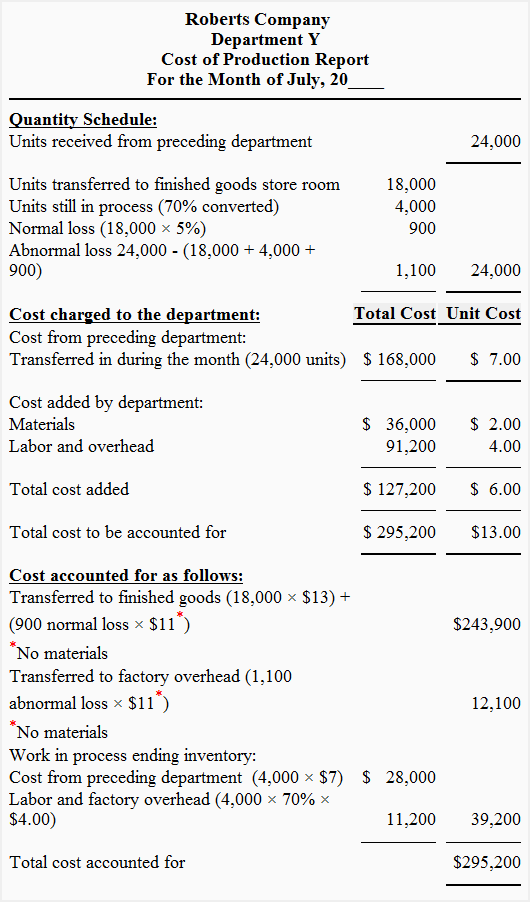

The components of the income statement include: An income statement is one of the three important financial statements used for reporting a company’s financial performance. For a manufacturer, normal costing means assigning the following costs to the actual goods produced each month:

By failing to record the inventory loss, rite aid overstated inventory (an asset) on the balance sheet by $9,000,000 and understated cost of goods sold (an expense) by. In order to be able to prepare income statements under marginal costing, you need to be able to complete the following proforma. Absorption costing is a managerial accounting cost method of expensing all costs associated with manufacturing a particular product and is required for generally.

Definition of normal costing normal costing for manufactured products consists of following: This approach applies actual direct costs to a product, as well as a standard. Definition of normal costing.

Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable. The normal costing method utilizes two main formulas: What is an income statement?

In chapter 2, we look at an alternative approach to recording manufacturing overhead called normal costing. What is normal costing? Normal costing definition the actual cost of direct materials, the actual cost of direct labor, and manufacturing overhead applied by using a predetermined annual overhead rate.