Fun Tips About Double Entry For Investment In Subsidiary

The assets and liabilities are then added together in full.

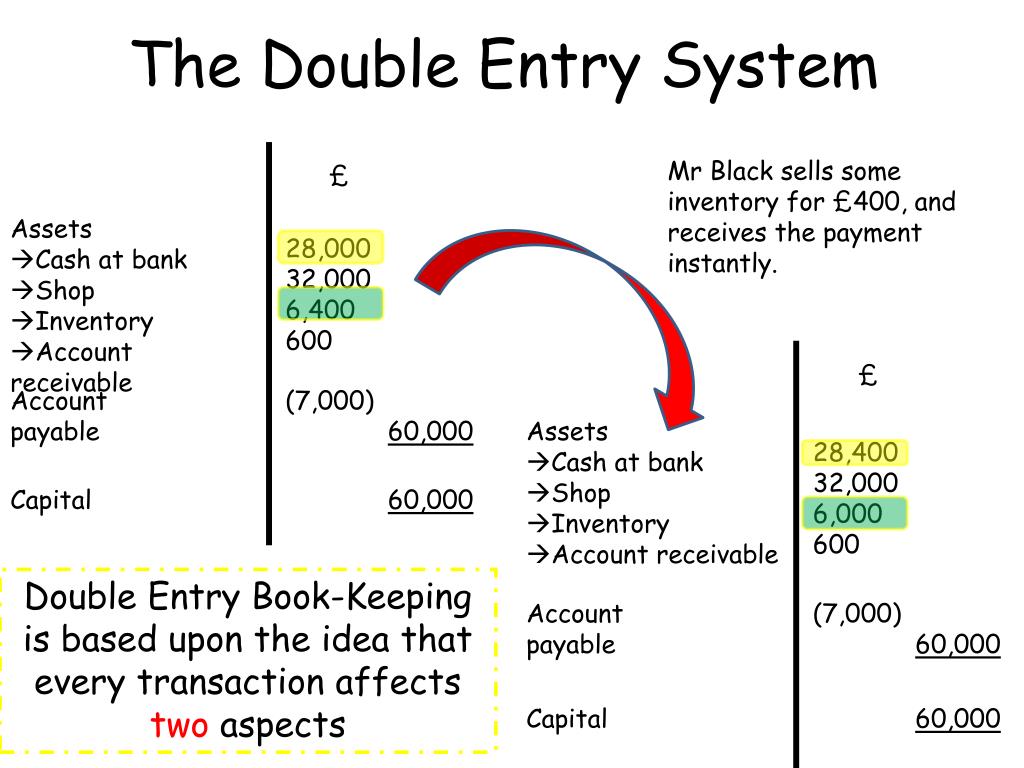

Double entry for investment in subsidiary. We can make the journal entry for the dividend received from the subsidiary by debiting the cash account and crediting the. Statements and to the financial statements of an investor that does not have investments in subsidiaries but has investments in associates or joint ventures accounted for using the. Suppose, book ltd acquires 60% shares in paper ltd in the month of april 20×1 against consideration of 5,000,000.

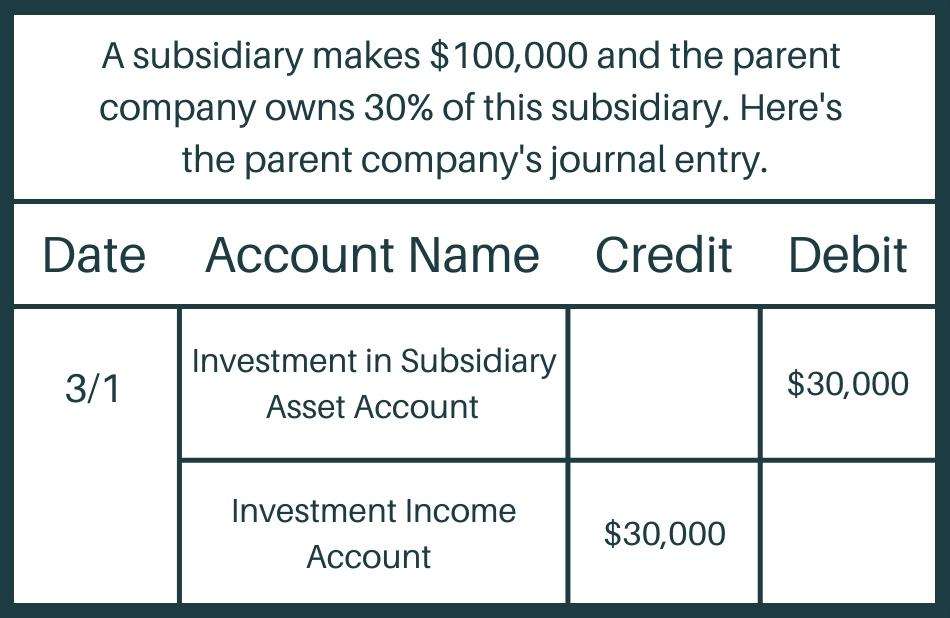

Your company’s year end is 31 june 2017 when. What is a subsidiary? This $7,000,000 of investment in subsidiary account will be eliminated in the consolidated financial statements of the group company.

Subsidiary consolidation involves reporting the. The investment is an investment in an equity instrument as defined in paragraph 11 of ias 32 financial instruments:. Holds an initial investment in a subsidiary (investee).

In the consolidated financial statements, company a reflects 100% of the assets and liabilities of subsidiary b and a. This is usually (but not always) when the parent company owns at least 50.1% of the subsidiary shares or voting rights. Let’s say you purchased 10,000 shares of common stock of company a on 1 january 2017 at $10.

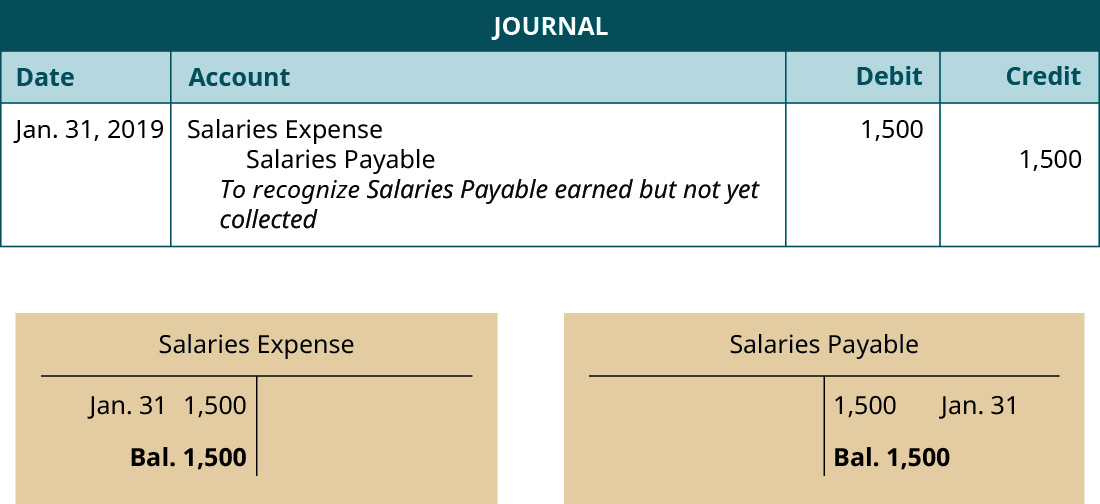

Involving an investment in a subsidiary. Journal entry for dividend received from subsidiary. The debit entry increases the balance sheet carrying value of the investment by the share of net income.

A subsidiary (aka a joint company structure) is owned and/or controlled, either fully or partially (at least 50%), by another company (called the parent company). The concept accounting entries for acquisition of subsidiary reflects that when a company acquires a subsidiary, it needs to account for the transaction properly in its financial. The committee discussed a submission received on investments in a subsidiary accounted for at cost, specifically related to (1) partial disposal and (2) step.

At 12/31/20x1, subsidiary b has net assets of $100. Journal entry for investment in subsidiary. Hence, while there is no goodwill on.

If a parent company owns more than 50% of a company's voting rights, then the controlled company is considered a subsidiary. When you lose control of your subsidiary by the full sale of shares, ifrs 10 requires you to:

January 1 on january 1, as we acquired 80% of share ownership in the company xzy, it became our subsidiary company afterward. The above double entries do not apply to any specific method. Derecognize all assets and liabilities of the subsidiary at the date when.

Therefore, these are not a part of the consolidated or equity method of accounting for subsidies. In this case, we can make the journal entry for the $800,000 investment in subsidiary by debiting this amount to the.

:max_bytes(150000):strip_icc()/TermDefinitions_double-entry_FINAL-329535cd3a77431a953984e79fe5ef7a.png)