One Of The Best Tips About S Corp Balance Sheet

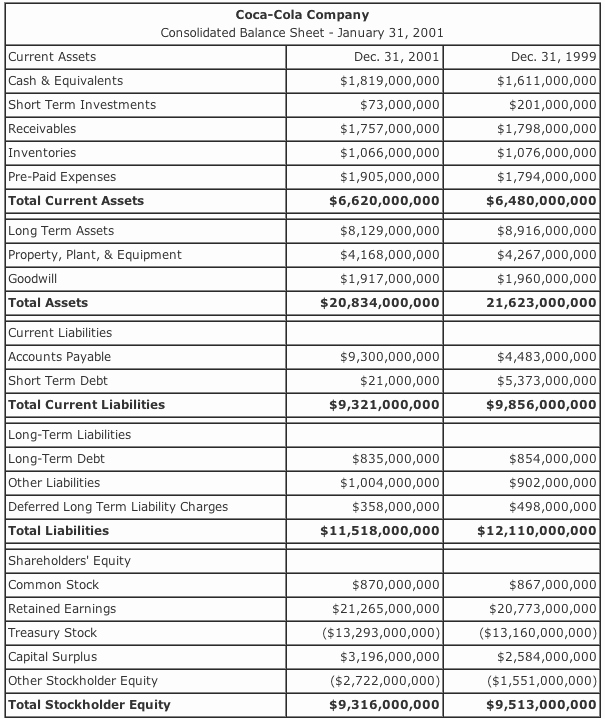

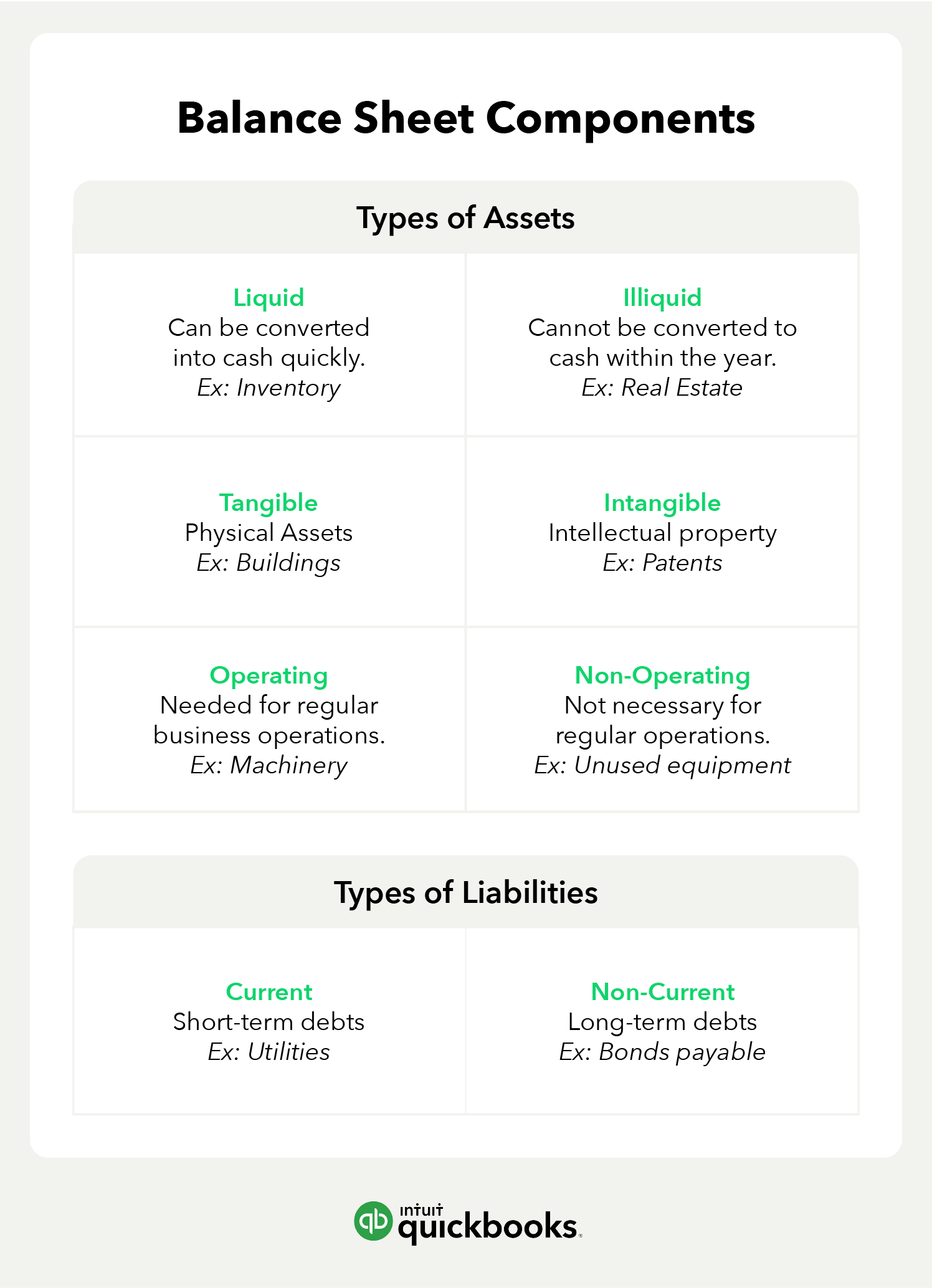

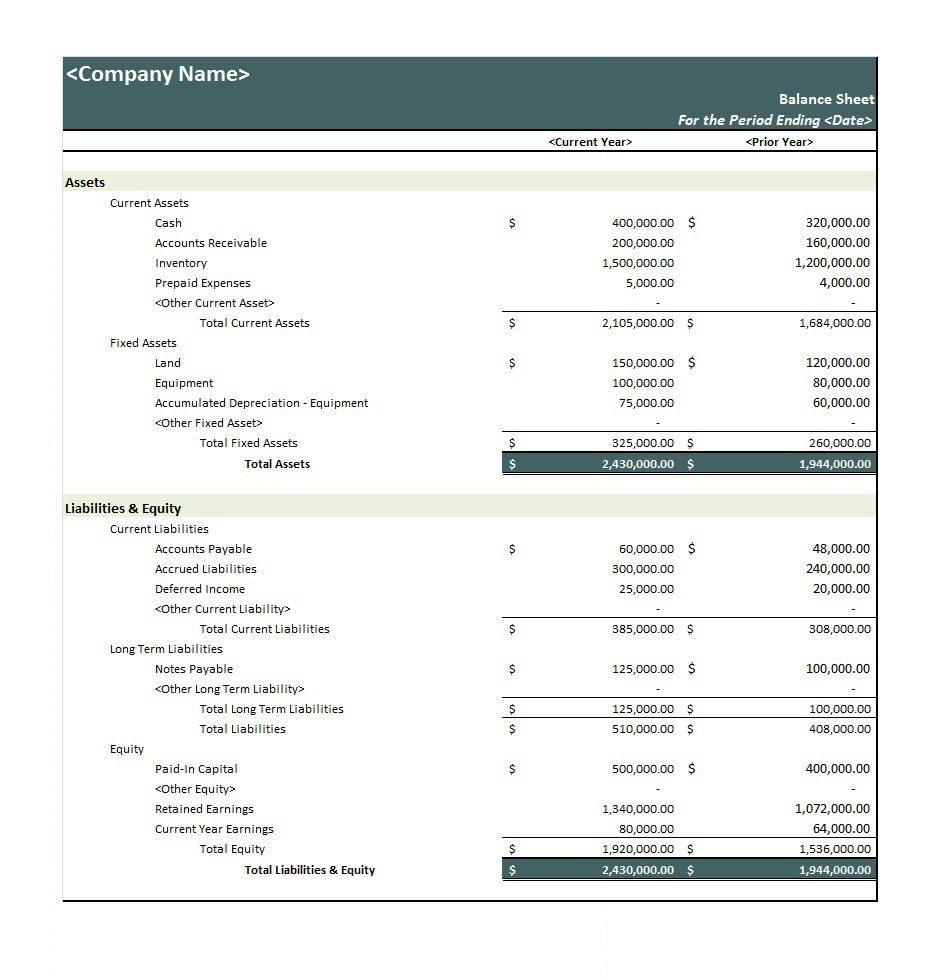

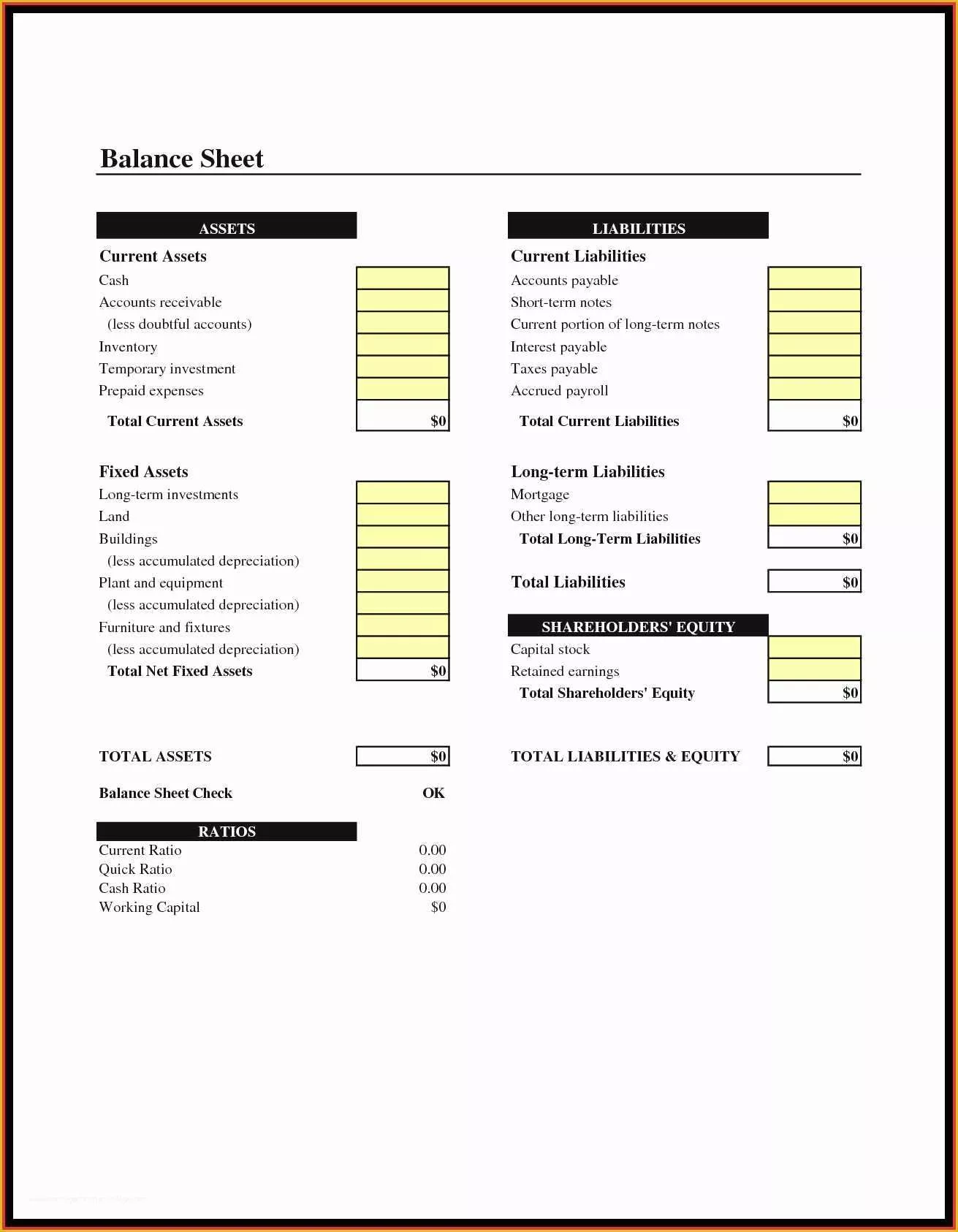

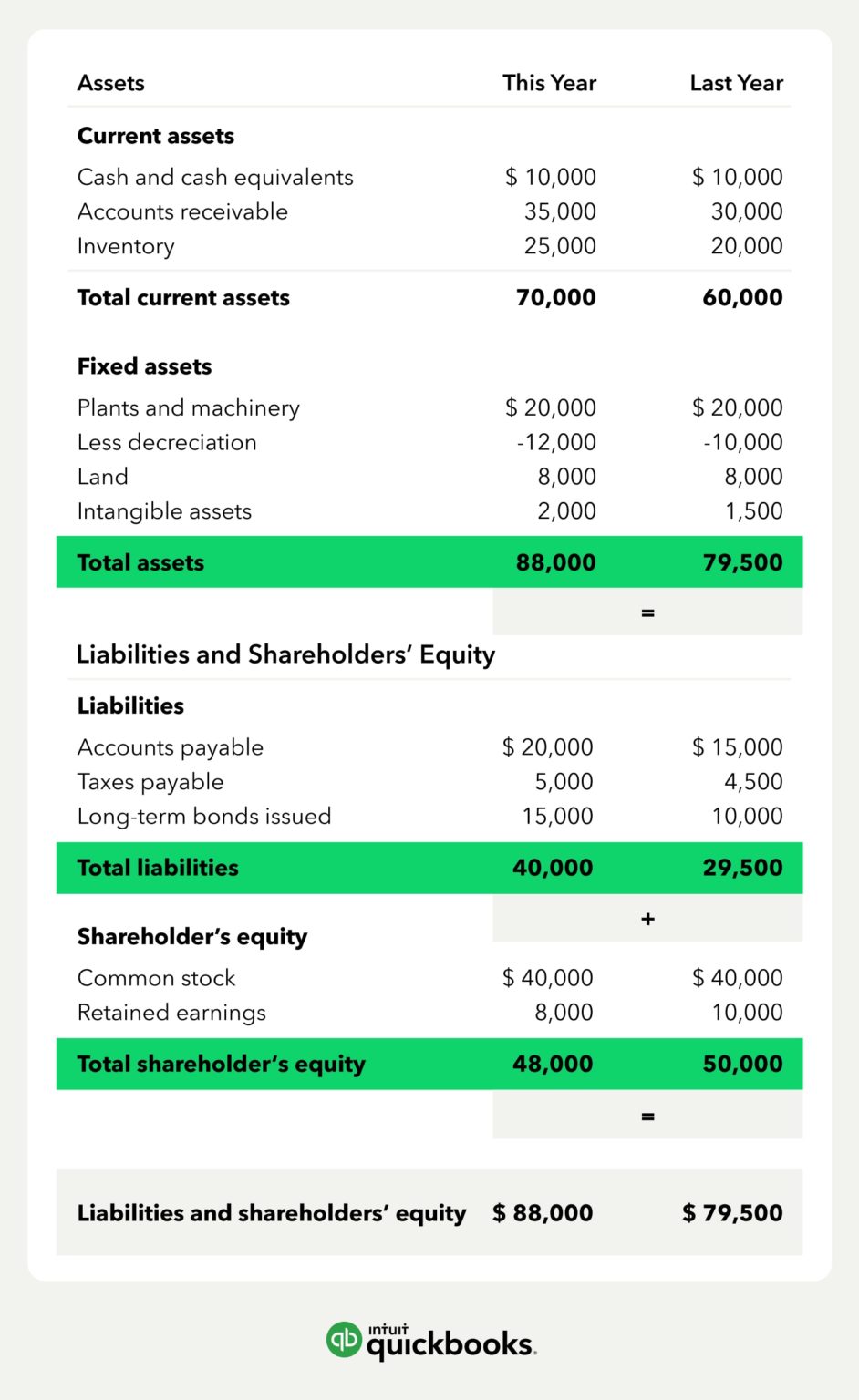

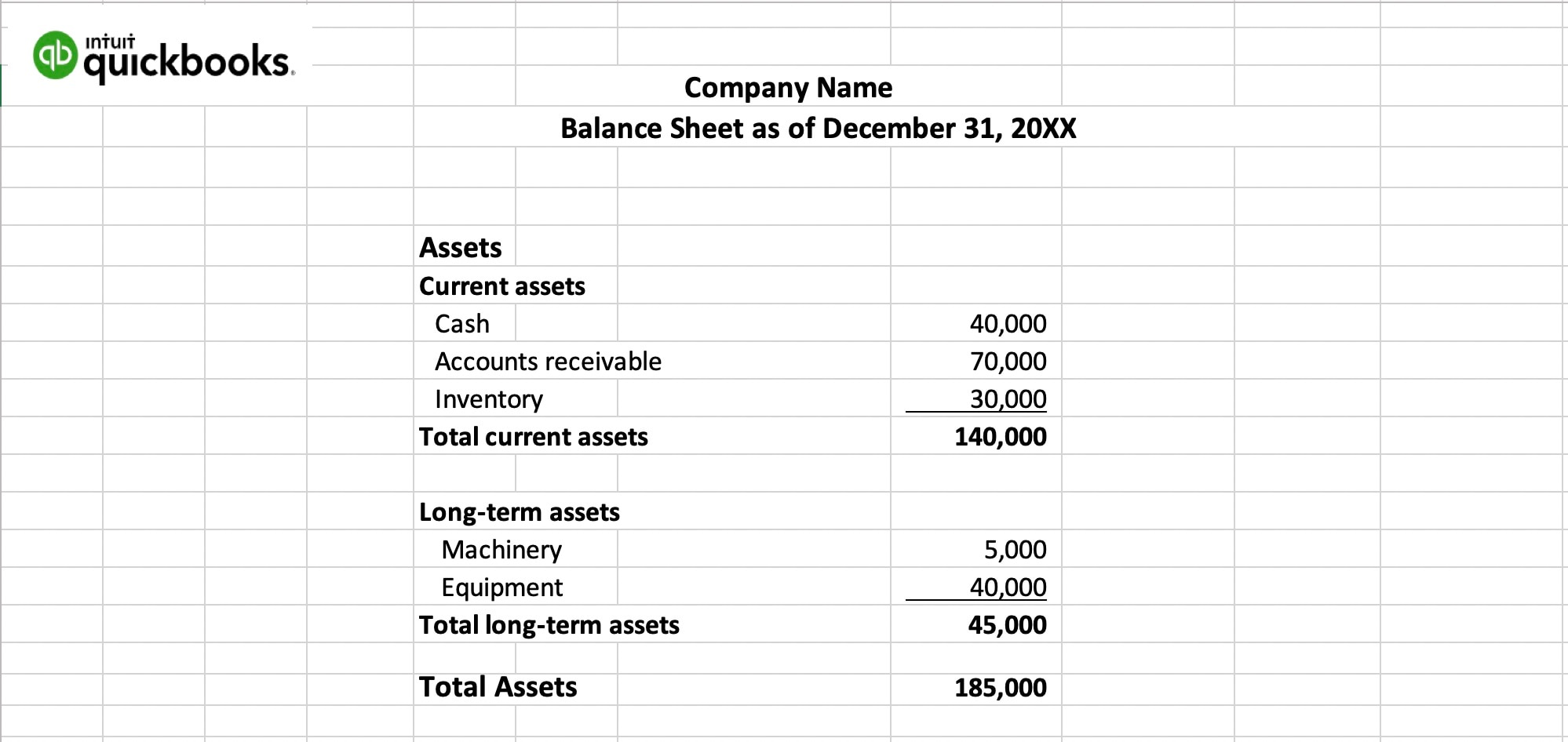

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.

S corp balance sheet. Menden, cpa december 31, 2011 related. When it comes time to file taxes, you’ll be able to refer to this sheet. Locate and select the balance sheet to open it.

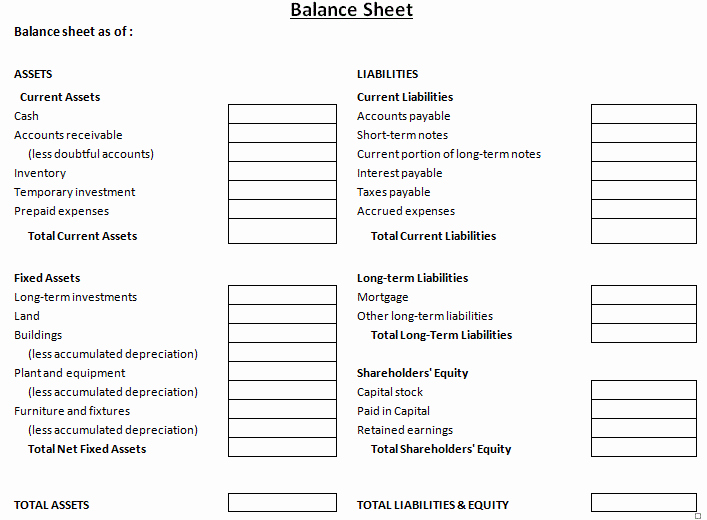

You must maintain a balance sheet for your s corporation. The $250,000 rule throughout the tax year, you must maintain a detailed balance sheet for your s corporation. Export data to excel for your own analysis.

An s corporation is a corporation with a valid s election in effect. The impact of the election is that the s corporation's items of income, loss, deductions and credits flow to the. In some instances you have to transcribe all of the information from a balance sheet onto a tax form.

Updated november 3, 2020: Trump was penalized $355 million, plus millions more in interest, and banned for three years from serving in any top. In the report, locate the retained earnings item to see your company's reported net income.

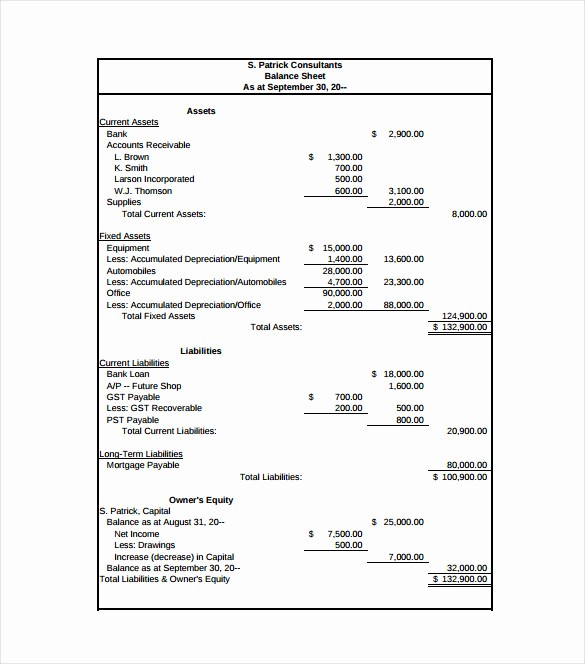

It can also be referred to as a statement of net worth. Step one — determine all related data as discussed above. For example, you pay $10,000 to purchase 500 shares of common stock at $20 a share.

You report s corporation stock purchases on the balance sheet. Small business | finances & taxes | tax returns by david barnes updated may 20, 2019 tax preparers of irs form 1120s for a subchapter s corporation are. Updated june 24, 2020:

The balance sheet is a very important financial statement that. 5) shareholder distributions is money taken out of the business in the current year. It includes your assets and liabilities and tells you your business's net worth.

Income statement example gather the necessary information for form 1120s then each shareholder’s capital account can be summarized on form 1120s. Learn how to account for an s corporation's income and expenses at the corporate level, and how to calculate shareholder capital accounts and loans. A balance sheet is a financial snapshot of your business at a given date in time.

The basics of s corporation stock basis avoid problems in calculating and tracking shareholders' basis. On january 1 before you make any transactions you look at the balances of. To file (or ‘elect’) for s corp status, your business must first be incorporated as a regular c corporation or have filed for llc status.

To help guide you in terms of balance sheet preparation, please refer to the following 10 steps: S corp shareholder distributions are the earnings by s corporations that are paid out or passed through as dividends to shareholders and. The irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft instructions.