Perfect Tips About Interest Payable In Cash Flow Statement

Under the accrual method of accounting, interest expense is reported on a company's income.

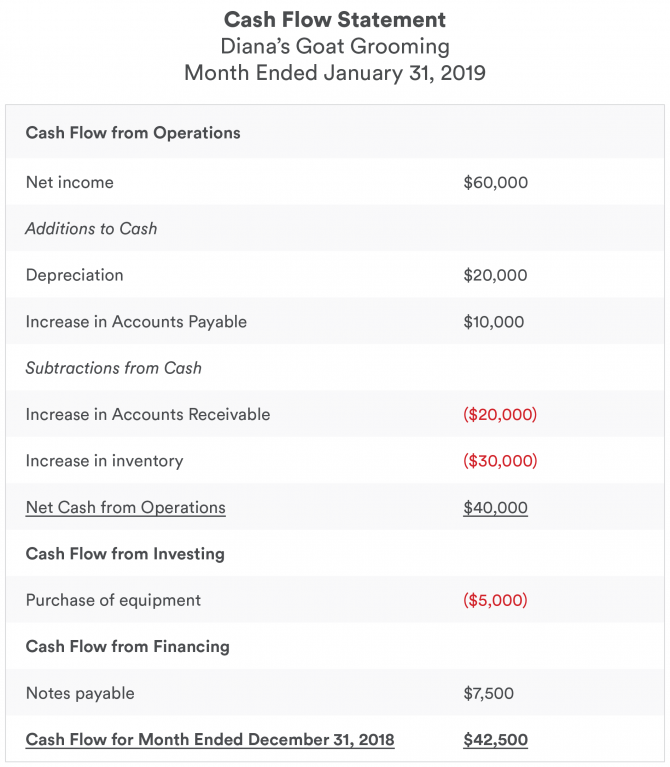

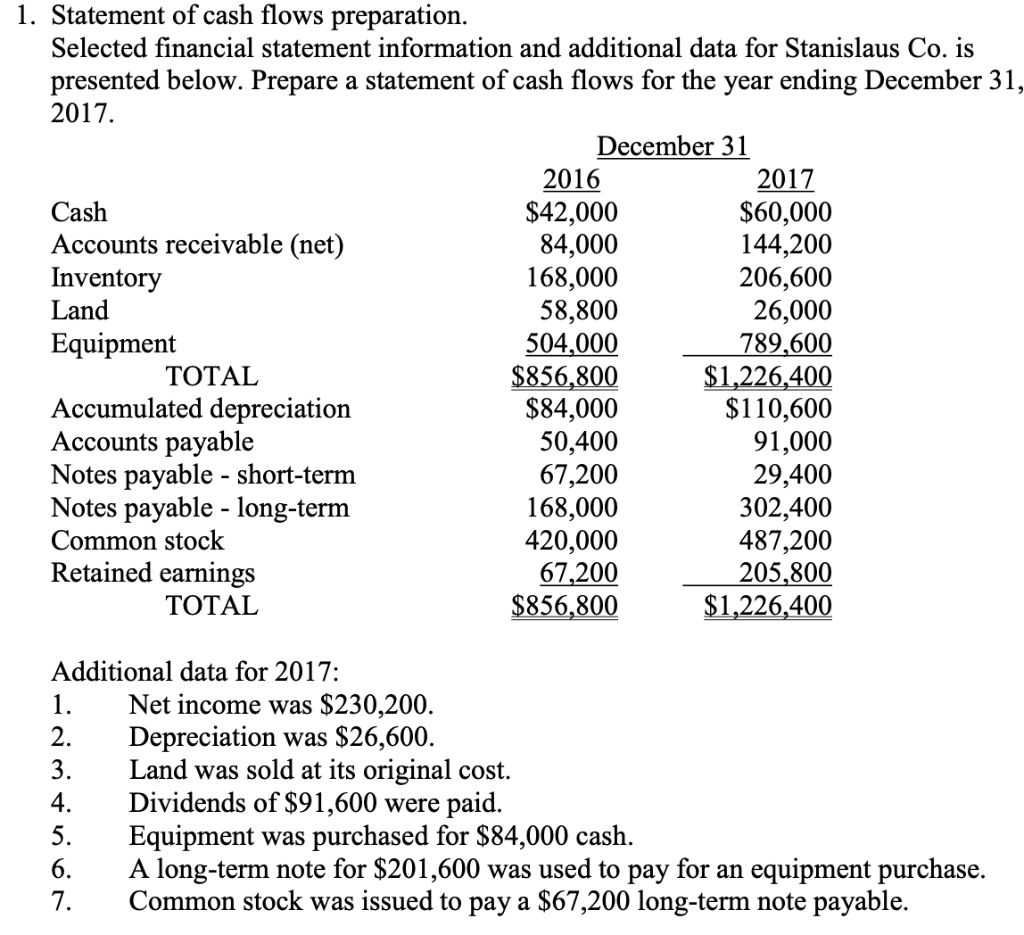

Interest payable in cash flow statement. Accounts payable is also recorded in the cash flow statement since it involves. While in the cash flow statement it is treated under the operating activities. Statement of cash flows accounts payable is the sum of money owed to suppliers and creditors.

When a company takes out a loan, it can have a significant impact on its cash flow statement. Regardless of that, these payments represent an expense for the issuer. Some of the big 4.

Bonds also mention the dates on which the interest income becomes. Definition of interest expense interest expense is the cost of borrowing money. This is because the amount owed needs to be paid back over time, with.

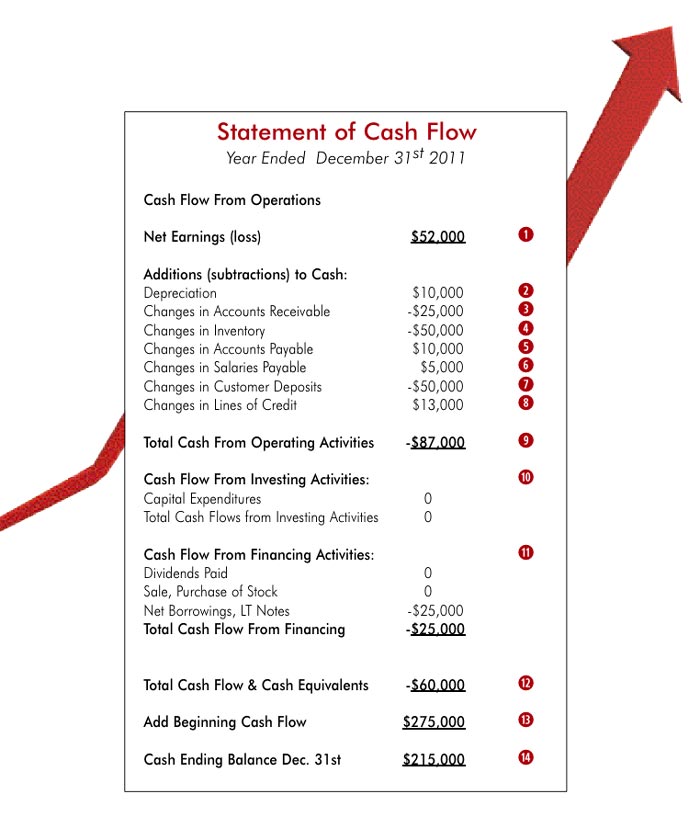

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a. A cash flow statement summarizes a company's cash inflows and outflows. Interest payables entail the charges imposed on a lending a company had taken from a creditor and require repayments within a given period.

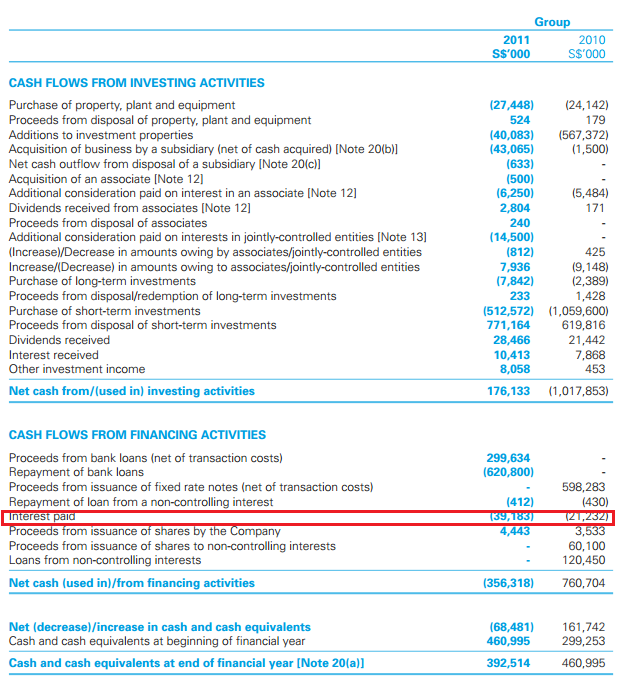

Paragraph 53 has other specific disclosures such as to disclose the interest expense and the total cash outflow, but those are usually covered within the notes. The expense paid on the loans and bonds is an expense out through the income statement. The direct method of presenting the statement of cash flows presents the specific cash flows associated.

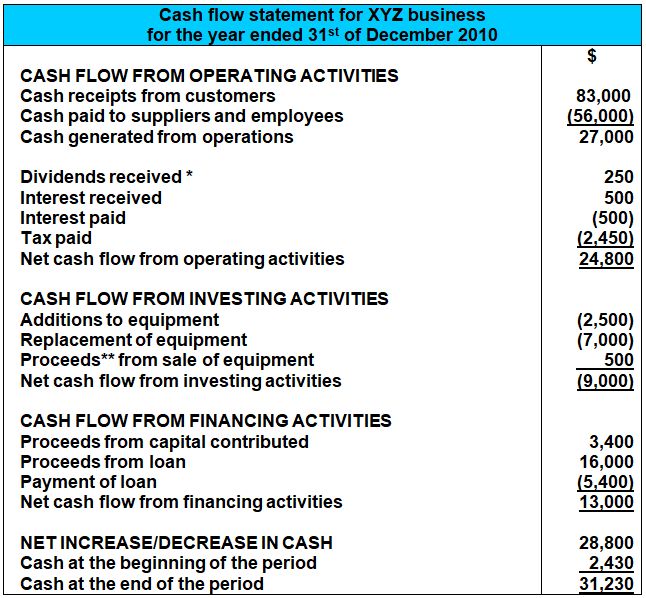

The cash flows from financing activities section reports the cash flows associated with the issuance and repurchase of a corporation's bonds and capital stock, the payment of. November 14, 2023 what is the cash flow statement direct method? For the lender, they are an income.

The interest paid on a note payable is reported in the section of the cash flow statement entitled cash flows from operating activities.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)