Inspirating Tips About Inventory Financial Ratios

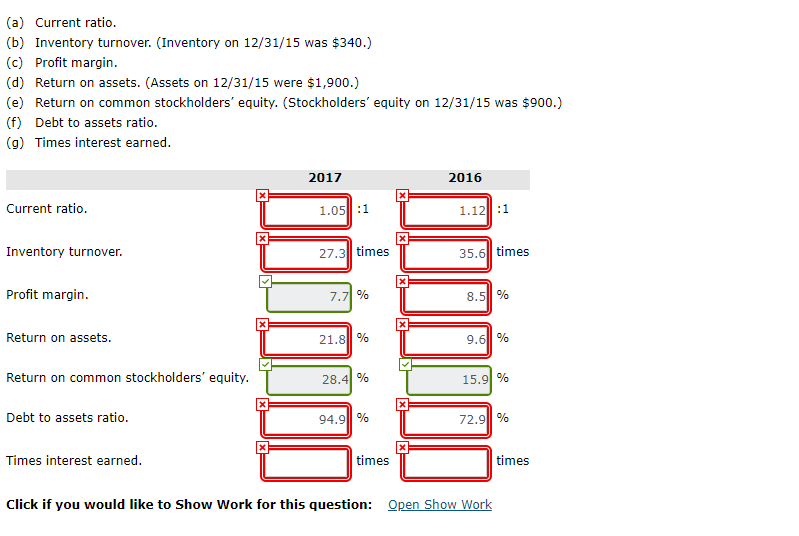

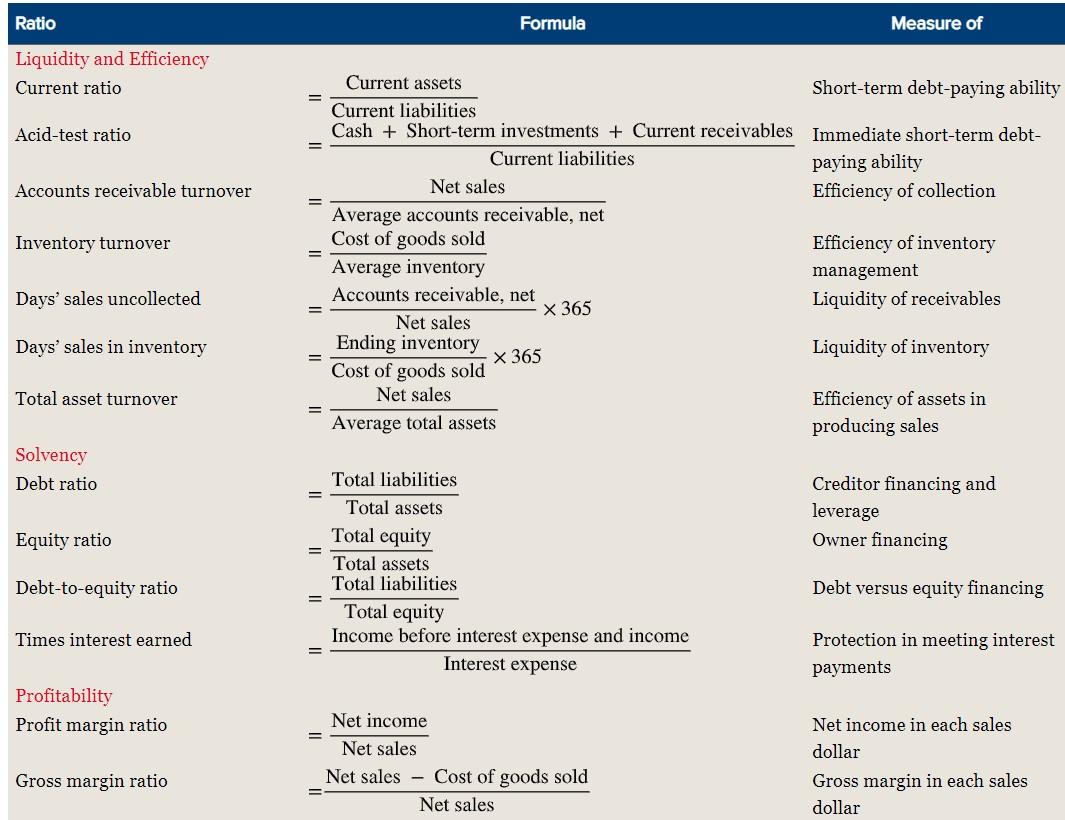

Inventory turnover ratio = (cost of goods sold)/ (average inventory) for example:

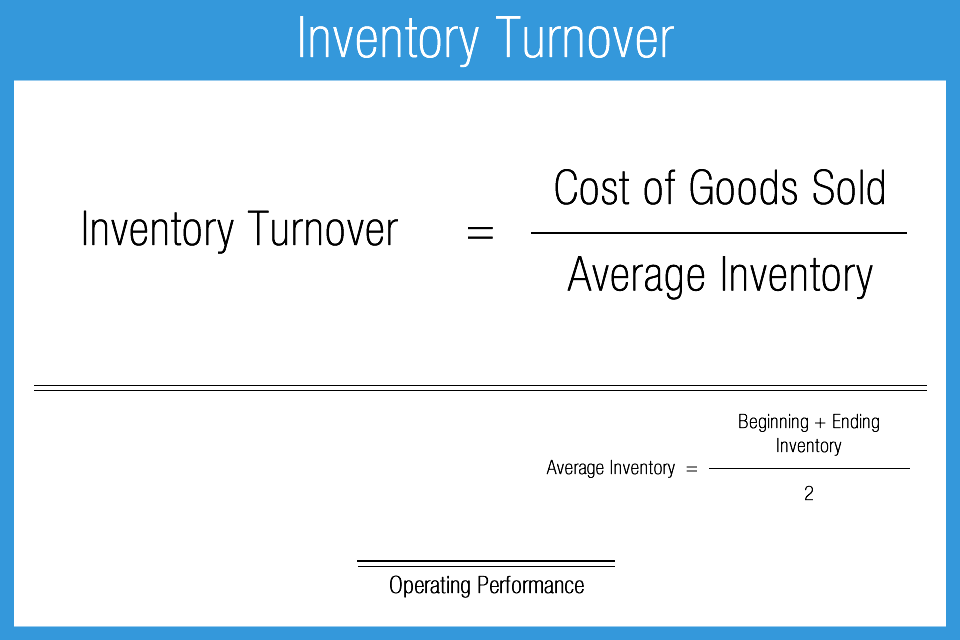

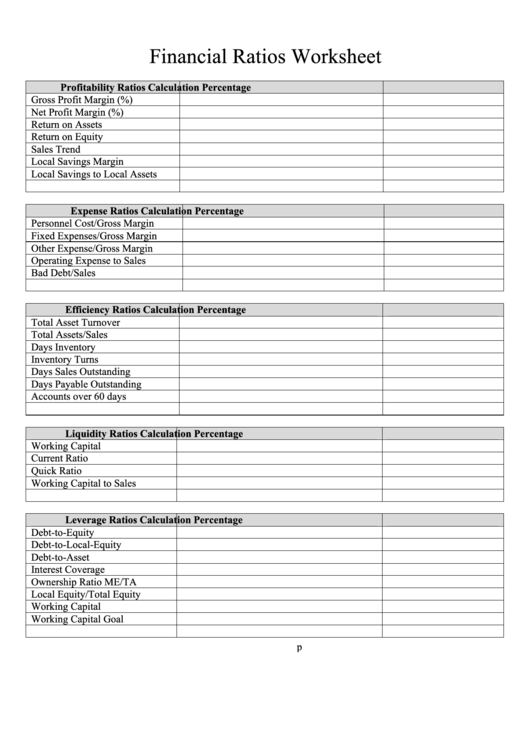

Inventory financial ratios. What are inventory formulas and ratios and why do i need them? It shows how many times a company has sold and replaced its inventory during a specified period. The purpose of this analysis is to detect a company's problems with inventory management,.

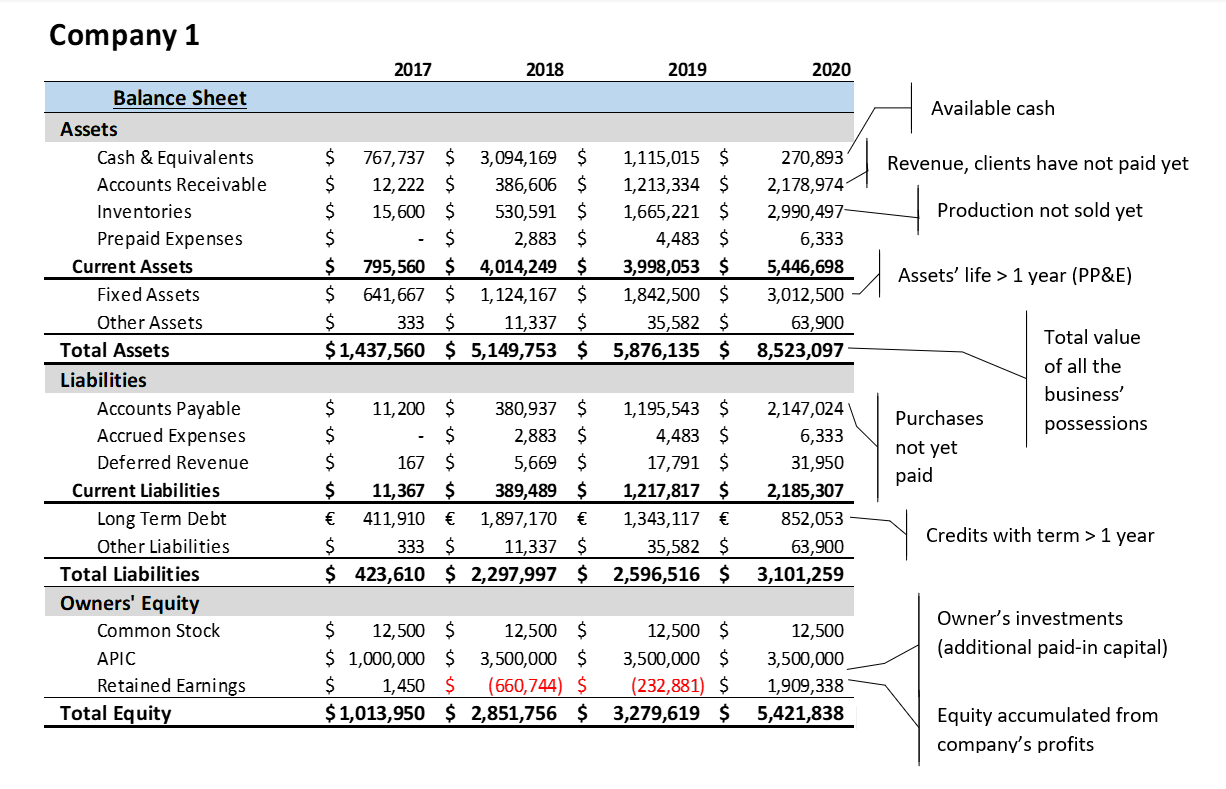

Financial ratios to analyze inventory, financial professionals typically use various financial ratios to judge whether a company has any issues with producing and promptly selling its. A company can then divide the. Inventory ratio analysis relates to how well the inventory is being managed.

The ratio can be used to determine if there are excessive inventory levels compared to. The company’s cost of beginning inventory was $600,000 and the cost of. What constitutes a 'good' inventory turnover ratio varies by industry.

In finance, ratio analysis is done by calculating ratios using historical inventory balances. What is a good inventory turnover ratio? The inventory turnover ratio is calculated by dividing the cost of goods by average inventory for the same period.

The inventory turnover ratio formula is equal to the cost of goods sold divided by total or average inventory to show how many times inventory is “turned” or sold during a period. The first ratio, inventory turnover, measures the number of times an average quantity of inventory was bought and sold during the period. The accounts receivable turnover ratio measures how many times a company can turn receivables into cash over a given period:

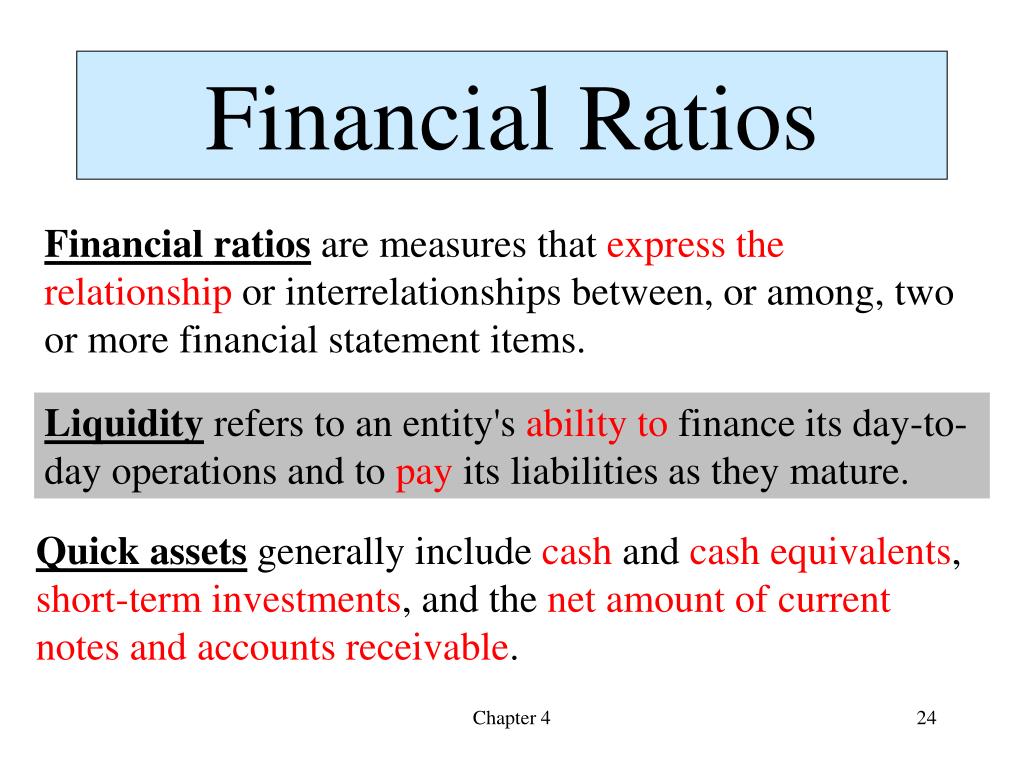

Financial ratios are powerful tools to help summarize financial statements and the health of a company or enterprise. Inventory ratios help precisely measure and manage your stock levels and improve performance, cash flow, and profitability. This ratio provides investors with the frequency of the sales of a company.

Inventory turnover ratio = cost of goods sold / average inventory. To calculate the inventory turnover ratio, divide the cost of goods sold (cogs) by average inventory. The inventory turnover ratio is a financial metric used to evaluate a company's efficiency in managing and selling its inventory.

Conversely, a higher ratio can indicate insufficient inventory on hand, and a lower one can indicate too much inventory in stock. Has a cost of goods sold of $5m for the current year. This measures how many times average inventory is “turned” or sold during a period.

These financial ratios quickly break down the complex information from financial statements. Inventory turnover ratio = cost of goods sold / average inventory. Two ratios can be used to assess how efficiently management is handling inventory.

Financial ratios are the indicators of the financial performance of companies. Learn the most useful financial ratios here. Inventory turnover ratio = $100,000 ÷ average ($60,000, $40,000) = 2.0x.

![[Updated 2023] 17 Major Mergers And Acquisitions PowerPoint Templates](https://www.slideteam.net/wp/wp-content/uploads/2019/04/Key-Financial-Ratios.png)