Glory Tips About Four Types Of Financial Ratios

Debt to equity (d/e) debt to equity or d/e is a leverage ratio.

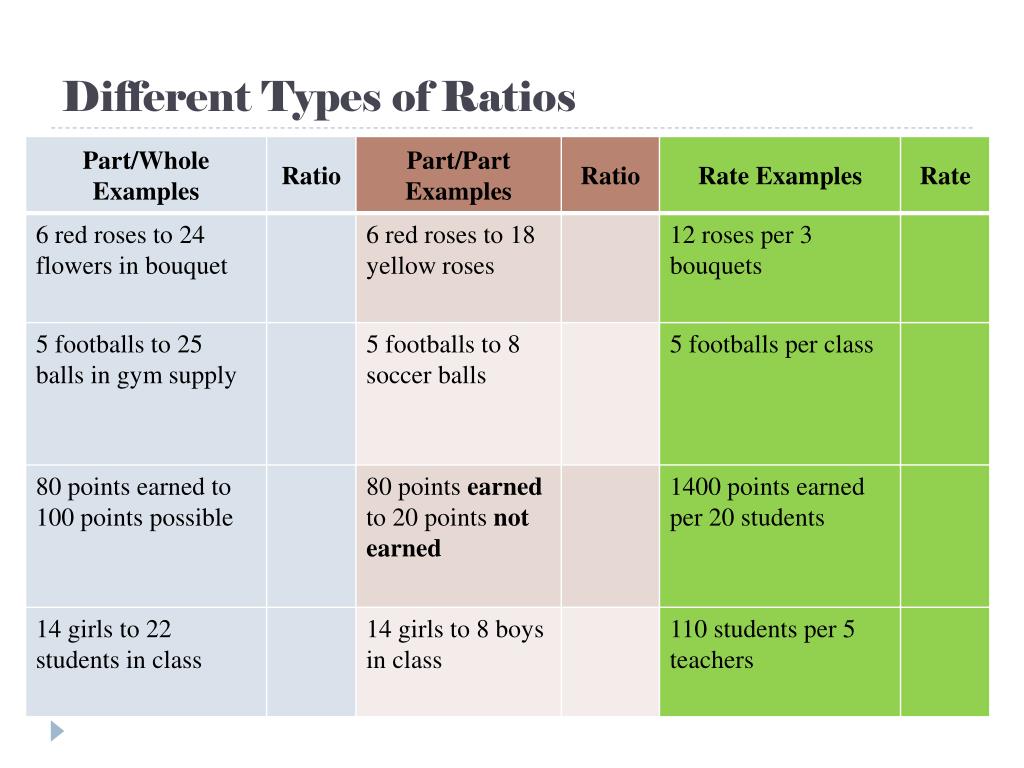

Four types of financial ratios. The gross profit is equal to sales minus cost of goods sold. While profitability helps understand how profitable a. This article breaks down the ratios by classifying them into four groups, including:

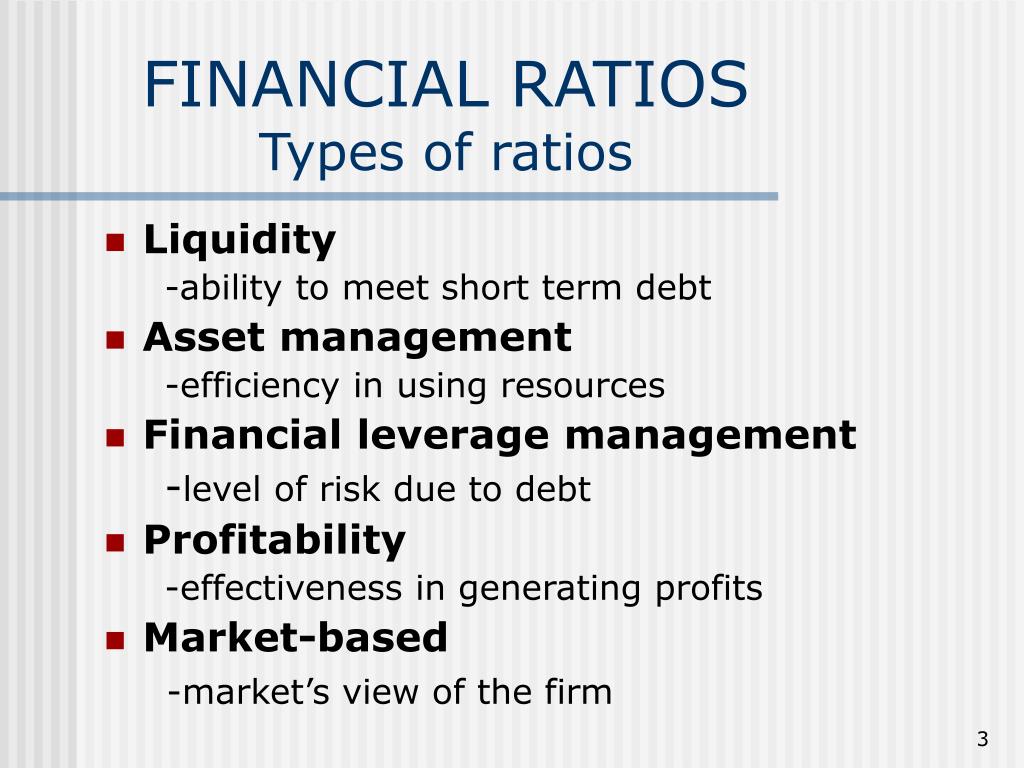

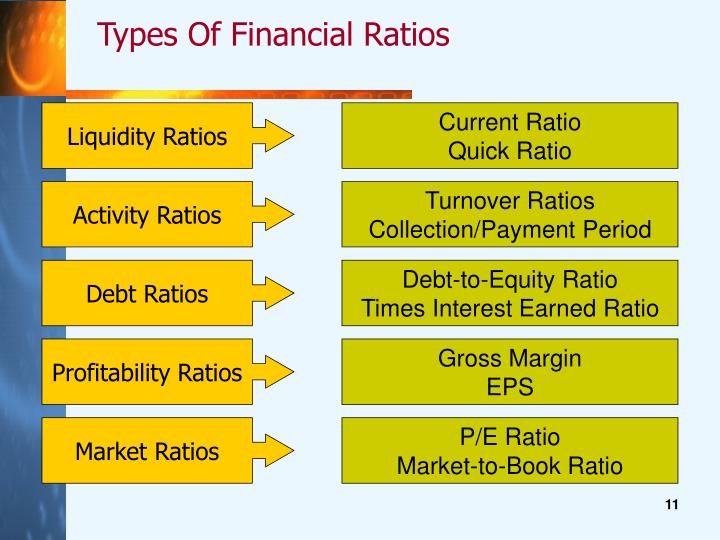

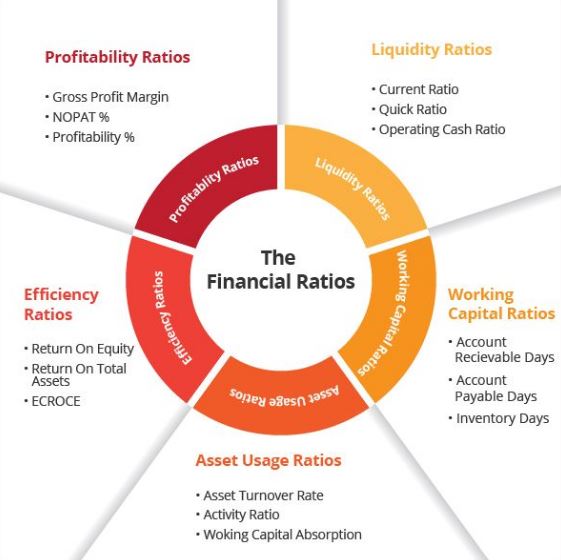

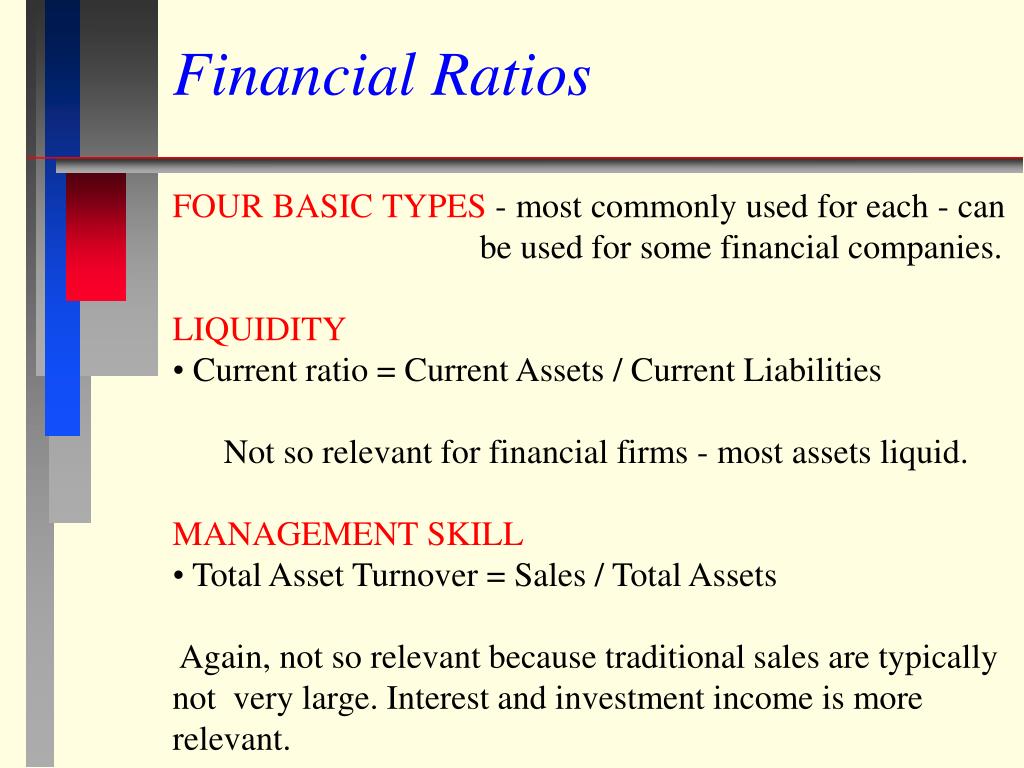

Financial ratios are grouped into the following categories: It gives you an idea of how well the company can meet its obligations in the next 12 months. Liquidity ratios measure a company’s ability to.

Its eps for the past 12 months averaged $5. Liquidity ratios measure the availability of cash to pay debt. The current ratio is an indicator of your company's ability to pay its short term liabilities (debts).

Key terms dividend payout ratio standard deviation compound annual growth rate (cagr) discounted cash flow (dcf) cost of goods sold (cogs) price elasticity of. In general, financial ratios can be broken down into four main categories: In general, there are four categories of ratio analysis:

Different types of financial ratios: This has been a guide to types of financial ratios. The common financial ratios every business should track are 1) liquidity ratios 2) leverage ratios 3)efficiency ratio 4) profitability ratios and 5) market value ratios.

Profitability, liquidity, solvency, and valuation. A company’s stock is trading at $50 per share. The quick ratio (sometimes called the.

What are the four types of financial ratios? Types of ratio analysis 1. Financial ratios are essential tools used for analyzing and understanding the financial health of a business.

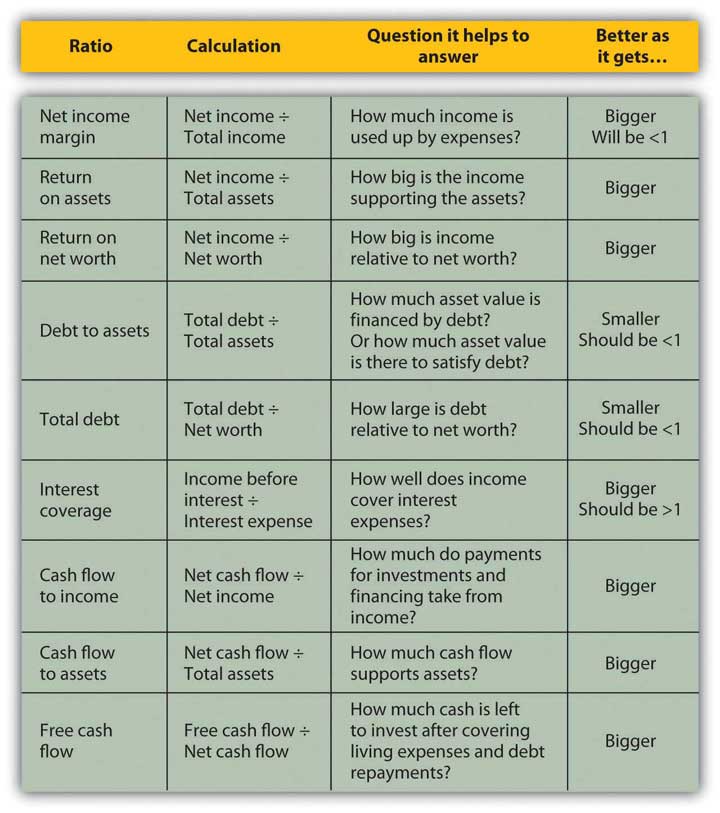

Key ratios include profit margin, return on assets (roa), and return on equity (roe). These ratios include current, quick, cash, and operating cash flow. The cash ratio will tell you the amount of cash a company has, compared to its total assets.

The second is functional distribution, grounded on the merits of the financial ratios and the idea for which they are. Also called financial leverage ratios, solvency ratios compare a company's debt levels with its. Although there are many financial ratios businesses can use to measure their performance, they can be divided into four basic categories.

Profit is both a means and end to the organization. Activity ratios (also called efficiency ratios) profitability ratios; Here we discuss the top 5 financial ratios, including liquidity ratios, leverage ratios, activity ratios, profitability ratios, and market value ratios.