Peerless Info About Explain The Profit And Loss Account

The profit and loss account.

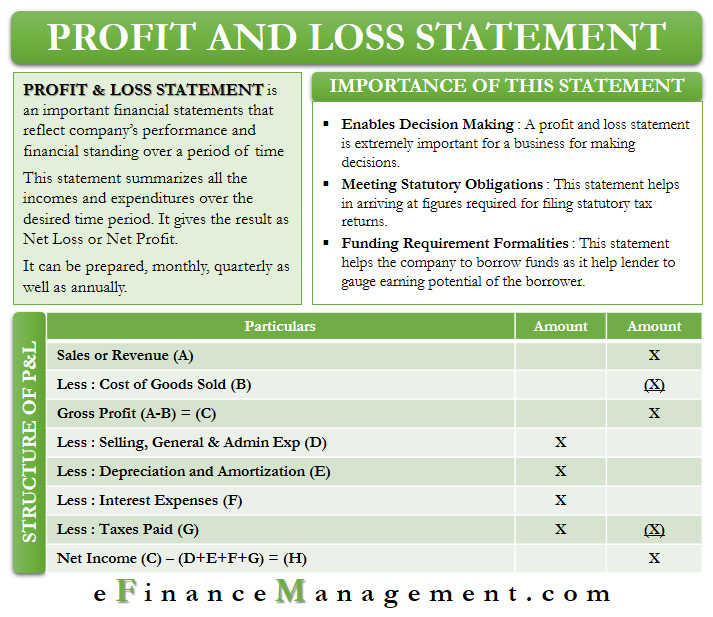

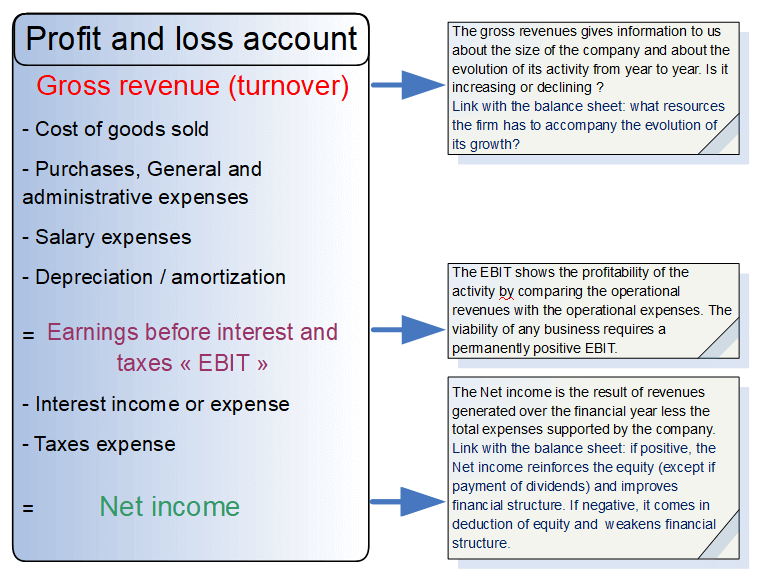

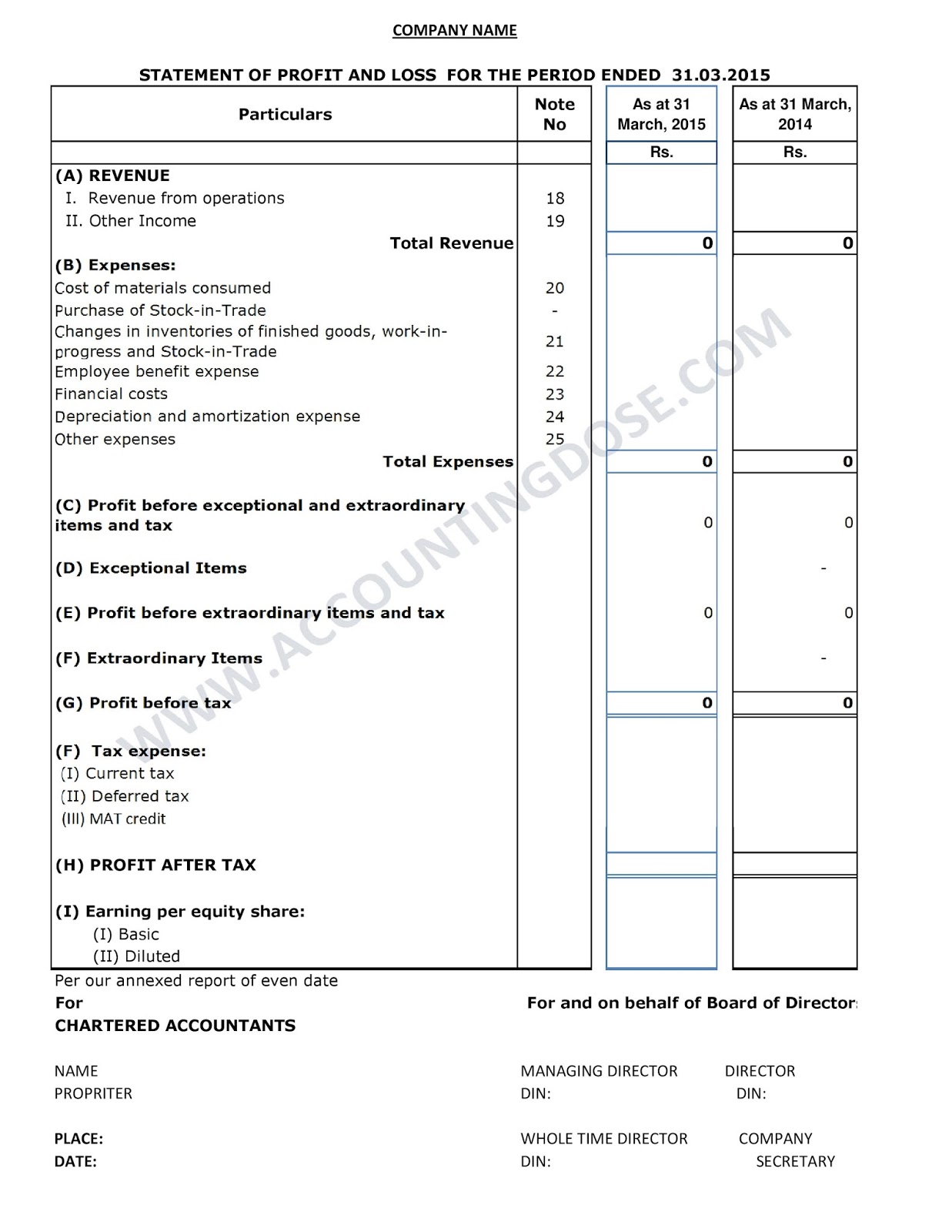

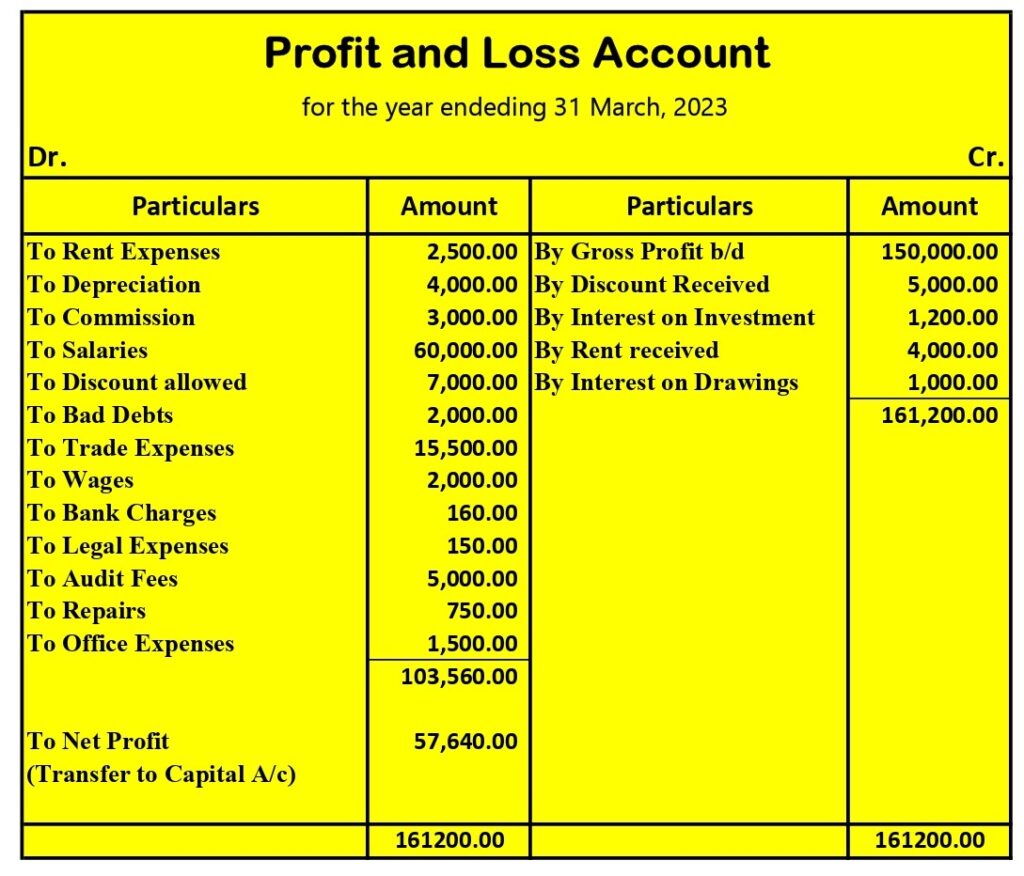

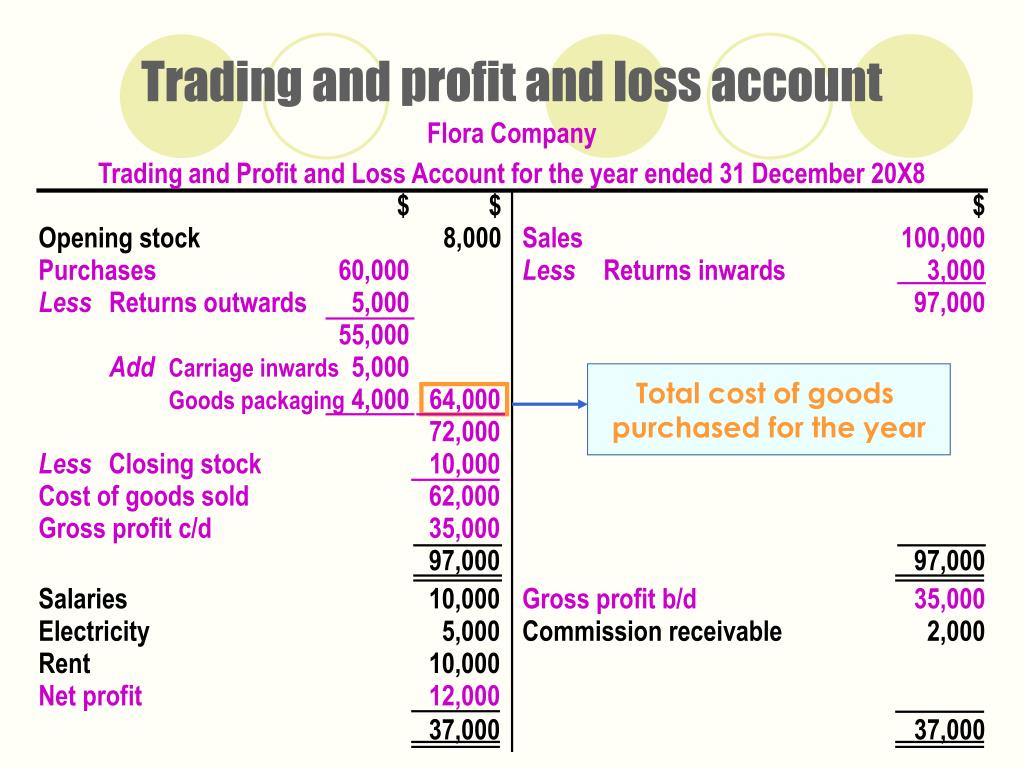

Explain the profit and loss account. A profit and loss account tells you about an organization’s financial performance and in this article the key components of the profit and loss account are explored. Trading account trading account is used to determine the gross profit or gross loss of a business which results from. Let us understand the trading account and profit and loss account in detail.

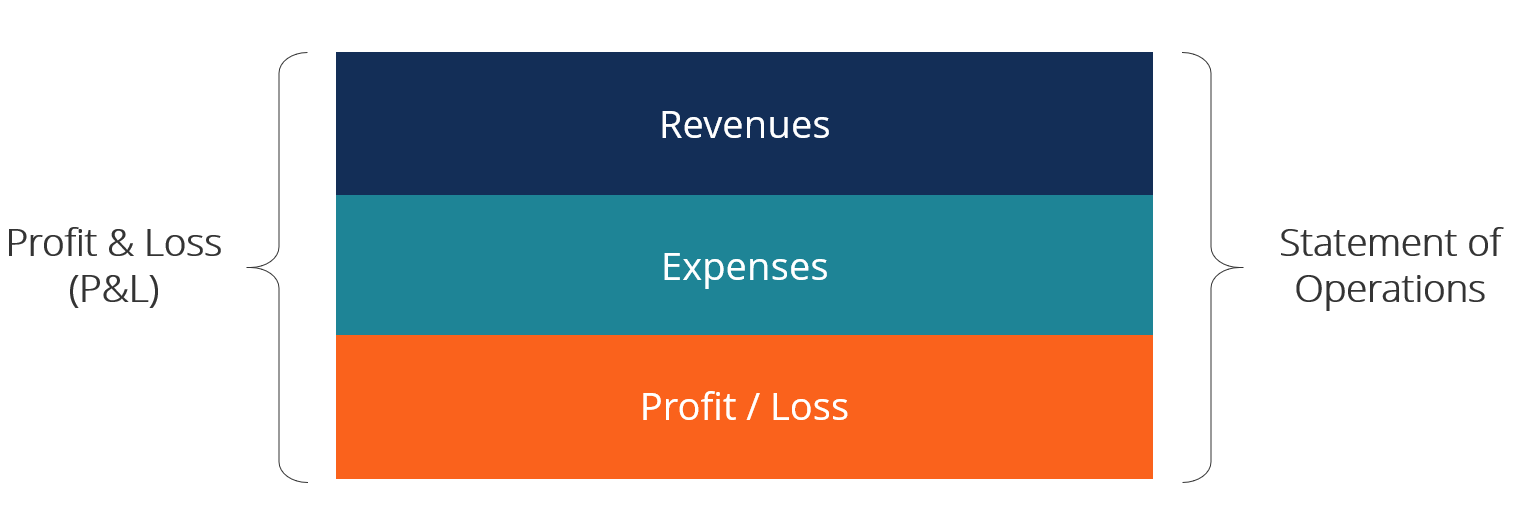

Profit and loss (p&l) accounting is the process of creating a profit and loss statement to help companies have a clear view of the revenues and expenses over a period. The purpose of a p&l statement A p&l statement provides information about whether a company can.

It will help increase your understanding of how to read and construct a profit and loss account. What are the benefits of preparing a profit and loss account? Despite doubling its ev deliveries in 2023, rivian.

The final account is used by both the external and internal parties for various purposes. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. It summarises the trading results of a business over a period of time (typically one year) showing both the revenue and expenses.

A new york judge has ordered former president donald trump and executives at the trump organization to pay over $364 million in a civil fraud case, handing a win to new york attorney general. Feb 22, 202406:31 pst. The p&l statement is one of three financial.

The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. This account is prepared to arrive at the figure of revenue earned or loss incurred during a period. At its core, a profit and loss account (p&l) is a financial statement that provides a snapshot of a company’s revenues, costs, and expenses over a specific period.

The profit and loss statement is an apt snapshot of a company's financial health during a specified time. Completion of this chapter will enable you to: Profit and loss account explanation.

A profit and loss account shows a company’s revenue and expenses over a particular period of time, typically either one month or consolidated months over a year. These figures show whether your business has made a profit or a loss over that time period. Explain the trading and profit or loss account.

What is a profit and loss account? The income statement, often known as the balance sheet, is a window into the heart of a corporation, presenting revenues, costs, and expenses in a comprehensive style. Profit and loss account is made to ascertain annual profit or loss of business.

Categorising costs between cost of sales and operating costs. The purpose of the profit and loss account is to: It can also be referred to as.

![[Free Template] What Is a Profit and Loss Statement? Gusto](https://gusto.com/wp-content/uploads/2019/05/Profit-and-Loss-Statement-Overview.jpg)