Best Tips About Monthly Cash Flow Statement Balance Sheet Projection Template

Inputs should only need to be input once.

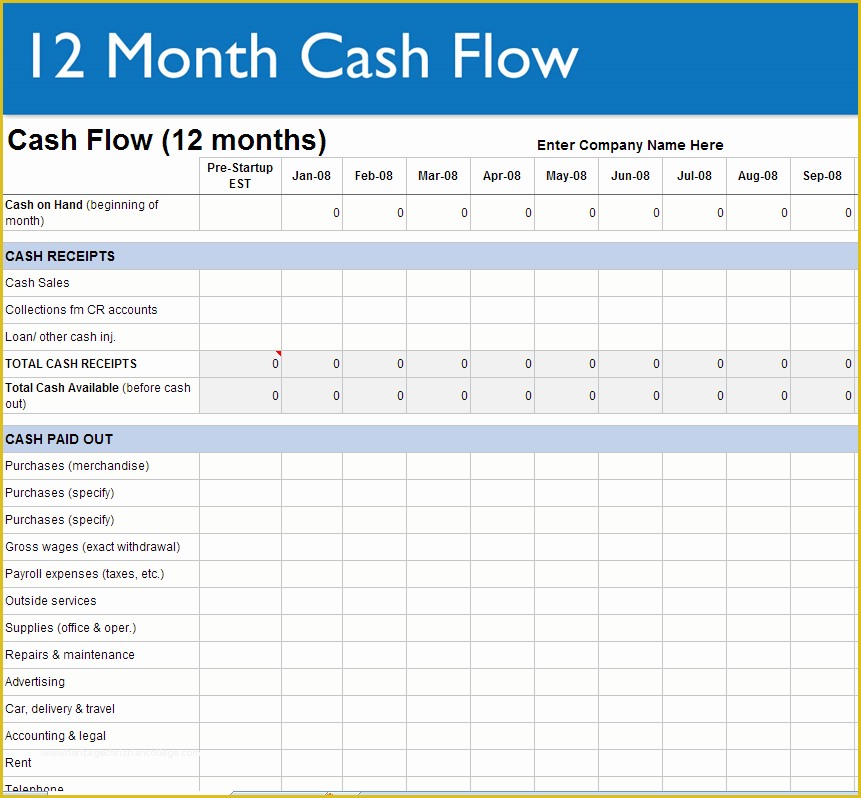

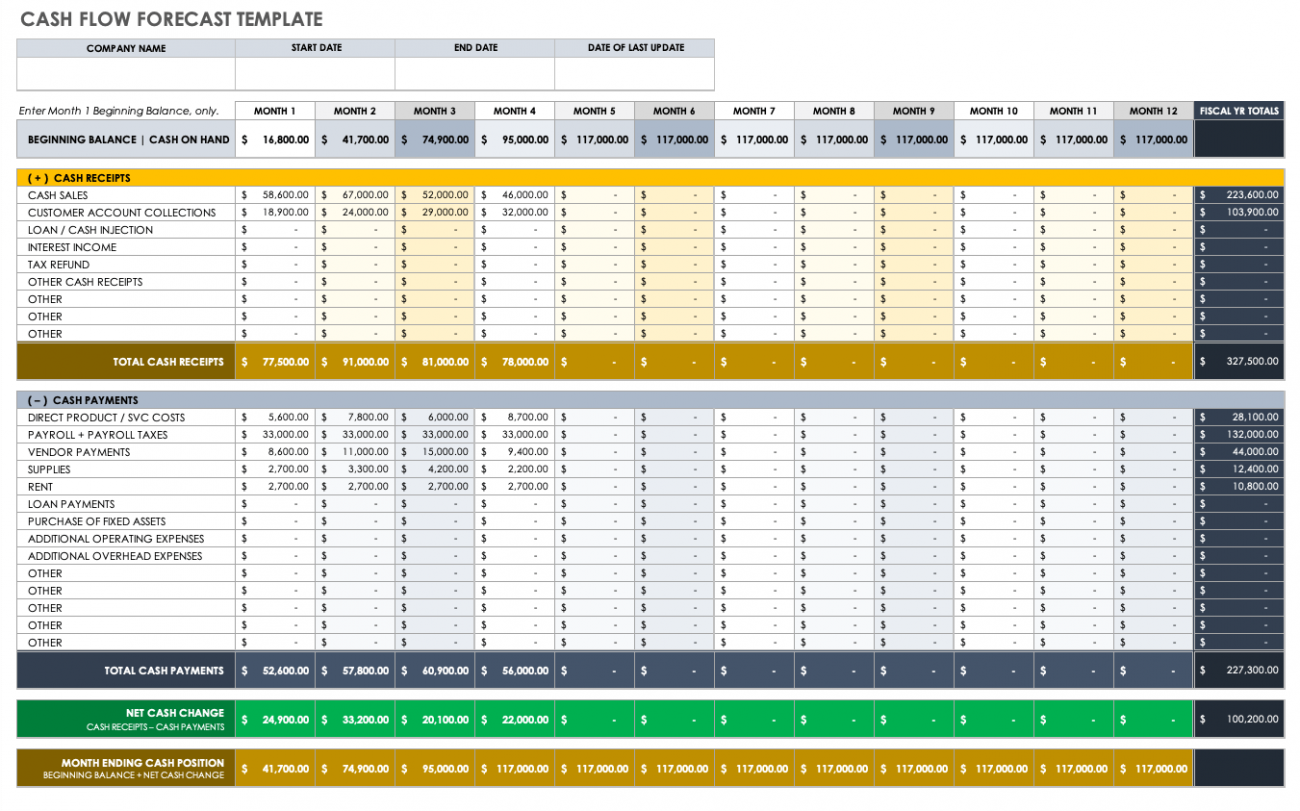

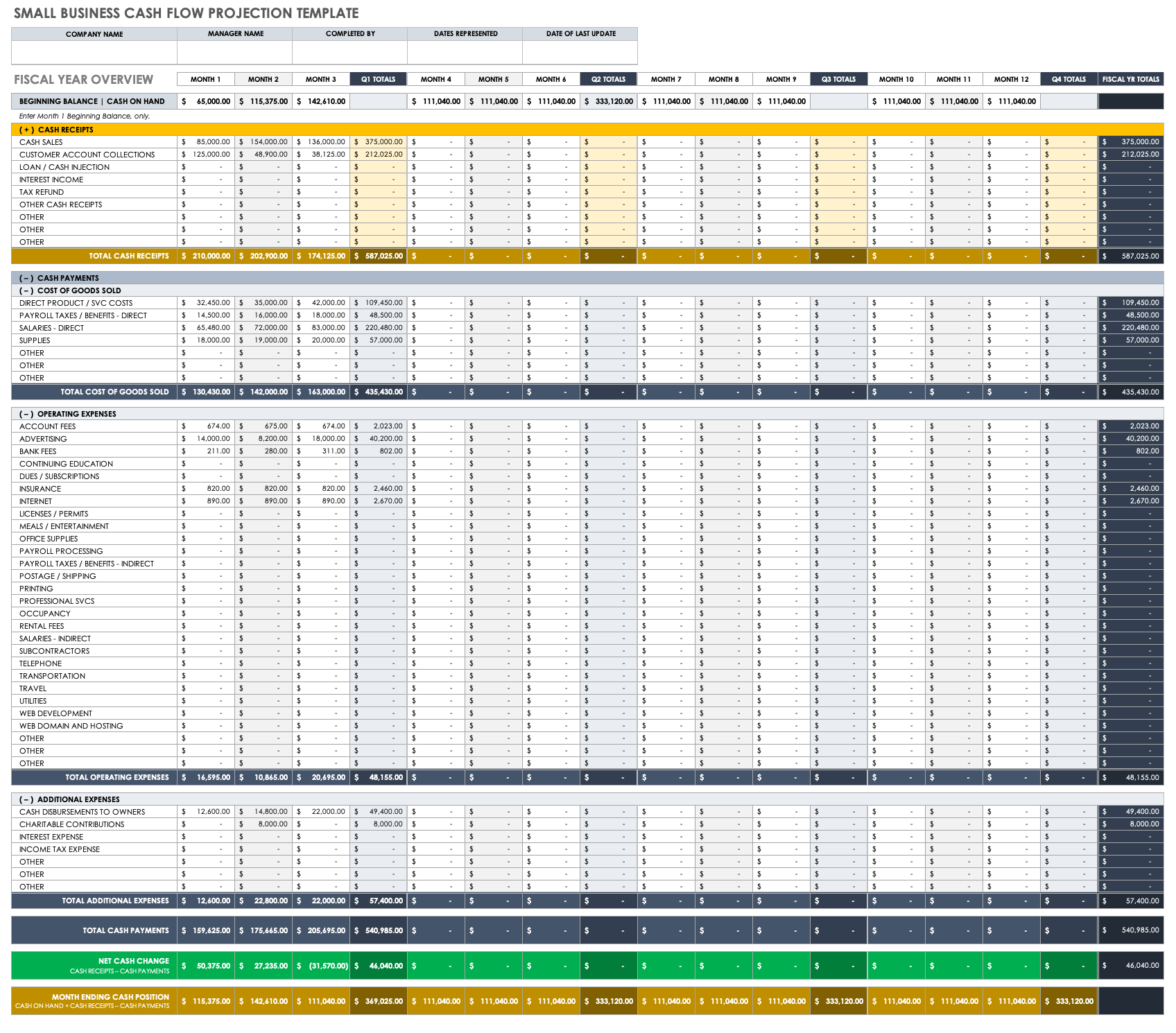

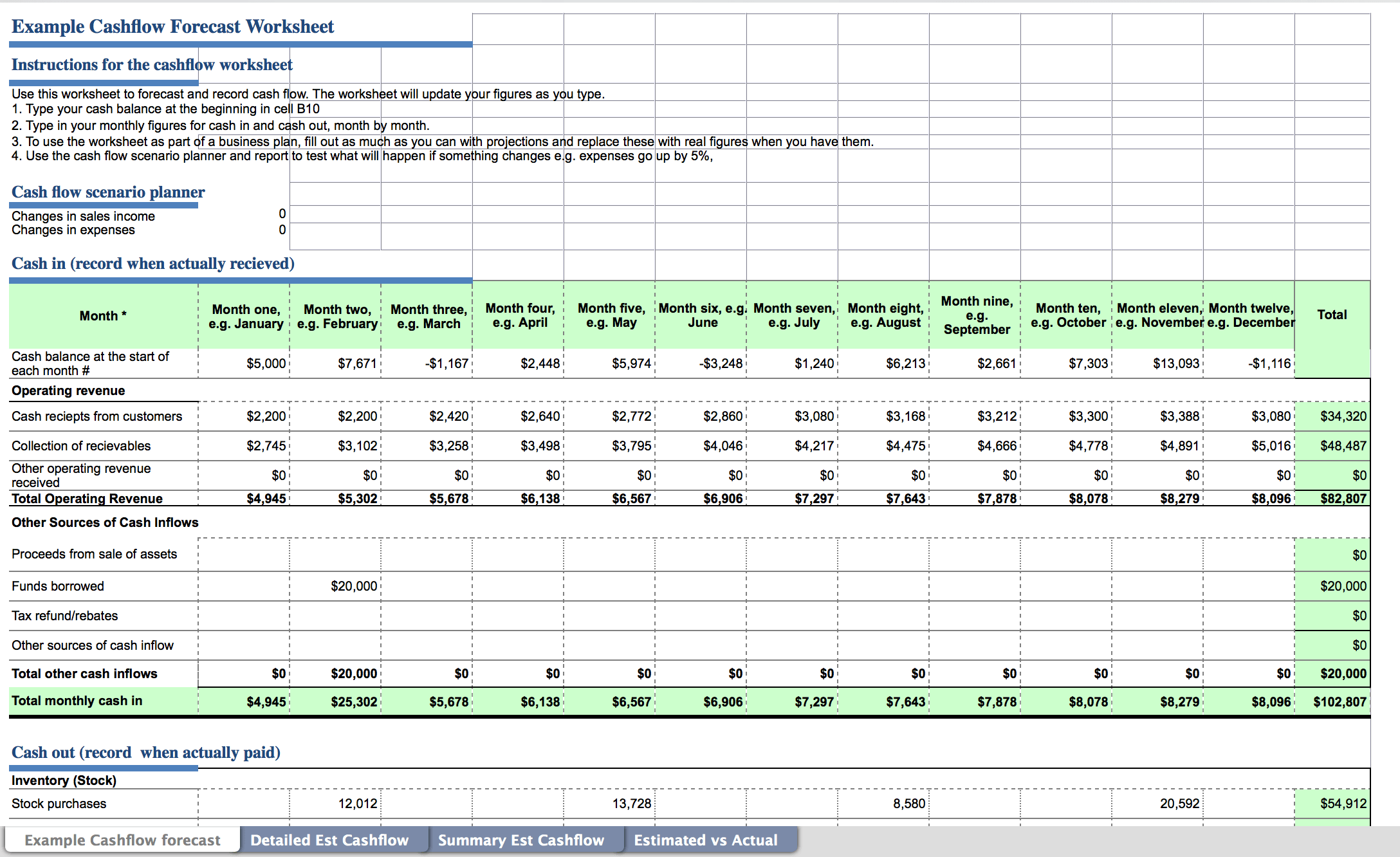

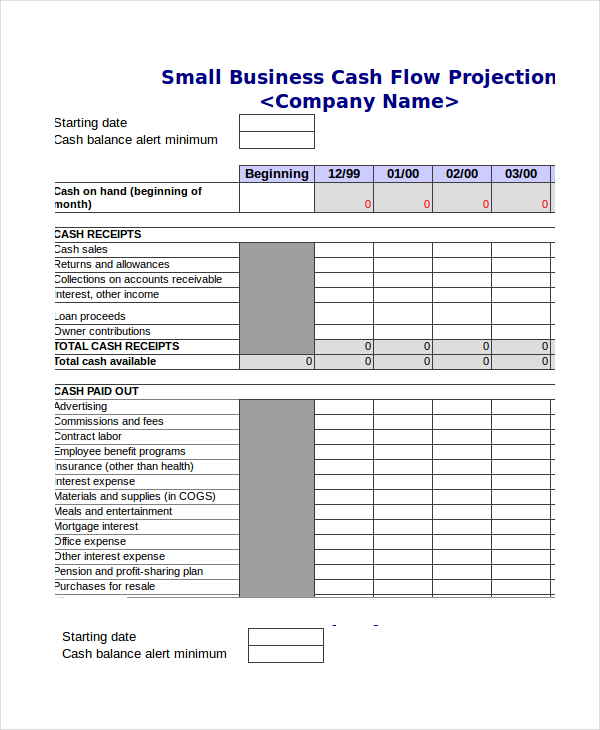

Monthly cash flow statement balance sheet projection template. Download a statement of cash flows template for microsoft excel® | updated 9/30/2021 the cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it went (cash paid). Build your cash flow forecasting model (you are here) part 3: Free cash flow forecast template.

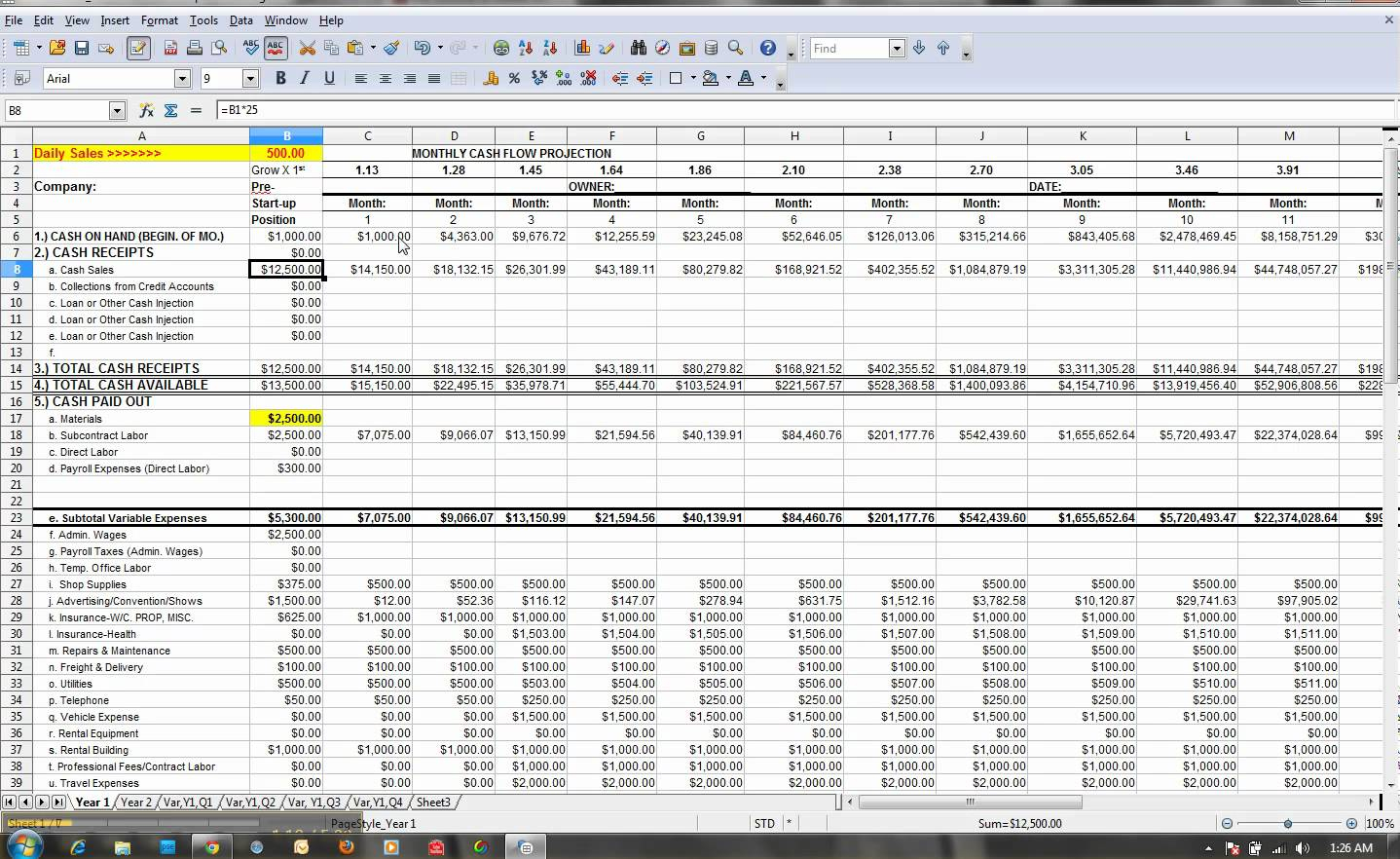

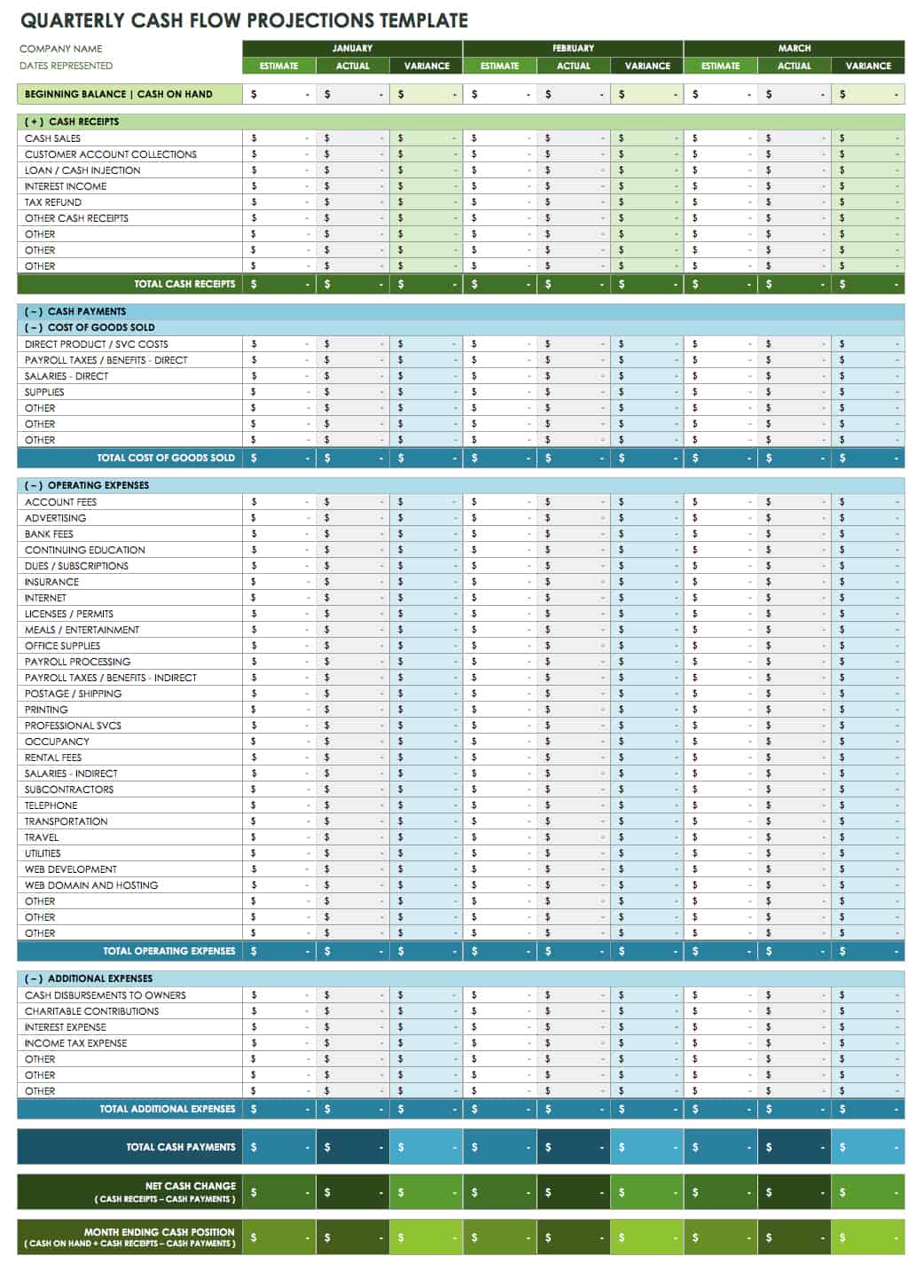

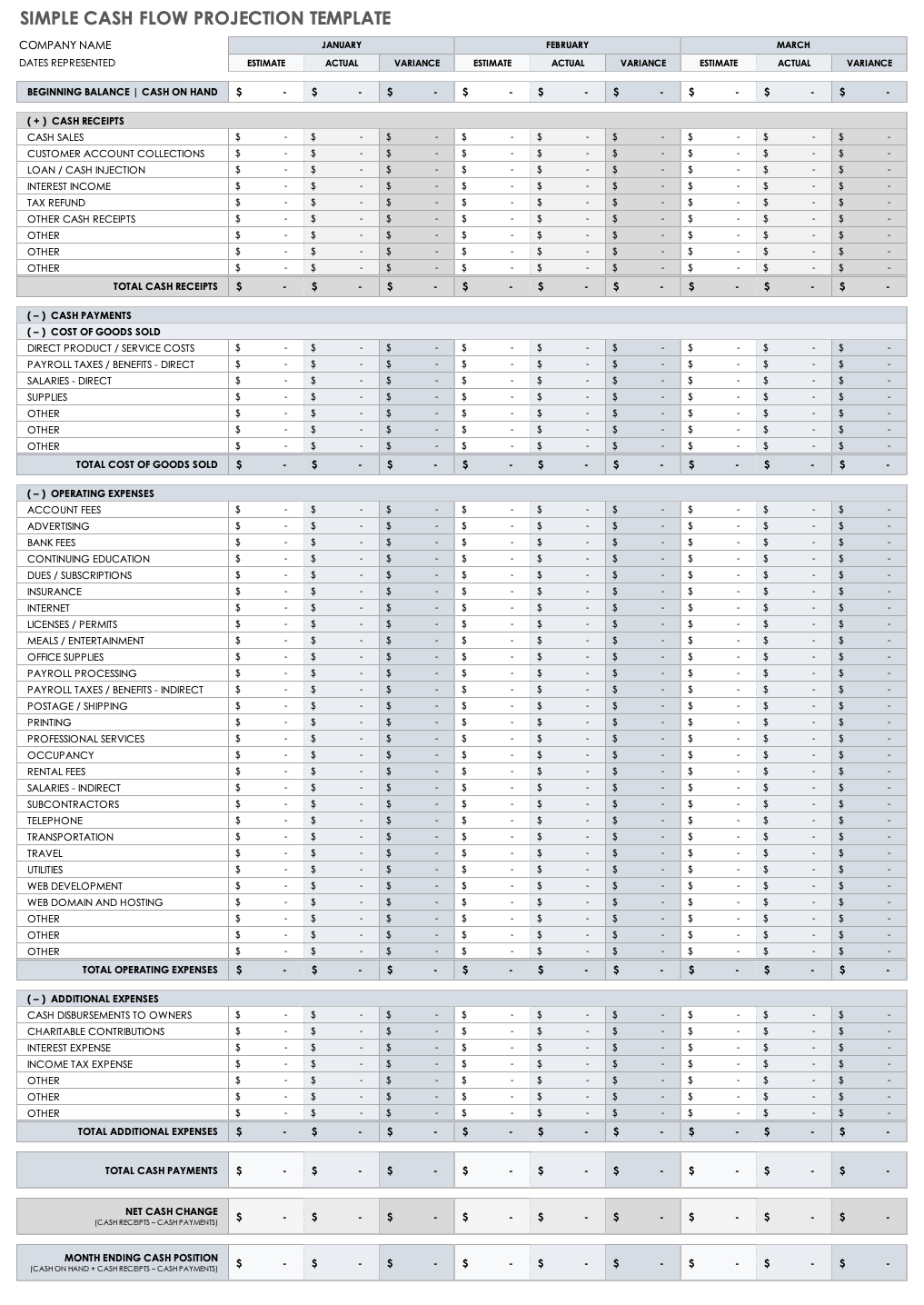

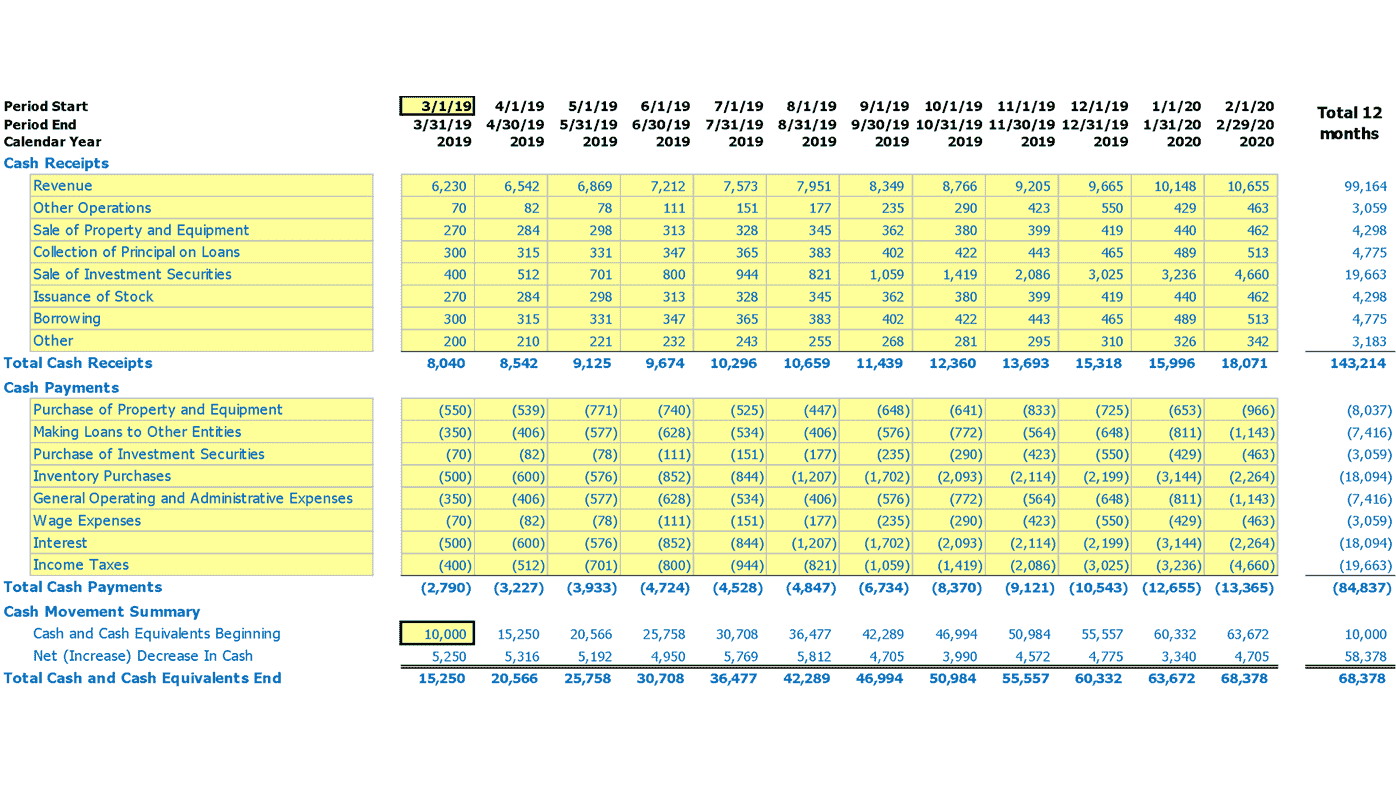

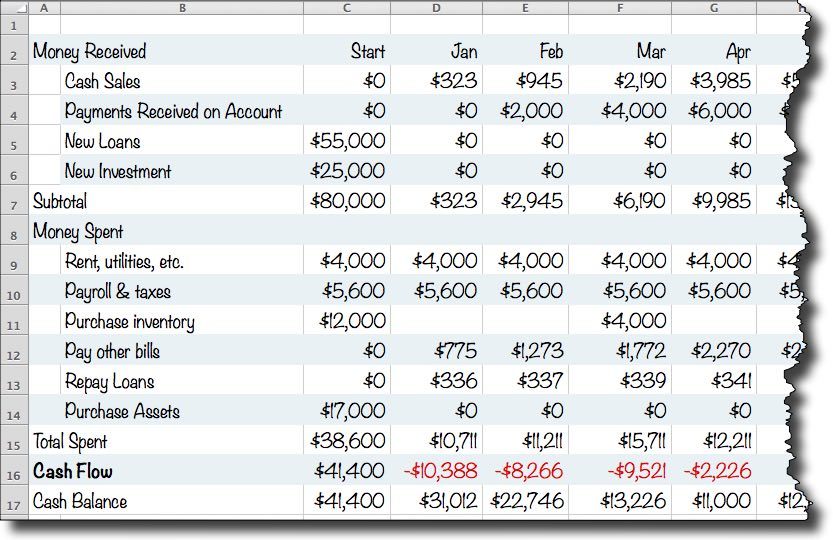

(the other two are the balance statement and the profit and loss statement.) like a checking account statement, the cash flow statement shows the money going into and out of your business. Use this cash flow projection template to compile monthly cash flow projections for 36 monthly periods in excel. If you create your projections at the end of the month, calculate how much cash the company earned and subtract the amount of cash the company.

The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). To make this a lot easier, we’ve created a business cash flow forecast template for excel you can start using right now. Use financial statement templates or accounting software for.

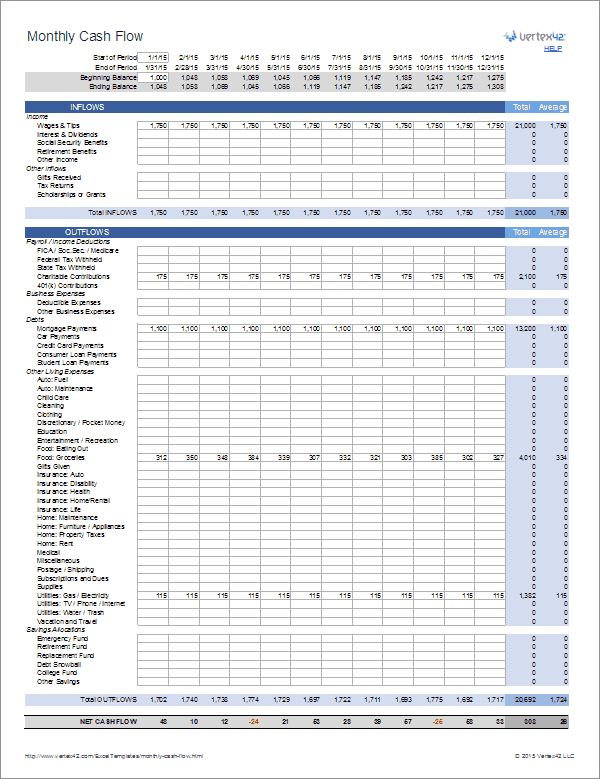

The “monthly cash flow template” by vertex42 is a detailed google sheets template designed for comprehensive financial planning. At the bottom of our cash flow statement, we see our total cash flow for the month: Cash flow projections are based on user defined monthly turnover, gross profit and expense values and automated calculations based on a series of user assumptions.

Cash flow for the month. This powerful tool allows you to break down your monthly income and expenses, track your cash flow, and make informed decisions about your financial health. Download startup financial projections template excel | smartsheet income statement templates for business plan

This will help the business to compute its revenue. Note that the model assumptions driving the forecast must be based on valid reasoning to justify the projection. In our example, a retail store business should start with the number of stores it plans to operate each month, then build up from there, based on the number of square feet and sales per square foot.

Calculate the current cash amount. This is the actual cash you expect to have on hand at the beginning of the month. It is designed for a startup or existing coffee shop business, generating revenue through.

Even though our net income listed at the top of the cash flow statement (and taken from our income statement) was $60,000, we only received $42,500. Use your model to make projections welcome back to our cash flow forecasting series with jirav! Our templates will help you produce a full pro forma financial model which will include a 5 year projected balance sheet as well.

Learn from industry executives as they discuss the six shortfalls in cash flow projections and offer strategies for overcoming them. The statement of cash flows acts as a bridge between the income statement and balance sheet by. Balance sheet forecast for a 70+ types of startups.

Input estimated monthly revenues and expenses, tracking financial performance over the course of a year. It’s the only template available that separates accounts payable and receivable for the right governance of your company. In this task, you will draft comparative financial statements for the next 12 months.