Peerless Tips About Depreciation In Cash Flow Statement Direct Method

The most common example of an operating expense.

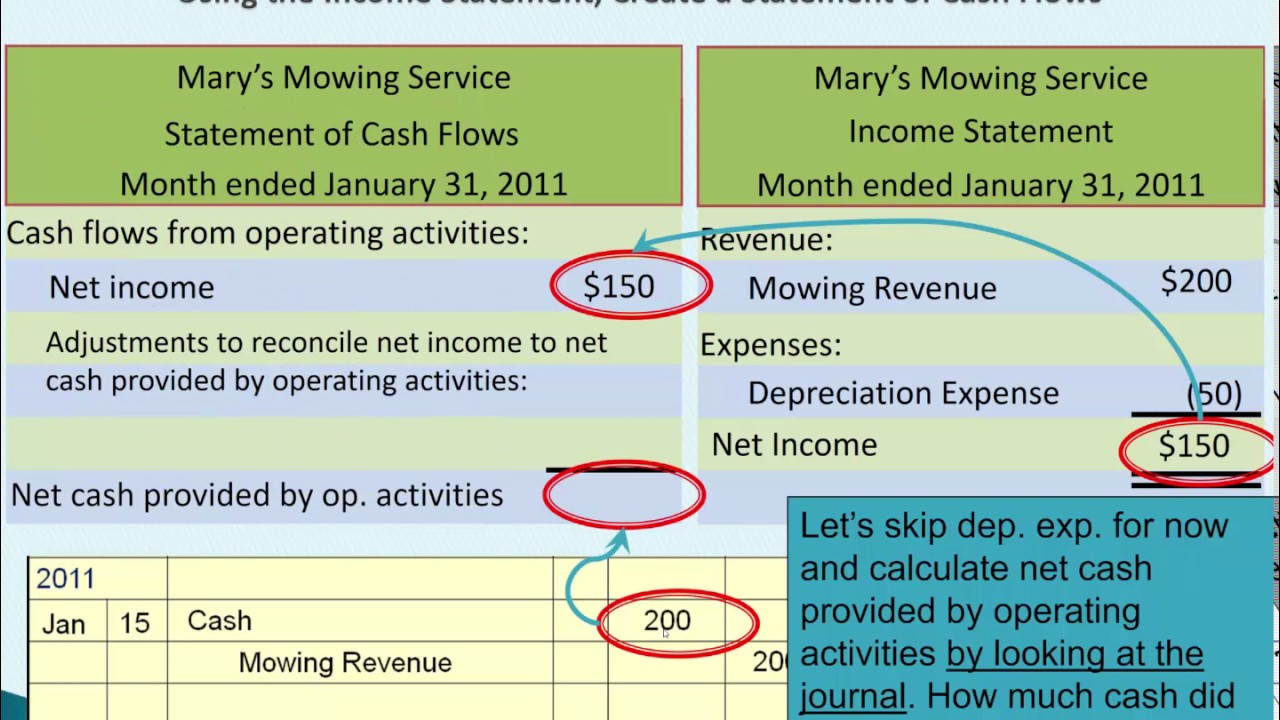

Depreciation in cash flow statement direct method. Depreciation can only be presented in cash flow statement when it is prepared using indirect method. By far the most obvious example is depreciation. Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows:

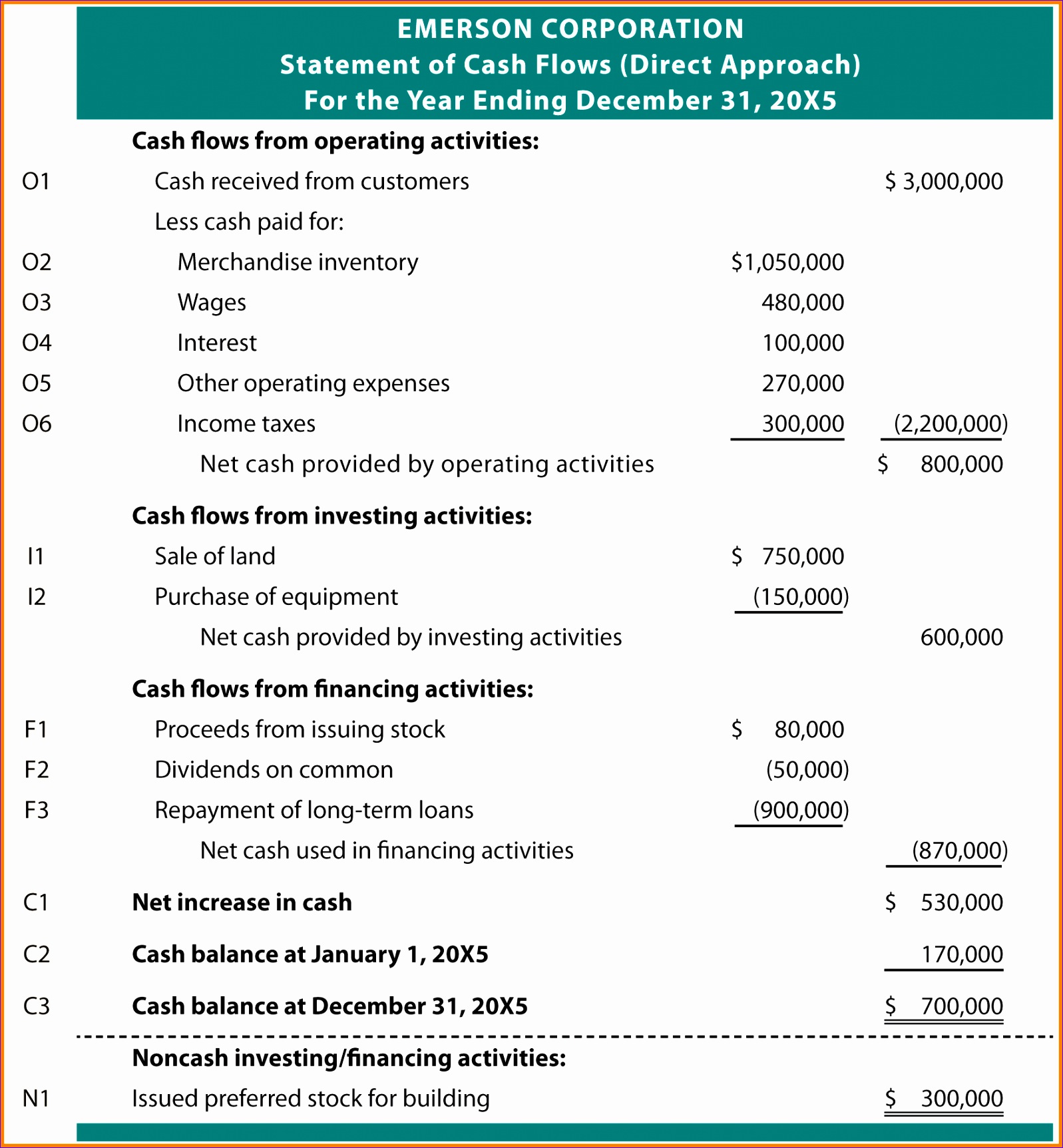

The cash flow from operations in the cash flow statement represent cash transactions that have to do with a company's core. This is due to no matter how big the depreciation expense is, it will be. Record each income statement amount into the corresponding direct method category of the operating activities worksheet shown below (recall that non.

The cash flow statement presented using the direct method is easy to read because it lists all of the major. Begin with net income from the income. Depreciation actually does not come under any of the categories of the cash flow statement, at least when you're using the direct method:

November 14, 2023 what is the cash flow statement direct method? The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of. As we have seen above, there is no direct impact of the depreciation expense on the cash flow statement.

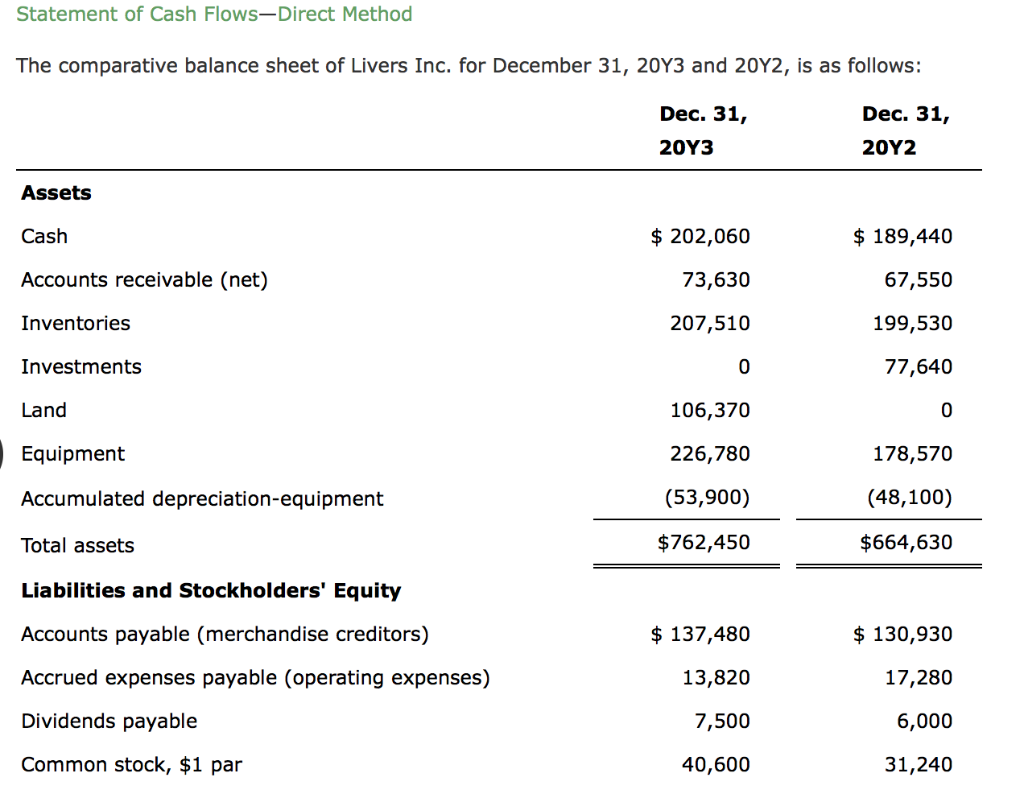

What is the statement of cash flows direct method? With the help of useful life of asset and the appropriate rate, the. The direct method of developing the cash flow statement lists operating cash receipts (e.g., receipt from customers) and cash payments (e.g., payments to.

There are two different ways of starting the cash flow statement, as ias 7, statement of cash flows permits using either the 'direct' or 'indirect' method for operating activities. The direct method of preparing a cash flow statement results in a more easily understood report than the indirect method. As with the indirect method, preparing a statement of cash flows using the direct method is made much easier if specific steps are followed in sequence.

The direct method of presenting the statement of cash flows presents the specific cash flows associated with items that affect cash flow. This method provides clarity about a company’s. The direct method of cash flow statement format presents a clear picture of a company’s cash flow.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)