Heartwarming Info About Financial Performance Ratio

The monetary authority announced today (20 february) that the countercyclical capital buffer (ccyb) ratio for hong kong remains unchanged at 1%.

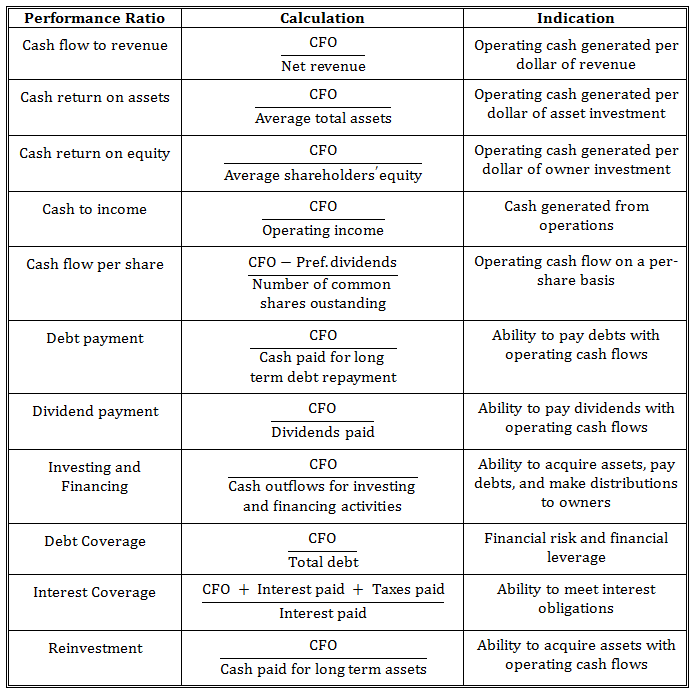

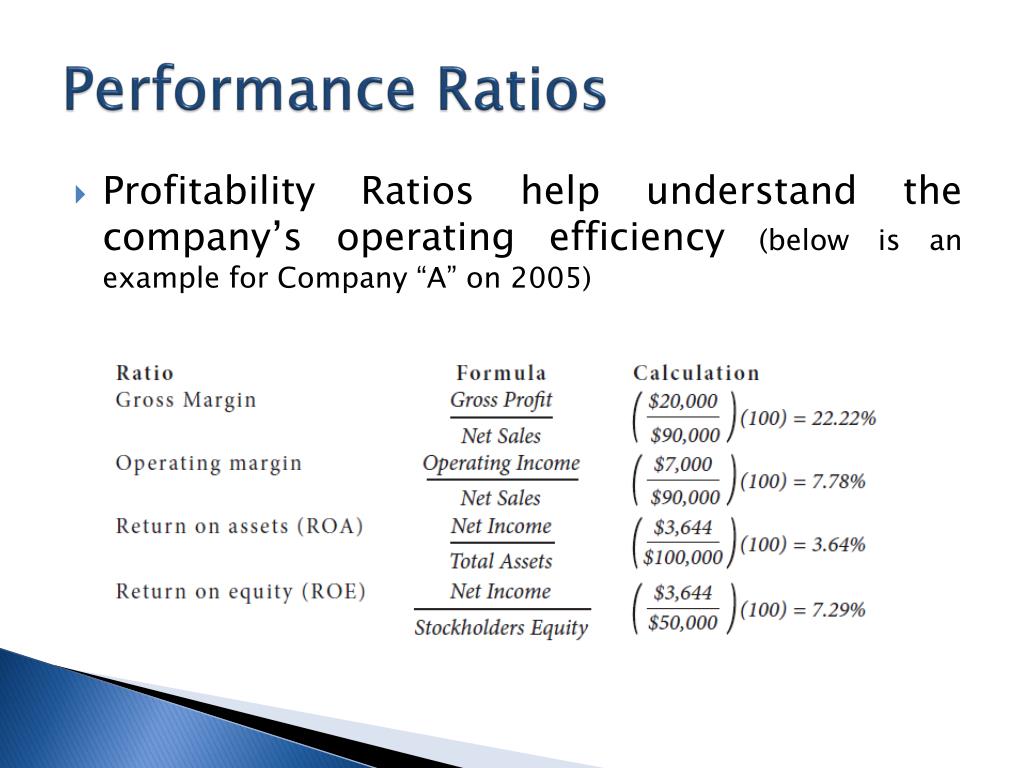

Financial performance ratio. The formula is the gross margin, divided by sales. Commonly used ratios in this classification include: Different financial ratios indicate the company’s results, financial risks, and working efficiency, like the liquidity ratio, asset turnover ratio, operating profitability ratios, business risk ratios, financial risk ratios, stability ratios, etc.

Analysts examine a firm’s income statement, cash flow statement, balance sheet, and annual report. Methods this retrospective analysis included consecutive patients suspected of having secondary hypertension during a period from january 2017 to may. The term liquidity refers to how easily a company can turn assets into.

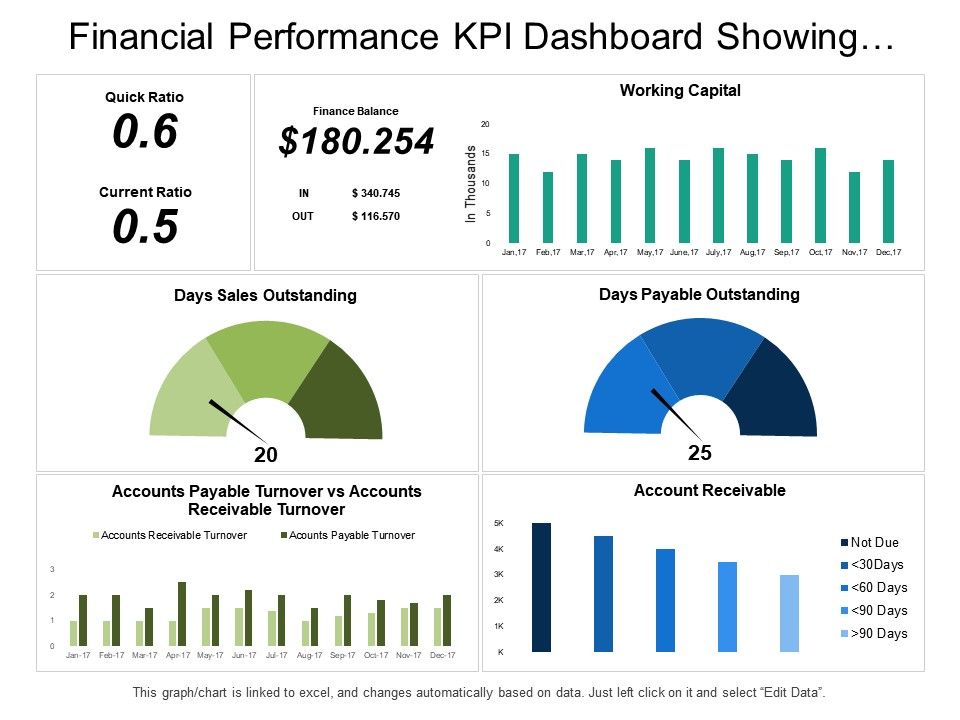

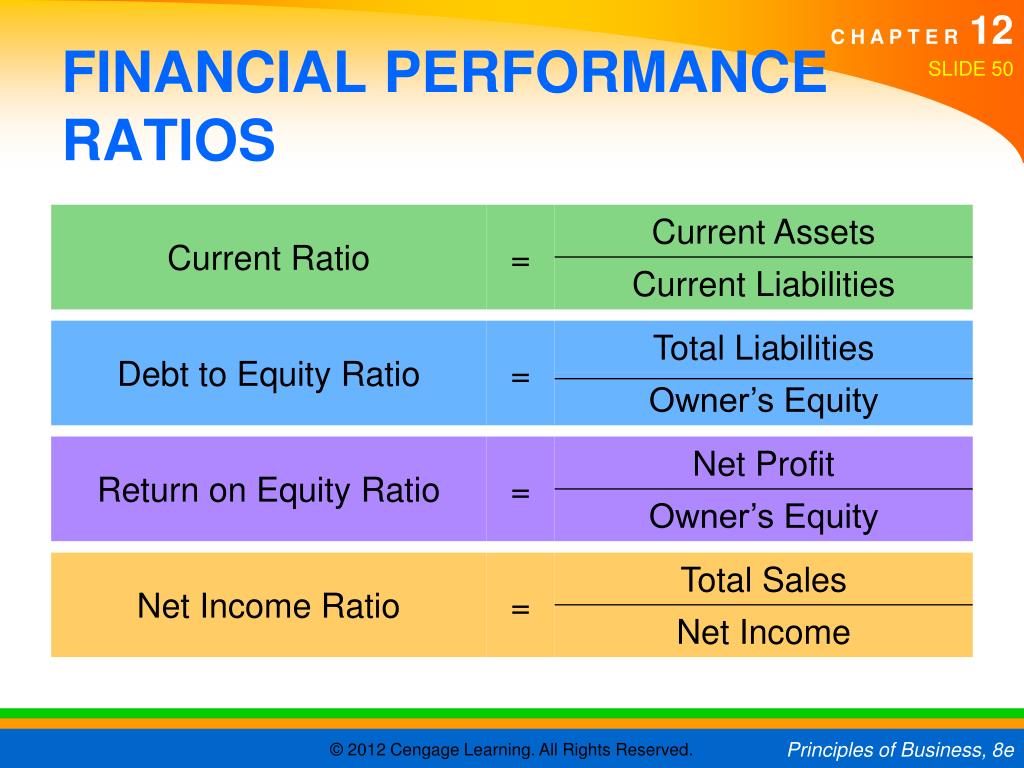

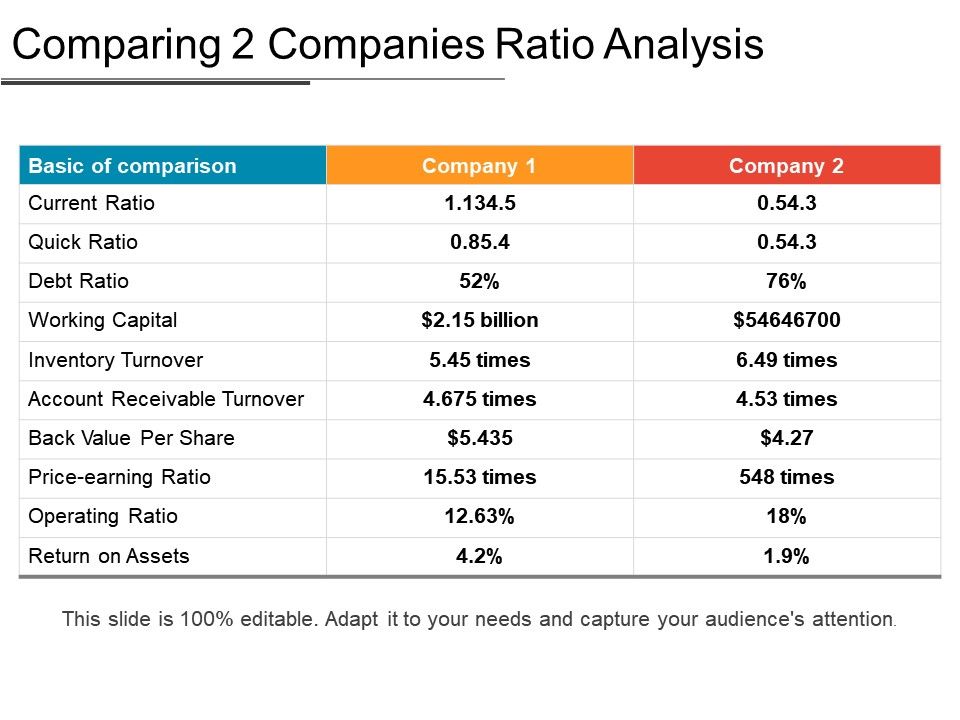

Liquidity ratio, profitability ratio, solvency ratio, efficiency r atio, leverage ratio. Financial performance is a gauge of a company’s financial health over a period of time. If the ratio is below 1, there are not enough assets to cover.

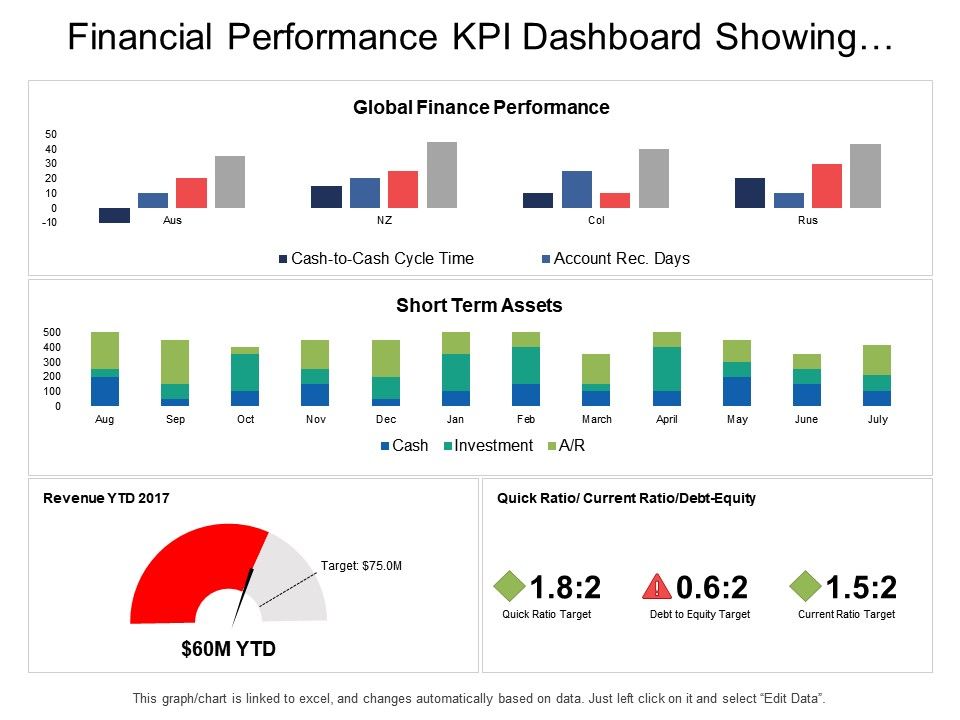

Financial ratios are grouped into the following categories: Financial ratios compare the results in different line items of the financial statements. Here’s a close look at the information used to measure financial performance accurately.

The present study delves into how aspect ratio (ar), inlet velocities, and inlet air temperature impact the coefficient of performance (cop) and melting rate. 1) return on assets (roa) return on assets measures a company’s ability to generate income from its assets. Analysis based on financial ratios (making it possible to diagnose financial health of companies) and cash flow analysis (helping managers manage—for operational, financial and investment activities—so that business sustainability be ensured).

A ratio above 1 shows that a company has more than enough assets to cover its liabilities; Ratio analysis is a quantitative method of gaining insight into a company's liquidity, operational efficiency, and profitability by studying its financial statements such as the balance sheet. Company b is earning greater profits of $7m, compared with company a’s $6m.

Find out how to calculate, track, adjust, review, and communicate your ldr. Here are a few of the most important financial ratios for business owners to learn, what they tell you about the company's financial statements, and how to use them. There are several ratios to measure the company's financial performance, among others;

Financial performance analysis is most effective when investors compare companies in similar industries. Analysis of financial ratios serves two. Financial performance measures a firm’s financial health based on assets, liabilities, revenue, expenses, equity, and profitability.

Mr eddie yue, the monetary authority, said, “quantitat Financial kpis (key performance indicators) are metrics organizations use to track, measure, and analyze the financial health of the company. Financial ratios are the indicators of the financial performance of companies.

Financial ratios are numerical expressions that indicate the relationship between various financial statement items, such as assets, liabilities, revenues, and expenses. It is a thorough analysis of company financial statements. Working capital ratio assessing the health of a company in which you want to invest involves measuring its liquidity.