Lessons I Learned From Info About Preparation Of Income Statement And Balance Sheet

Now that you understand the basics, let’s discuss (in the next section) the six steps to.

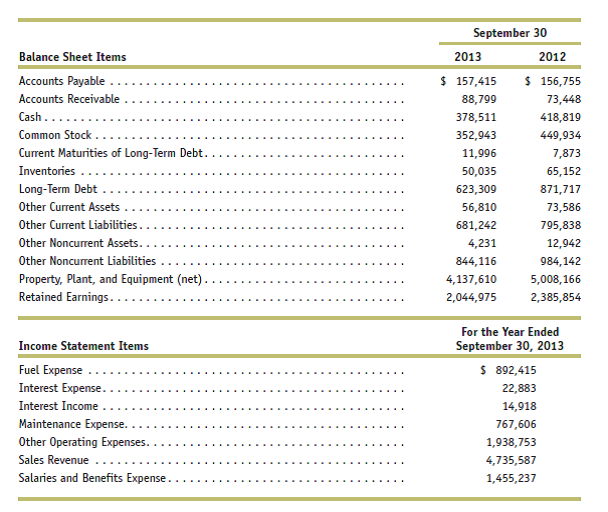

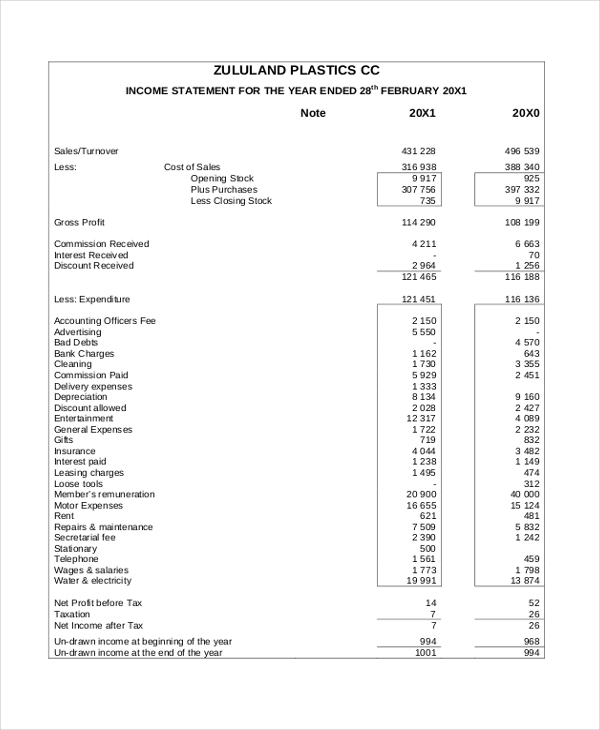

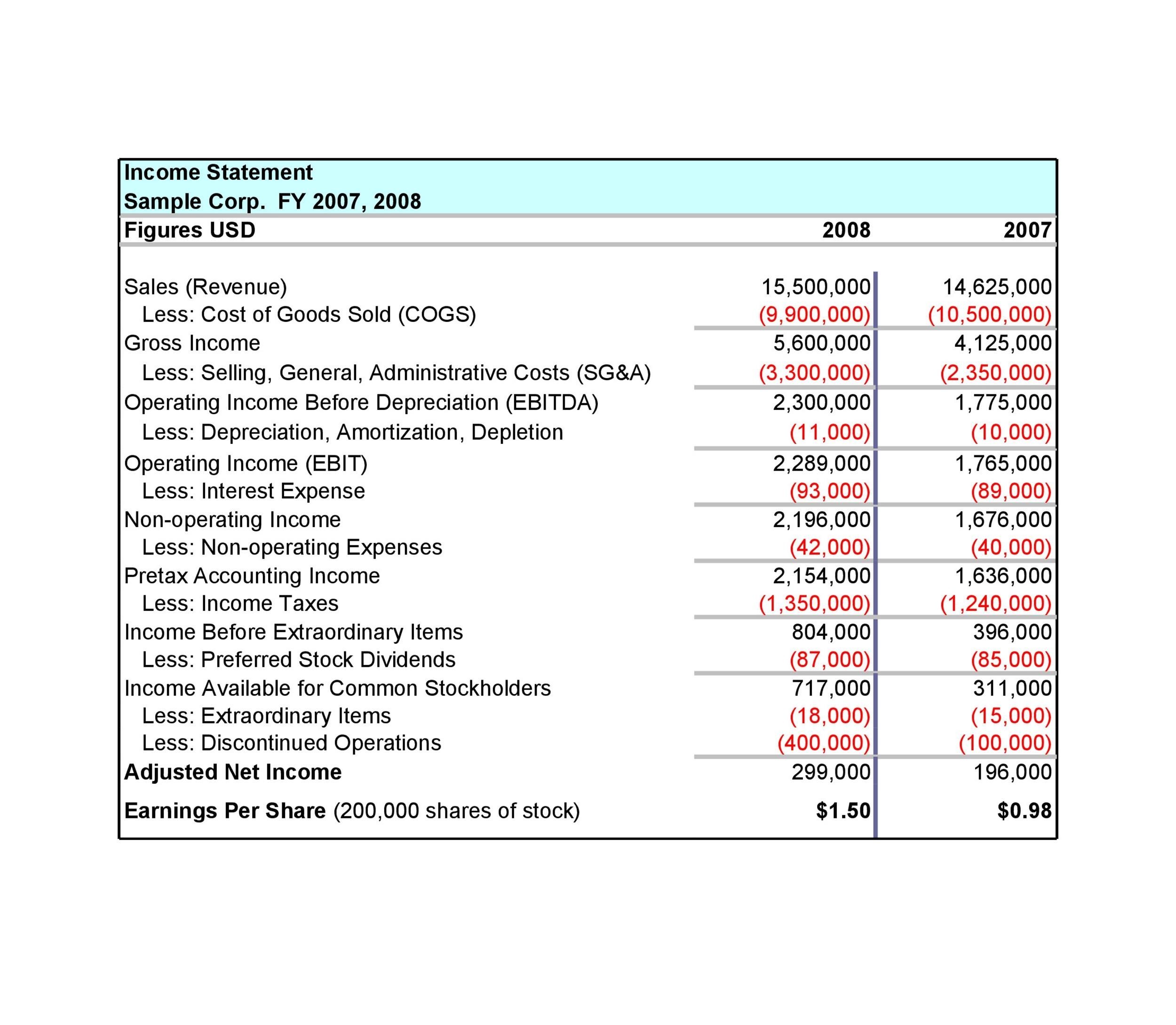

Preparation of income statement and balance sheet. Typically, the income statements and balance sheets are prepared in a comparative form to undertake such an analysis. The income statement is one of the most important financial statements because it details a company’s income and expenses over a specific period. As mentioned earlier, the financial statements are linked by certain elements and thus must be prepared in a certain order.

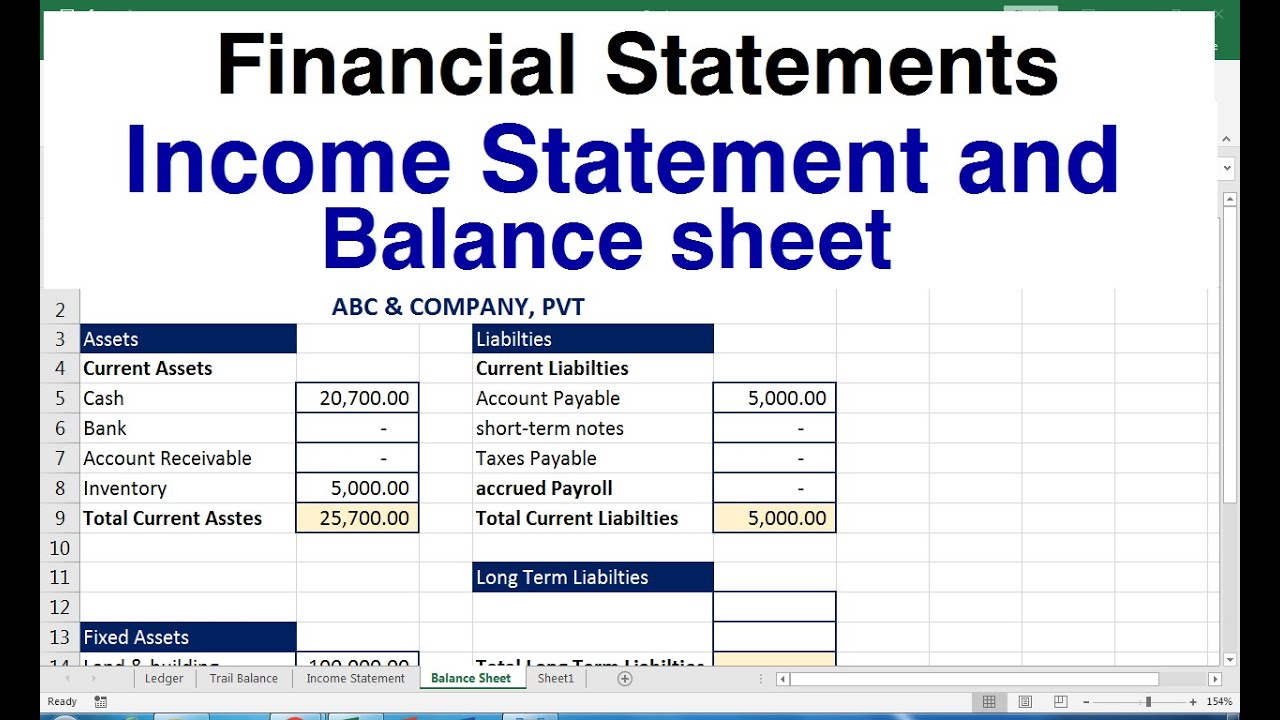

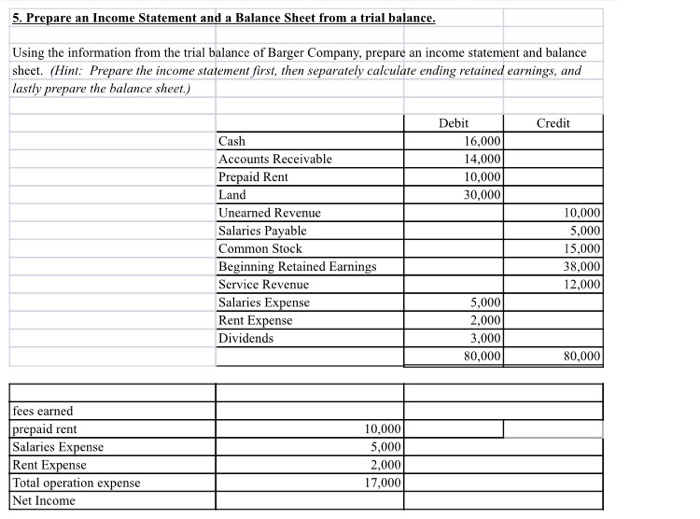

Determine the reporting date and period. Prepare an income statement prepare a statement of owner’s equity prepare a balance sheet identify the three main components of the statement of cash flows the following is the adjusted trial balance of maggie’s music shop. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity.

One of the key differences between income statement vs balance sheet is timing. The balance sheet is one of the three core financial statements that are used. Often, the reporting date will be the final day of the accounting period.

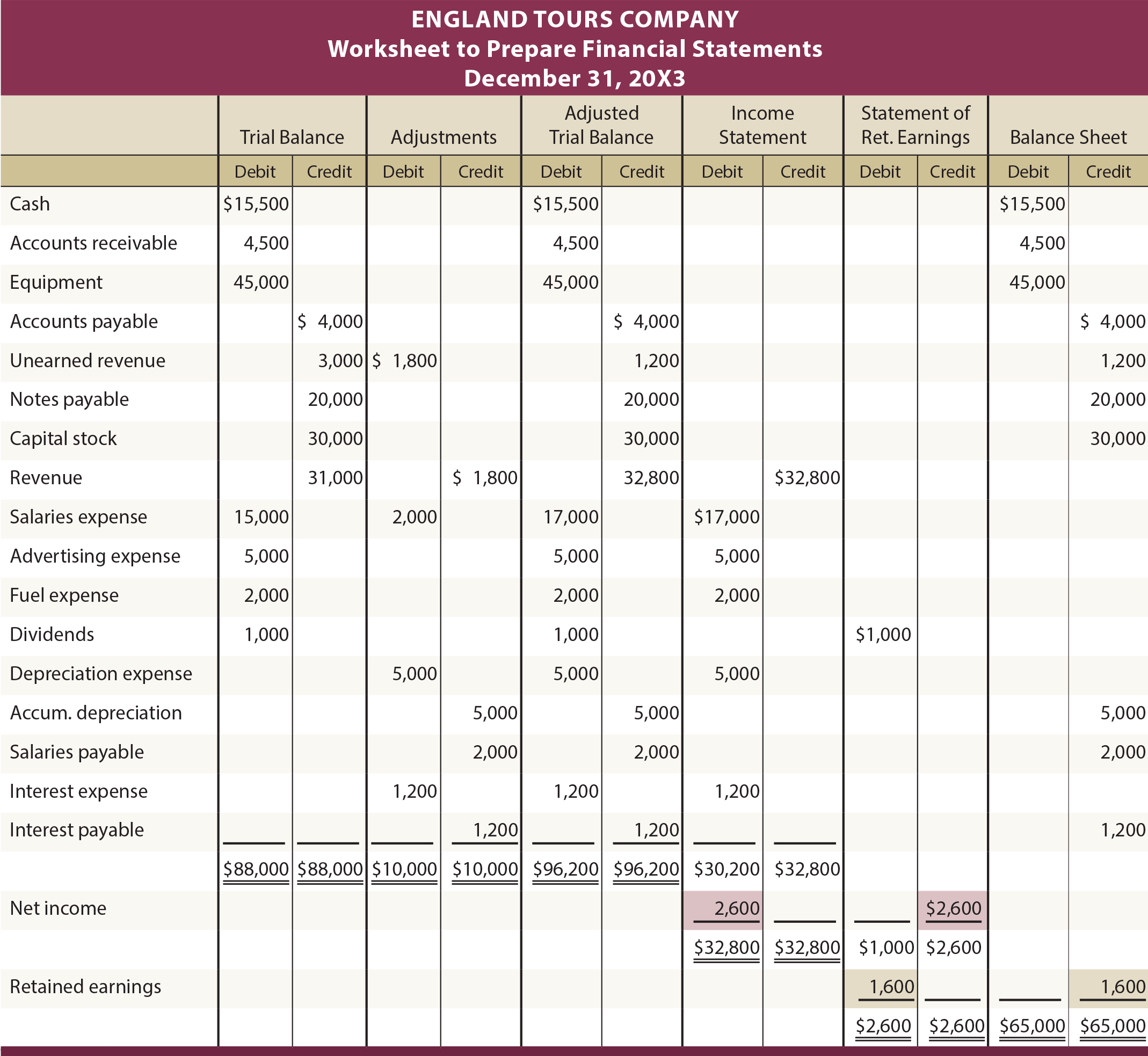

The income statement was first since net income (or loss) is a required figure in preparing the balance sheet. With freshbooks, you don’t need to become an accountant overnight to run your business the way it deserves. Prepare an income statement by taking income and expense items (such as sales) from the trial balance and organizing them in a proper format.

Remember that we have four financial statements to prepare: A balance sheet shows a snapshot of the company’s assets and liabilities at a specific moment in time. Gather the necessary information in an accounting system, the best tool to take information from would be the adjusted trial balance.

2.1 describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate; However, a balance sheet looks at how much a business is earning versus its liabilities to understand its total value of the company.⁴. In any case, any report that shows a complete listing of company accounts can be used.

2.2 define, explain, and provide examples of current and noncurrent assets, current and noncurrent liabilities, equity, revenues, and expenses Furthermore, there is a provision attached to comparing the financial data showcased by such statements. This document communicates a wealth of information to those reading it—from key executives and stakeholders to investors and employees.

A balance sheet is meant to depict the total assets, liabilities, and shareholders’ equity of a company on a specific date, typically referred to as the reporting date. Identify which income statement each account will go on: Updated april 24, 2021 reviewed by margaret james fact checked by michael logan companies produce three major financial statements that reflect their business activities and profitability for.

From there, an accountant can start to compile his income statement and balance sheet. I'd say that the income statement shows all revenue and expenses, on an accrual basis, between two points in time (usually represented by balance sheets). This is the most updated trial balance (i.e.

2.3 prepare an income statement, statement of owner’s equity, and balance sheet highlights one of the key factors for success for those beginning the study of accounting is to understand how the elements of the financial. Cash, accounts receivable, office supplied, prepaid insurance, equipment, accumulated depreciation (equipment), accounts payable, salaries payable, unearned lawn mowing revenue, and. Prepared after considering any adjustments to the accounts).