Real Info About Depreciation And Amortization In Cash Flow Statement

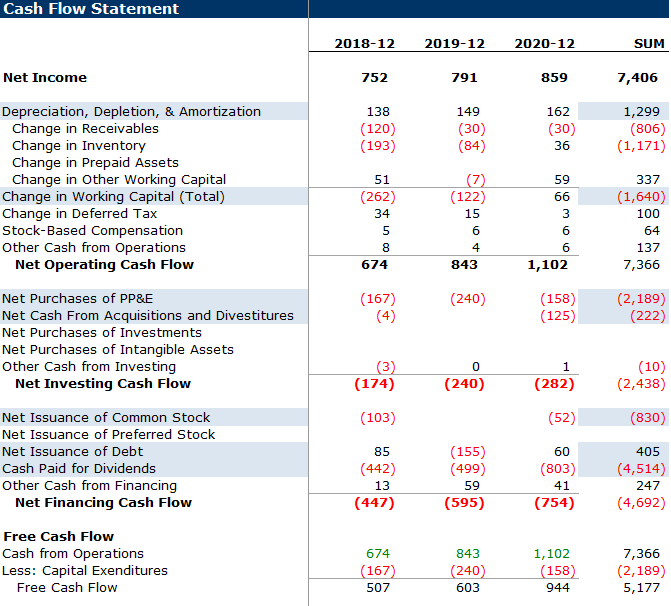

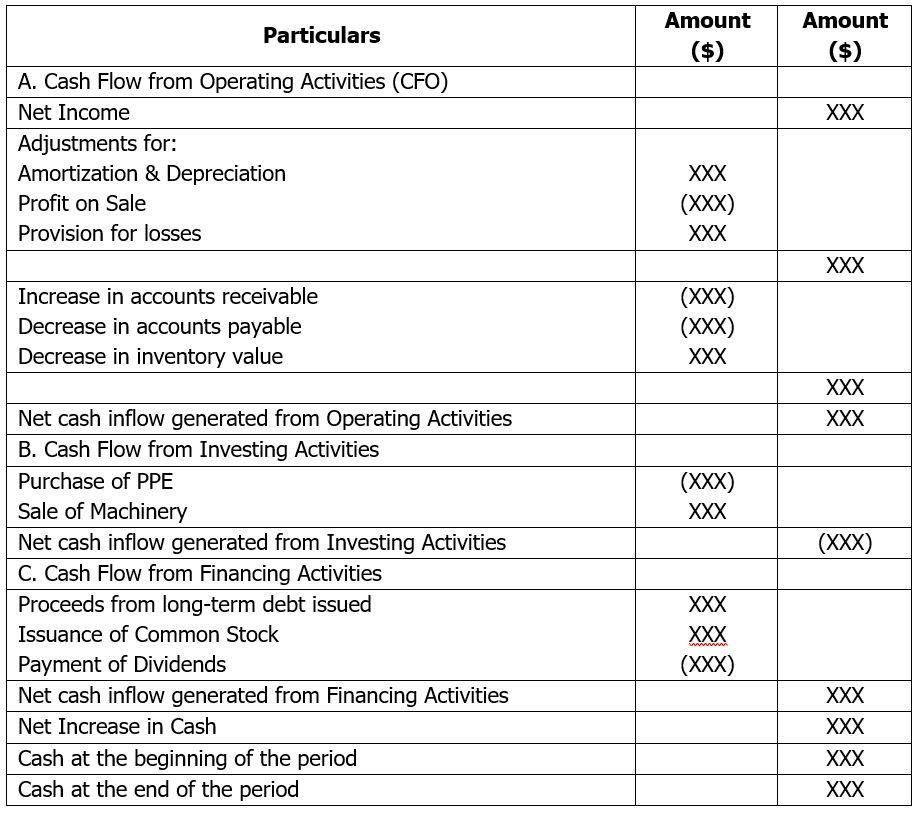

Depreciation can only be presented in cash flow statement when it is prepared using indirect.

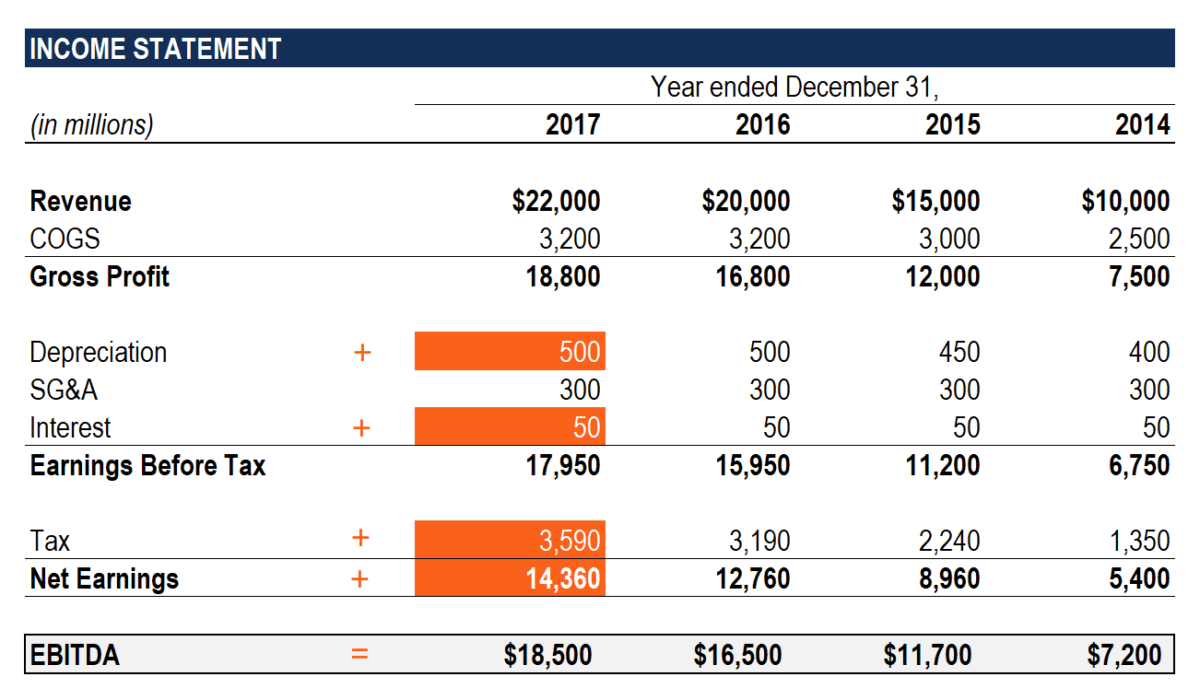

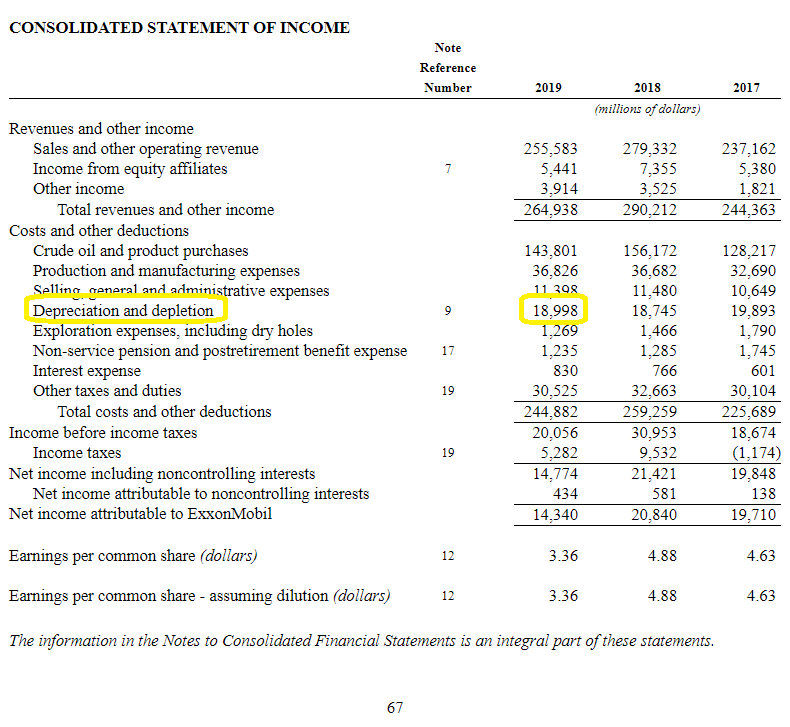

Depreciation and amortization in cash flow statement. Depreciation and amortization is a noncash charge that companies subtract from earnings on their income statement. The two terms are also commonly used together, most notably in the ebitda formula: Not all captions are applicable to all reporting entities.

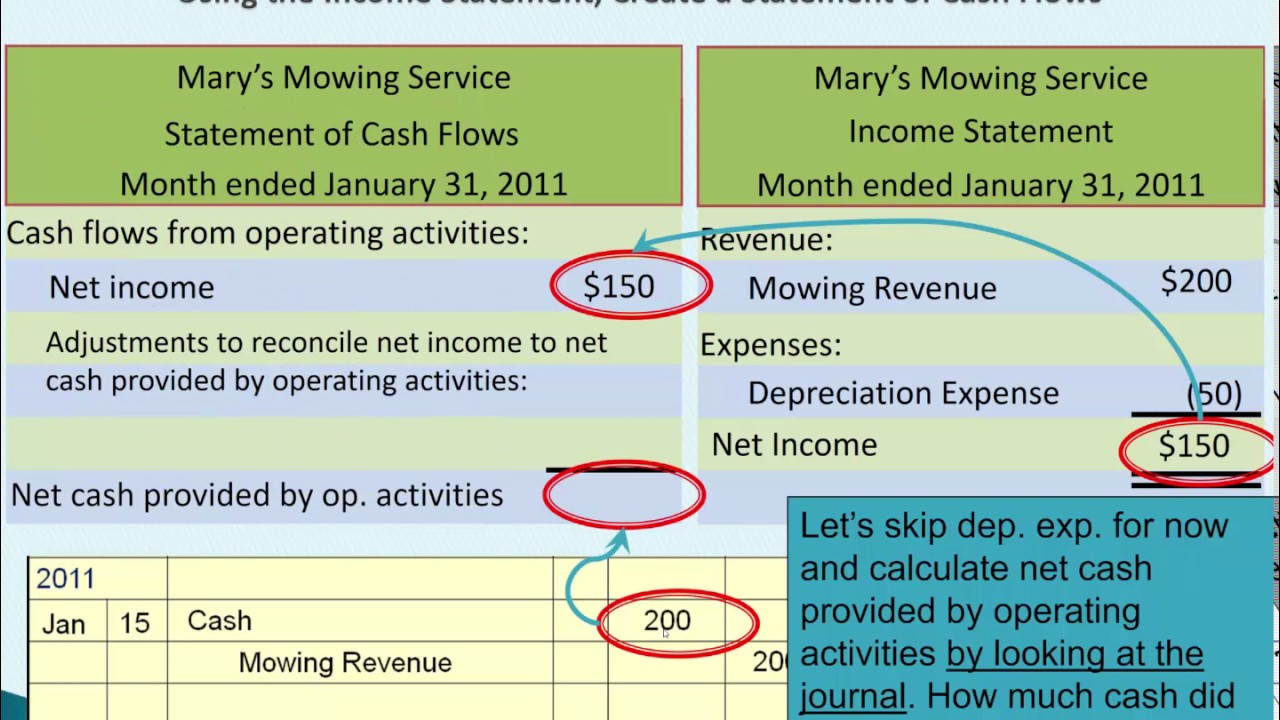

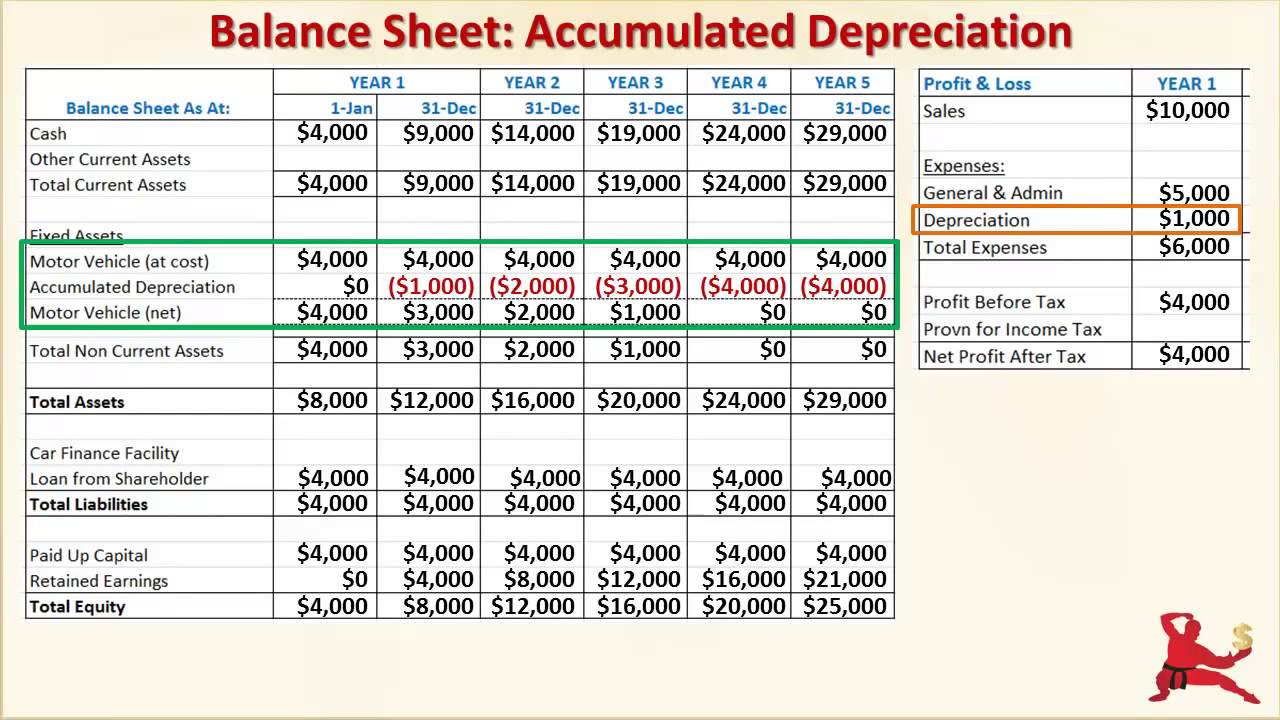

Likewise, there is no cash involved when we make the depreciation on the fixed asset. It is often claimed to be a proxy for cash flow, and that may be true for a mature business with little to no capital expenditures. This is because depreciation and amortization do not reflect cash flow — they only reflect the usage of an asset.

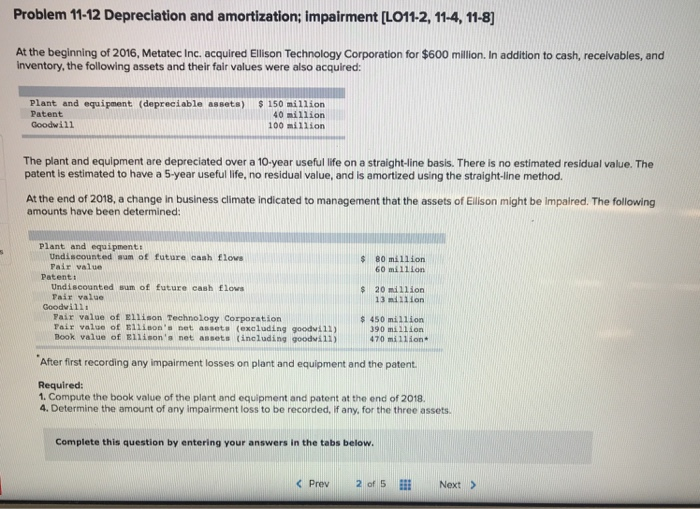

It is an estimated expense that is scheduled rather than an explicit. Amortization and depreciation are two methods of calculating the value for business assets over time. In accounting, the depreciation expense that we charge to the income statement represents the cost allocation of the fixed asset that we have purchased.

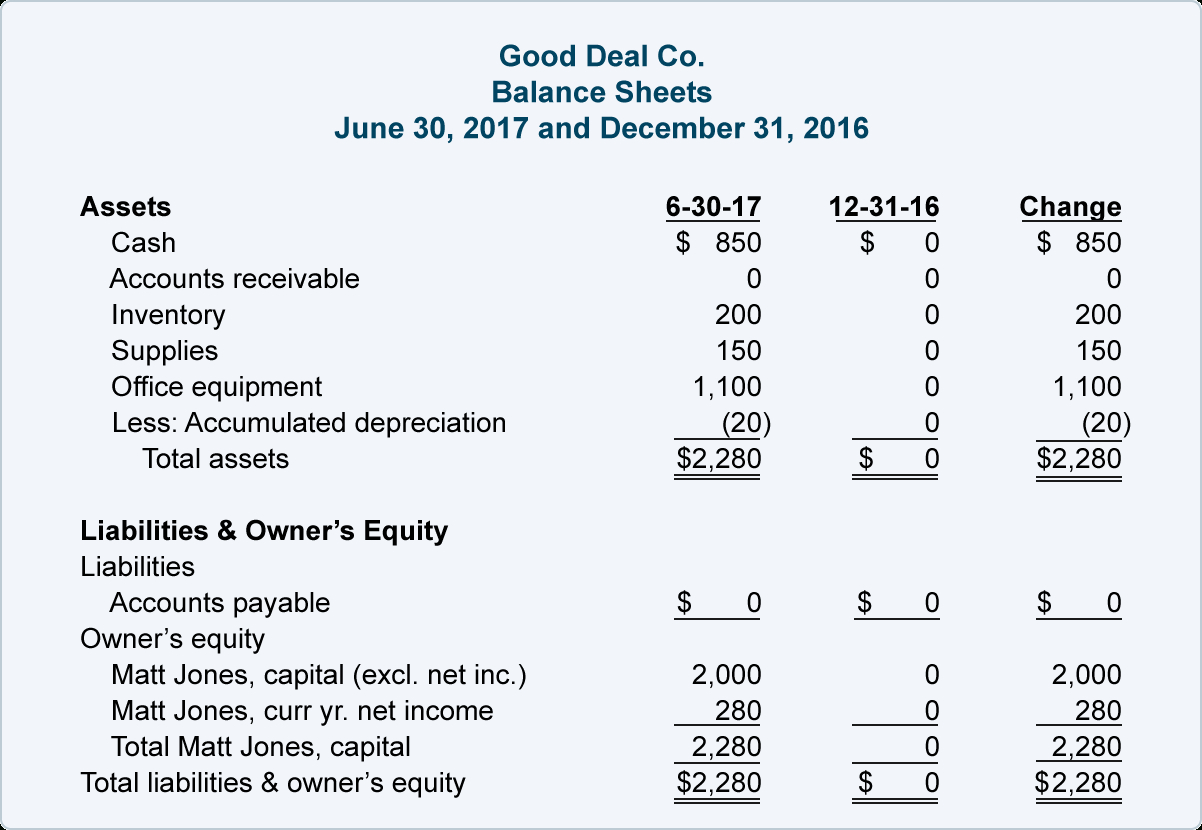

The accounts involved in recording depreciation are depreciation expense and accumulated depreciation. Put simply, lower taxes lead to increased net income, and as net income is. Depreciation represents the cost of capital assets on the balance sheet being used over time, and.

Depreciation actually does not come under any of the categories of the cash flow statement, at least when you're using the direct method: The truck didn’t give u back $20 to put in your pocket each year. To make matters worse, different companies calculate depreciation and amortization differently, fogging up earnings comparisons across companies.

Fact checked by suzanne kvilhaug depreciation is a type of expense that is used to reduce the carrying value of an asset. As you see, cash is not involved. It has no effect on cash flows.

And so you could imagine in period zero we buy a truck for $60,000. You'll often hear the words depreciation and amortization used together. Depreciation expense and accumulated depreciation depreciation expense is an income statement item.

Depreciation is an expense, but an expense that never involves cash. Questions tips & thanks want to join the conversation? Depreciation, depletion, and amortization (dd&a) is an accounting technique that enables companies to gradually expense various different resources of economic value over time in order to match.

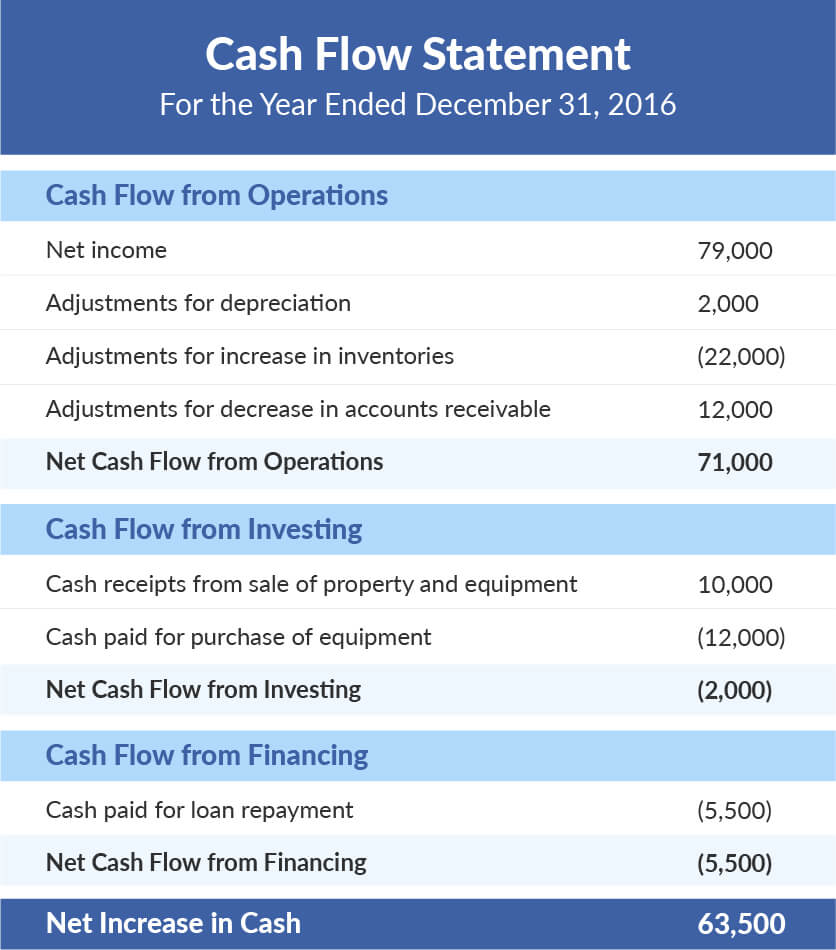

In a nutshell, depreciation is an accounting measure and added back to revenue or net sales while calculating the company’s cash flow. Think of it this way; Depreciation moves the cost of an asset from the balance sheet to depreciation expense on the income statement in a systematic manner during an asset's useful life.

Ebitda can be easily calculated off the income statement (unless depreciation and amortization are not shown as a line item, in which case it can be found on the cash flow statement). Specifically, amortization occurs when the depreciation of an intangible asset is split up over time, and depreciation occurs when a fixed asset loses value over time. Amortization is the practice of spreading an intangible asset's cost over that asset's.

:max_bytes(150000):strip_icc()/Walmart202010KIncomestatement-365d4a49671b4579a2e102762ada8029.jpg)