Looking Good Info About Patents In Accounting Balance Sheet

This shapes how you record a patent as an accounting journal entry and document patents.

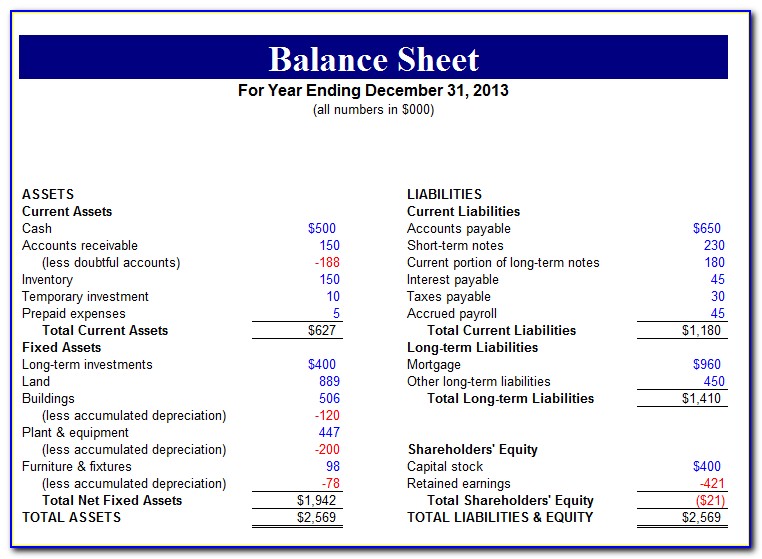

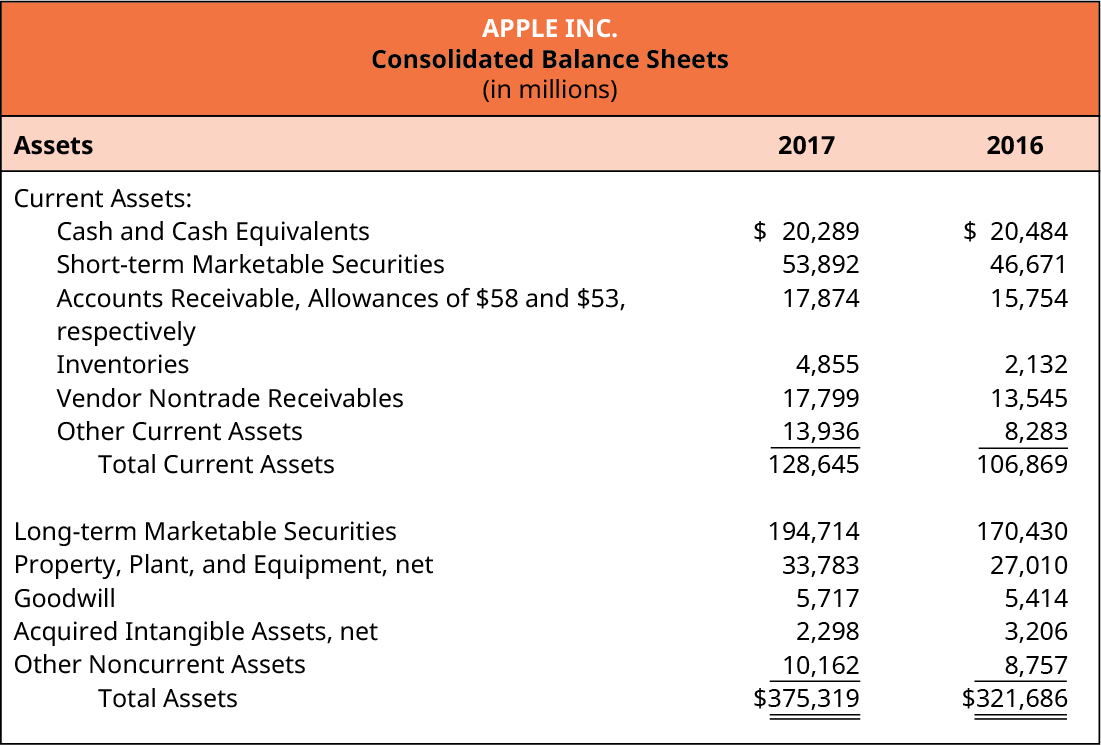

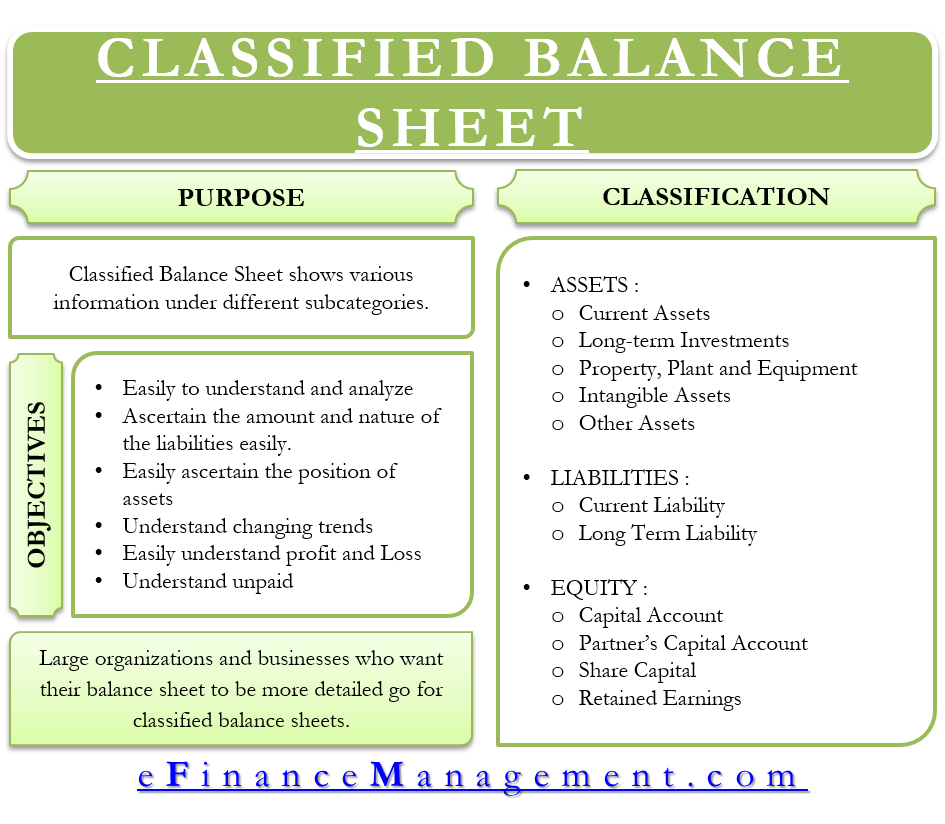

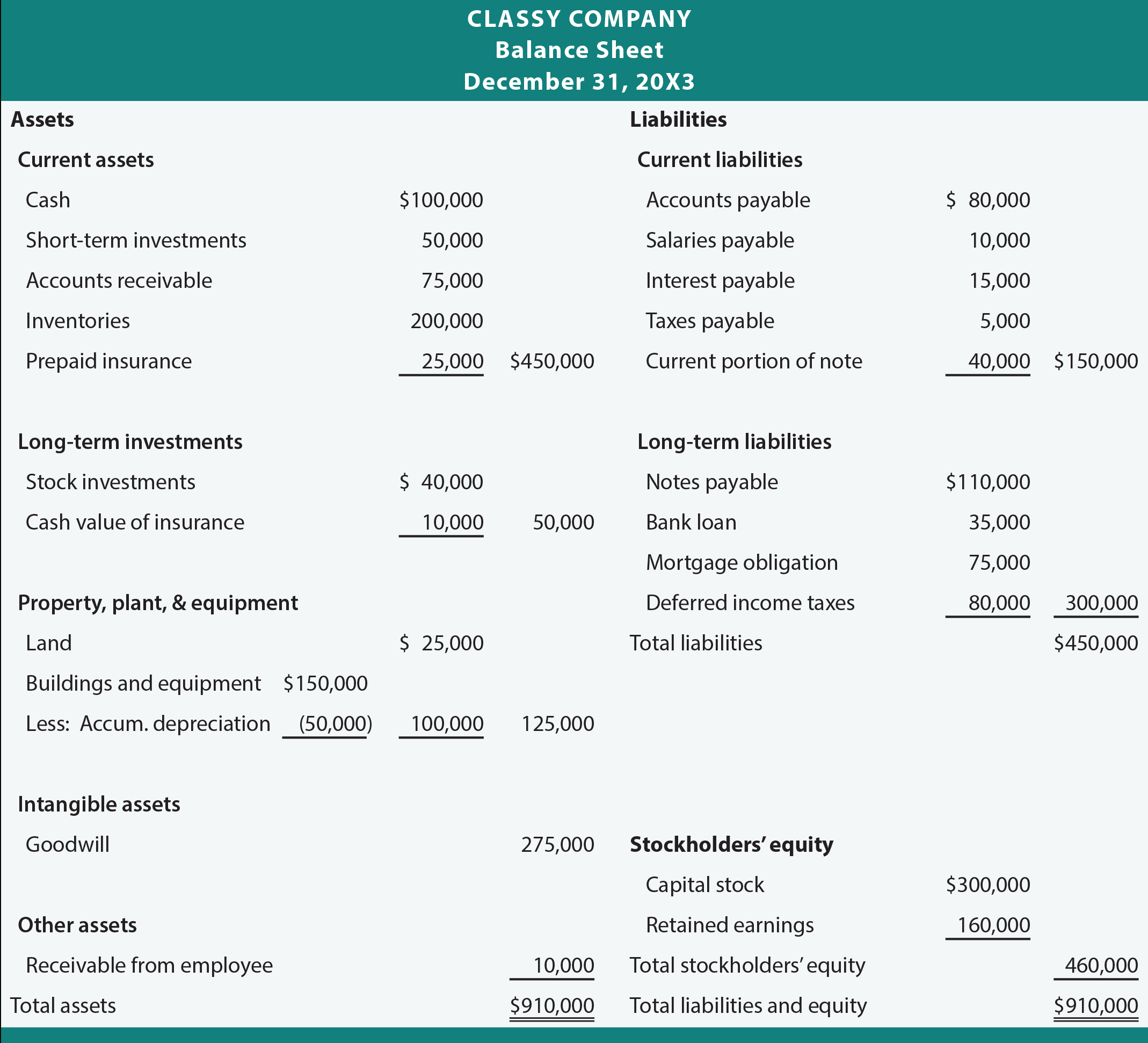

Patents in accounting balance sheet. A patent is considered an intangible asset; Where are patents classified on the balance sheet? Intangible assets are not physical objects.

This type of asset is. Gaap permits only patents acquired from third parties to be recorded in your. Patent as loan collateral, accounting, debt and equity financing, voluntary capital market information.

Published on 1 jan 2021 you can use an inventor’s idea to improve your own operations by entering into a licensing agreement. Patents, copyrights, trademarks on the balance sheet guide | accountant town the topics suggested by the subject of this chapter are frequently considered along with.

These differences are as follows: Intangible assets, including patents, are defined as assets that are not physical and which can be useful for longer than 12 months. The licensing agreement gives you the right to use.

In the case of a listed company, an ip valuation helps to communicate the value of its ip assets to capital markets, supports its share prices, and helps to obtain. Total the development costs for the patent, including research. Although patents are not conventional liquid assets that appear on a balance sheet, their uses as an alternative asset class directly increase the value of the.

When a patent is acquired, generally accepted accounting procedures requires that it be included on the business’s balance sheet at its fair value. Realize that the use of historical cost means that a company’s intangible assets such as patents and trademarks can be worth much more than is shown on the balance sheet. As such, the accounting for a patent is the same as for any other intangible fixed asset,.

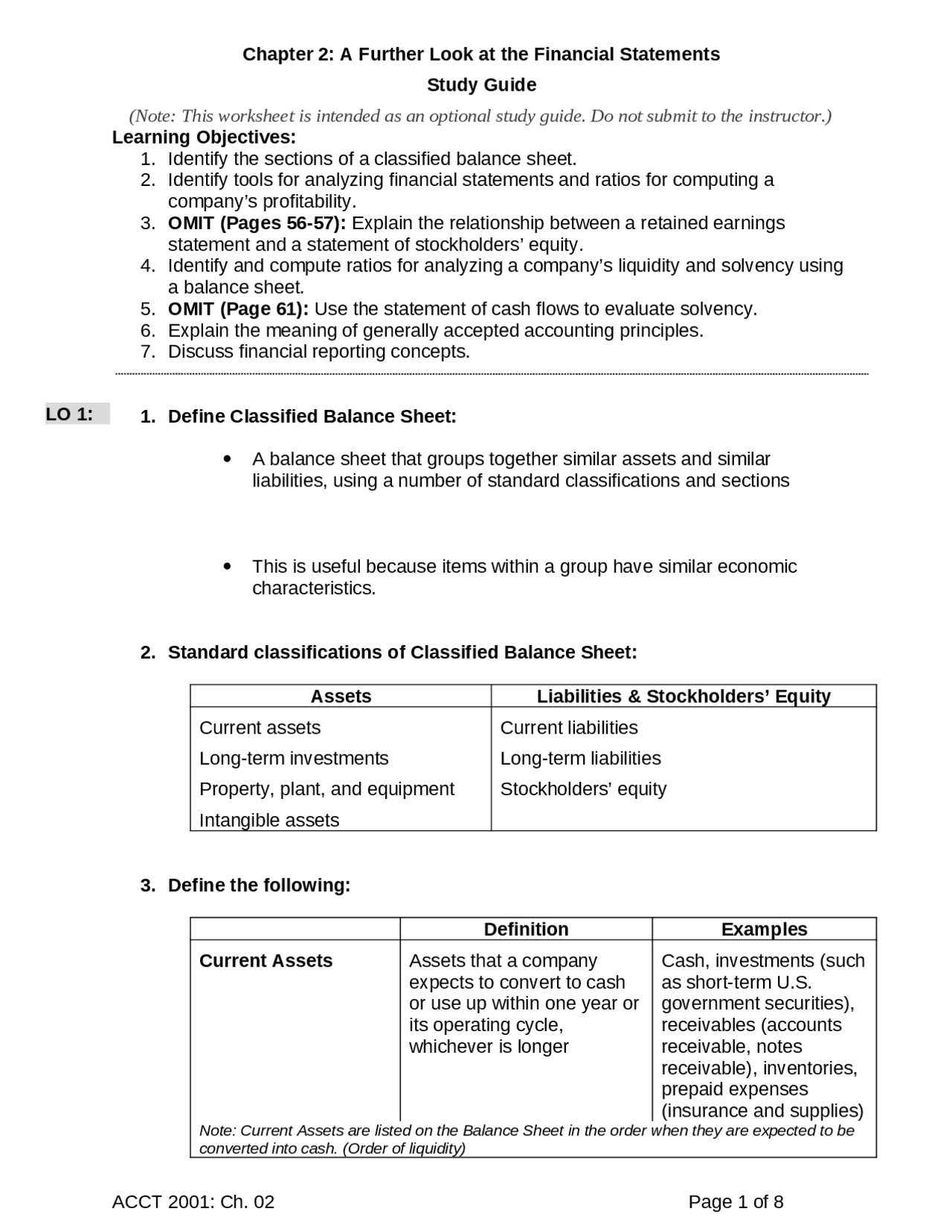

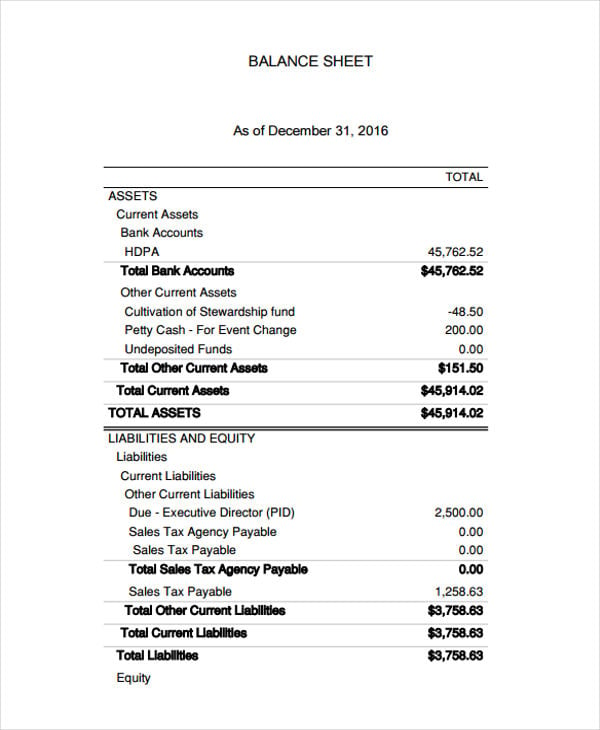

Calculate the value of a patent on the balance sheet using its development costs or purchase price. What is the balance sheet? The balance sheet is one of the three fundamental financial statements and is key to both financial modeling and accounting.

It is time for that to change. Examples of intangible assets are patents, copyrights, customer lists, literary works,. Realize that the use of historical cost means that a company’s intangible assets such as patents and trademarks can be worth much more than is shown on the balance sheet.

The useful life of tangible and. There are a few key differences when accounting for tangible and intangible assets. Each of these balance sheet components can tell a story.

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)

![What Is Accounting? Introduction to Business [Deprecated]](https://s3-us-west-2.amazonaws.com/courses-images/wp-content/uploads/sites/143/2016/09/22182604/11322953266_46d8906a42_k.jpg)