Inspirating Tips About Profit And Loss Account Uk

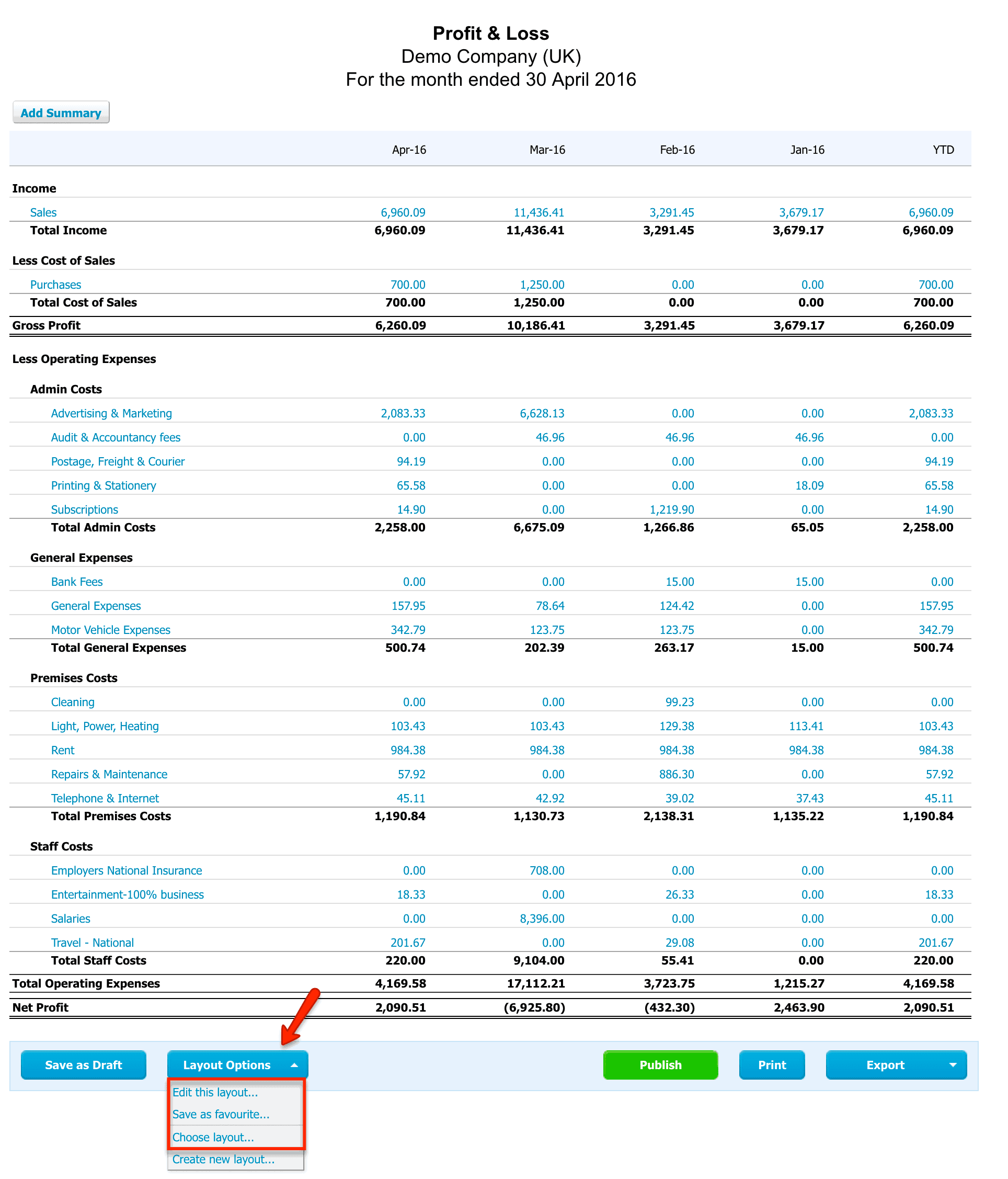

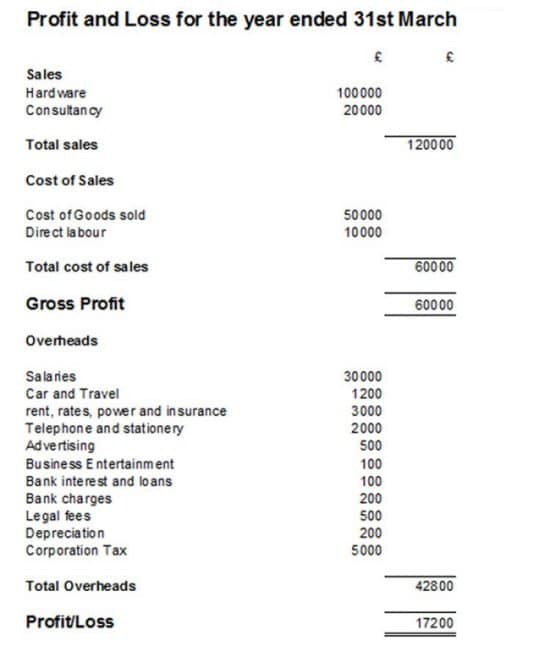

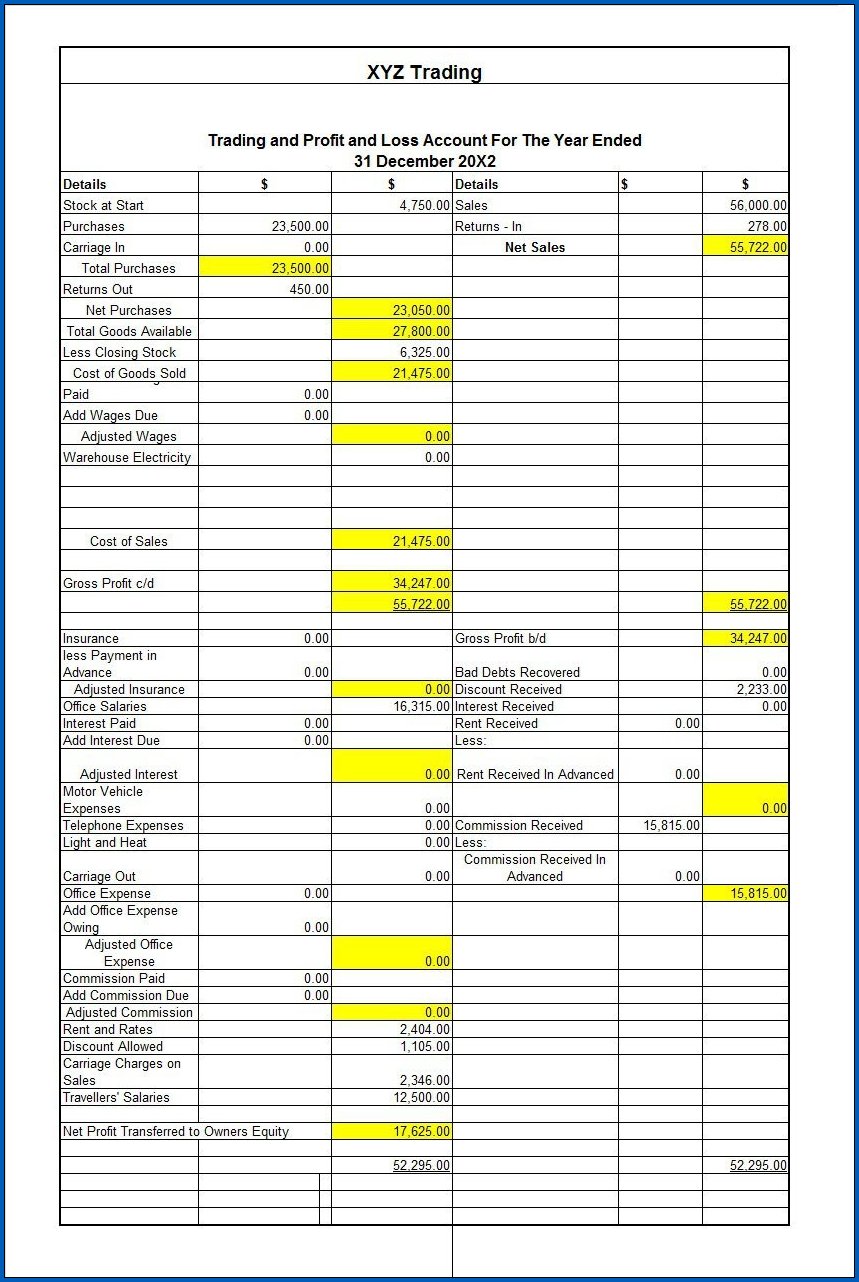

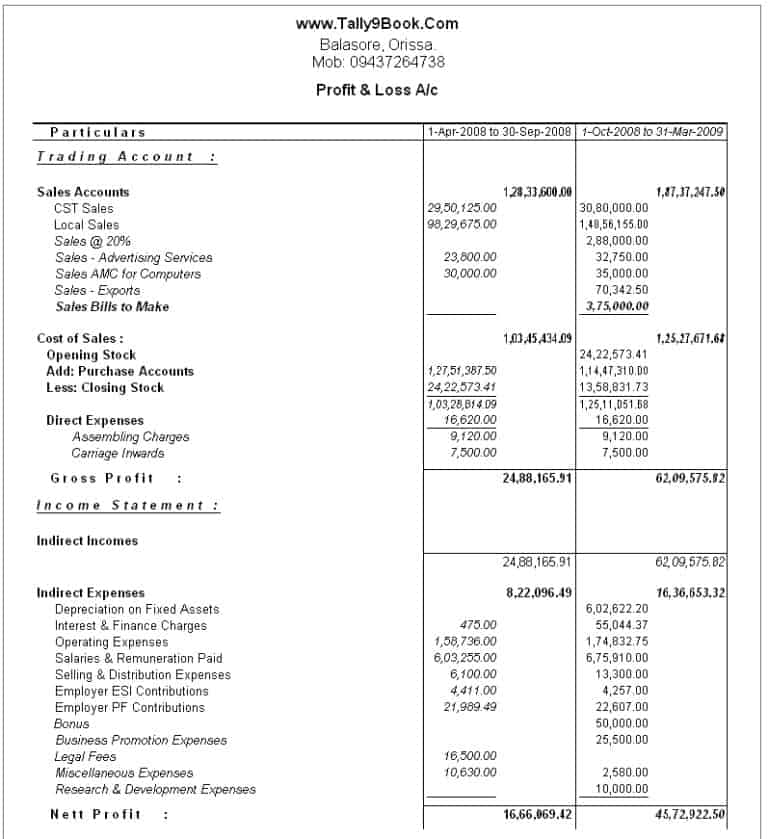

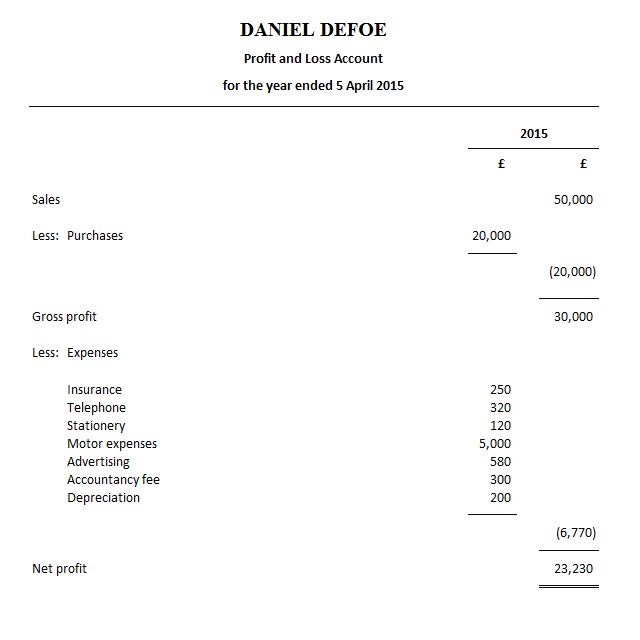

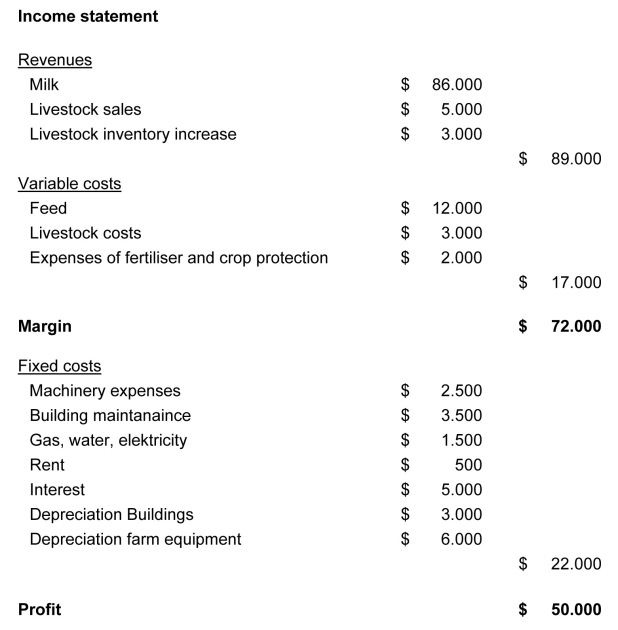

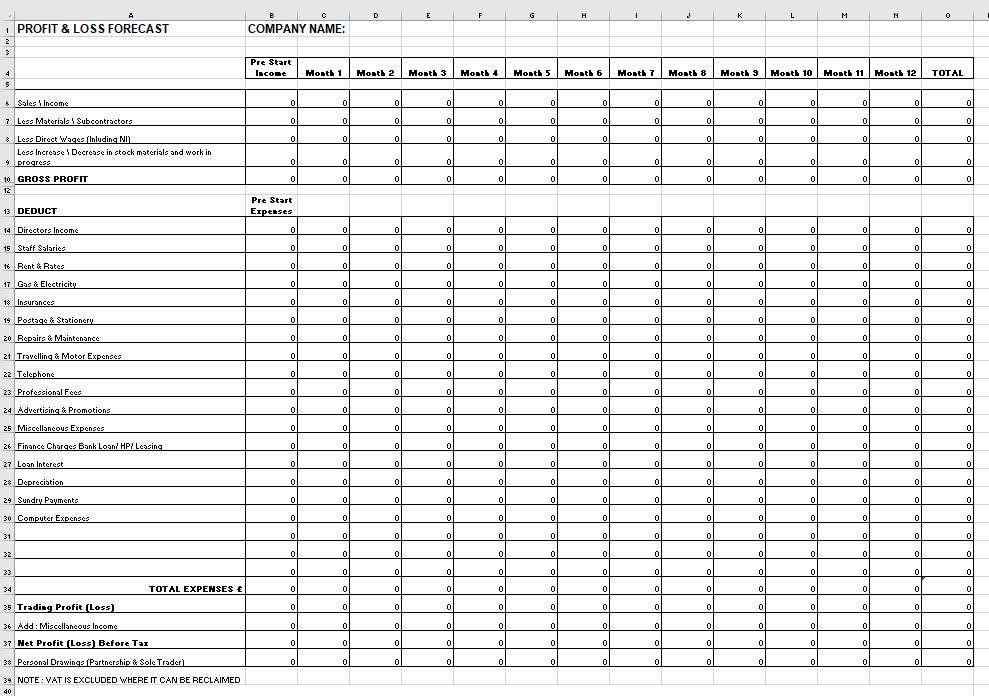

It summarises the trading results of a business over a period of time (typically one year) showing both the revenue and expenses.

Profit and loss account uk. A profit and loss account can give owners a sense of their business’s finances, helping them to identify inefficiencies and potential improvements. It shows both turnover and profitability for. It is primarily used to put a company’s financial performance into context.

Despite doubling its ev deliveries in 2023, rivian. You may be selling your goods at 50% higher than you are buying them, but you are making a loss when considering all the overheads. Profit and loss (p&l) is a financial statement that examines the gains and losses that a business has made over a quarter or an entire year.

A profit and loss account (or statement or sheet) is, on a simple level, used to show you how much your company is making or how much it is losing. This is the most significant information to be reported for decision making. After that, we’re pretty soon left with profit before tax.

Your profit and loss account (also known as the income statement) is one of three key documents that show you the health of your company’s finances. Finance businesses succeed or fail based on their ability to make a profit. Along with the balance sheet and cash flow statement, the profit and loss account forms the basis of every company’s accounts, providing a snapshot of your incomings and outgoings over time.

It could be for a week, a quarter or a financial year. Overview of a profit and loss statement. Net income or net profit is calculated by charging all operating expenses and by considering other incomes earned in the form of.

Taking into account profit from 1 october 2023 to 5 april 2024: Feb 22, 202406:31 pst. A profit and loss account is prepared to determine the net income (performance result) of an enterprise for the year/period.

German energy company wintershall dea posted a net loss of €48. And this is the bottom line — the final profit (or loss. A profit and loss account shows the revenue and costs of a business and these are used to work out whether or not the business has made a profit.

The profit and loss account (which in accounting standards is now referred to as the income statement of statement of comprehensive income) must give a true. A ‘profit and loss account’, which shows the company’s sales, running costs and the profit or loss it has made over the financial year notes about the accounts a director’s report. The profit and loss account is compiled to show the income of your business over a given period of time.

Generate more cash coming into your business than going out as costs, and your business is on solid ground. 31, compared with a 684 million pound loss a. Profit and loss account.

An accounting statement which sets out the details of a company's revenues less expenses, including depreciation and tax, to give an overall profit or loss figure. They must prepare and audit group accounts under uk law, and for companies. A profit and loss account is a valuable tool for financial decisions, as it looks at the costs related to revenue during the period.