Brilliant Info About The Preparation Of Combined Balance Sheet

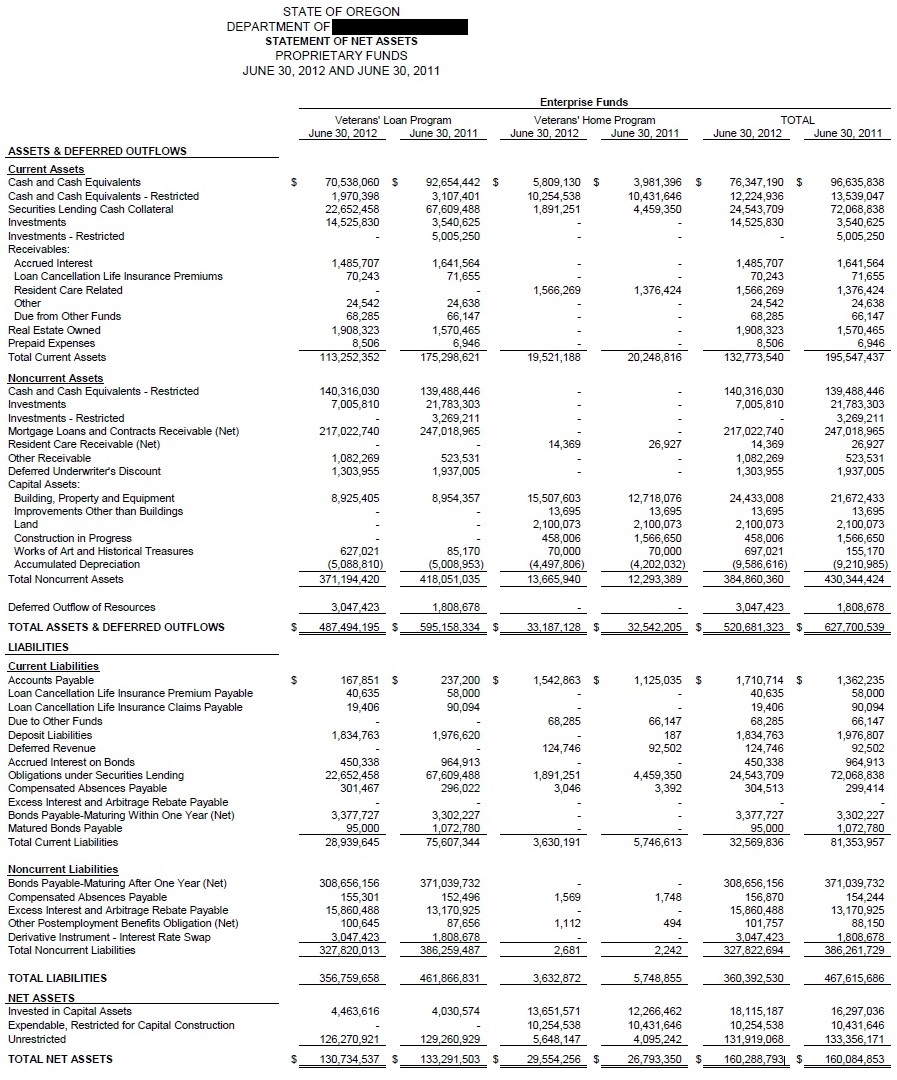

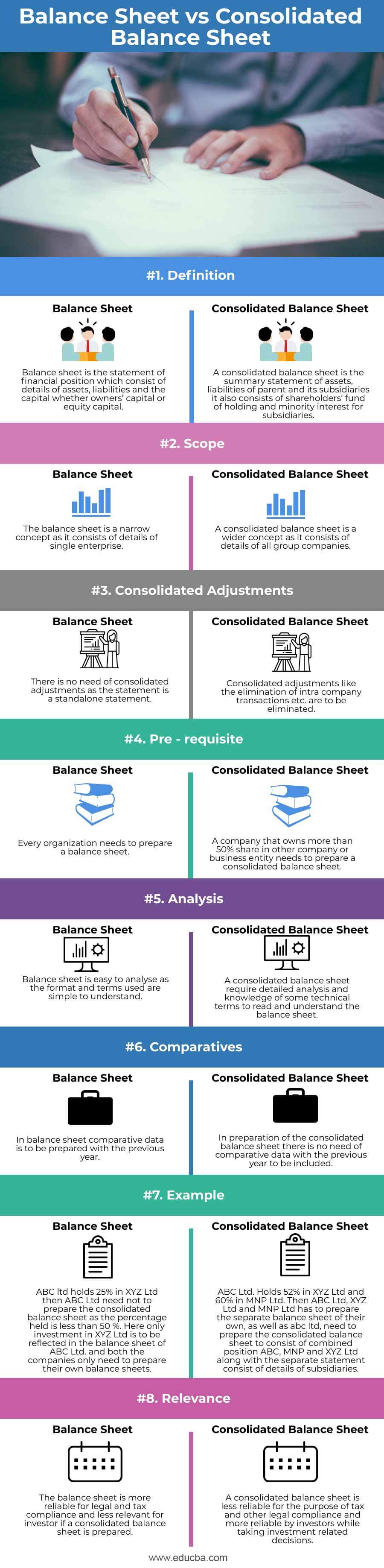

It is normally presented as part of the consolidated financial statement of the parent or holding company and its subsidiaries.

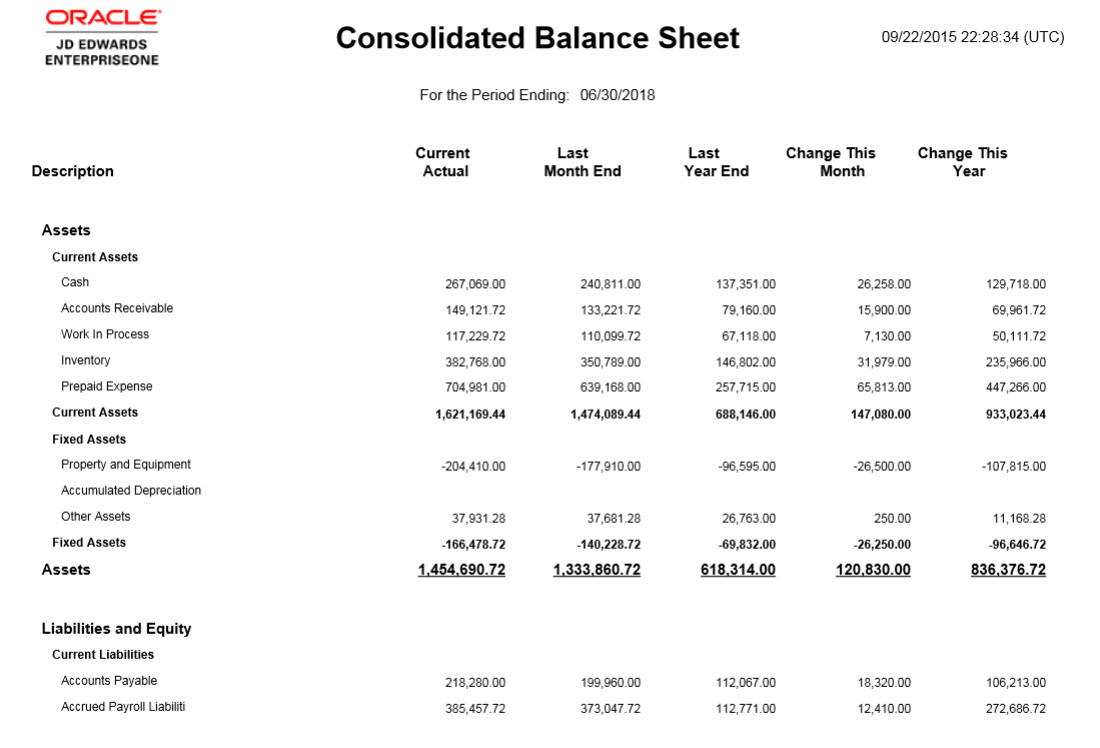

The preparation of combined balance sheet. How do businesses prepare a consolidated balance sheet? Often, the reporting date will be the final day of the accounting period. The consolidation of financial statements integrates and combines all of a company's financial accounting functions to create statements that show results in standard balance sheet, income.

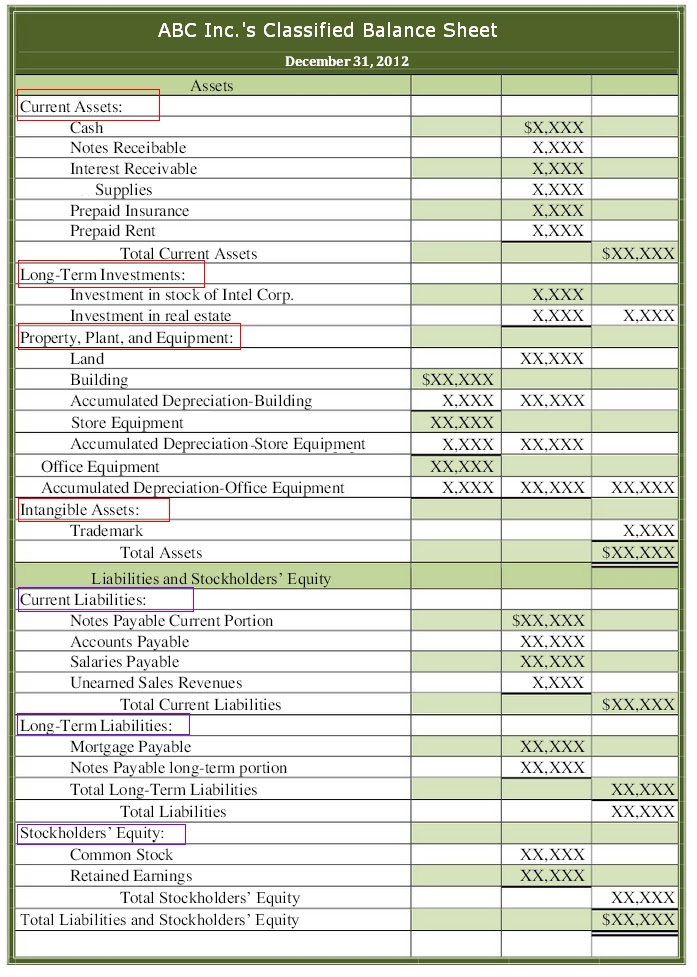

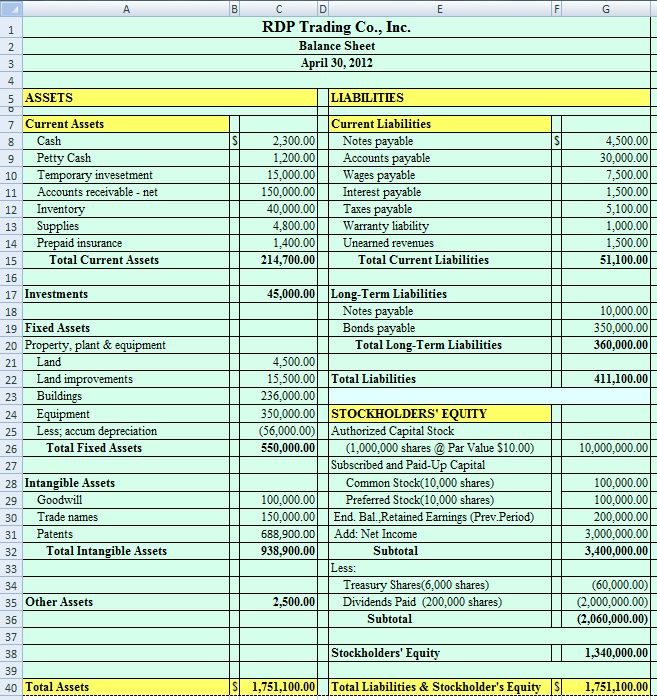

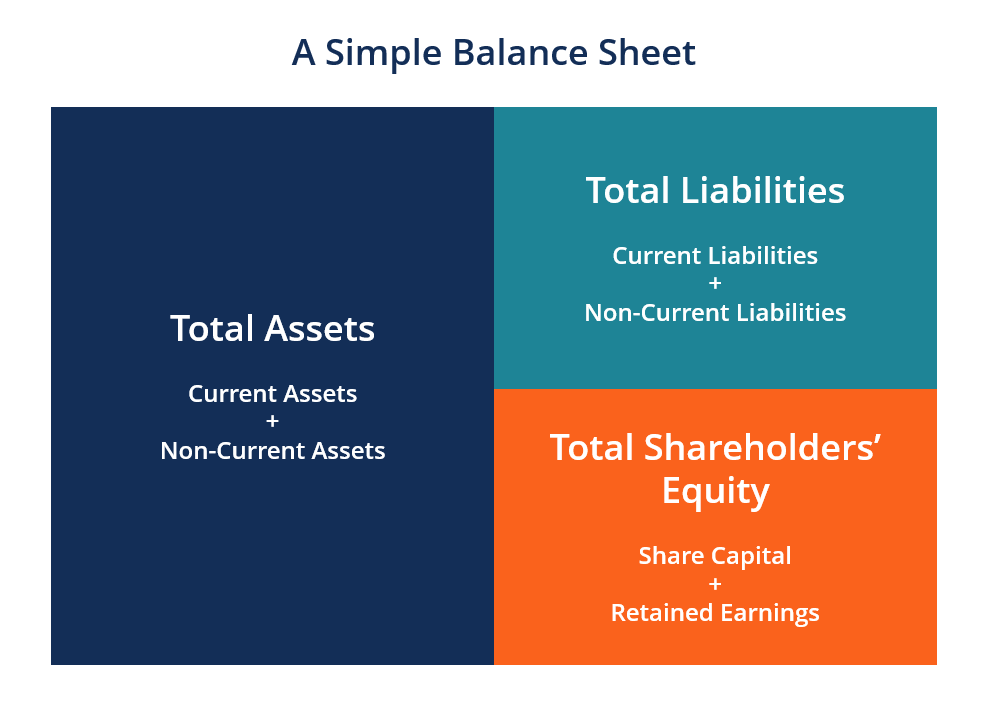

How to prepare a consolidated balance sheet consolidated balance sheets must be prepared according to the same rules and accounting methods used across the parent company and its subsidiaries. A balance sheet is a financial statement that shows the relationship between assets, liabilities, and shareholders’ equity of a company at a specific point in time. Additionally, fsp corp should disclose the fact that the sub co balance sheet information included in fsp corp’s consolidated balance sheet as of march 31, 20x8 is as of the acquisition.

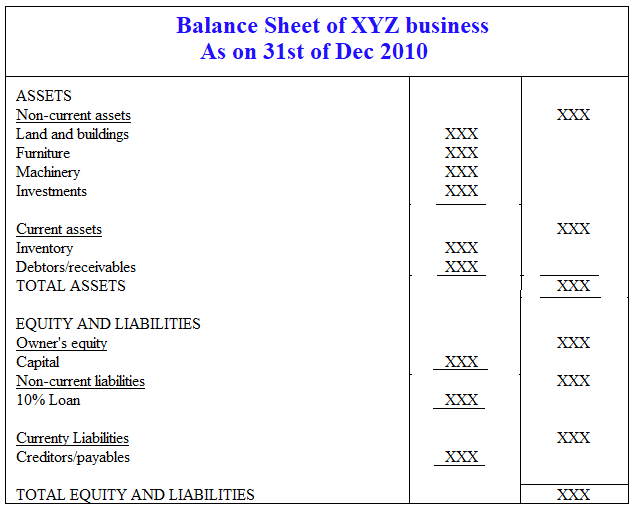

This is done by simply adding together the separate values from the balance sheets of the parent company and the subsidiaries. The preparation of consolidated financial statements is based on the assumption that a reporting entity and its consolidated subsidiaries operate as a. The combined financial statements comprise combined income statements, combined statements of comprehensive income, combined balance sheets, combined cash flow statements, combined statements of changes in invested equity and the notes to the combined financial statements for the fiscal years 2015, 2014 and 2013.

Similarly, for disclosure requirements of ind as, the references begin with the number of the ind as. Furthermore, the starting point for the preparation of combined financial statements is two or more sets of financial statements that are prepared in accordance with gaap; Consider these steps when making a consolidated balance sheet:

If a reporting entity concludes that consolidated financial statements are not required, it may still be appropriate to bring together the balance sheet, income statement, equity, and cash flow accounts of two or more affiliated companies into a single set of comprehensive financial statements (i.e., as a. The combined financial statements comprise statement of comprehensive income, balance sheet, statements of changes in equity and cash flows and notes, prepared in accordance with international financial reporting standards as adopted by the eu, and further requirements in the danish financial Why is there diversity in practice?

Each organization is responsible for preparing its balance sheet. How to prepare a balance sheet: Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity.

Create a consolidated balance sheet. Check all of your reference information before creating the actual consolidated balance sheet, you need to make sure that the rules and methods used to collect financial information regarding the parent company and its subsidiaries were consistently applied. The financial statements of several firms within the same group are combined to portray the financial condition as a whole.

Generally accepted accounting principles, sometimes known as gaap, must be adhered to at all times. The balance sheet is one of the three core financial statements that are used to. In the case of group enterprises, the consolidated balance sheet is a crucial financial statement.

A balance sheet determines the financial position of your. Balance sheets are useful tools. Every organization must prepare the balance sheet, whether the subsidiary company, associate company, or standalone business;

Consolidate financial statements by creating a balance sheet that reflects a sum of net worth, assets and liabilities. 4.5 prepare financial statements using the adjusted trial balance; Under the ‘general instructions for preparation of balance sheet’ of the schedule iii to the companies act, 2013.

![Problem 33 Balance sheet preparation [LO32, 33] The following is a](https://img.homeworklib.com/questions/ed407e30-435c-11ea-87dd-89e7fcbab79e.png?x-oss-process=image/resize,w_560)