First Class Tips About Ge Income Statement 2019

:max_bytes(150000):strip_icc()/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)

37 rows 15.98%.

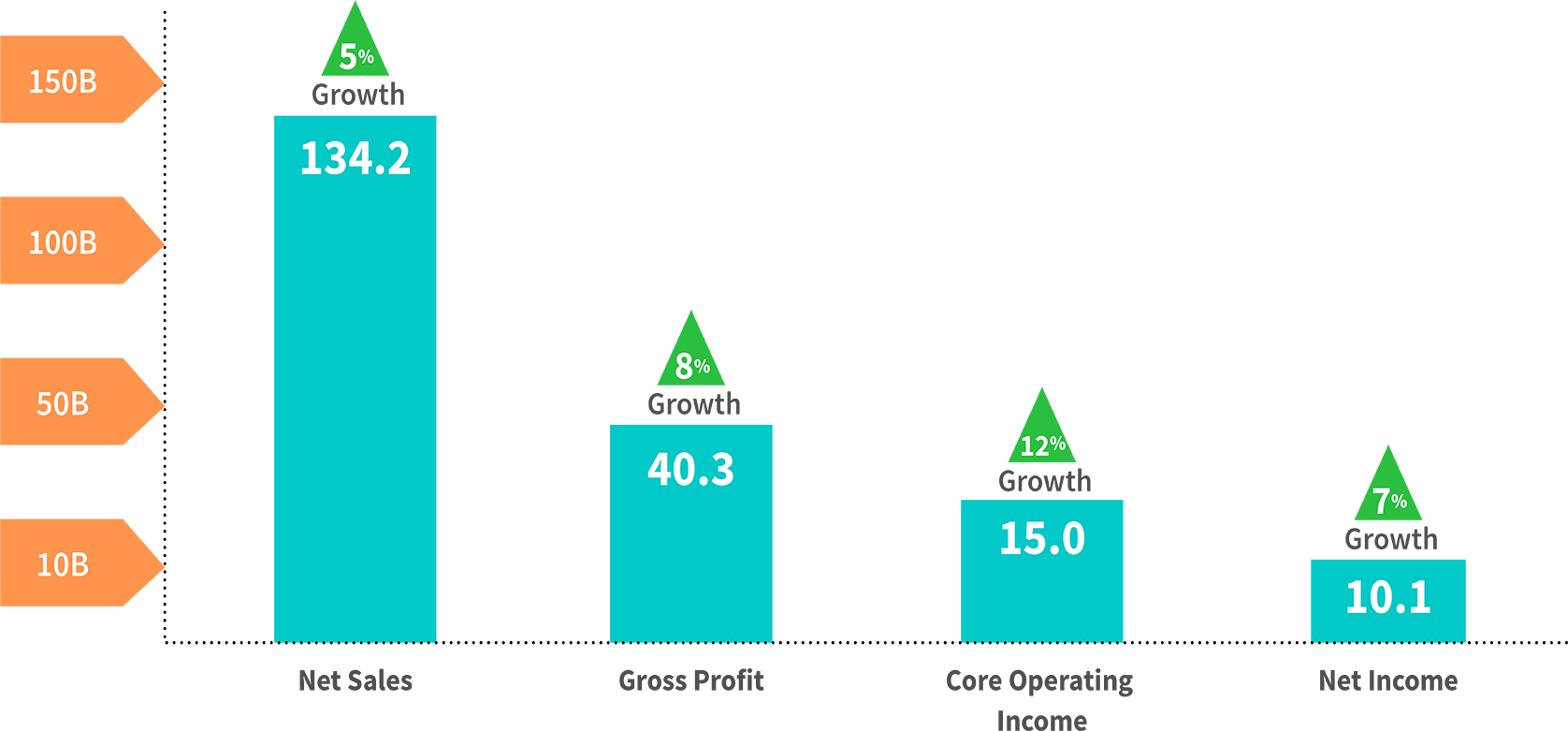

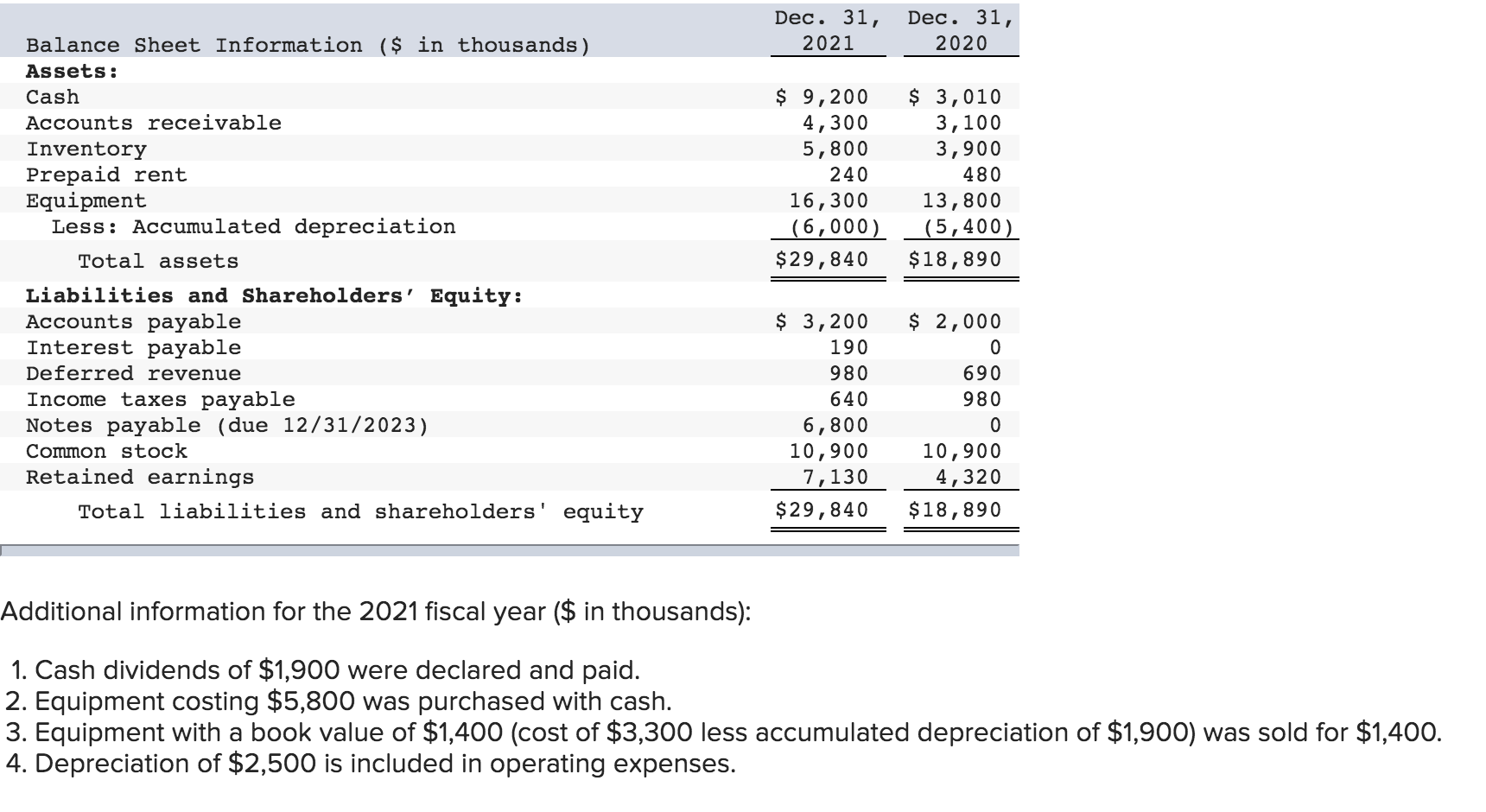

Ge income statement 2019. 2019 deleveraging actions % reduced ge industrial leverage: 28 rows general electric co. View ge financial statements in full.

Get the income statement charts for general electric (ge). View ge financial statements in full, including balance sheets and ratios. Get the detailed income statement for general electric company (ge).

View the latest ge income statements by webull. Ten years of annual and quarterly financial statements and annual report data for general electric (ge). Find out the revenue, expenses and profit or loss over the last fiscal year.

Watch list new set a price target alert after hours last updated: Compare ge with other stocks general electric annual/quarterly net income history. Get the detailed quarterly/annual income statement for general electric company (ge).

The income statement communicates how much. Balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. Get 20 years of historical income statement charts for ge stock and other companies.

Compare ge with other stocks general electric annual/quarterly revenue history. Marketwatch ibd 4.09% 0.05% advertisement general electric co. Provision (benefit) for income taxes:

43 rows general electric annual revenue for 2020 was $75.833b, a 15.95% decline from 2019. Feb 2, 2024 7:59 p.m. General electric annual net income for 2020 was $5.23b, a 196.16% decline from 2019.

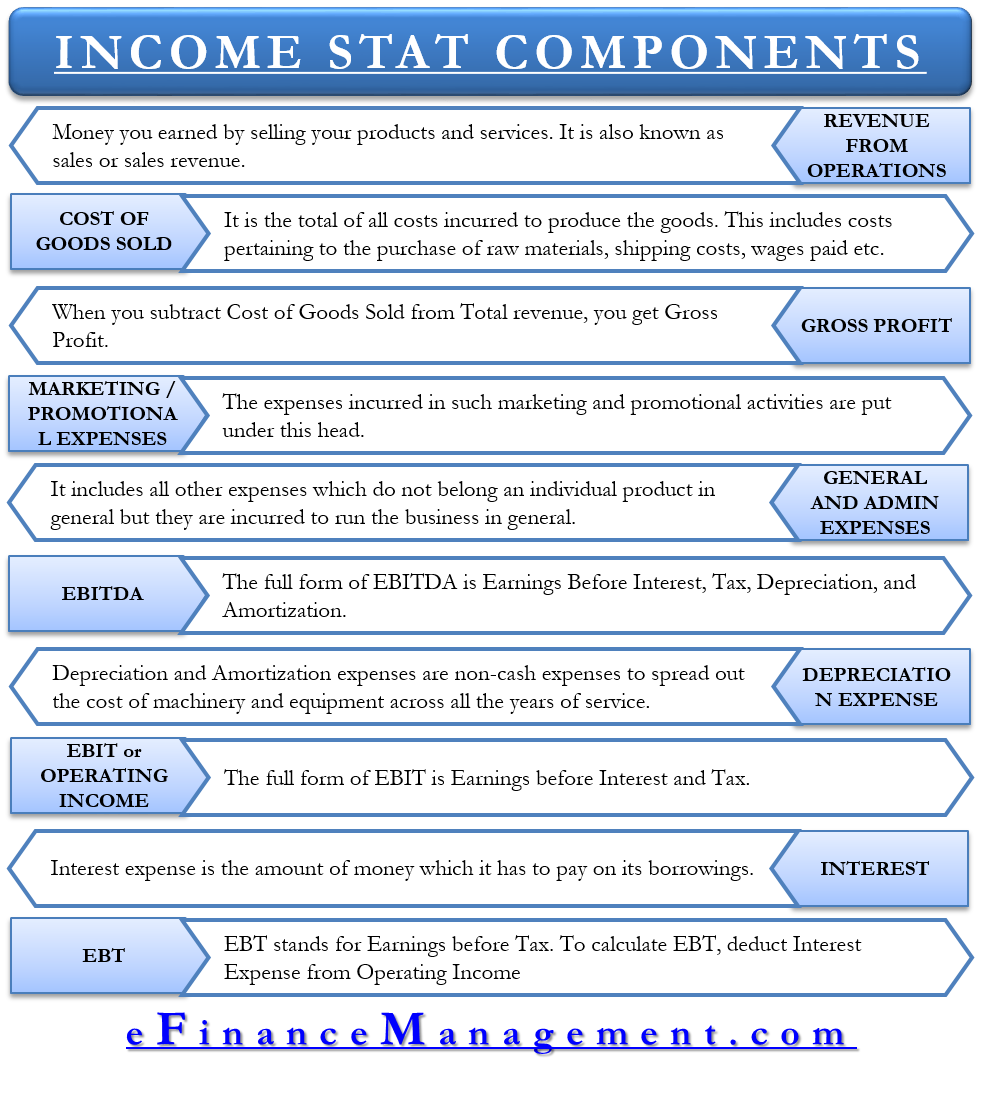

Up to 10 years of financial statements. Income statements, balance sheets, cash flow statements and key ratios. The income statement presents information on the financial results of a company business activities over a period of time.

Ge uses drones to safely inspect these turbines. Up to 10 years of financial statements. Net earnings (loss) attributable to the company decreased from q1 2023 to q2 2023 but then slightly increased from q2 2023.

Ten years of annual and quarterly income statements for general electric (ge). % reduced ge capital leverage: $7b net debt* reduction, ending 2019 with 4.2x net debt* to ebitda* vs.