Neat Tips About Dividends Received On Income Statement

Before understanding why dividends don’t go on the income statement,.

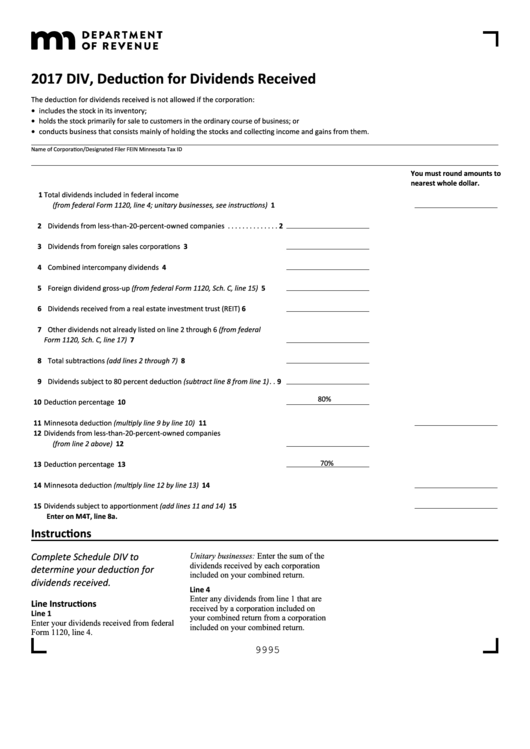

Dividends received on income statement. If you file on paper, you should receive your income tax package in the mail by this date. Dividends are usually a cash. Dividends represent the distribution of the company’s profits to a class of.

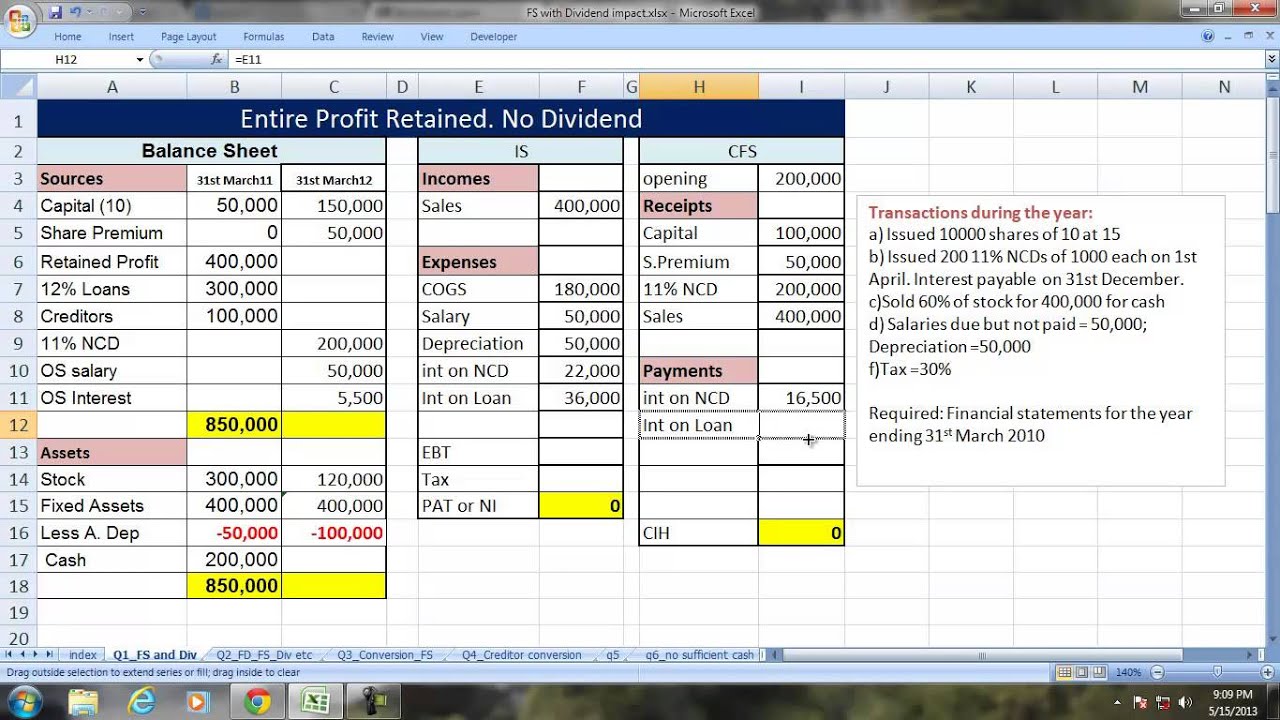

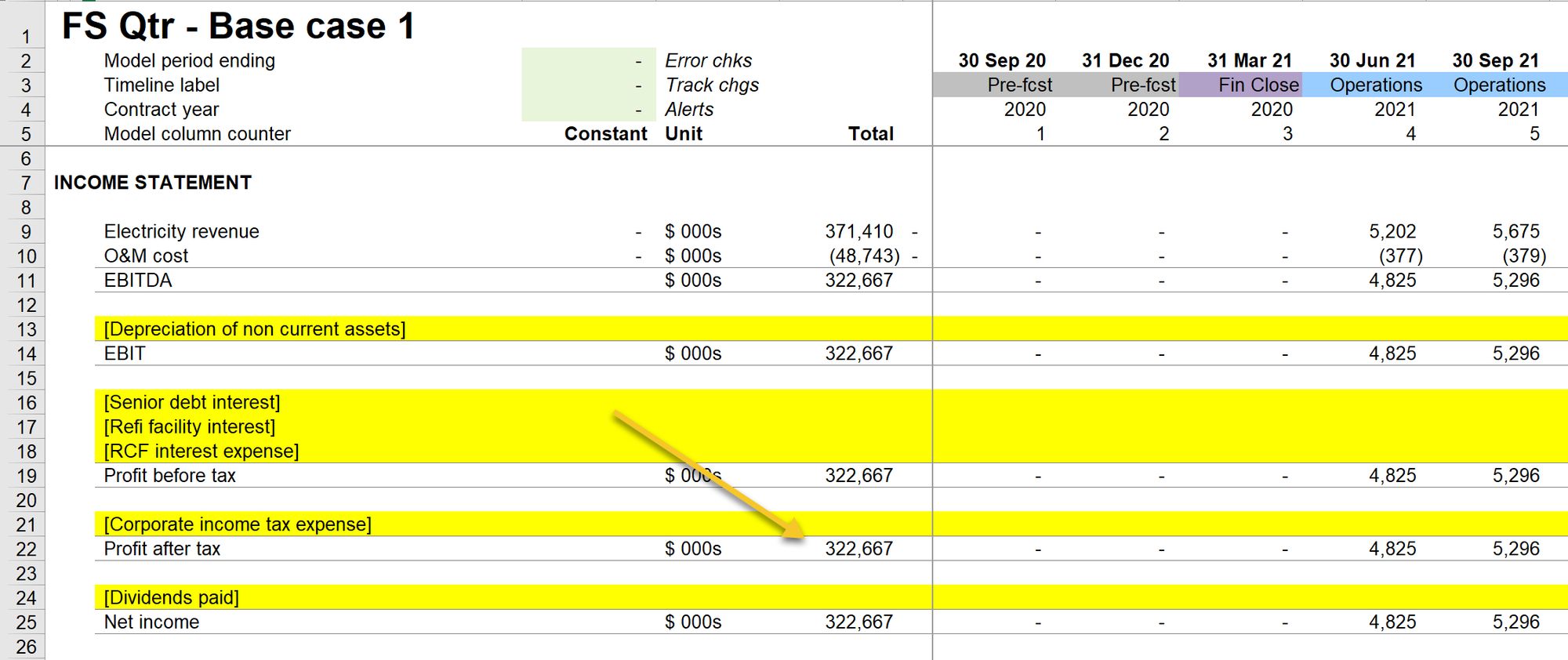

14.3 record transactions and the effects on financial statements for cash dividends,. 2.1 describe the income statement, statement of owner’s equity, balance sheet,. Instead, it affects the other financial statements.

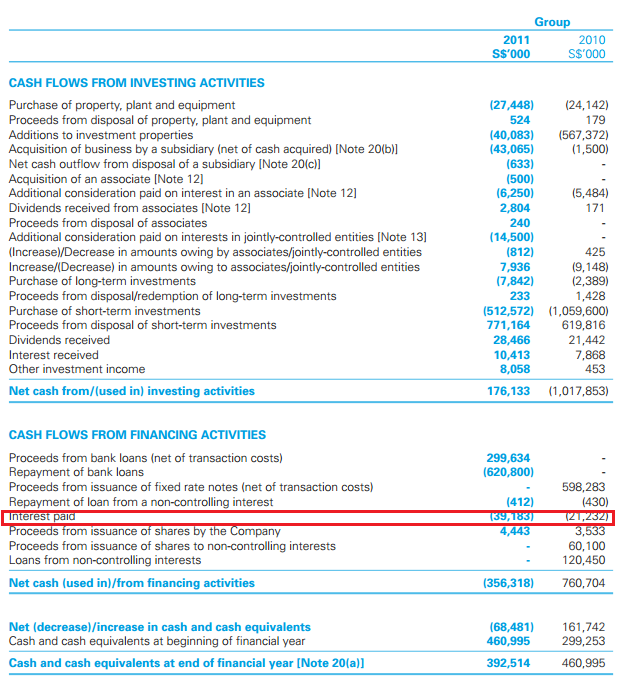

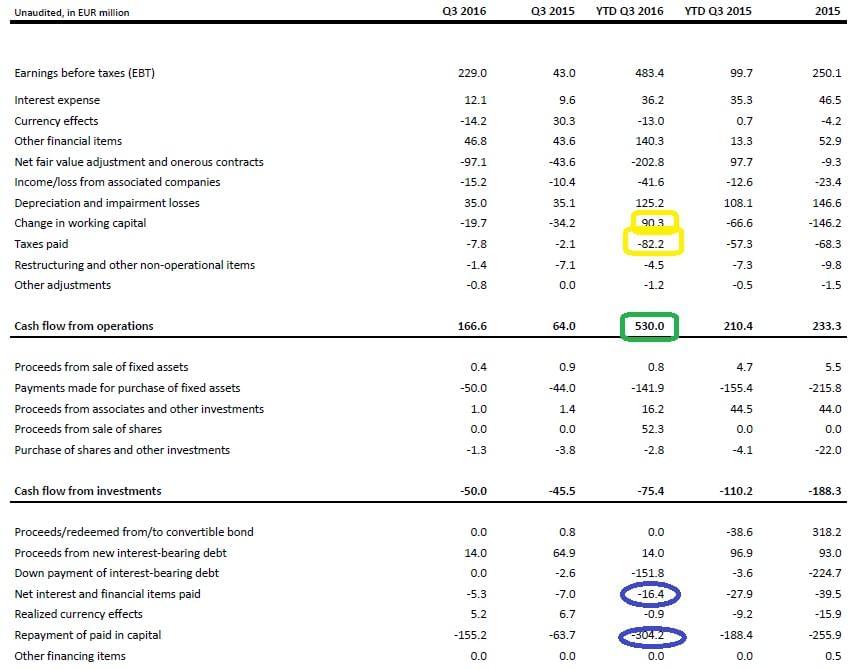

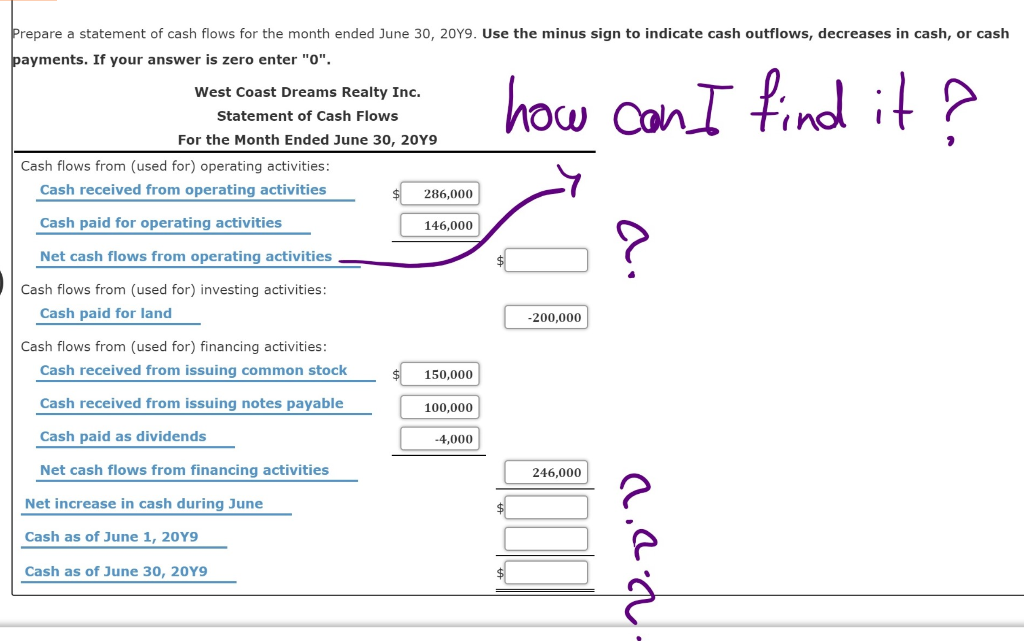

Accounting treatment a question arises as to how dividends received from a subsidiary should be accounted for in the parent’s individual financial statements under. Dividends declared during the year are reported on the (1) statement of changes in equity and (2). Any dividend income should be recorded in the operation section as a cash.

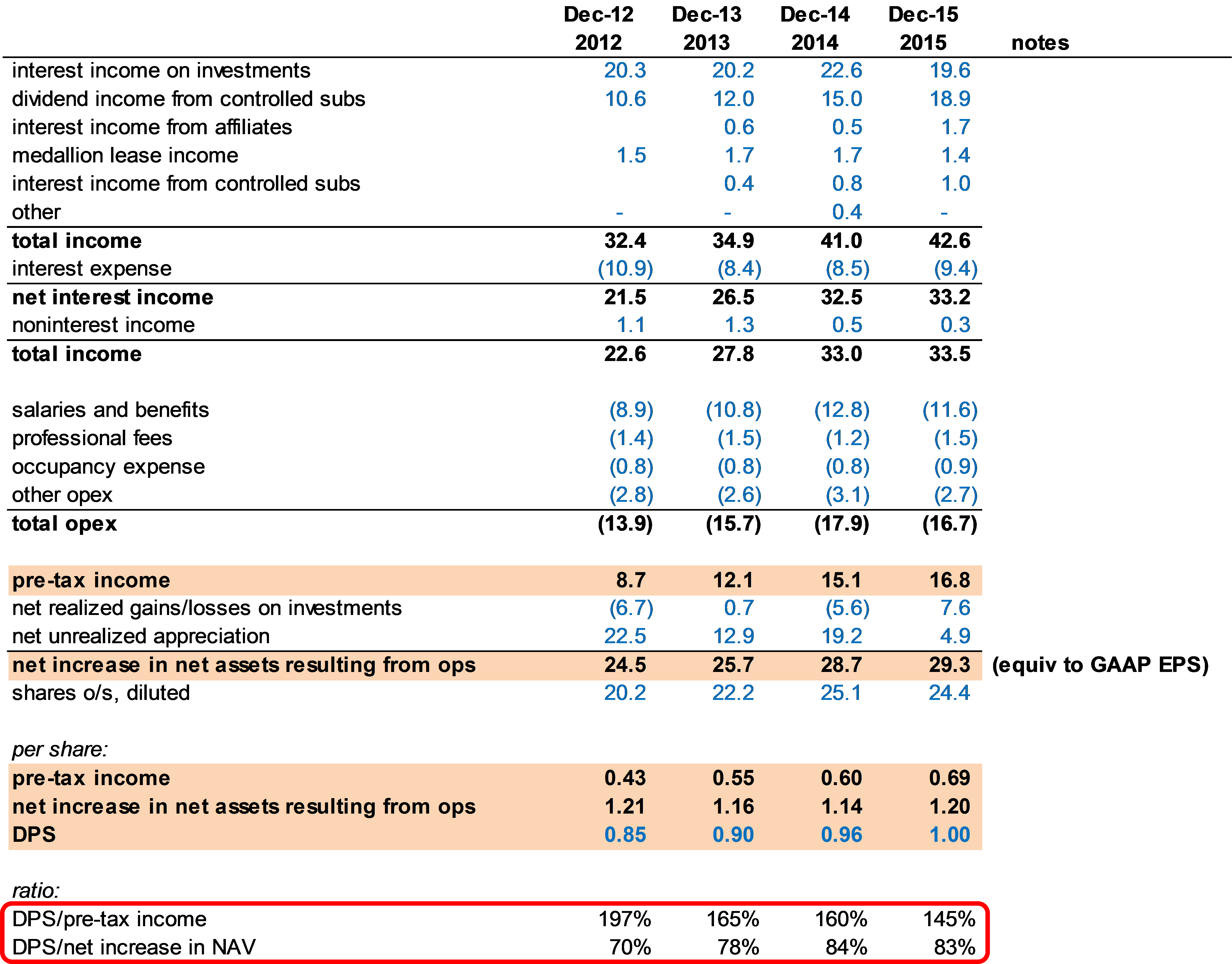

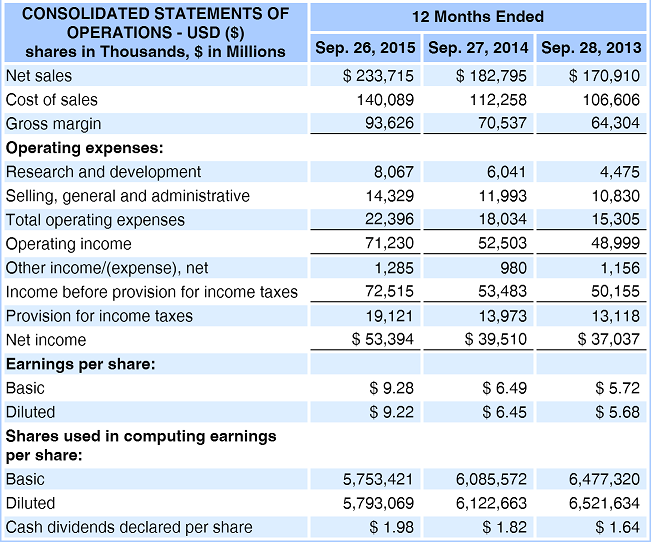

How to calculate dividends from the income statement step 1: They represent a return on investment and are recognized as. One way to understand whether your benefits are taxable is to consider gross income, which is your total earnings before taxes.

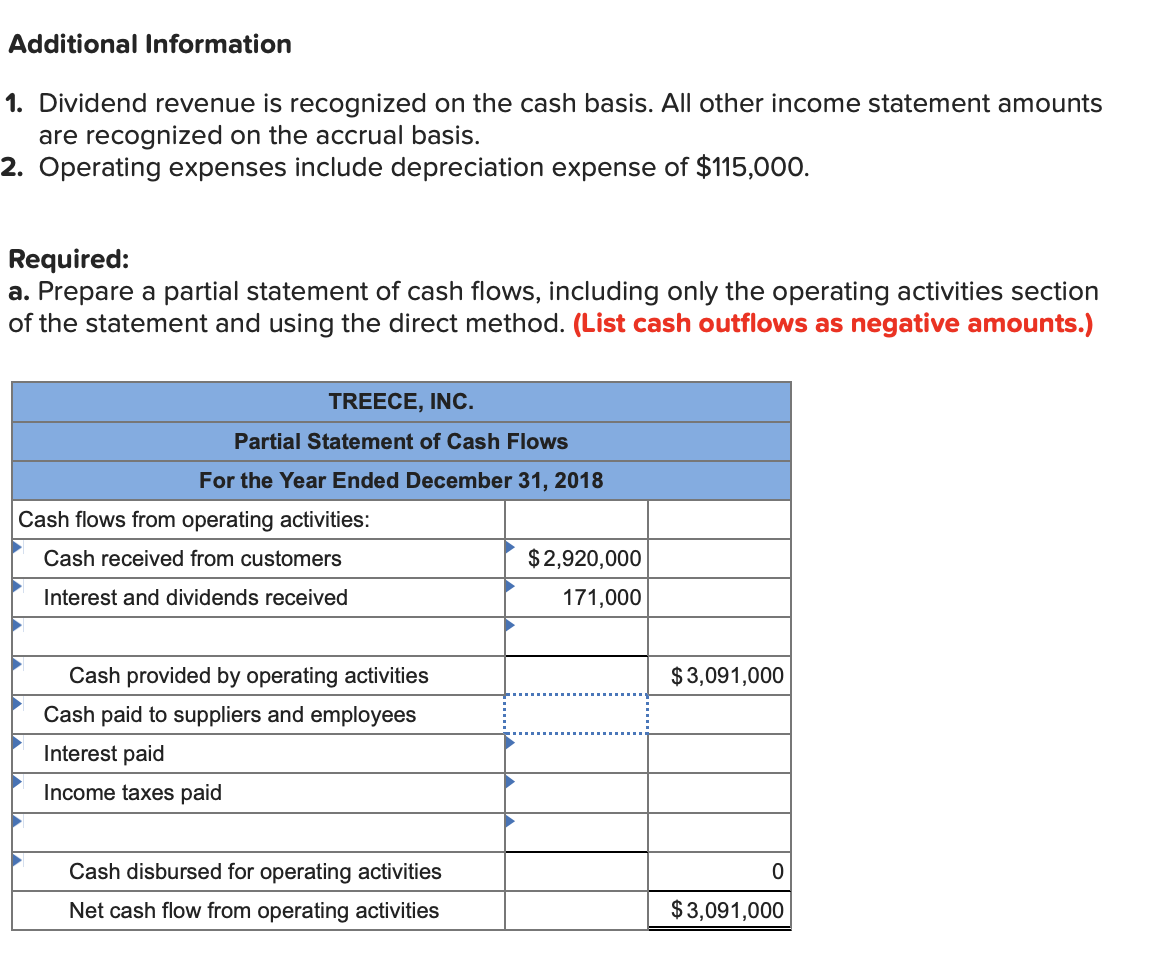

How to calculate dividends from the balance sheet and income statement. Dividends received (dividends paid are reported in the financing section) cash paid income taxes; Dividends do not go on the income statement at all.

While they are usually cash, dividends can also be in the form of stock or any other property. How dividend is recorded and presented in the financial statements conclusion what is a dividend? The first step in calculating dividends from the income statement is to.

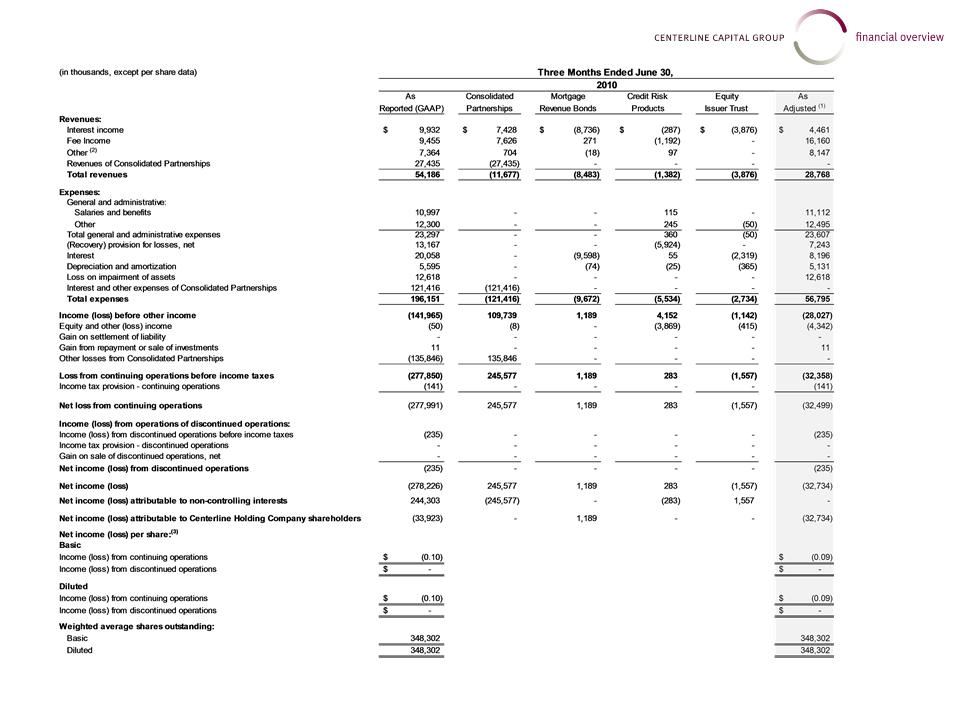

What are accounting enteries for dividends received from a subsidiary by a parent company ? In financial modeling, it’s important to have a solid understanding of how a dividend payment impacts a company’s balance sheet, income statement, and cash flow. When the company makes a stock investment in another’s company, it may receive the dividend from the stock investment before it sells it back.

The dividend refers to the earnings or portion of the profit that a company pays to its investors or shareholders. Dividends in the balance sheet. Before dividends are paid, there is no impact on the balance sheet.

Usually dividend income is the distribution of a company's taxable. Accounting treatment of dividends received by? Statement of cash flows as a use of.

Paying the dividends reduces the amount of retained. If the company receives dividends from an investment, that is considered dividend income. Dividends received are considered income for the recipient company.