Fantastic Tips About Stock Repurchase Cash Flow Statement

Repurchase of common stock — (75) proceeds from issuance of convertible notes, net of issuance costs.

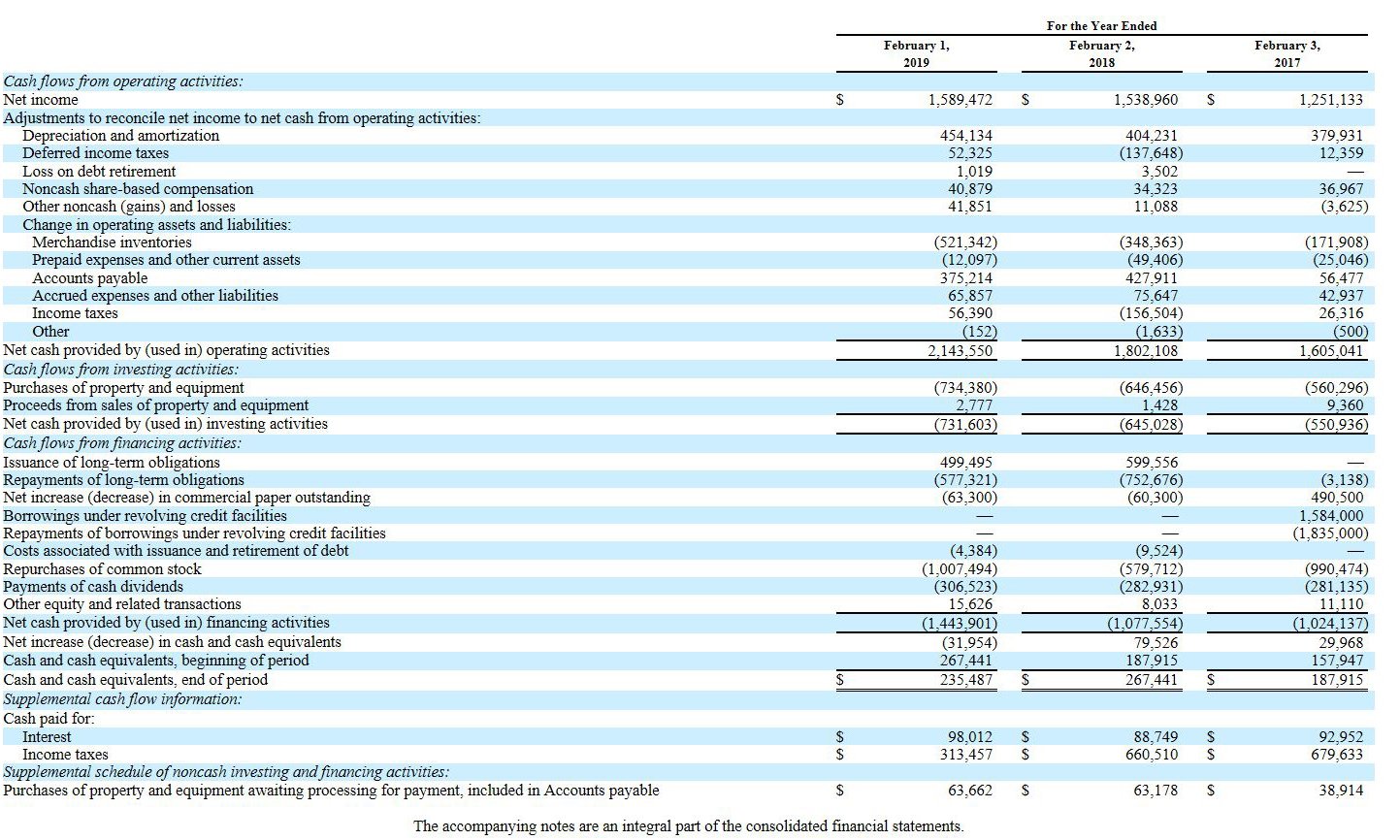

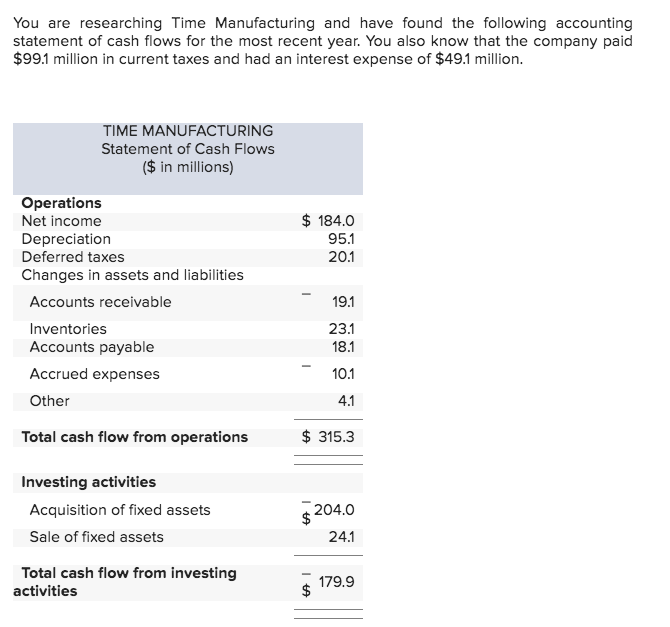

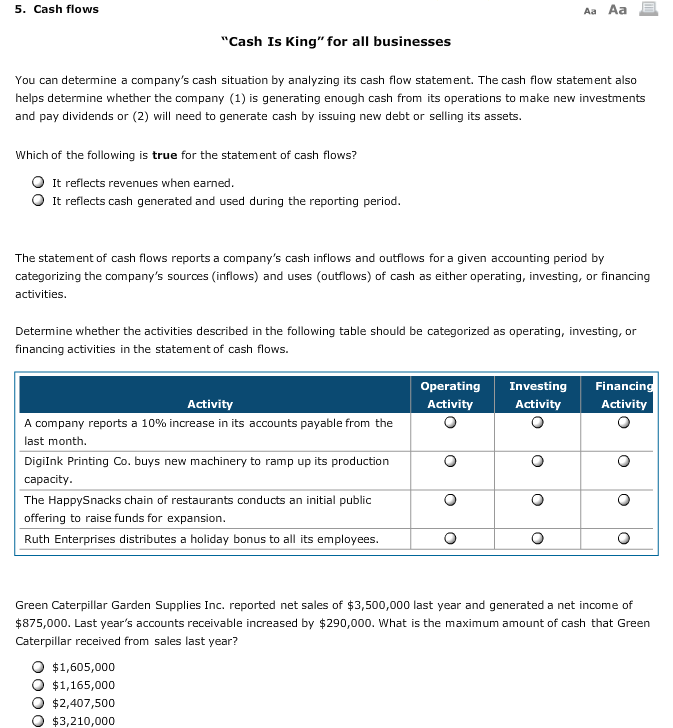

Stock repurchase cash flow statement. In order to repurchase stock, the company has to make payments to the existing shareholders resulting in a cash outflow. The cash flow statement, also called the statement of cash flows, is a financial statement showing how cash flows in and out of a company over a specific period of time. Detailed cash flow statements for jianpu technology inc (jtchy), including operating cash flow, capex and free cash flow.

That stock would now be considered treasury stock since the company owns their own stock (reduces the equity owned by shareholders). It tells you how cash moves in and out of a company's accounts via three main channels: When a company issues new stock for cash, assets increase with a debit, and equity accounts increase with a credit.

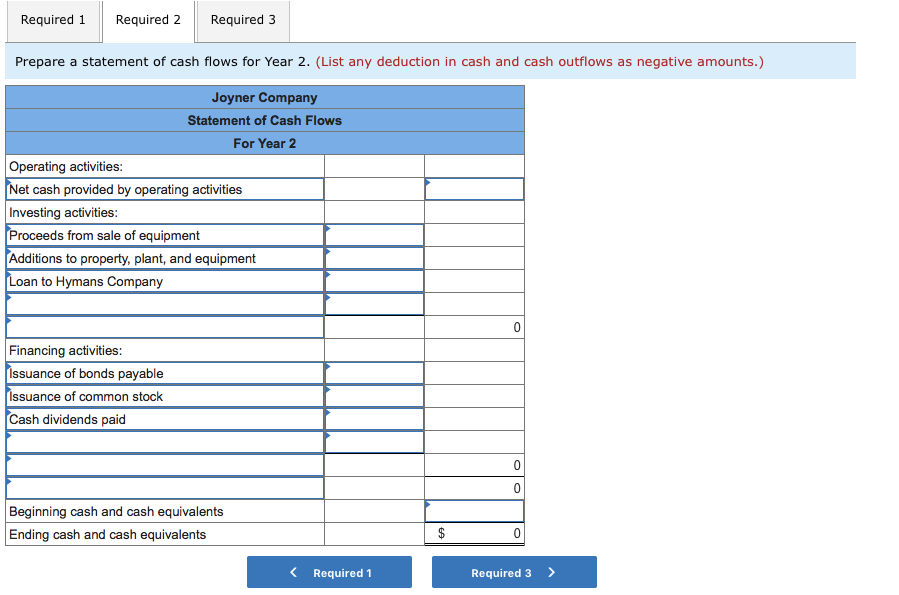

The three net cash amounts from the operating, investing, and financing activities are combined into the amount often described as net increase (or decrease) in cash during the year. The first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. Reconciling the increase in cash from the scf with the change in cash reported on the balance sheet.

You also may get the amount spent on share buybacks from the statement of cash flows in the financing activities section, and from the statement of changes in equity or statement of. Issuing common stock with a par value in exchange for cash. Treasury stock on statement cash flow the purchase of treasury stock is the transaction that causes cash flow out of the company.

It paves the way for a few different phenomena. A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. Effect of treasury stock on statement of cash flow:

The company needs to spend cash to acquire its own shares back. To illustrate, assume that la cantina issues 8,000 shares of common stock to investors on january 1 for cash, with the investors paying cash of $21.50 per share. Financials in millions cny.

Now that you understand what comprises a cash flow statement and why it’s important for financial analysis, here’s a look at two common methods used to calculate and prepare the operating activities section of cash flow statements. First, many technical analysis metrics such as earnings per share (eps) or cash flow per share (cfps) will increase due to a decrease in the denominator used to produce the figures. A company might buy back its shares to boost the value of the stock and to improve.

On the cash flow statement, the share repurchase is reflected as a cash outflow (“use” of cash). Detailed cash flow statements for the boeing company (ba), including operating cash flow, capex and. Cash flow from financing activities (cff) is a section of a company’s cash flow statement, which shows the net flows of cash used to fund the company.

The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. When a company repurchased or reacquires their own common stock, that represents a cash outflow. Share repurchases can have a significant positive impact on an investor’s portfolio and belong a great way to build investor wealth through time.

The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). How cash flow is calculated. The cash flow statement is one of the three main statements that comprise a company’s financial statements (the other two being the balance sheet,.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)