Unbelievable Tips About Bank Loan In Cash Flow Statement

Project loans, deposits, and key iea/ibl 6:56:

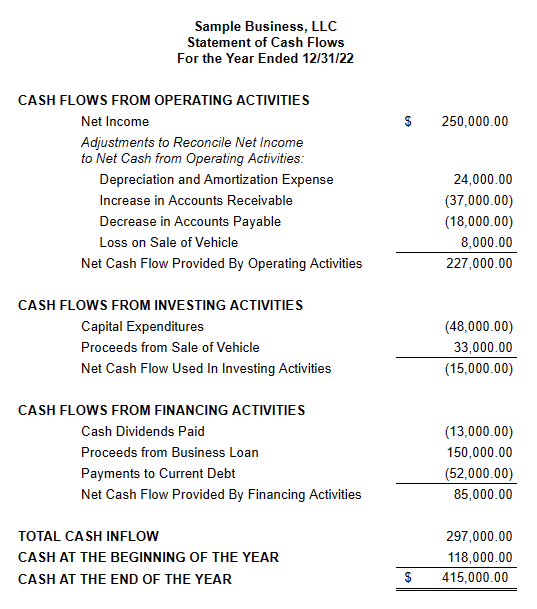

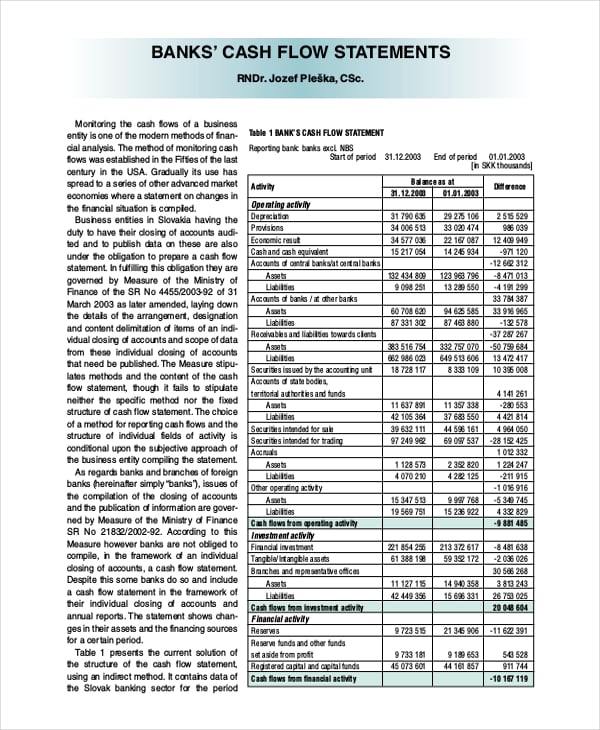

Bank loan in cash flow statement. Cash flow from financing activities (cff) is a section of a company’s cash flow statement, which shows the net flows of cash that are used to fund the company. In the cash flow statement, financing activities refer to the flow of cash between a business and its owners and creditors.

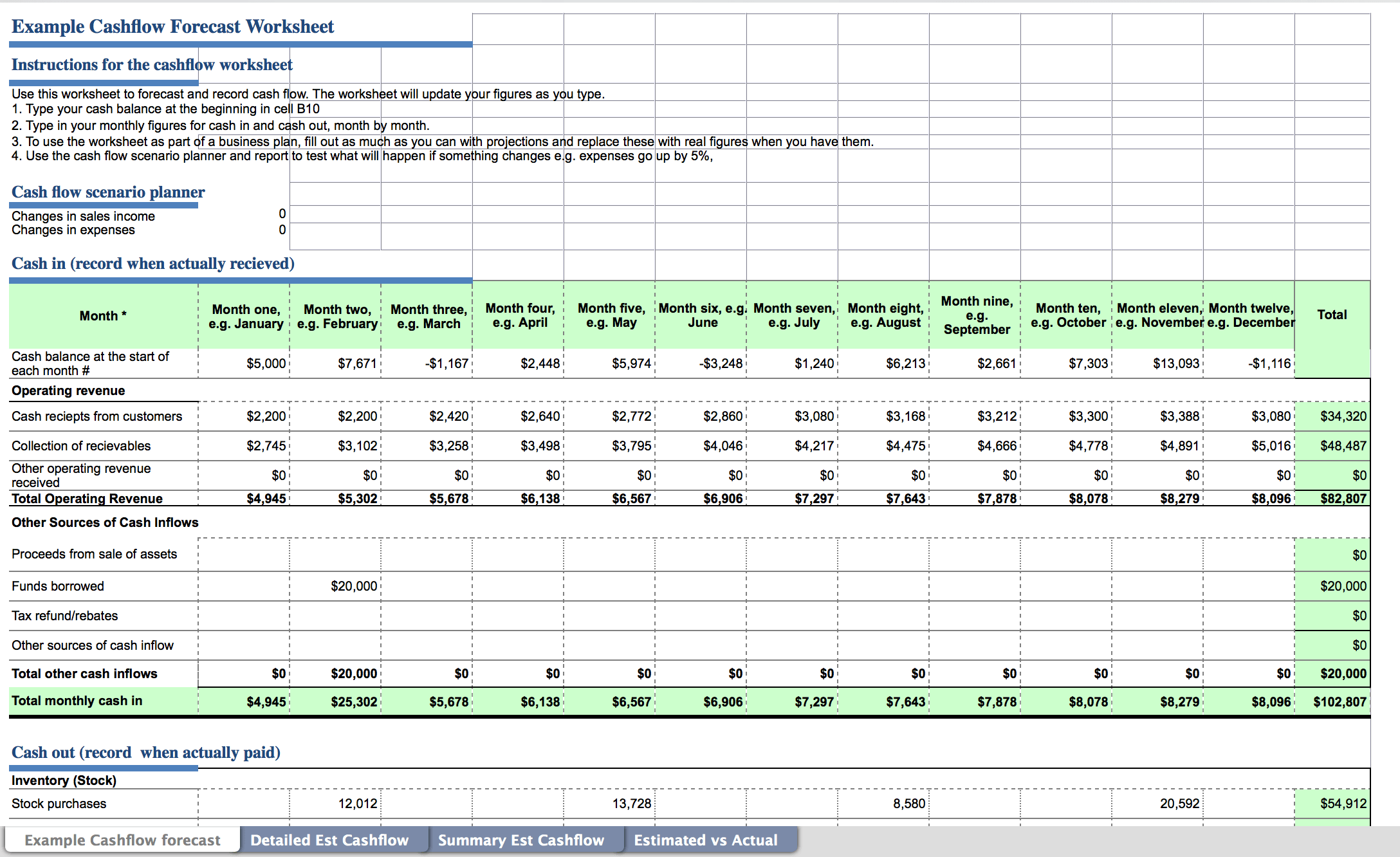

Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the. Cash flow refers to the net balance of cash streaming in and out of a business over a specified period. Cash and cash equivalents may also include bank overdrafts repayable on demand that form an integral part of an entity’s cash management.

How to prepare a cash flow statement? Since most companies use the indirect method for the. Following are the basic steps to proceed with a cash flow statement:

It focuses on how the business raises. In the statement of cash flows, interest paid will be reported in the section entitled cash flows from operating activities. The cash flow statement is one of the primary financial statements under frs 102 that is going to need a lot of thought devoted to it in terms of classifications as cash flows as.

Explanation and pointers statement of cash flows presents the inflows and outflows of cash in the different activities of the business, the net increase or. Cash flow financing is a form of financing in which a loan made to a company is backed by the company's expected cash flows. Assign interest rates & calculate interest.

Cash flow from financing activities is the net amount of funding a company generates in a given time period.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)