First Class Info About Provisional Profit And Loss Account

Calculation of net profit ratio:

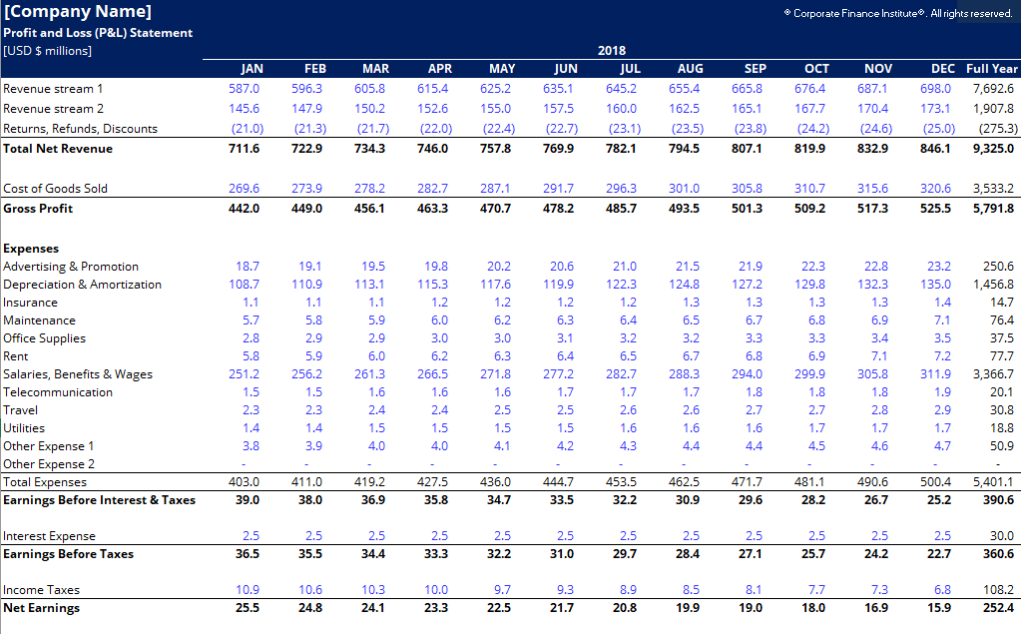

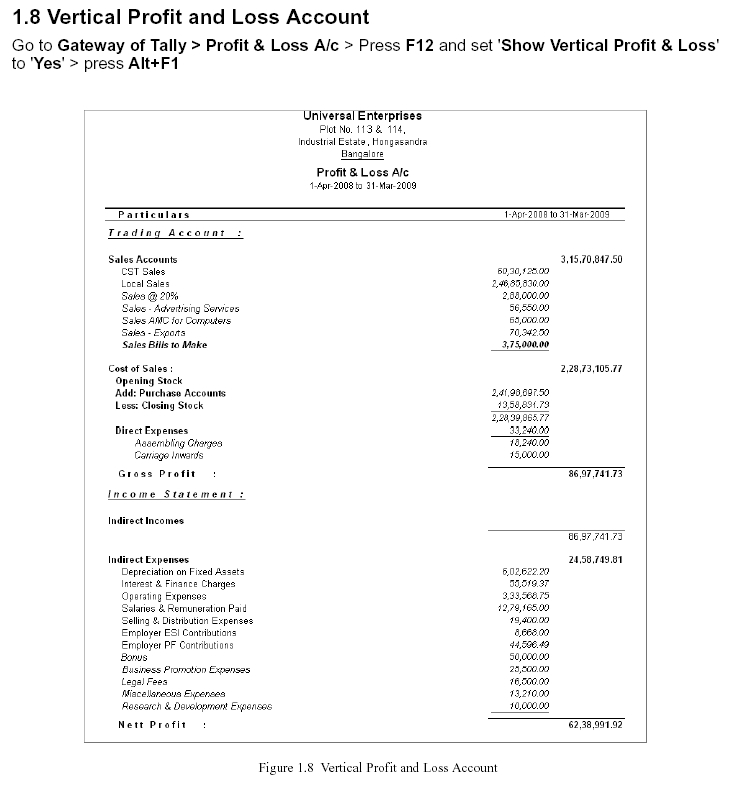

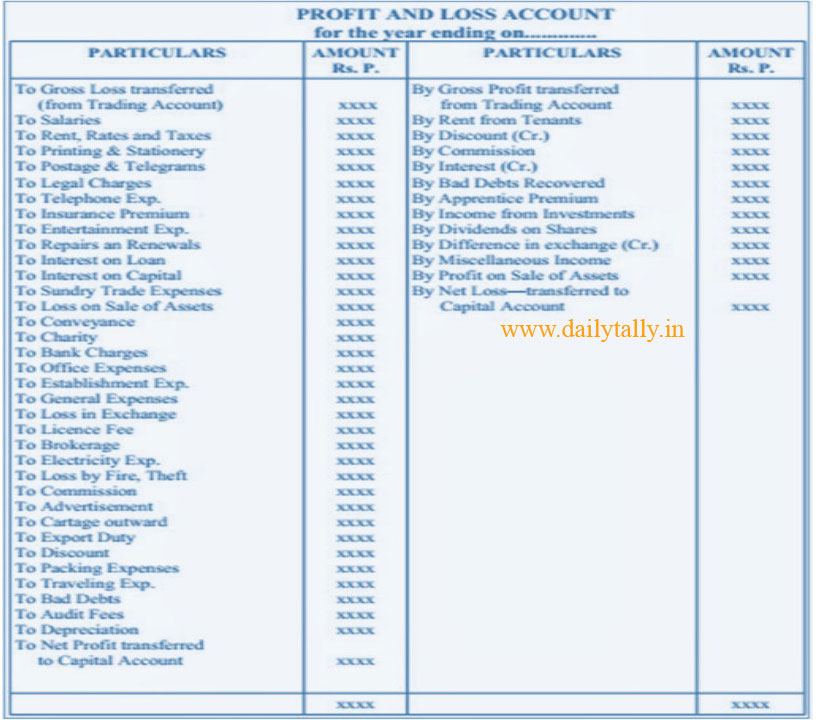

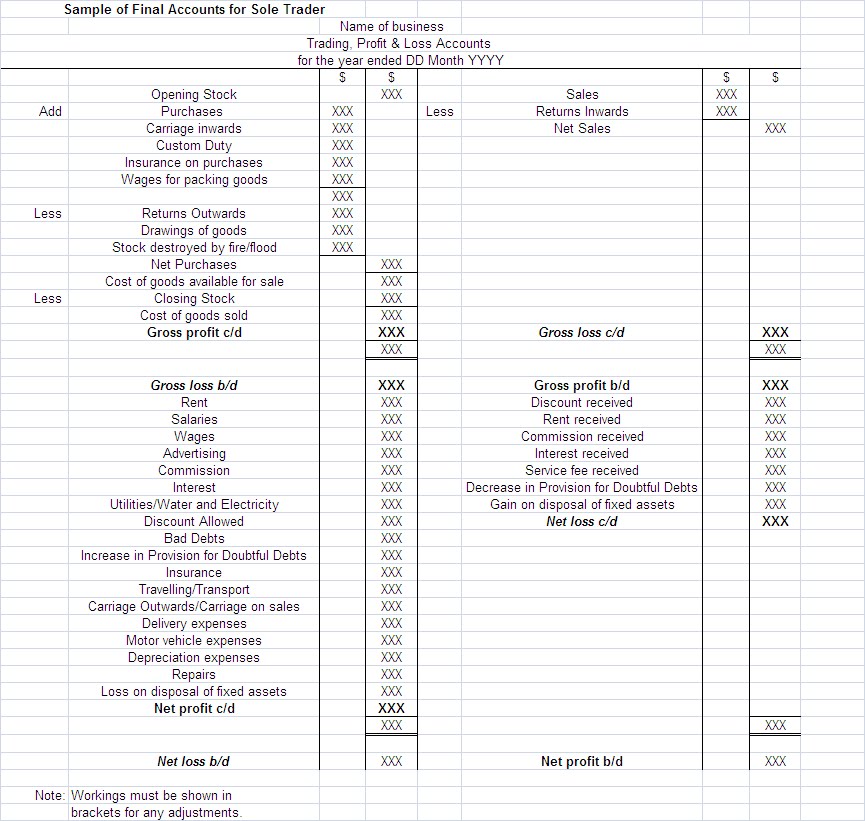

Provisional profit and loss account. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a. By default, the profit & loss a/c report will be generated as on the date of the last voucher entry. Only indirect expenses are shown in this account.

A profit and loss account shows the revenue close revenue the income earned by a business over a period of time from selling its goods or services. It is an important tool for tracking the.

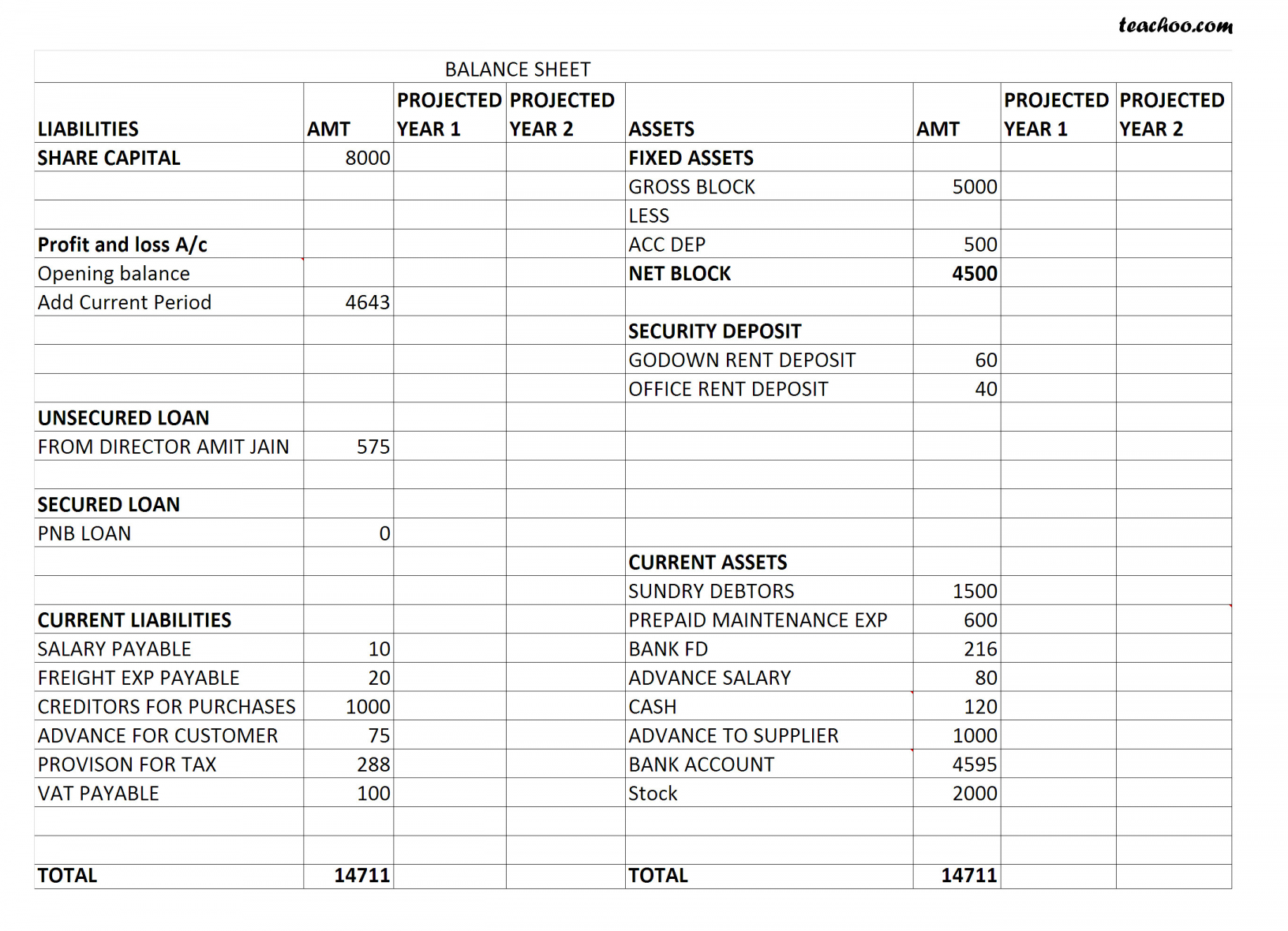

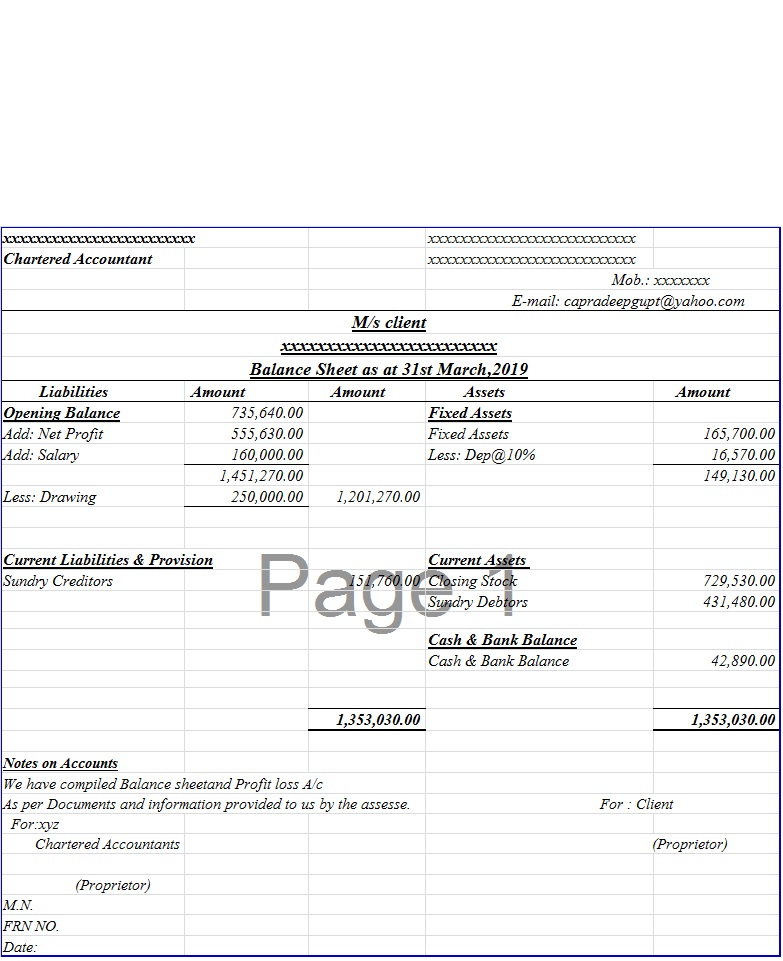

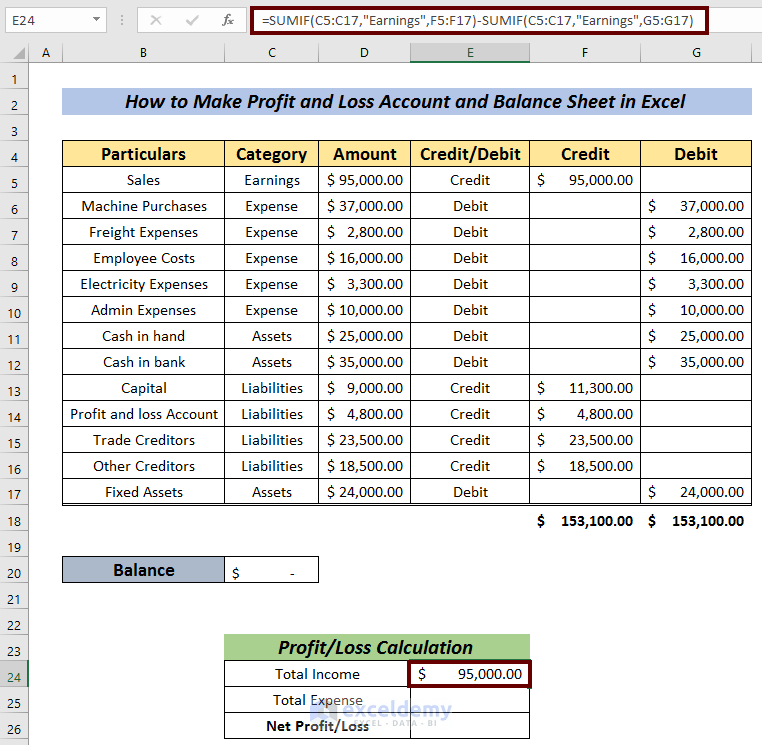

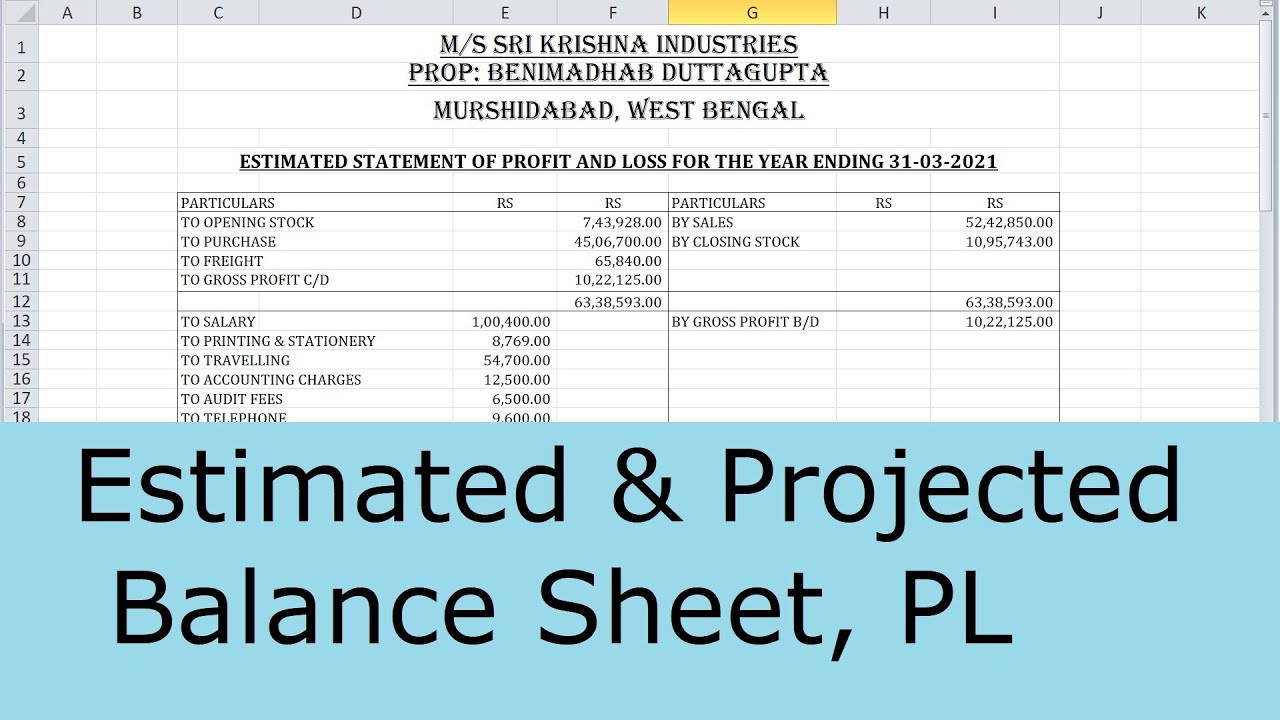

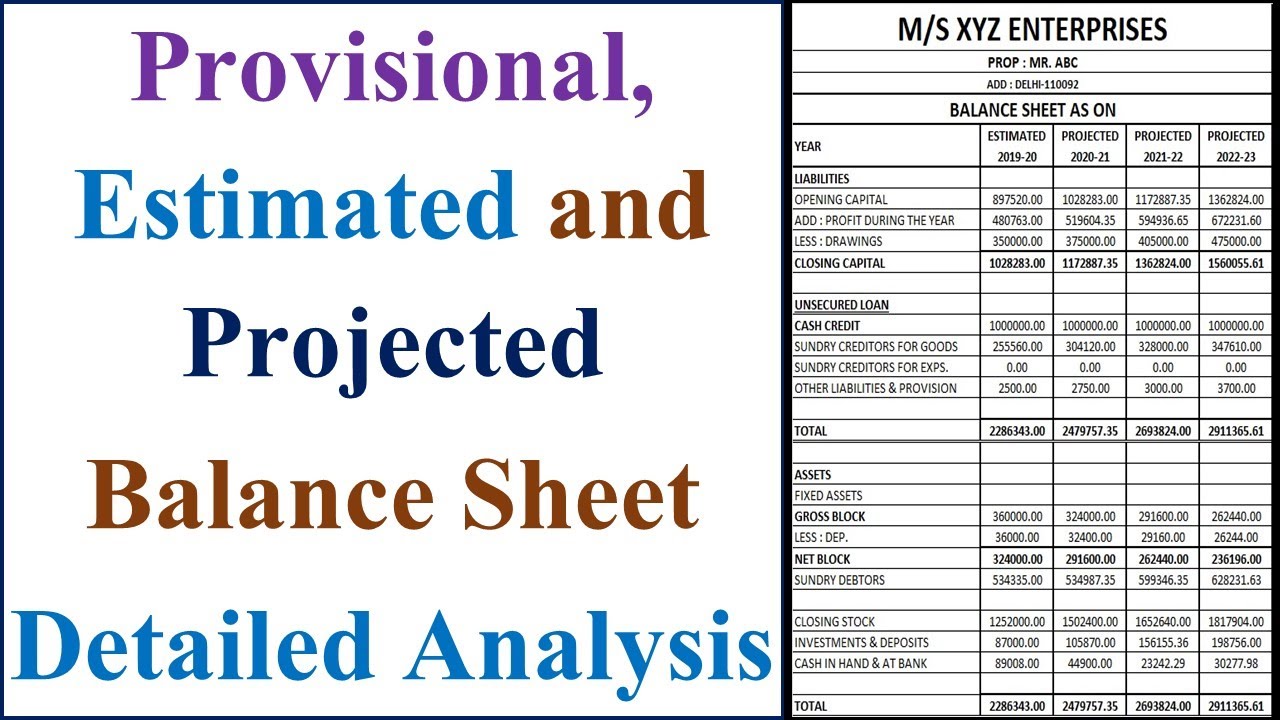

How to make stock balance sheet in excel (with quick steps) how to tally a balance sheet in. Learn the difference between projected, estimated and provisional financial statements, and the line items to be considered while preparing them. You can change the date to view the report for the.

It is an important tool for. And costs of a business. How to make profit and loss account and balance sheet in excel;

The feature of p&l account: Sports fees claim for deduction (maltese) sports fees claim for deduction (english) cultural & creative. Profit and loss account:

Profit & loss account the trading account reflects the gross profit or loss of the business. Some firms also maintain a provision for discounts—that is, a provision to meet discounts. The purpose of the profit and loss account is to:

Describe how the profit or loss. View profit & loss a/c. What is profit and loss account?

Provisional profit and loss accounts means the unaudited provisional profit and loss accounts for the period from 1st april. Show whether a business has made a profit or loss over a financial year.; Provisional profit and loss account.

The profit and loss account starts with the credit from the trading account in respect of gross profit (or debit if there is gross loss). It is an important tool for tracking the management of. Provisional profit and loss accounts.

What is the profit and loss statement (p&l)? The profit & loss statement forecast presents the profits, costs and result for a future period. Profit & loss account.