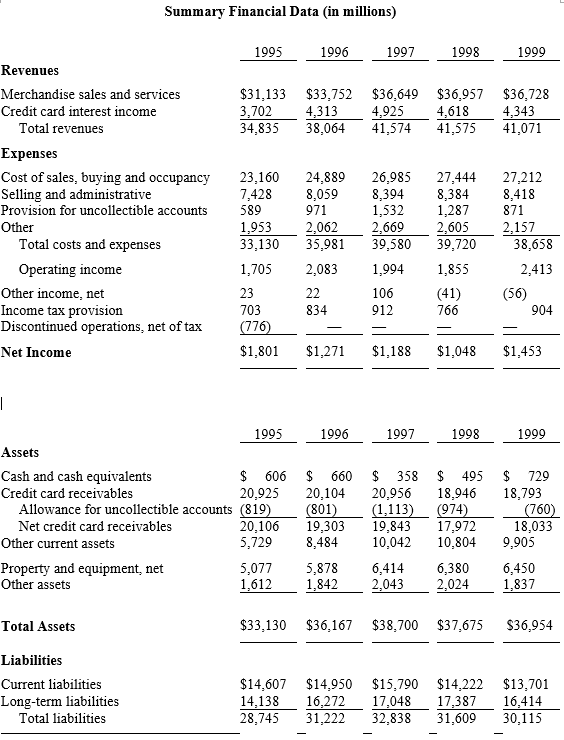

Amazing Info About Bad Debt Expense In Balance Sheet

But my question is how does it affect the balance sheet?

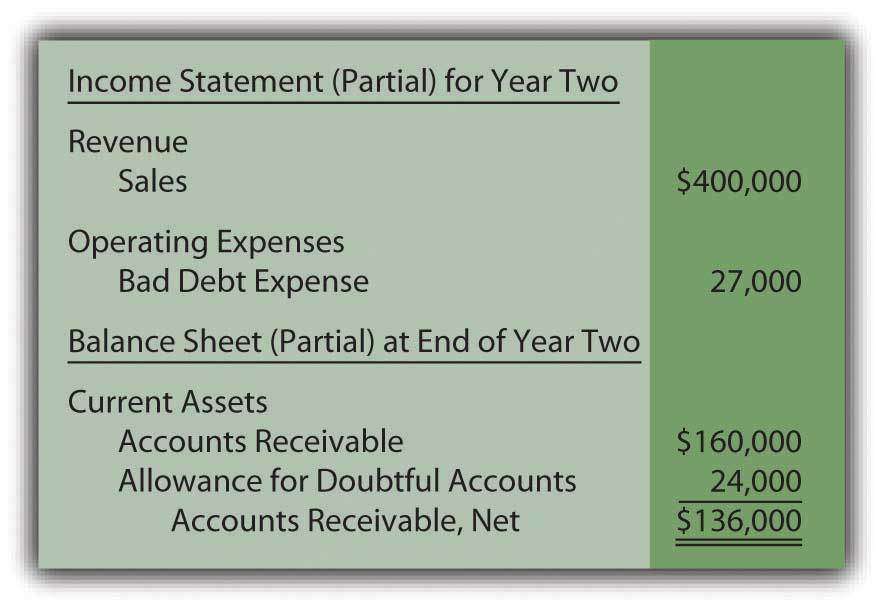

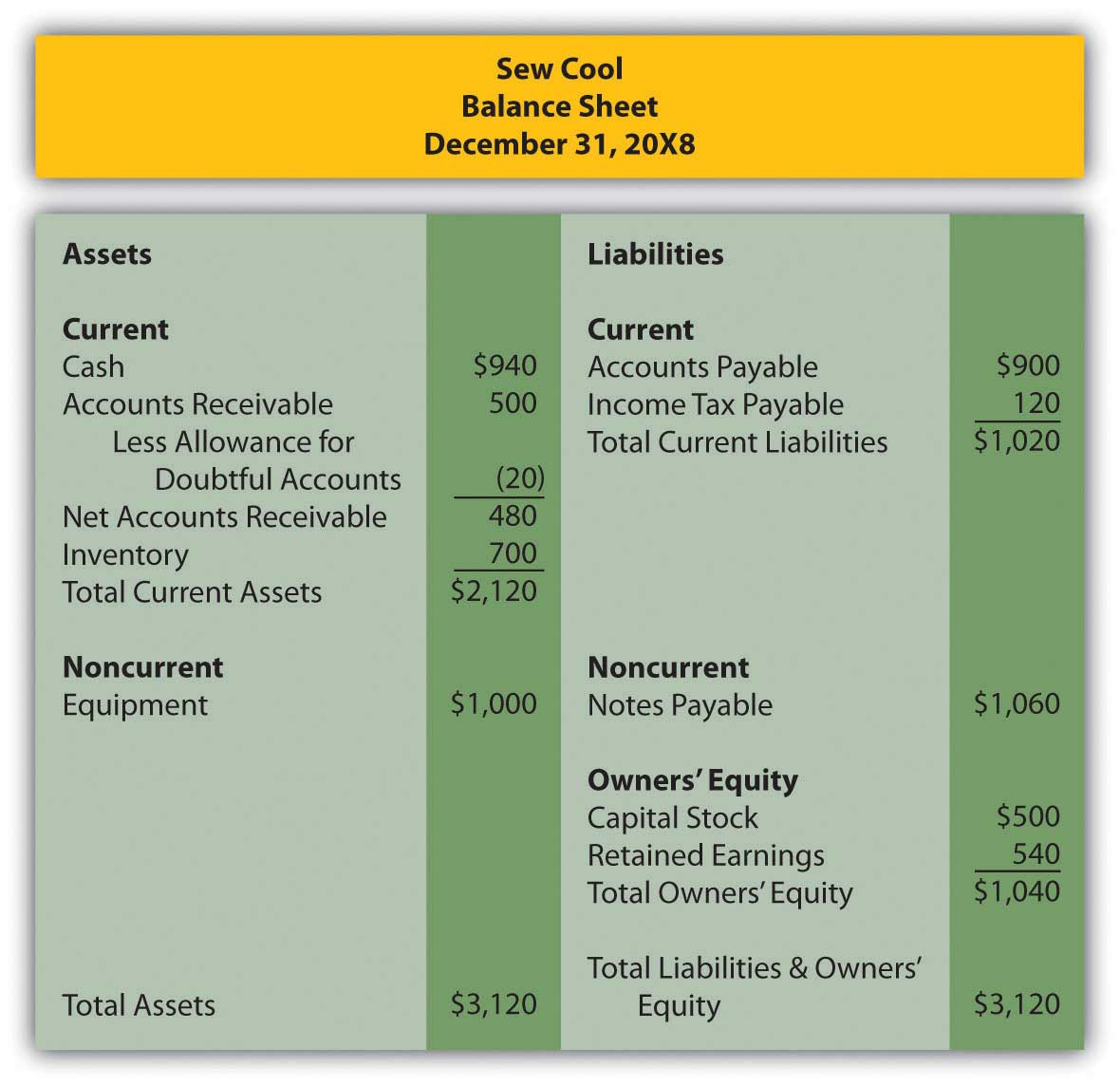

Bad debt expense in balance sheet. If the actual bad debt was greater than the provision, the bad debt expense must be tracked on the income statement for the same accounting period during which the loan or. This means that bww believes $22,911.50 will be uncollectible debt. On the balance sheet, bad debt is recorded as a reduction in the accounts receivable asset account.

This article delves into bad debt expense, how to record and manage it, and its impact on a business’s financial health. Bad debt refers to loans or outstanding balances owed that are no longer deemed recoverable and must be written off. Bad debt expense is an estimated projection of uncollectible accounts during an accounting period.

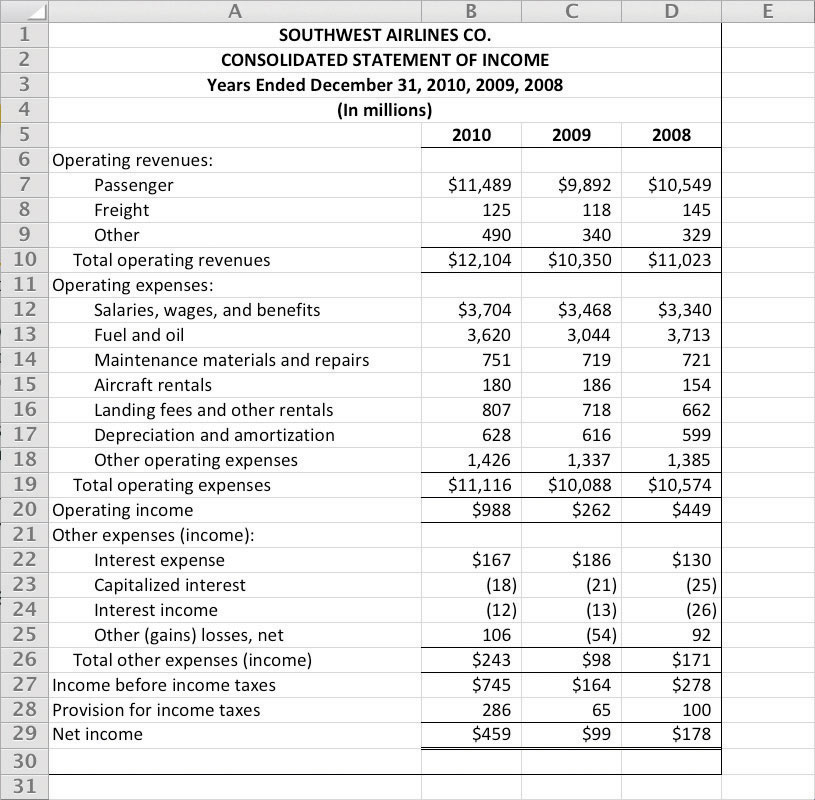

Bad debt expense = $20 million × 1.0% = $200k; Let’s say that on april 8, it was determined that customer robert craft’s account was uncollectible in the amount of $5,000. For example, if credit sales are made to a customer who says it’s not recoverable or is partially recoverable then the amount is bad debt.

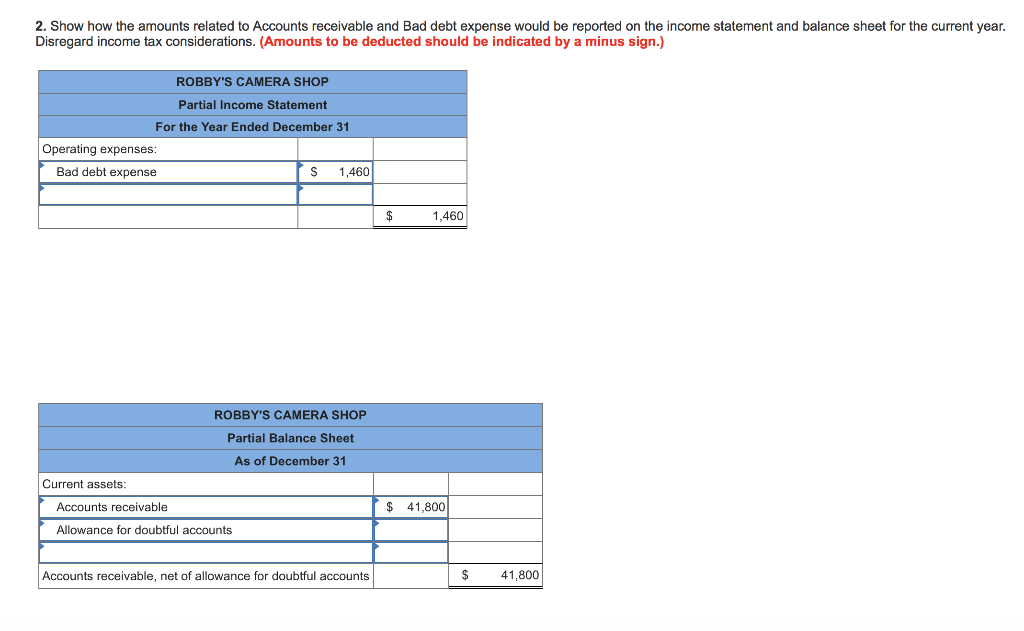

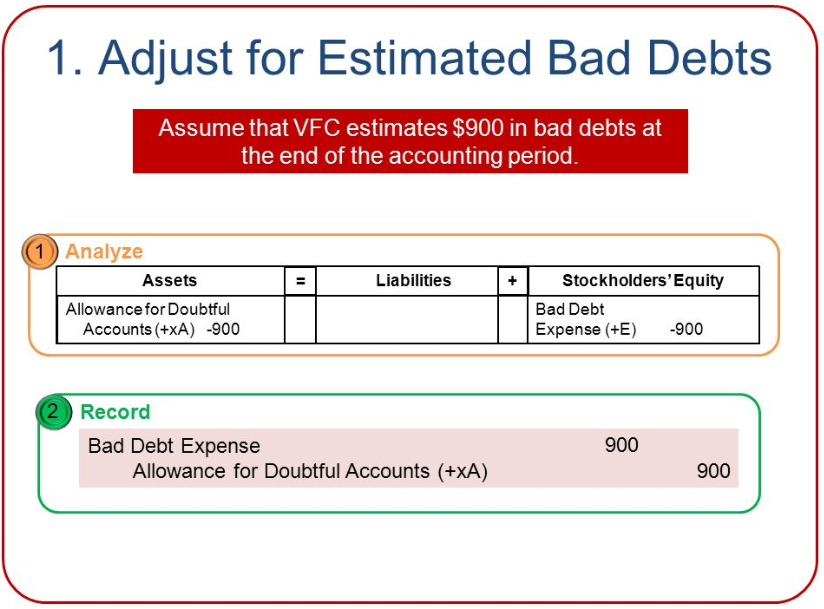

Explanation of bad debt expense formula With respect to financial statements, the seller should report its estimated credit losses as soon as possible using the allowance method. This is because accounts receivable represents the amount of money that a company is owed by its customers, and bad debt is money that is unlikely to be collected.

In balance sheet; There are two ways to calculate your business’ bad debts: The amount of bad debt expense can be estimated using the accounts receivable aging method or the percentage sales method.

The balance sheet aging of receivables method estimates bad debt expenses based on the balance in accounts receivable, but it also considers the uncollectible time period for each account. Bad debt expense = accounts receivable balance x estimated % uncollectible recognizes and expenses estimated losses from bad debts; Appears on the income statement as an operating expense

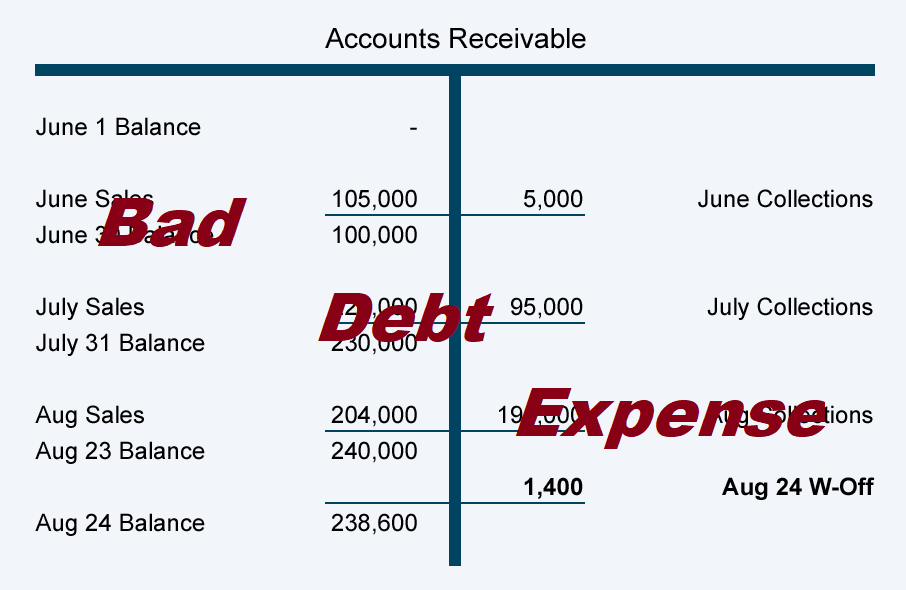

The bad debt expense account is debited, and the customer’s accounts receivable account is credited. Incurring bad debt is part of the cost of doing business with customers,. After this entry is recorded, the company's income statement for the month of january will report bad debts expense of $1,000 and its january 31 balance sheet will report a credit balance in allowance for doubtful accounts in the amount of $4,000.

Bad debt expense is used to reflect receivables that a company will be unable to collect. The percentage of receivables method is a balance sheet approach, in which the company estimate how much percentage of receivables will be bad debt and uncollectible. Using the same information as before, rankin makes an estimate of uncollectible accounts at the end of the year.

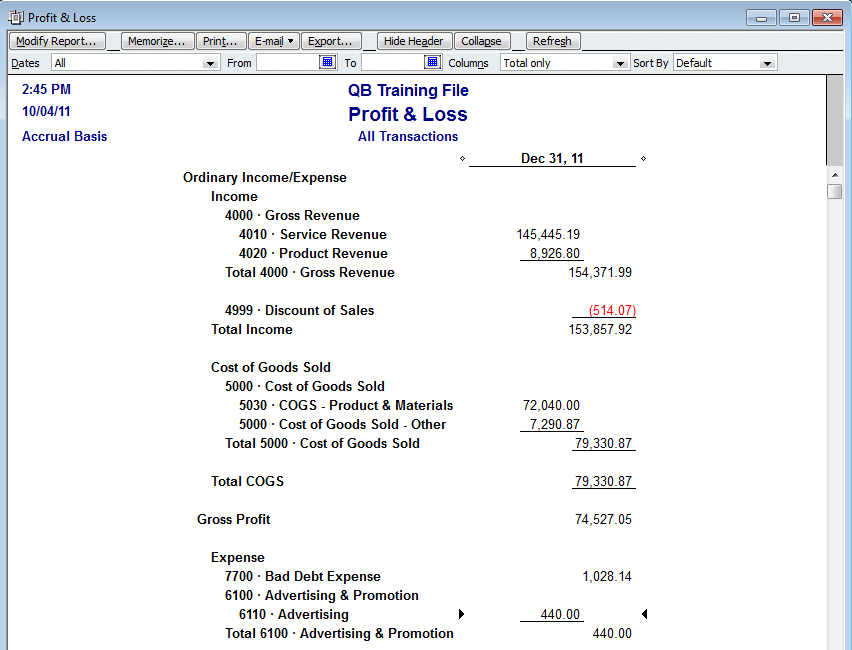

Bad debt expense is a critical aspect of accounting that affects a business's balance sheet and income statement. This reduces the number of accounts receivable and increases the amount of bad debt expense on the income statement. In this case, the company usually use the aging schedule of accounts receivable to.

So if we remove an asset from the sheet, won't this mean that the balance sheet no longer balances out? Bad debt in accounting bad debt provision to record bad debts in the account books, firms must initially estimate their. Balance sheet (extract) as on 30 th june 2016

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)