Recommendation Info About Uses Of Cash Flow Statement In Points

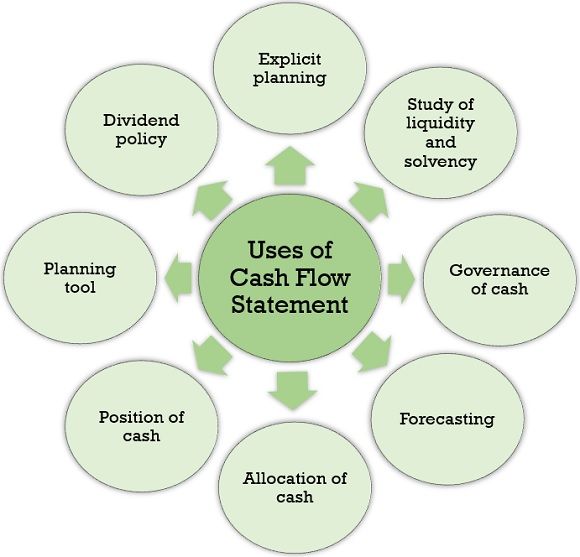

3.3 help in evaluating financial policies and cash position;

Uses of cash flow statement in points. When computing their total amounts, the sources and uses accounts should equal each other. Positive cash flow indicates that a company's liquid assets are increasing, enabling it to settle debts. It is usually helpful for making cash forecast to enable short term planning.

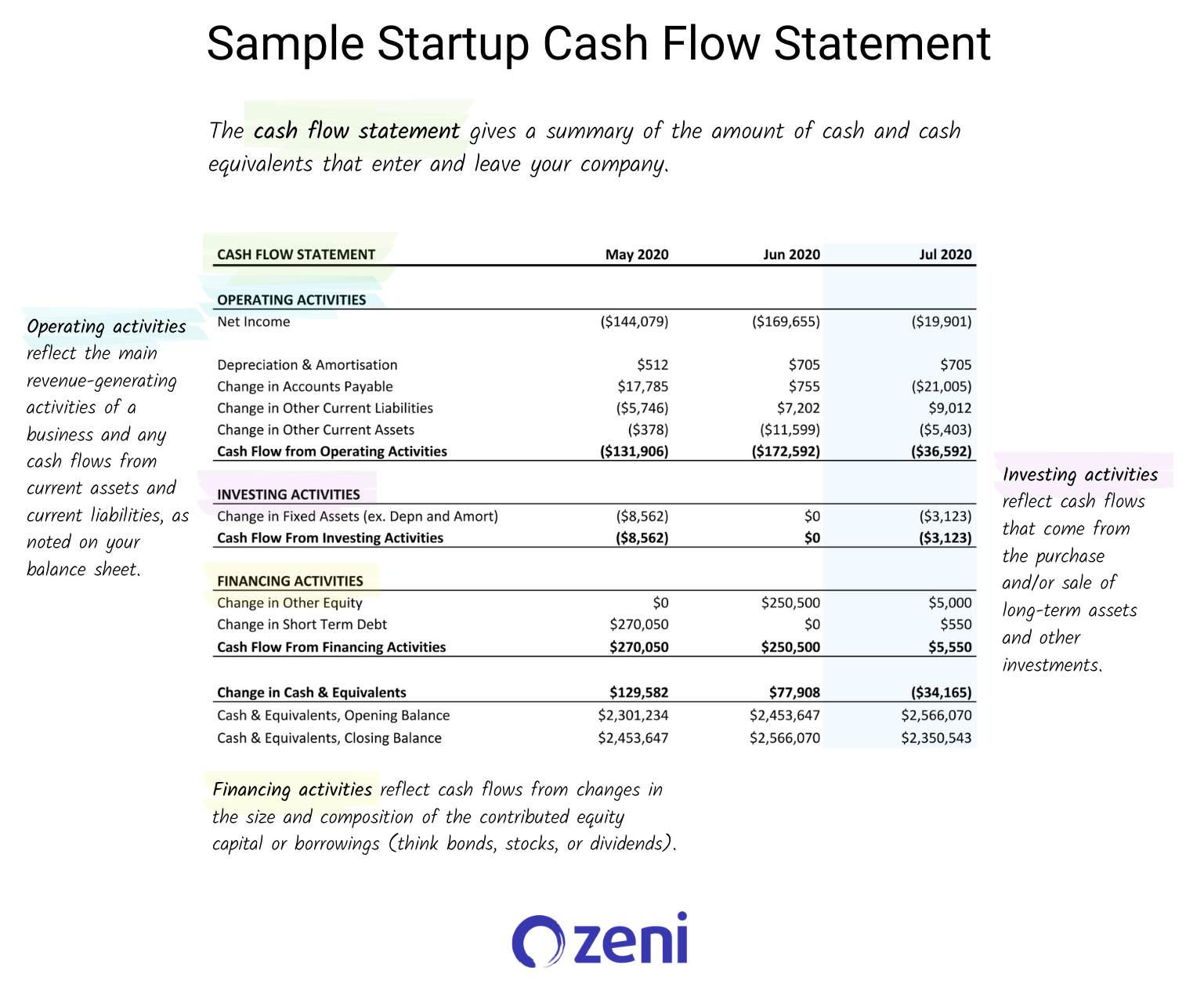

This statement compares money in money out to determine if a business’s cash flow is negative or positive. Ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the international accounting standards committee in december 1992. Also known as the statement of cash flows, this statement illustrates how your business operations are performing.

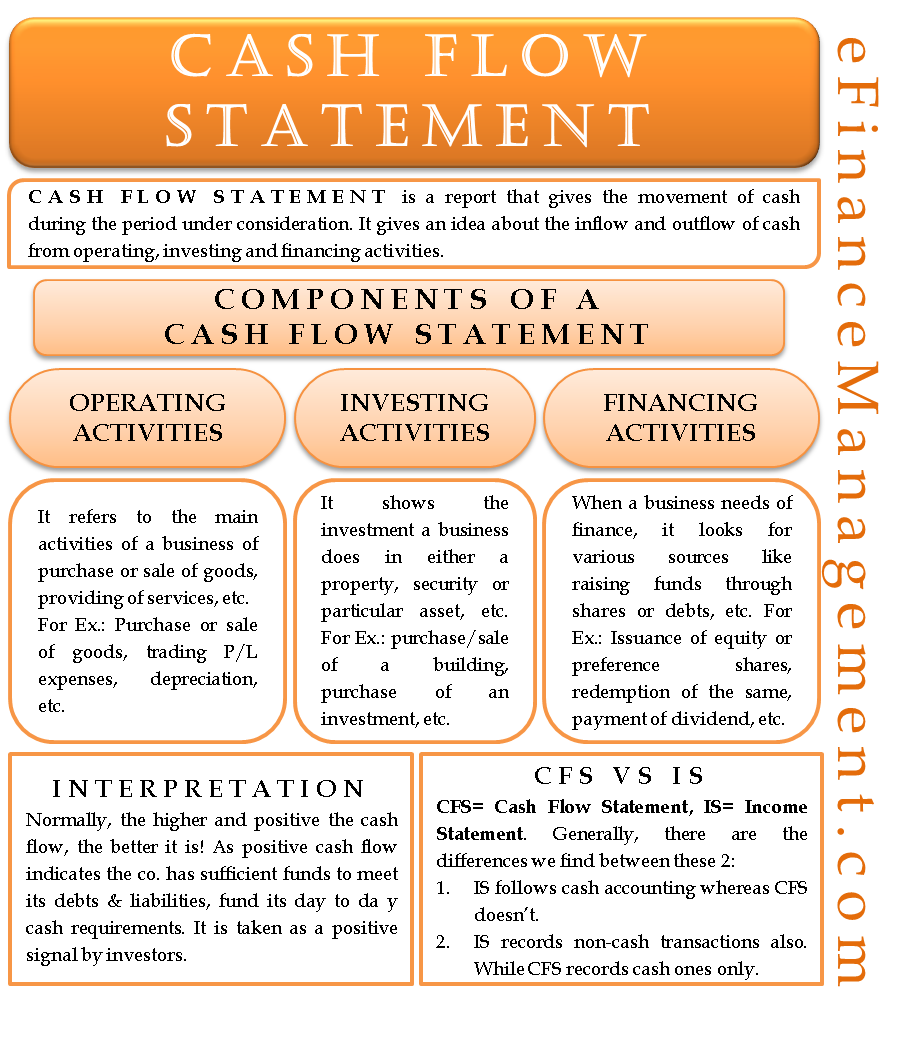

This statement is one of the three key reports (with the income statement and the balance sheet) that help in determining a company’s performance. The cash flow statement is the name commonly used by practicing accountants for the statement of cash flows or scf. 3.2 discloses success or failure of cash planning;

The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. A company's cash flow is the figure that appears in the cash flow statement as net cash. The cash flow statement provides information about a company’s cash receipts and cash payments during an accounting period.

A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. A sources and uses of cash schedule gives a summary of where capital will come from (the “sources”) and what the capital will be spent on (the “uses”) in a corporate finance transaction. Cash flow statements are one of the three fundamental financial statements financial leaders use.

A cash flow statement tells you how much cash is entering and leaving your business in a given period. This helps in critical periods, so they’re prepared when making investments, taking loans, repaying debts and even reducing the workforce if it’s affecting the business. Operating cash flow can be found in the cash flow statement, which reports the changes in cash compared to its static counterparts—the income statement, balance sheet, and shareholders’ equity.

It is used to check out a business’s financial health. A cash flow statement is the most important part of analyzing cash flows related to financing, operations, investments and profits. Internal users can assess sources of and uses of cash in order to aid in adapting, as.

3.4 providing information about funds available from operations; Use of cash flow statement # 2. 3.1 discloses the movement of cash;

Simply put, it reports the cash inflows and cash outflows within your business during a time period, whether that’s over a week, a quarter, or a financial year. Ias 7 cash flow statements replaced ias 7 statement of changes in financial position (issued in. It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business.

What is a cash flow statement? 3.5 other uses of cash flow statement; Importance of cash flow statement.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)