Matchless Tips About Profit Loss Statement Quickbooks

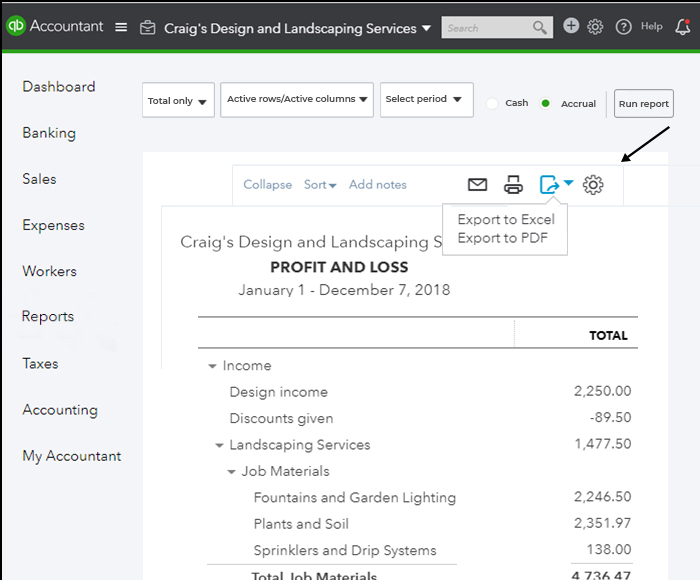

Start running the profit and loss statement in quickbooks step 6:

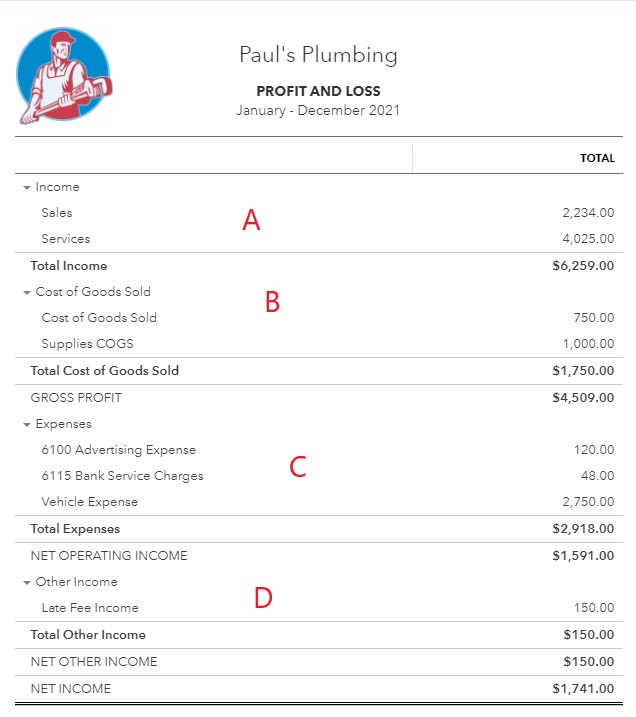

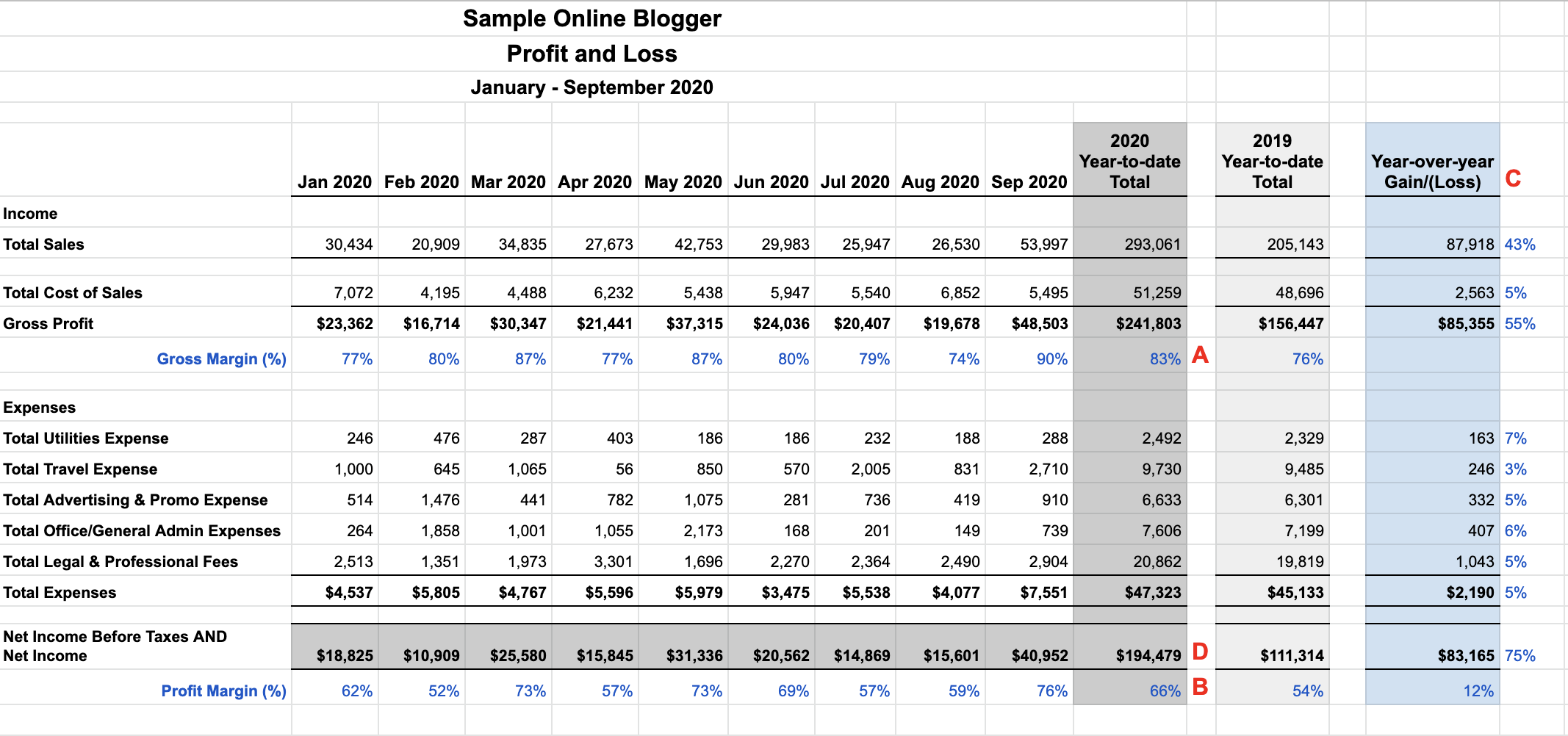

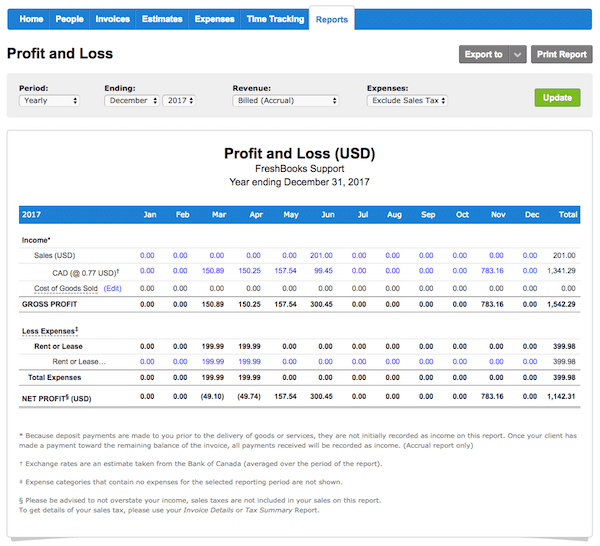

Profit loss statement quickbooks. To build a p&l statement on quickbooks online, you need to have your bookkeeping in order, otherwise, the data will not be available to create an accurate report. The income statement, also called the profit and loss statement, is used to calculate profits by comparing revenue to expenses. The oil and gas company's earnings statement showed that adjusted net income totalled 513 million euros ($556 million) in.

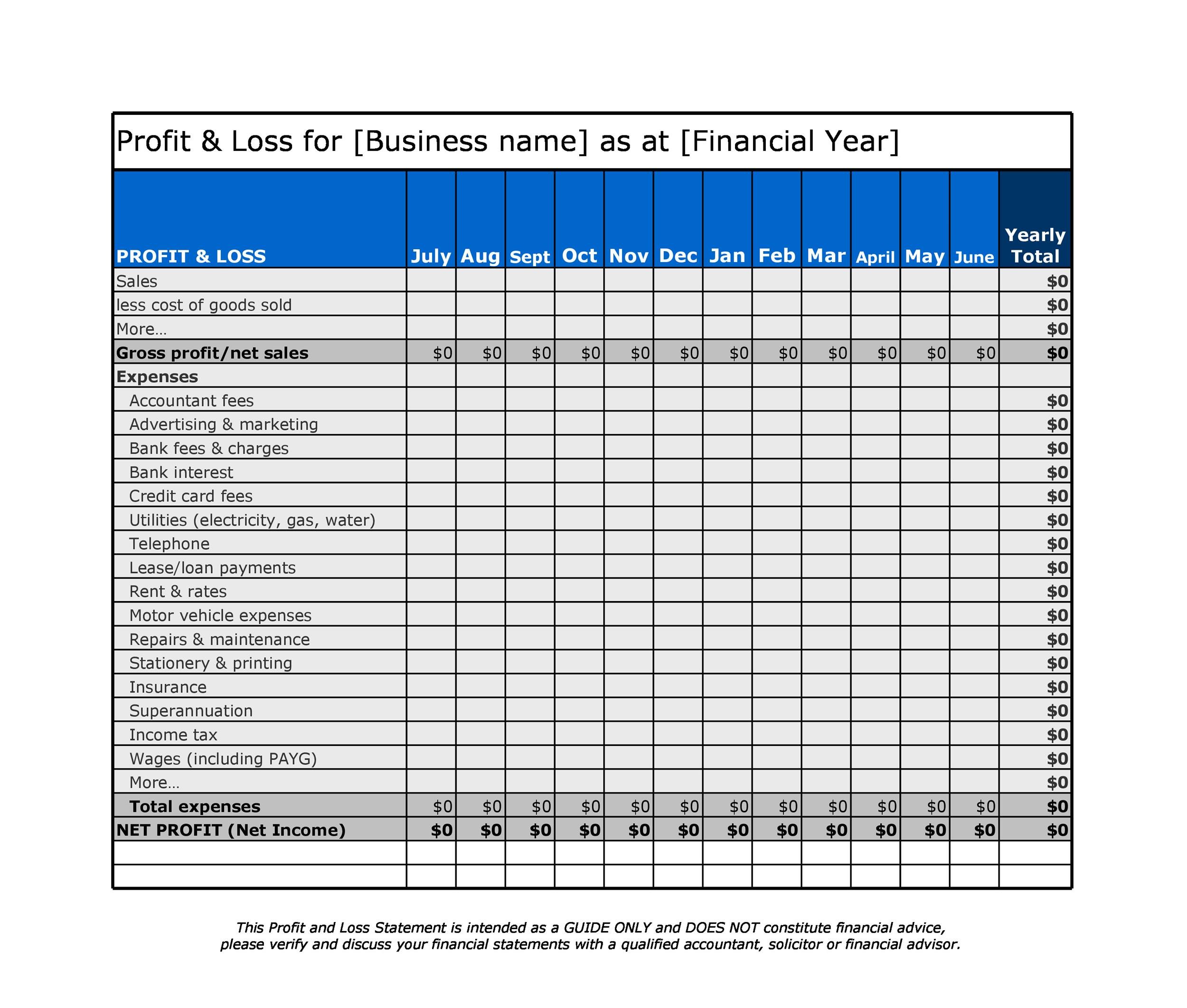

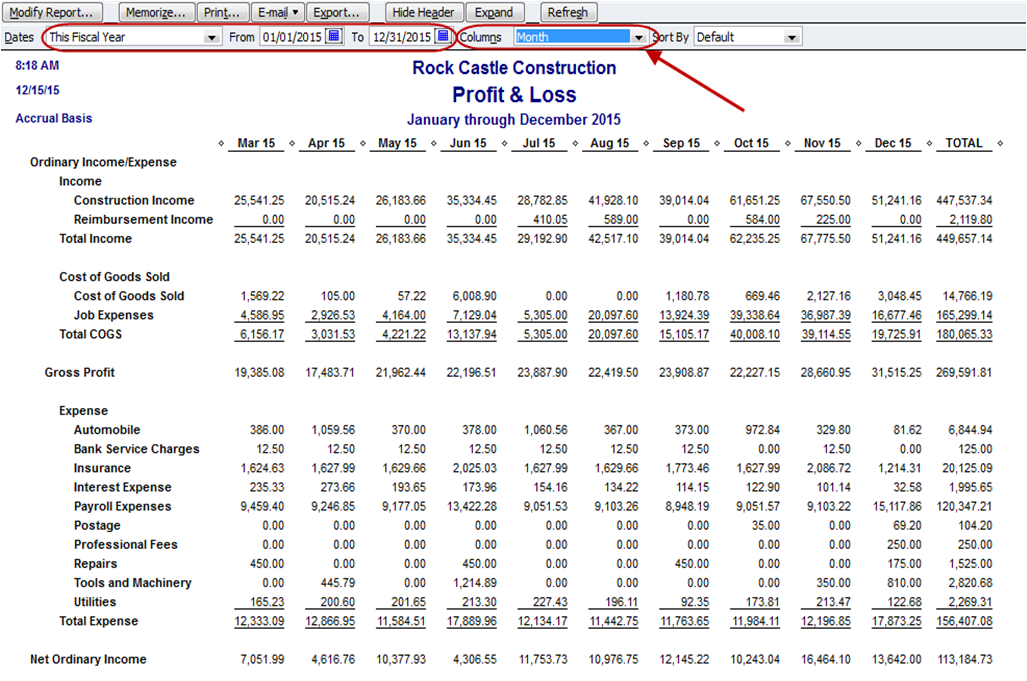

Change the columns to display to month (as indicated by the arrow below) 4. A profit and loss statement is a snapshot of a company's sales and expenses over a period of time, such as one year. Easy access to the profit & loss report is one of the main benefits to using quickbooks.

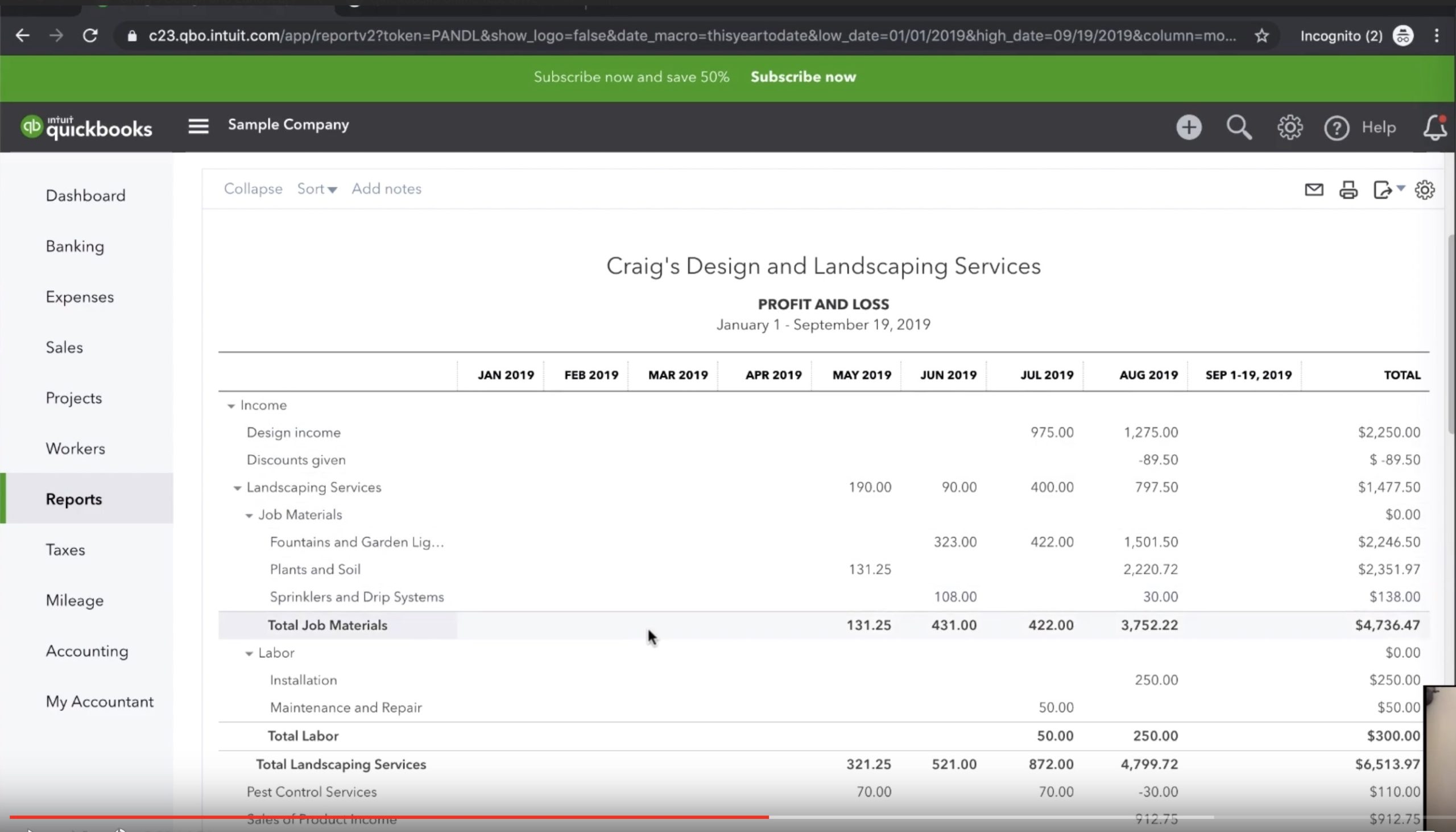

Learn how to prepare profit and loss, balance sheet and cash flow reports using quickbooks. Navigate to profit and loss in quickbooks online The oil and gas company's earnings statement showed that adjusted net income totalled 513 million euros ($556 million) in.

Also referred to as a p&l, the profit and loss statement is exactly the same. On the left of your quickbooks online (qbo), click reports. This video shows you how to create a profit and loss report a.k.a an income statement in quickbooks and how to customize this report to show you only the inf.

Open quickbooks and log in to your account the first step to run a profit and loss statement in quickbooks is to open the quickbooks application and log in to your account using your credentials. Select the profit and loss detail report under the business overview section. It compares your income to your expenses and shows you the amount of profit or loss over a specified amount of time.

Running a profit and loss (p&l) statement is an essential task for any business, as it provides a comprehensive overview of the company's financial performance over a specific period. Choose the range step 4: Creating a detailed profit and loss report in quickbooks online is easy.

Change the dates to the year desired (for a calendar year from january 1 to december 31 for the year desired) 3. With quickbooks profit & loss reports, you can see if your business is operating at a loss or profit. It shows company revenues, expenses, and net income over that period.

The bottom line on a p&l will be net income, also known as profit or loss. Create the standard profit & loss report (reports > company & financial > profit & loss standard). The video walks you through how to create your profit and loss statement in quickbooks by quarter (or whatever time period you want) for a year on 1 page.

Create a quickbooks account step 2: Standard reports are separated into 10 groups, so open the business overview group and click on profit and loss, as shown in the gif below. The profit and loss formula is:

If this doesn't work, please come back and give additional information. Modify the reporting period to a specific month. Find the profit and loss statement in quickbooks report center step 3:

![[QODBCDesktop] How to run a Profit and Loss Standard Report in QODBC](https://support.flexquarters.com/esupport/oneadmin/_files/Image/Screen Dump Upload Folder/ProfitandLossStd1.JPG)