Looking Good Tips About Exceptional Items In Profit And Loss Statement

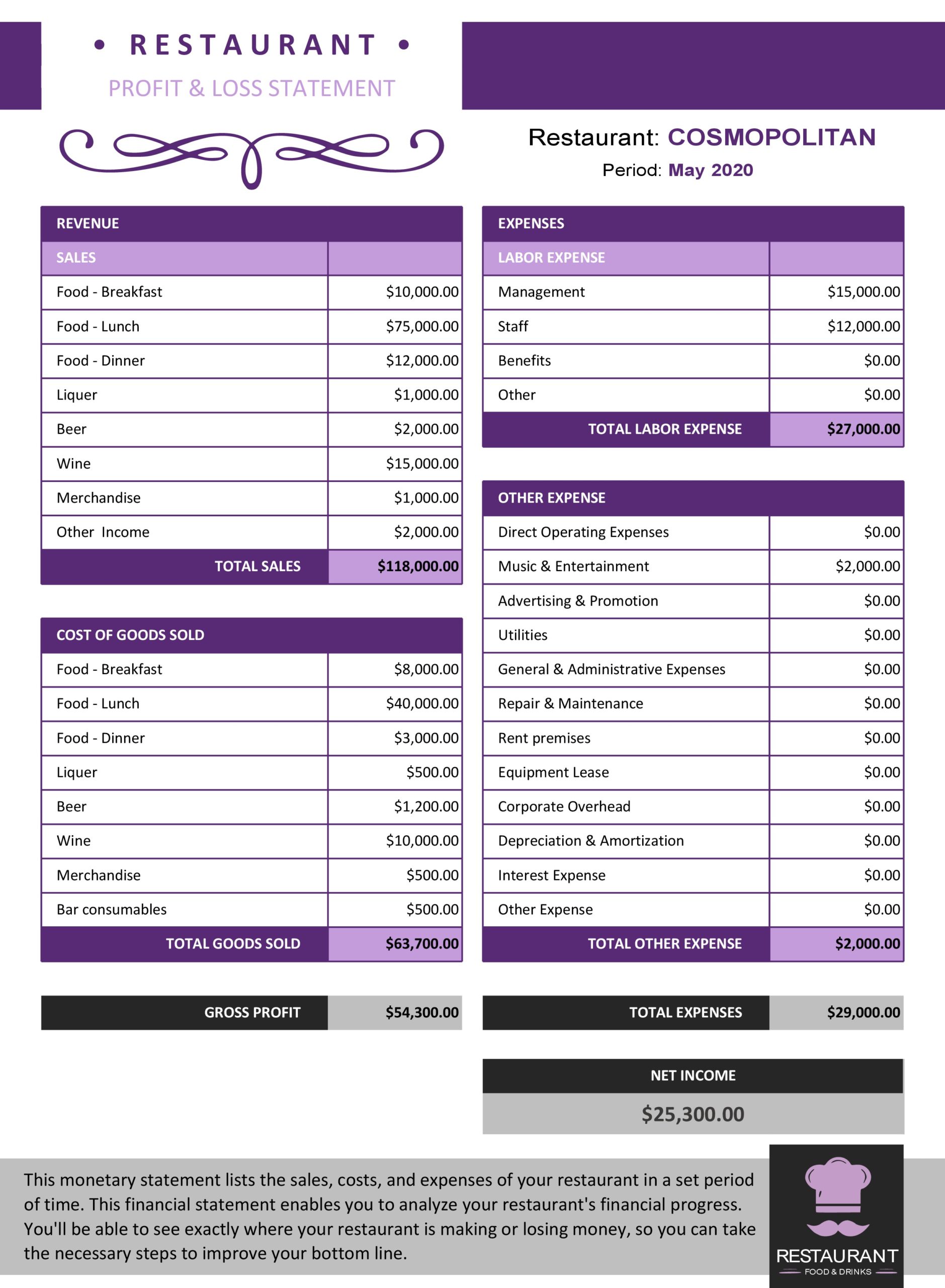

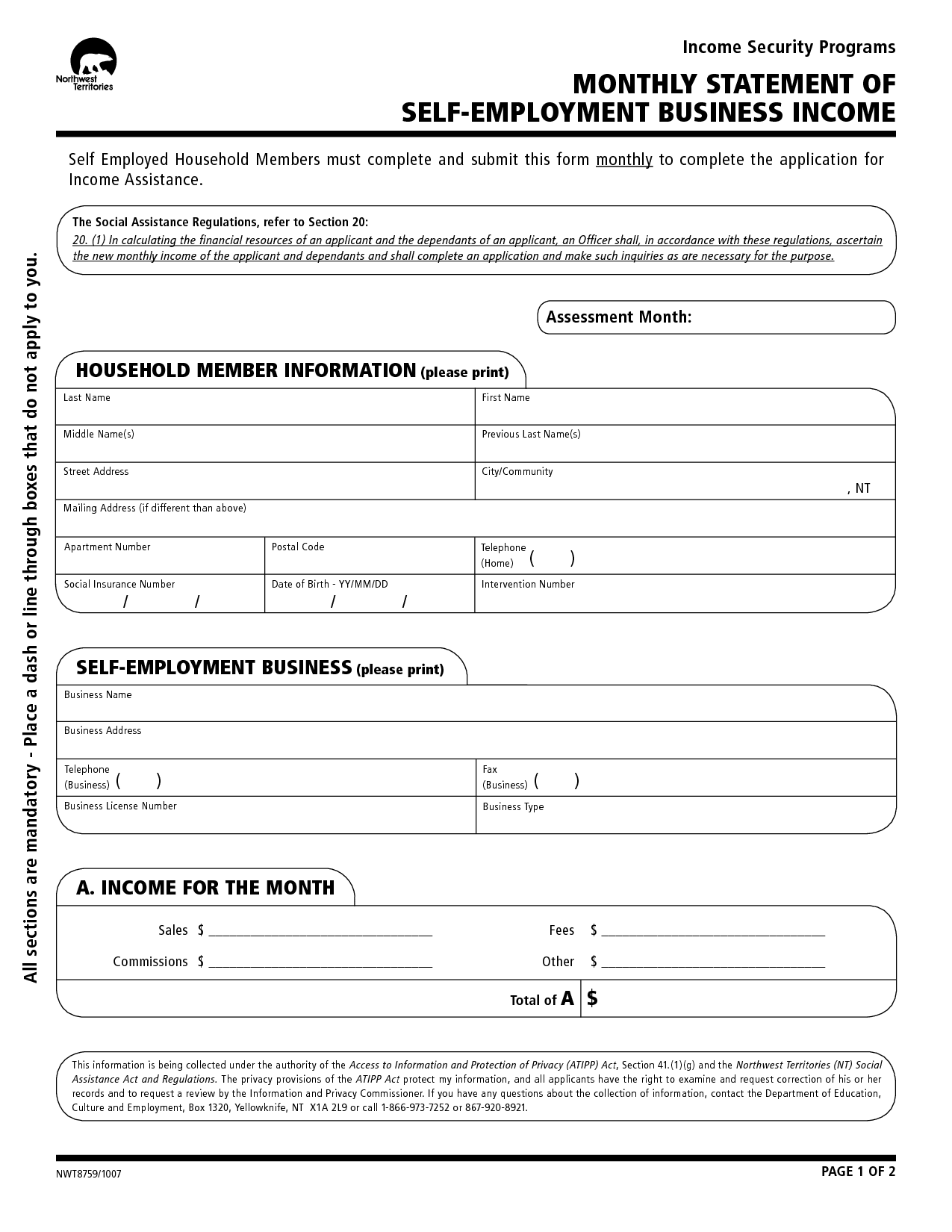

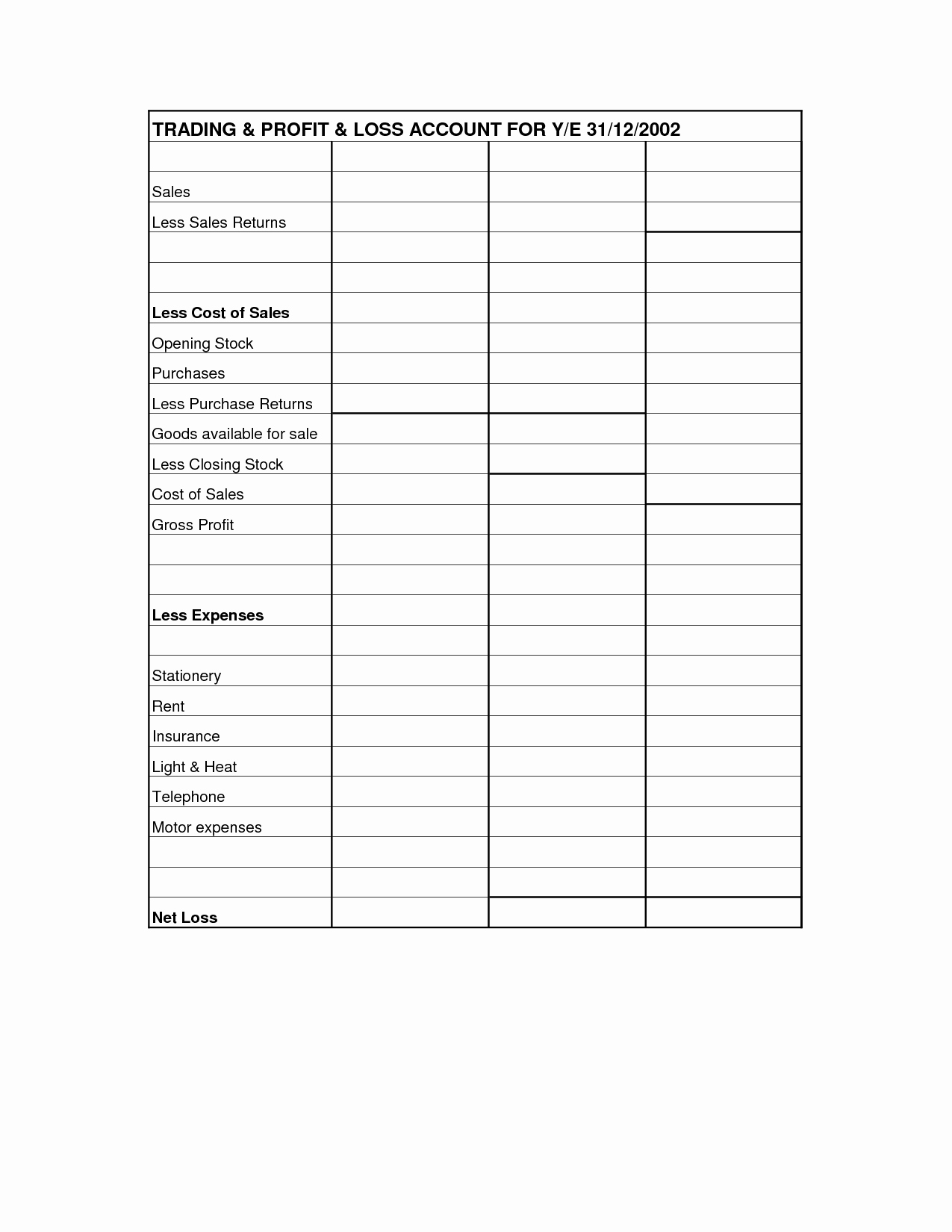

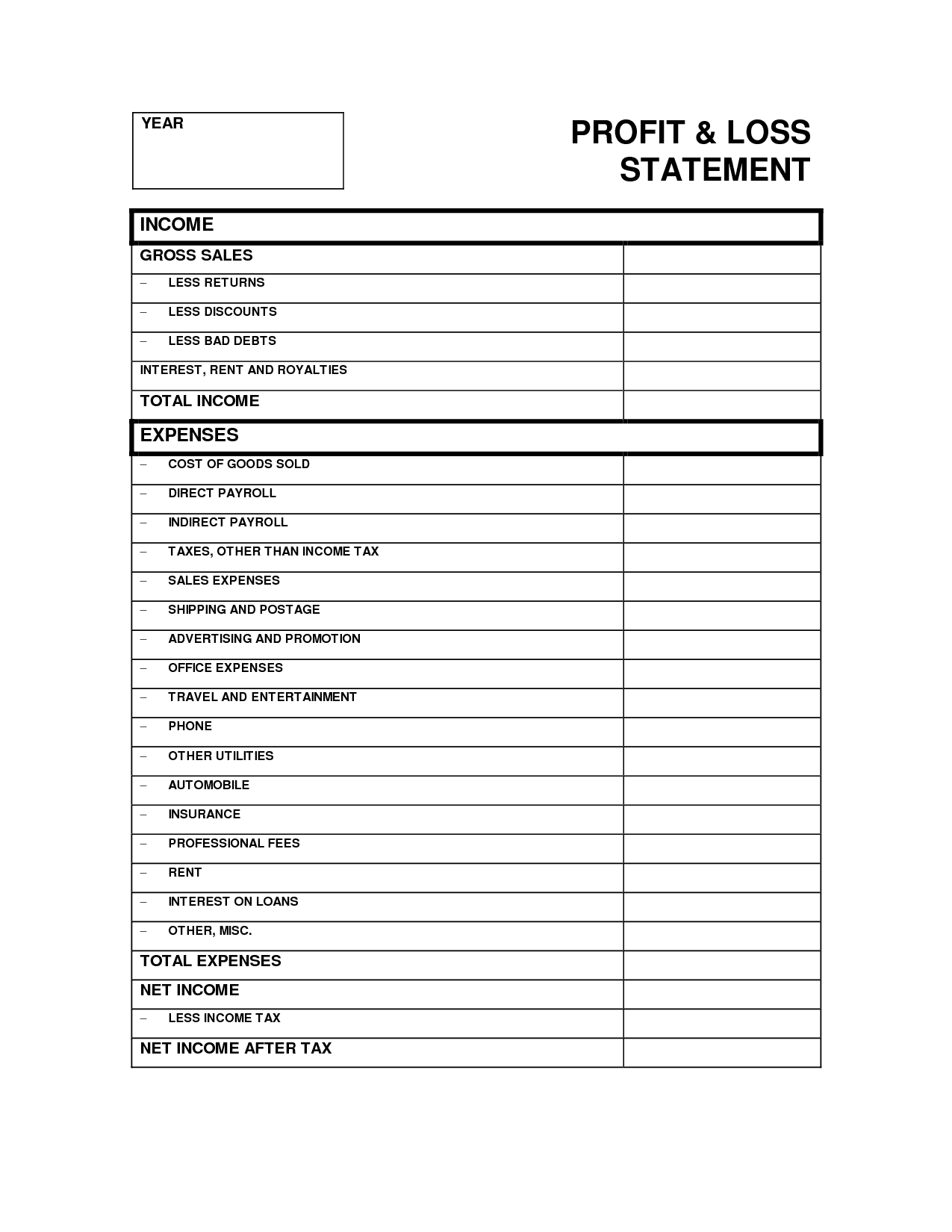

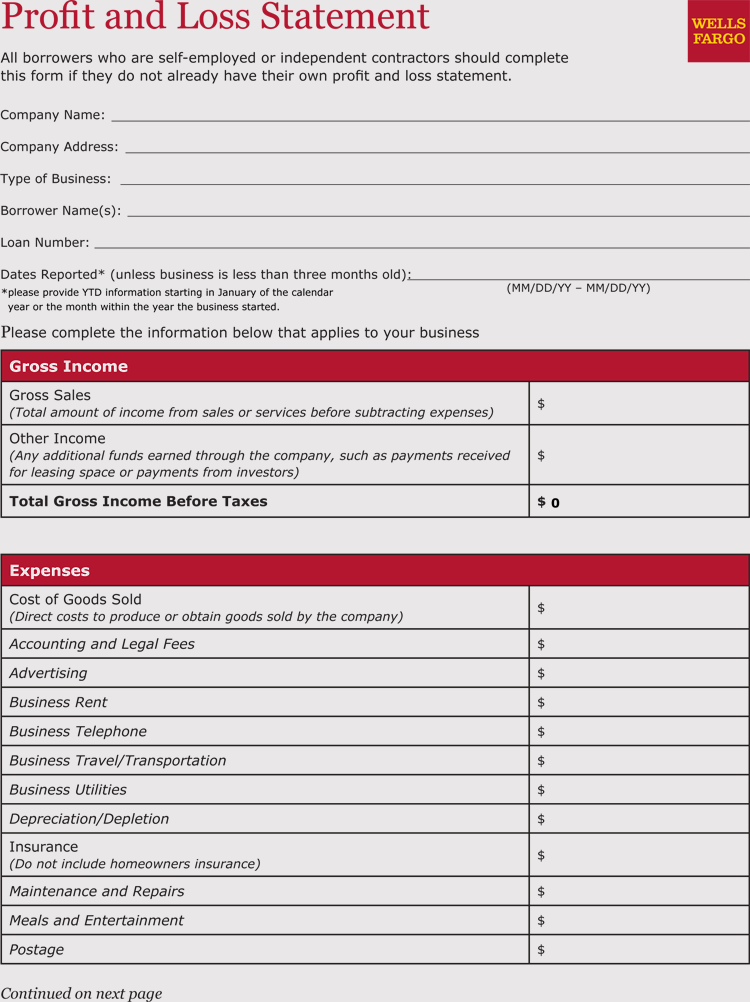

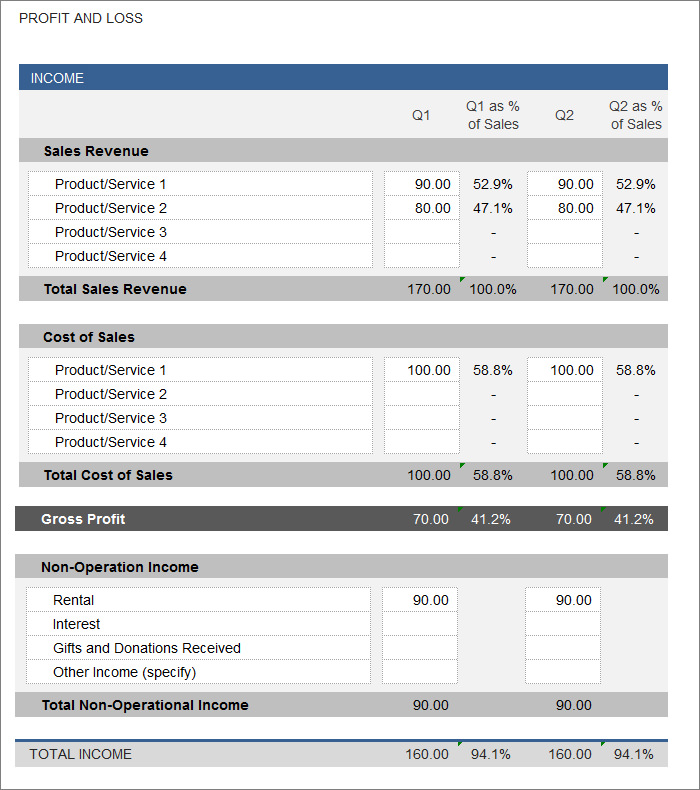

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and.

Exceptional items in profit and loss statement. Revenue and expenses are shown when they occur, not. There are some items in a company’s financial statements that can lead to unusual profits and losses in the final balance of a. A good definition of “exceptional items” can be:

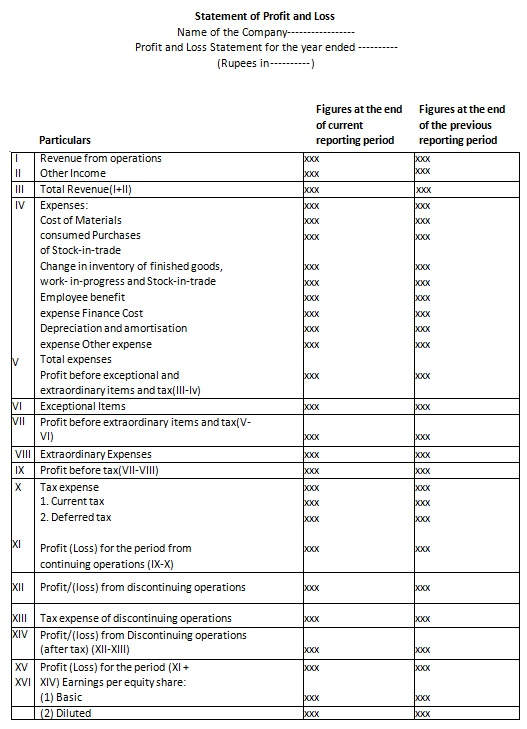

Exceptional items are not defined. The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income. Extraordinary items should be disclosed in the statement of profit and loss as a part of net profit or loss for the period.

Extraordinary items must be declared in the statement of profit or loss as a part of net profit or loss for the given period. Exceptional items/ extraordinary items are expenses occurring at one odd time for the company, and the company does not foresee this as a recurring expense. Losses or slowdown of operations due to natural disasters;

However, each material class of item is presented separately on the face of the profit and loss where they are relevant to an. An extraordinary item on a balance sheet indicates a substantial gain or loss that is unlikely to be repeated. Profit/ (loss) before tax :

The nature and the amount of each extraordinary item. Ias 1 presentation of financial statements sets out the overall requirements for financial statements, including how they should be structured, the minimum requirements for their. A p&l statement shows investors and other interested parties the amount of a company's profit or loss.

Examples of unusual or infrequent items include gains or losses from a lawsuit; Investinganswers expert updated december 1, 2020 what is an exceptional item? A profit and loss statement is a financial statement that typically covers the following items:

Frs at paragraph 14 requires turnover and operating profit to be shown separately on the face of the profit and loss account and should be split between. Disclosure of extraordinary items. Profit (loss) for the period.

Items of profit and loss and oci can be presented as: Information about the statement of profit or loss and other comprehensive income (p&l and oci) and the statement of financial position (balance sheet). Sembcorp industries has posted a group net profit after exceptional items (ei) and loss from discontinued operations was s$942m for the full year of 2023, 11% higher than the.

Sometimes exceptional items appear in profit and loss statements of companies. Exceptional items as well as extraordinary items are reported in the profit and loss statement. Profit/(loss) before exceptional items and tax :

A detailed explanation regarding the nature of the item is given in. What are exceptional items?

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Yearly-Profit-Loss-Statement-Template-TemplateLab-790x1101.jpg)