Simple Info About Ias 36 Standard

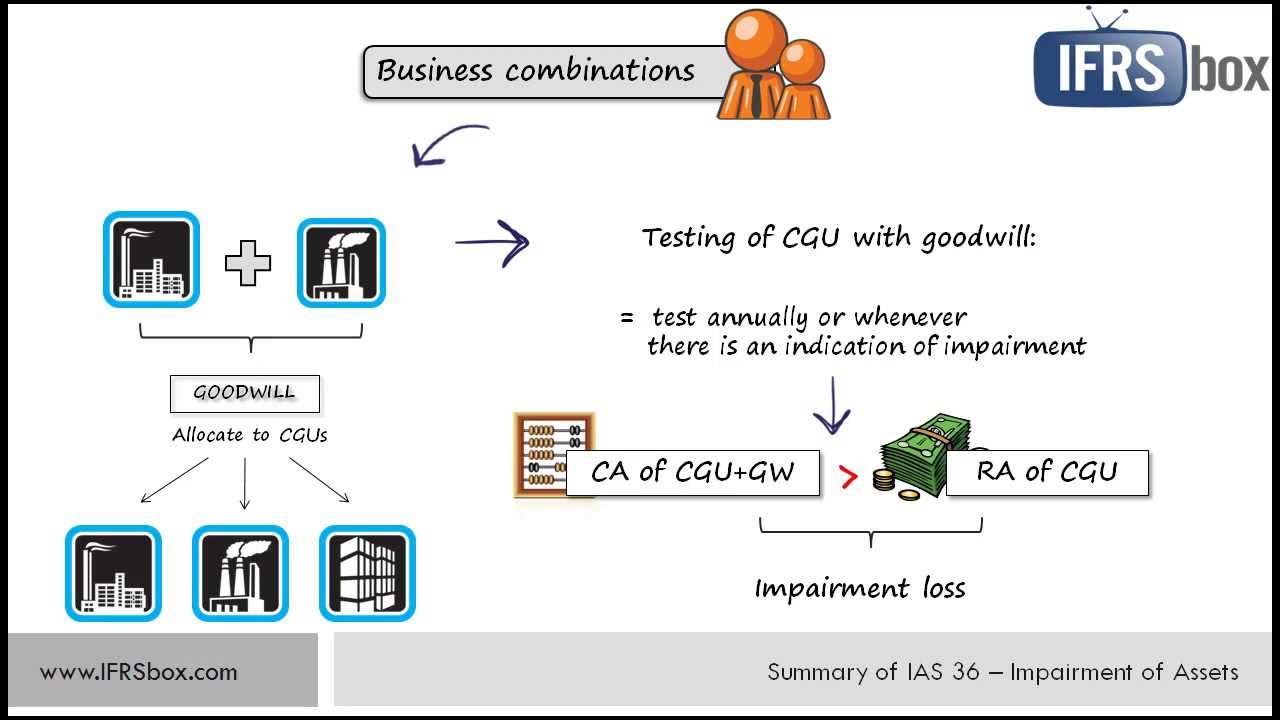

Ias 36 was reissued in march 2004 and applies to goodwill and intangible assets acquired in business combinations for which the agreement date is on or after 31 march 2004, and.

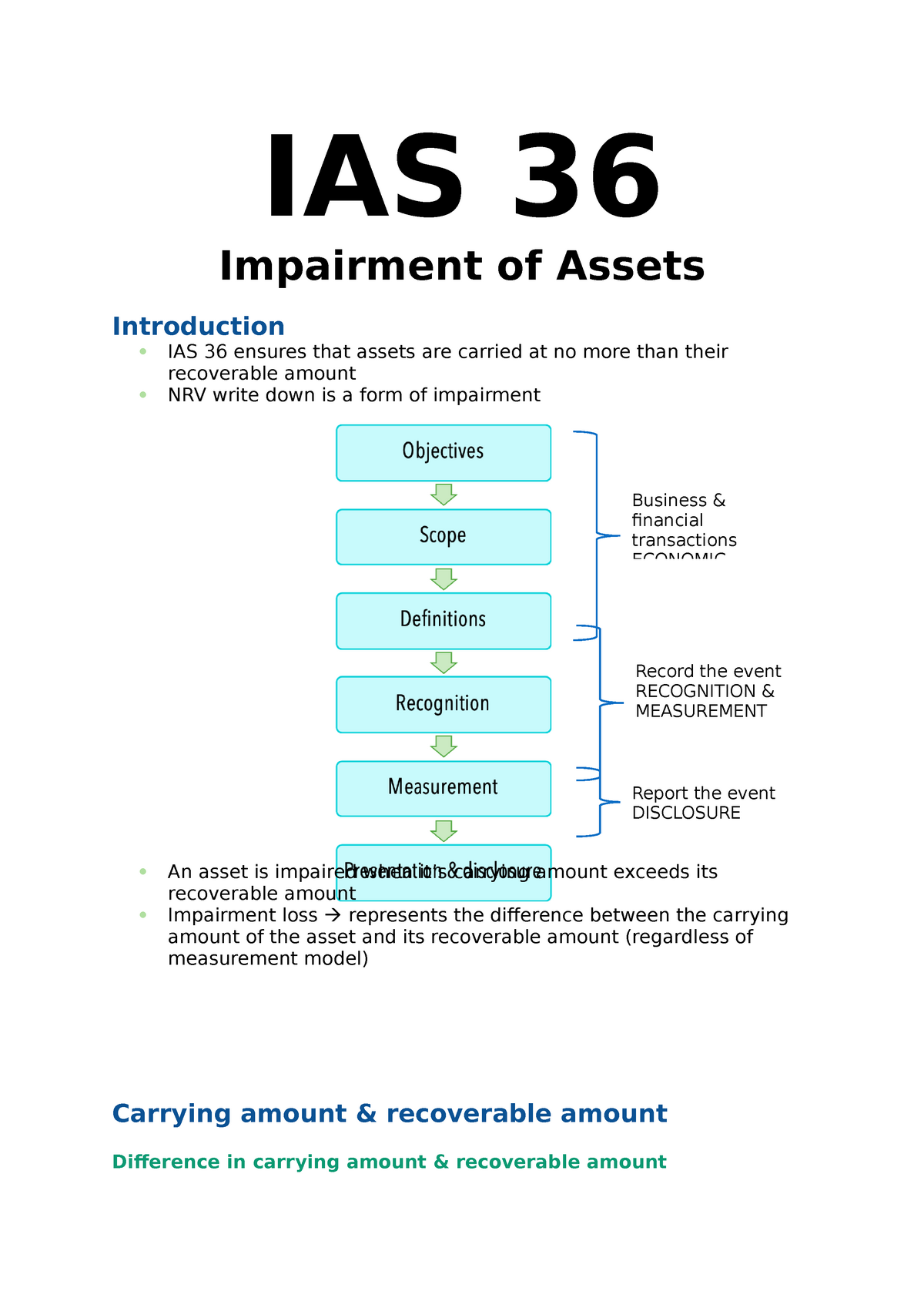

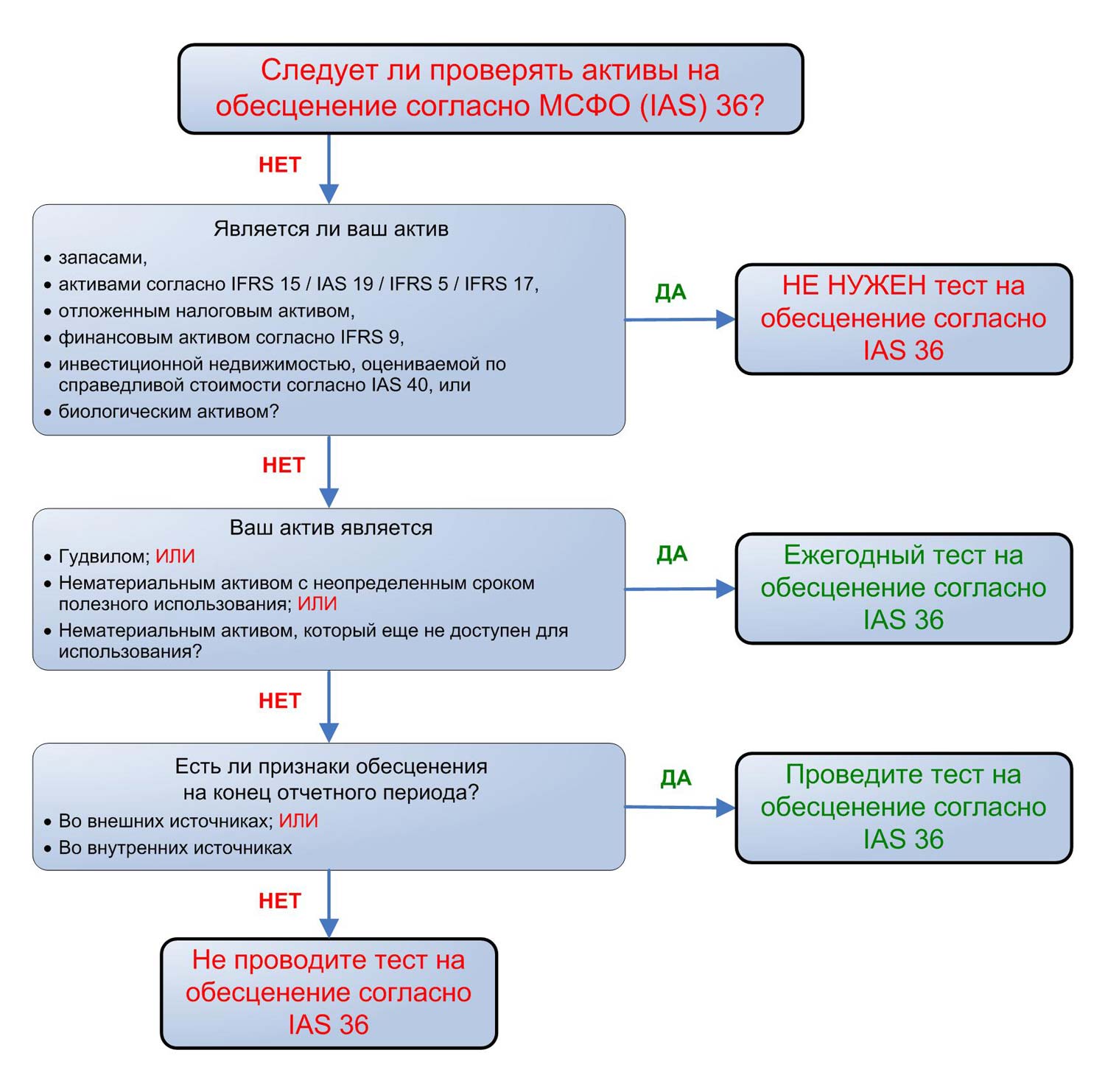

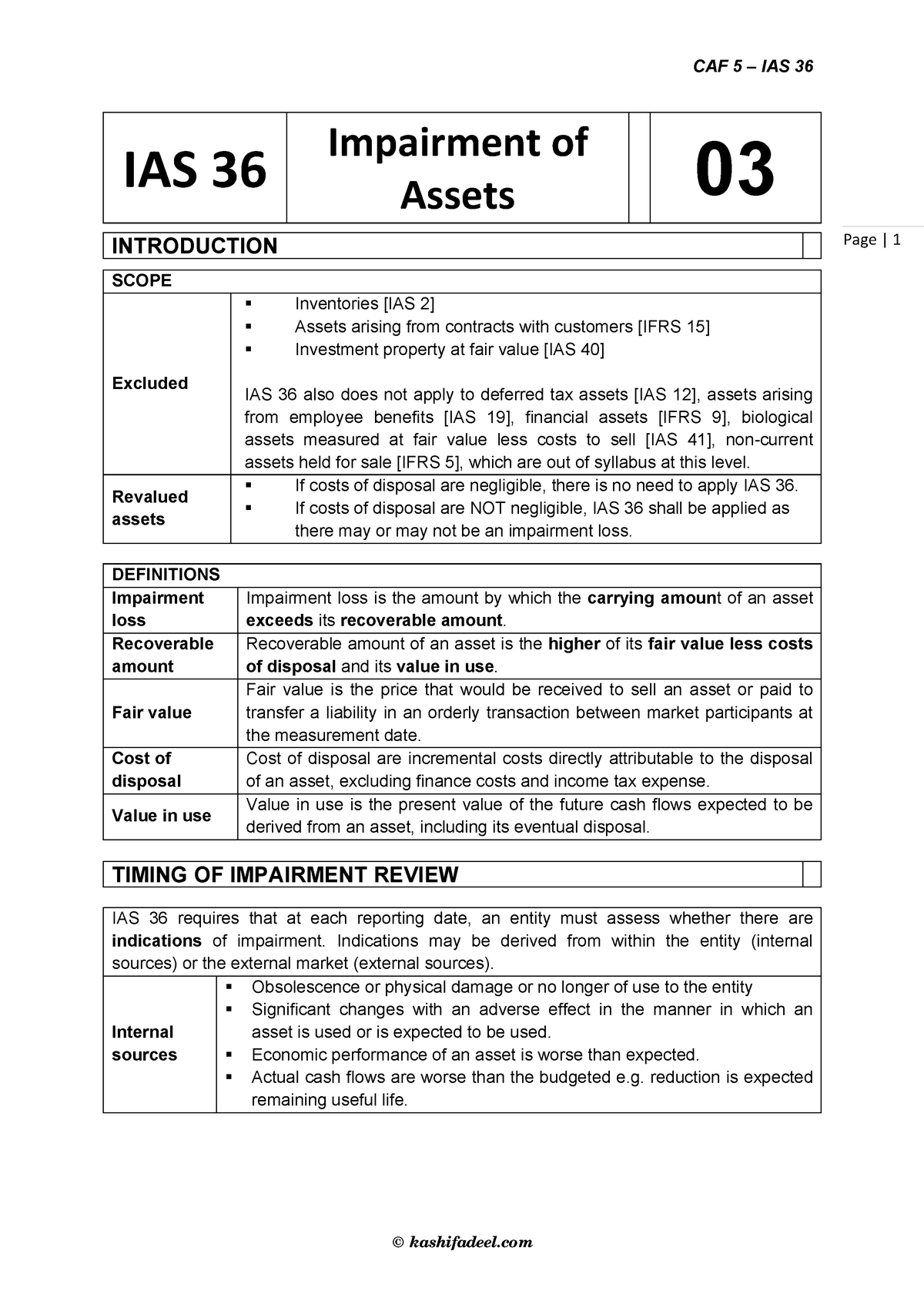

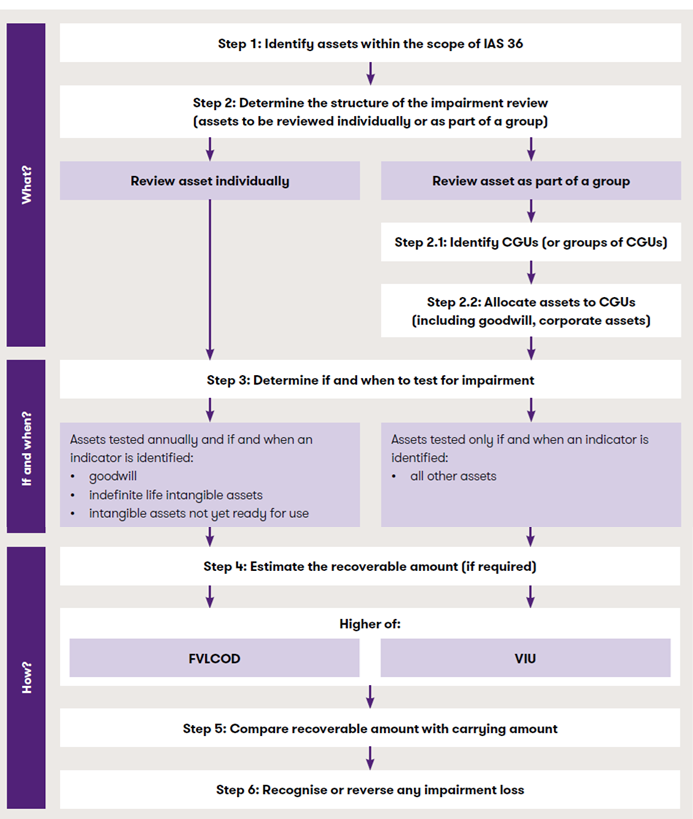

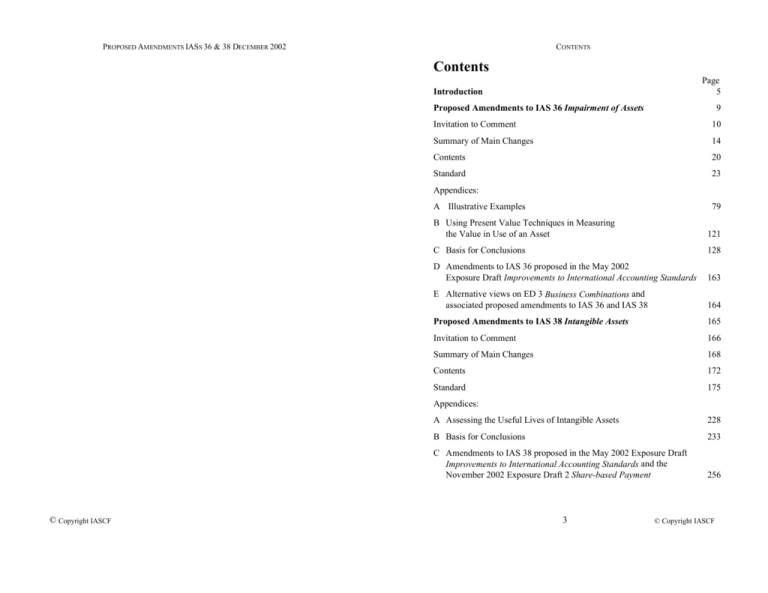

Ias 36 standard. Ias 36 — impairment of assets. Ias 36 impairment of assets prescribes the procedures to apply to ensure assets are carried at no more than their recoverable amount. Ias 36 should be read in the context of its objective and the basis for conclusions, the preface to ifrs standards and the conceptual framework for financial reporting.

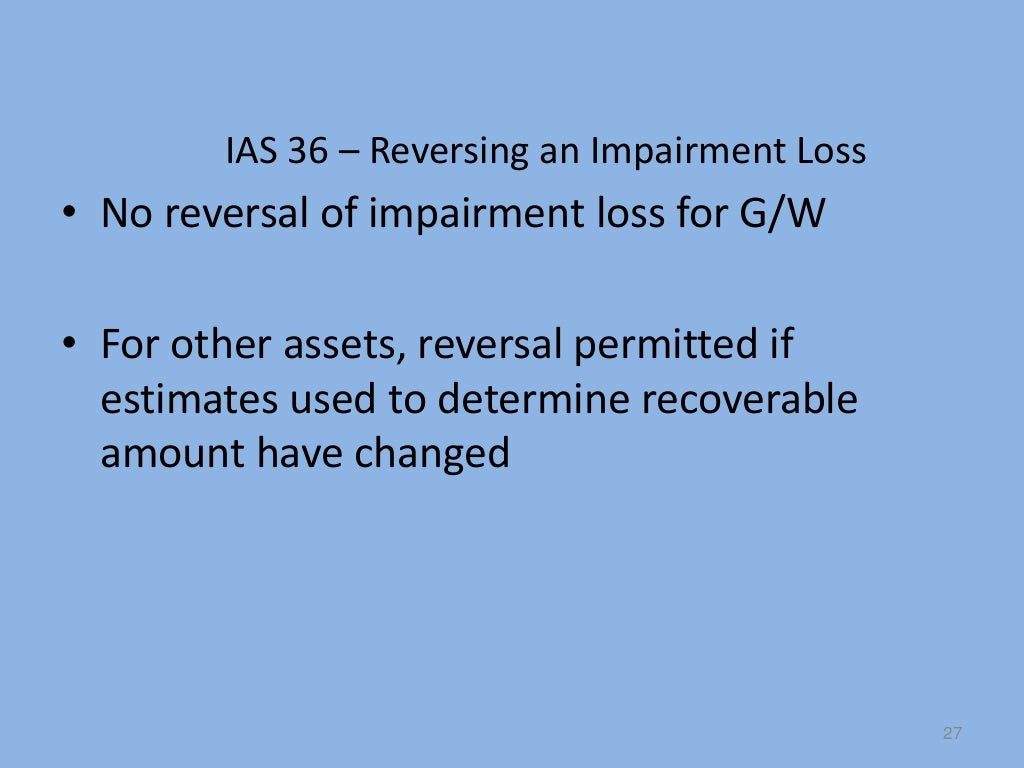

That standard consolidated all the requirements on how to assess for recoverability of an asset. In april 2001 the international accounting standards board (board) adopted ias 36 impairment of assets, which had originally been issued by the international accounting. These requirements were contained in ias 16 property, plant and equipment, ias.

In order to view our standards you need to be a registered user of the site. Ias 36 impairment of assets series. Ias 36 impairment of assets.

International accounting standard ias 36 impairment of assets january 2012 (incorporating amendments from ifrss issued up to 31 december 2011, including those. Ias 36 © ifrs foundation 1 international accounting standard 36 impairment of assets objective 1 the objective of this standard is to prescribe the procedures that an entity. If and when to test for impairment ias.

Ias 36 ‘impairment of assets’ is not a new standard, and while many of its requirements are familiar, an impairment review of assets (either. In1 international accounting standard 36 impairment of assets (ias 36) replaces ias 36 impairment of assets (issued in 1998), and should be applied: Ias 36 standard sets out the impairment requirements of intangibles, property, plant and equipment and subsidiaries, investment in associates and joint ventures.