Beautiful Work Tips About Itc Availed As Per Audited Financial Statements

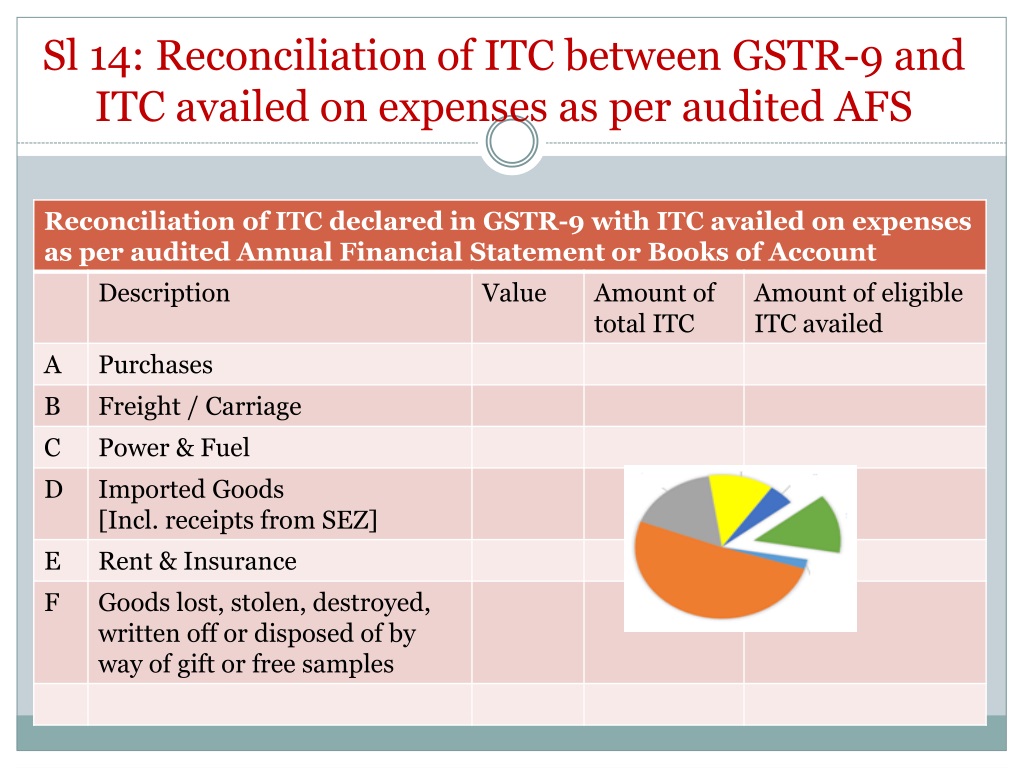

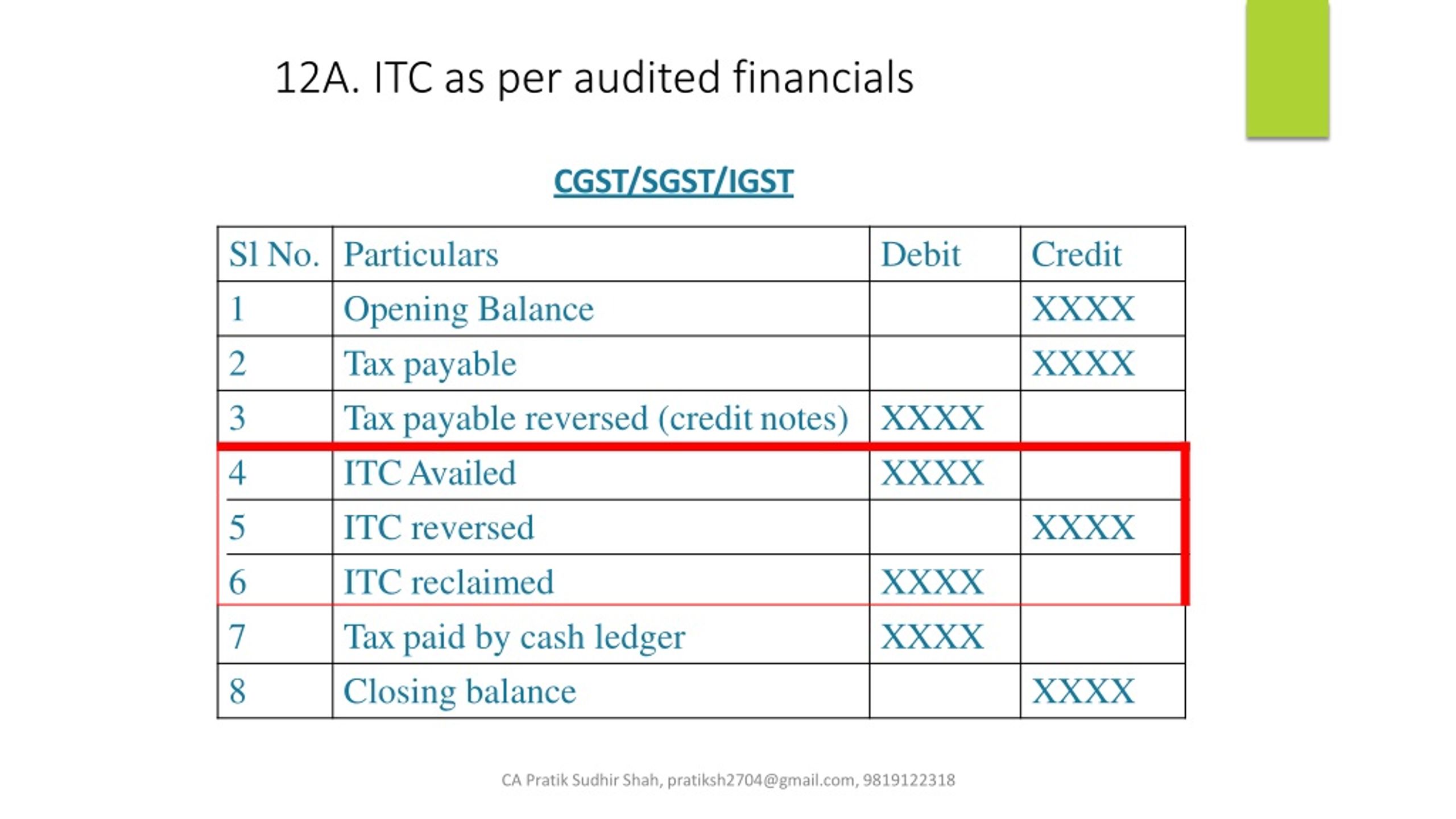

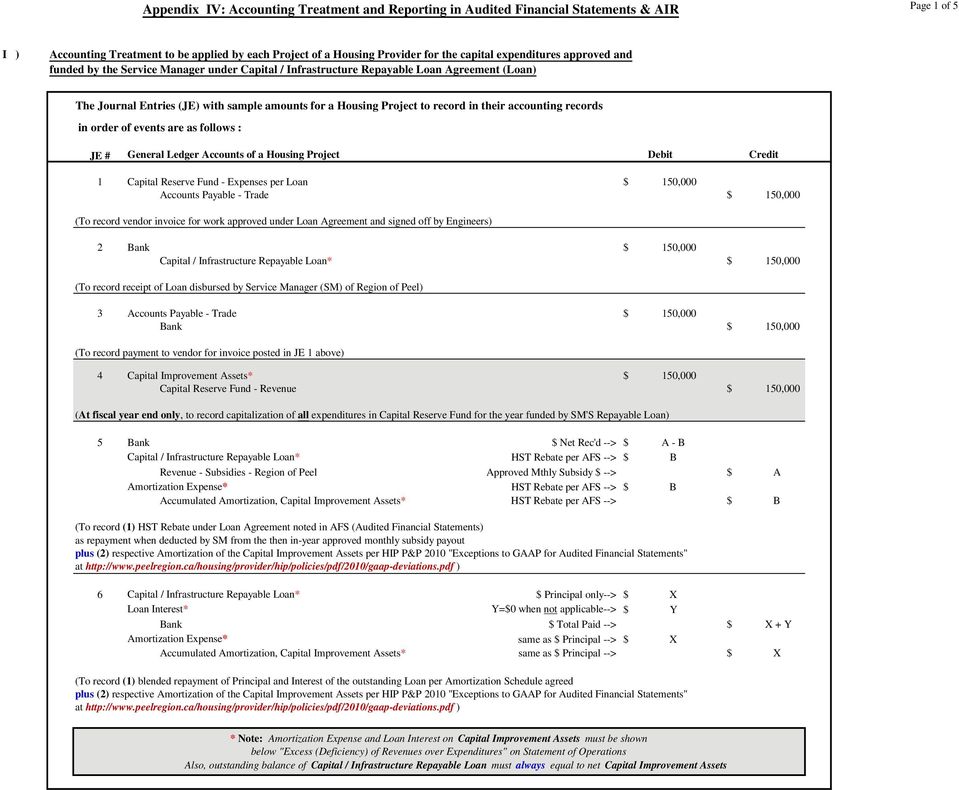

Part iv consists of reconciliation of input tax credit (itc).

Itc availed as per audited financial statements. (to understand how to fill input tax credit details in. Reconciliation of itc declared in annual return (gstr9) with itc availed on expenses as per audited annual financial statement or. Hence, the turnover, tax paid and itc earned on a particular gstin (or state/ut) must be.

Along with the gstr 9c audit form, the. Reconciliation of input tax credit (itc) under this part, reconciliation of itc availed as per audited financial statements and itc claimed in annual return. Gstr 9c is an annual audit form for all the taxpayers having the turnover above 5 crores in a particular financial year.

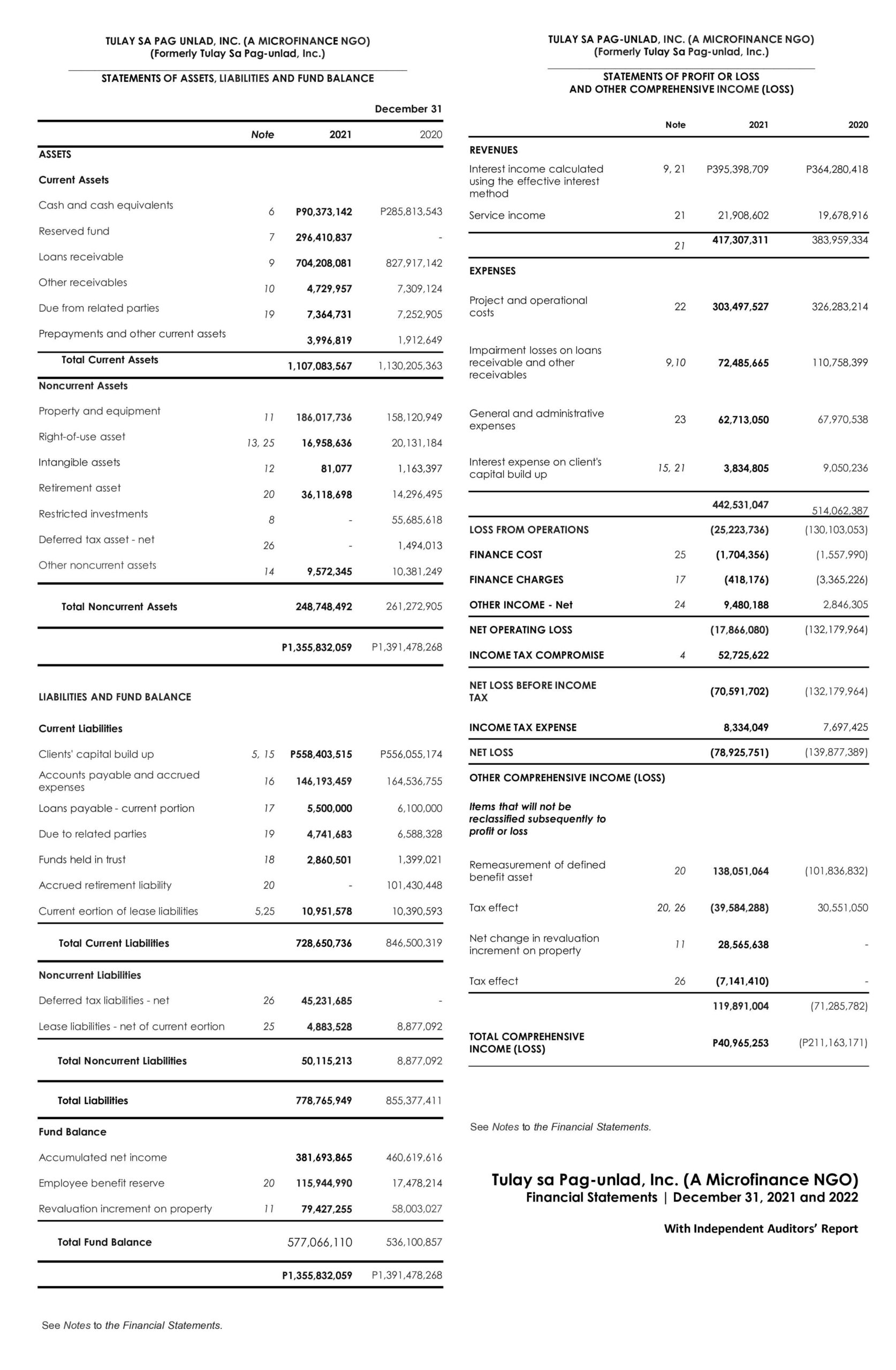

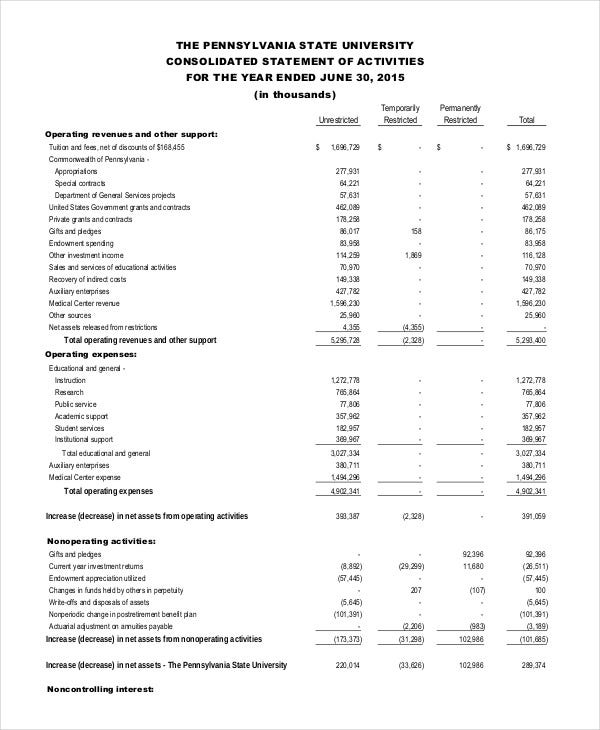

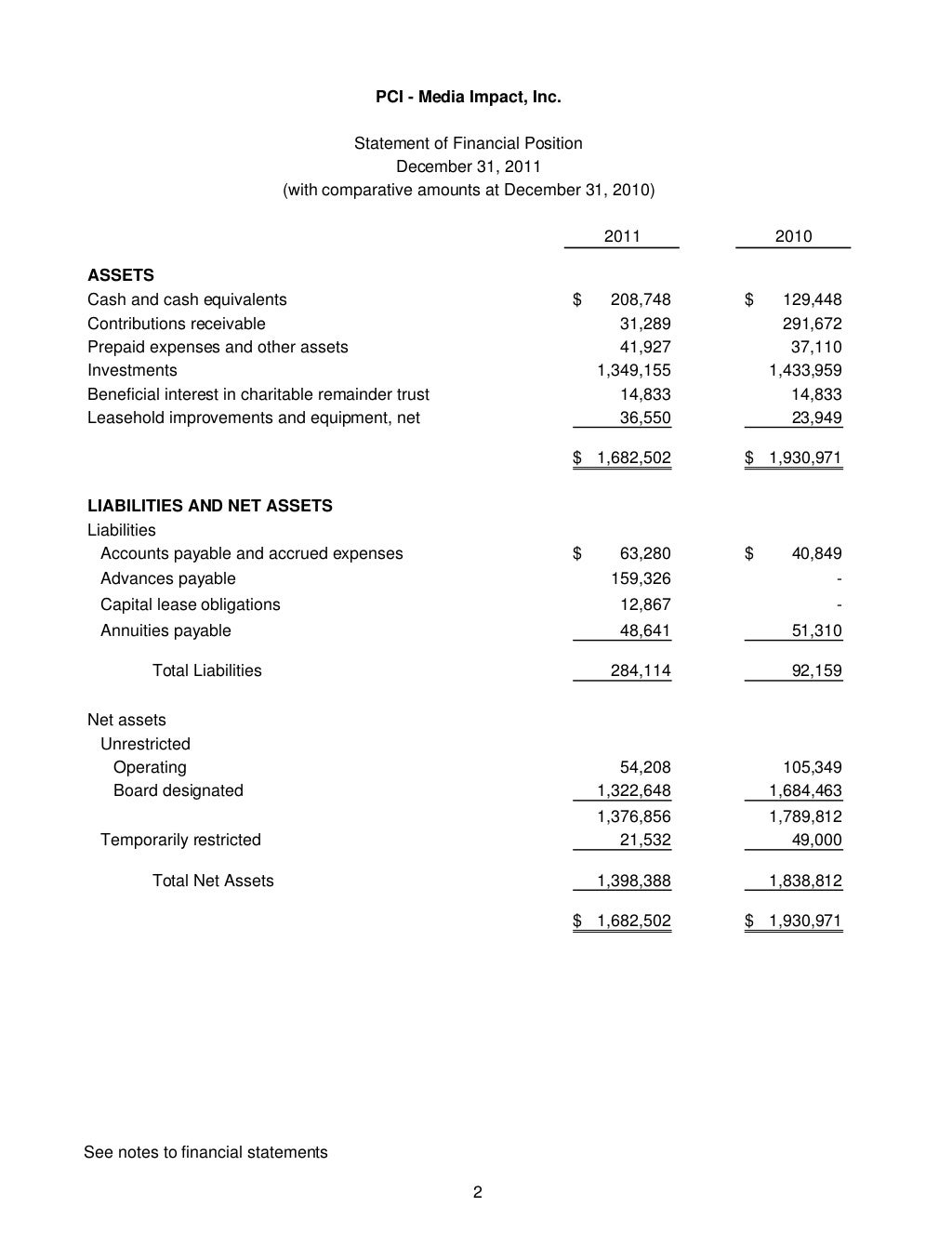

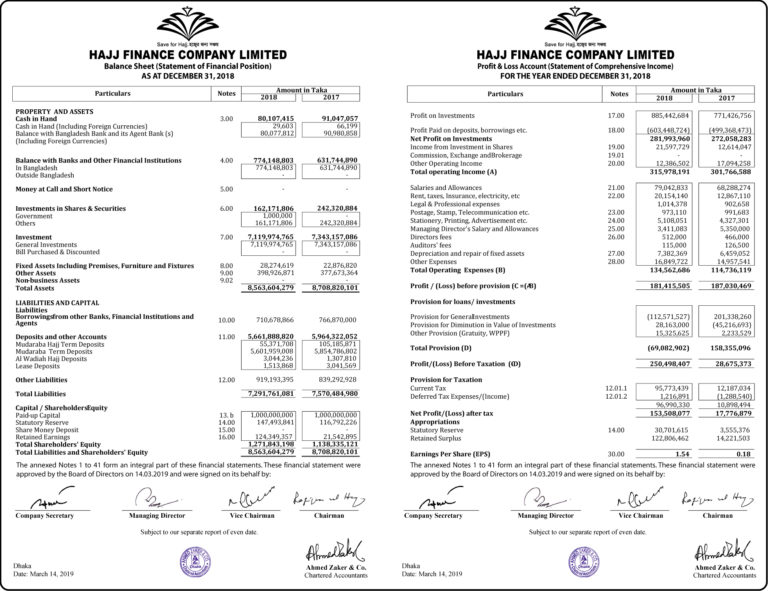

Consolidated financial statements itc limitedreport and accounts 2023233 consolidated financial statements balance sheet 234 statement of profit and loss. Itc availed as per audited annual financial statement for the. Itc limited report and accounts 2023 147 statement of profit and lossfor the year ended 31st march, 2023 the accompanying notes 1 to 30 are an integral part of the.

It is a sum total of a, b,. The figures in the audited financial statements are at pan level. 7 rows itc availed as per audited financial statements or books of account:

Be derived from books of accounts) itc booked in. Financial statements with gstr 9 step 02 reconciliation of tax paid as 03 per financials and gstr 9 reconciliation of itc declared in annual return (gstr 9) with itc availed. Part v consists of the auditor‘s recommendation on the additional liability.

Reconciliation of itc declared in annual return (gstr9) with itc availed on expenses as per audited annual financial statement or books of.