Exemplary Tips About Cash Flow Statement 101

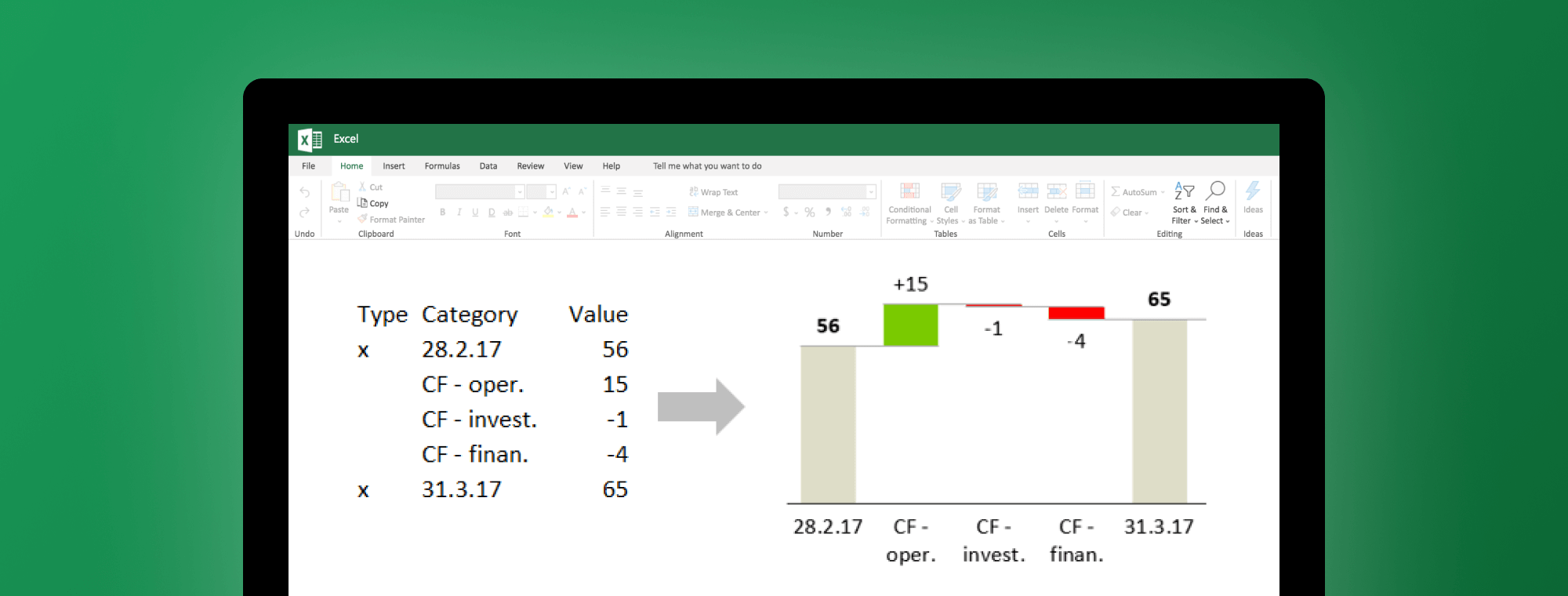

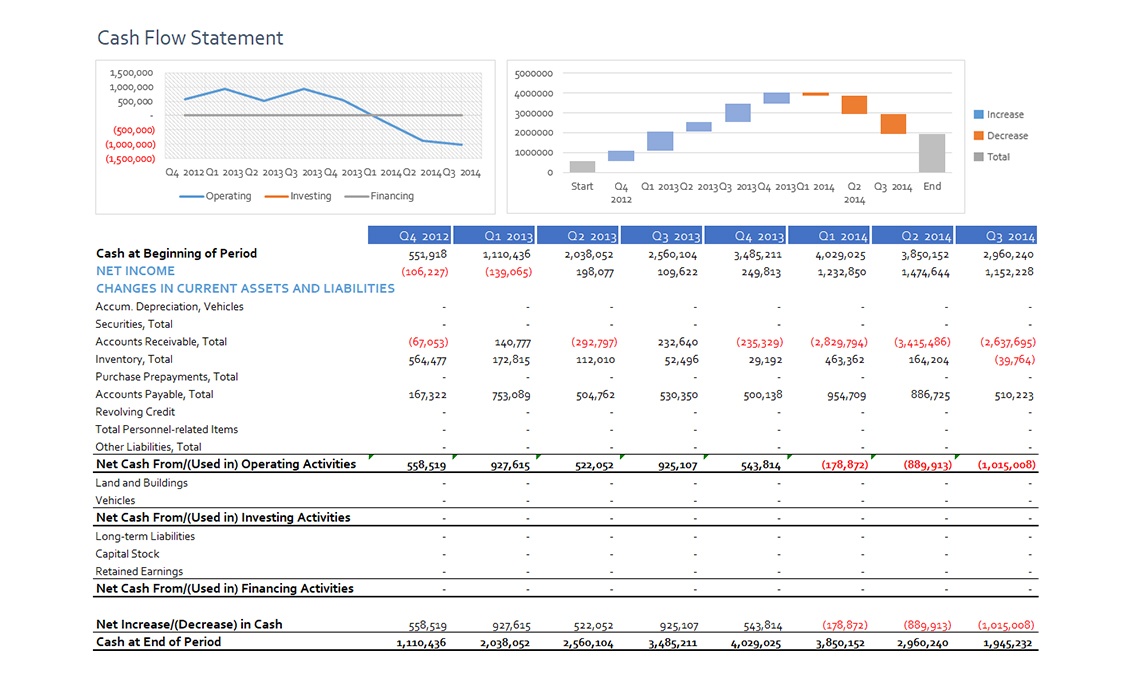

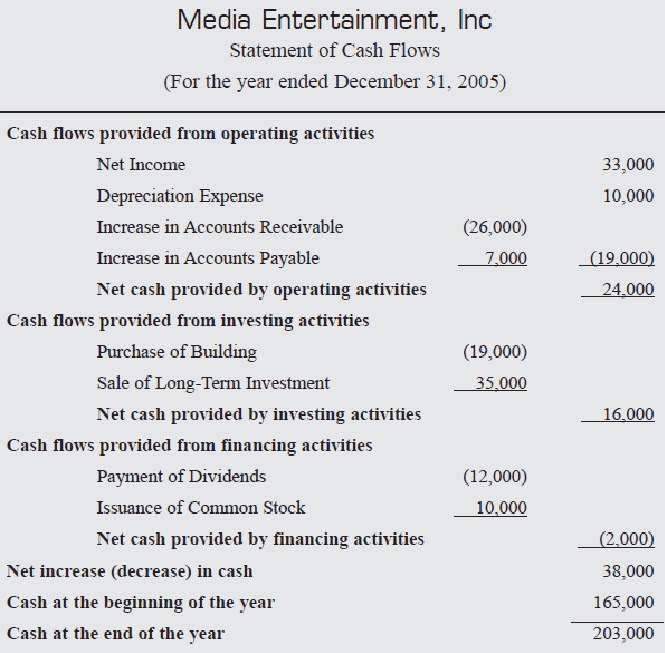

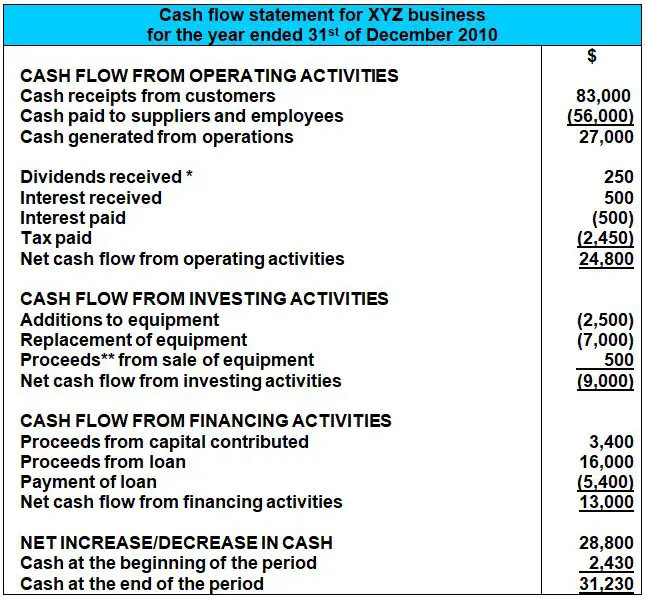

Cash flow from operations, cash flow from investing, and cash flow from financing are summed to calculate the net change in cash.

Cash flow statement 101. It monitors the flow of. This financial statement shows how management is generating and. Learn the key components of the cash flow statement, how to analyze and interpret changes in cash, and what improved free cash flow means to shareholders.

A cash flow statement begins with the starting cash balance for the period in question; The cash flow statement is the most important and insightful financial statement for any organization. Statement of cash flows presents the inflows and outflows of cash in the different activities of the business, the net increase or decrease in cash, and the.

How to read a cash flow statement. In financial accounting, a cash flow statement, also known as statement of cash flows, is a financial statement that shows how changes in balance sheet accounts and income. In the direct cash flow forecasting method, calculating cash flow is simple.

Calculate the change in cash this is the difference between the beginning and the ending cash balance from the beginning and end period on the. Profit and loss (p&l) statements (also known as income. A cash flow statement is a financial document that offers a concise overview of how cash enters and exits a business during a given period.

What is the cash flow statement? A complete guide to understanding cash flow table of contents introduction & cash flow basics the benefits of positive cash flow symptoms of poor. Net change in cash represents the change in cash on the.

Players start with a predetermined occupation and a fixed salary. This is the amount of cash the. Just subtract the amount of cash you plan on.

Getty images each new cash flow statement gives investors a pulse of the corporation's financial health. 12, 2023, at 3:38 p.m.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)