Unique Tips About Not For Profit Audited Financial Statements

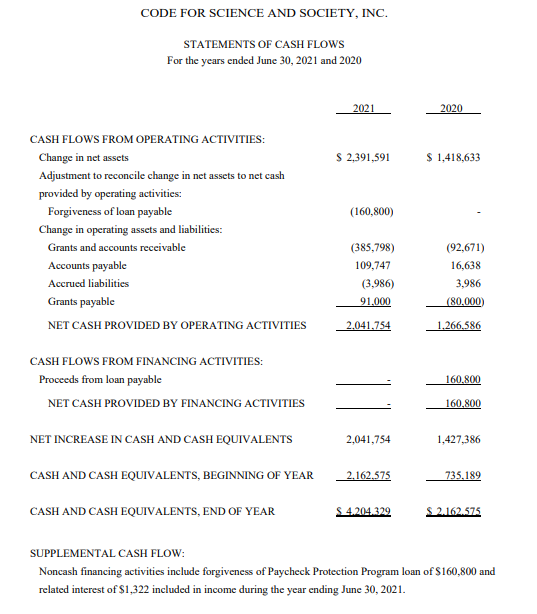

(a nonprofit organization) (the “foundation”) which comprise the statement of financial position as of june 30, 2020, and the related statements of activities and changes in net assets, cash flows, and functional expenses for the year then ended,.

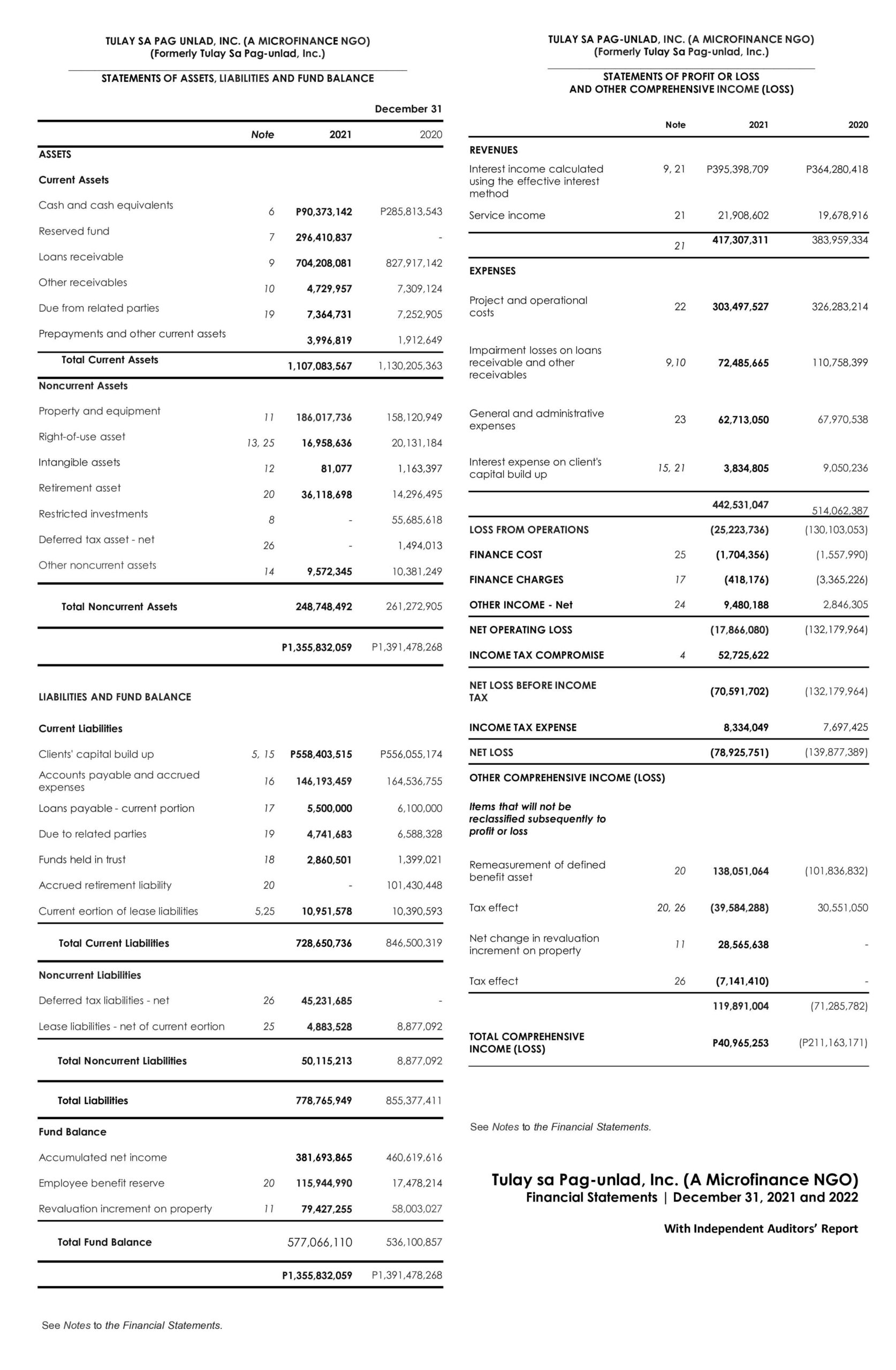

Not for profit audited financial statements. 11 users of the financial statements. The simplest answer is no. We have audited the accompanying financial statements of national council of nonprofits (a nonprofit organization), which comprise the statements of financial position as of december 31, 2022 and 2021, and the related statements of activities and changes in net assets, functional expenses, and cash flows for

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of first as of june 30, 2022 and 2021, and the results of its operations and its cash flows for the years then ended in accordance with u.s. There are cases when you’re required to audit your nonprofit’s finances, but it’s not the irs conducting that audit. This set of illustrative financial statements is one of many prepared by grant thornton to assist you in preparing your own financial statements.

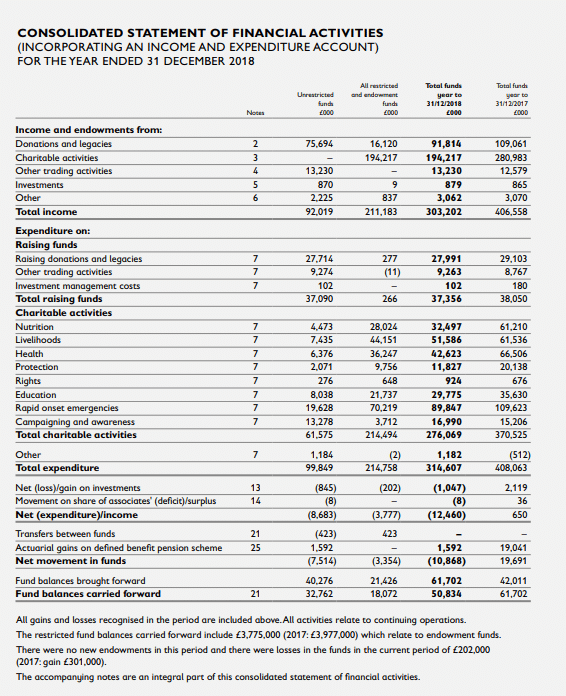

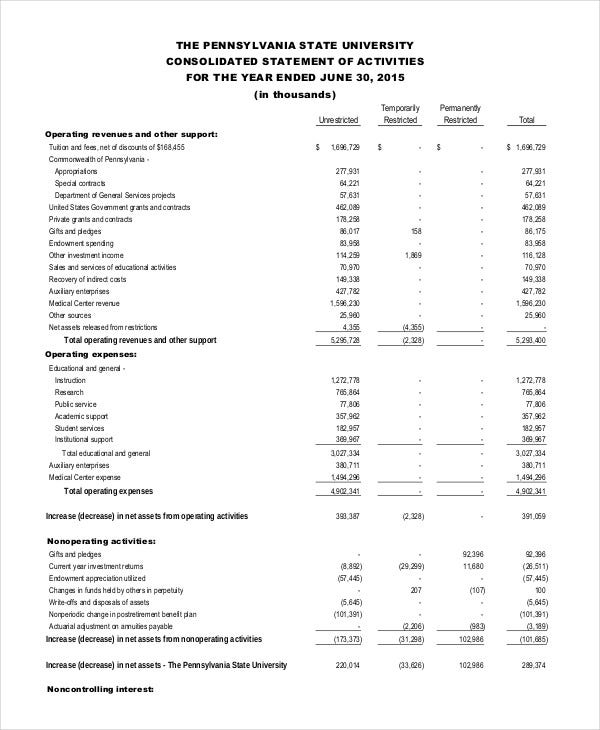

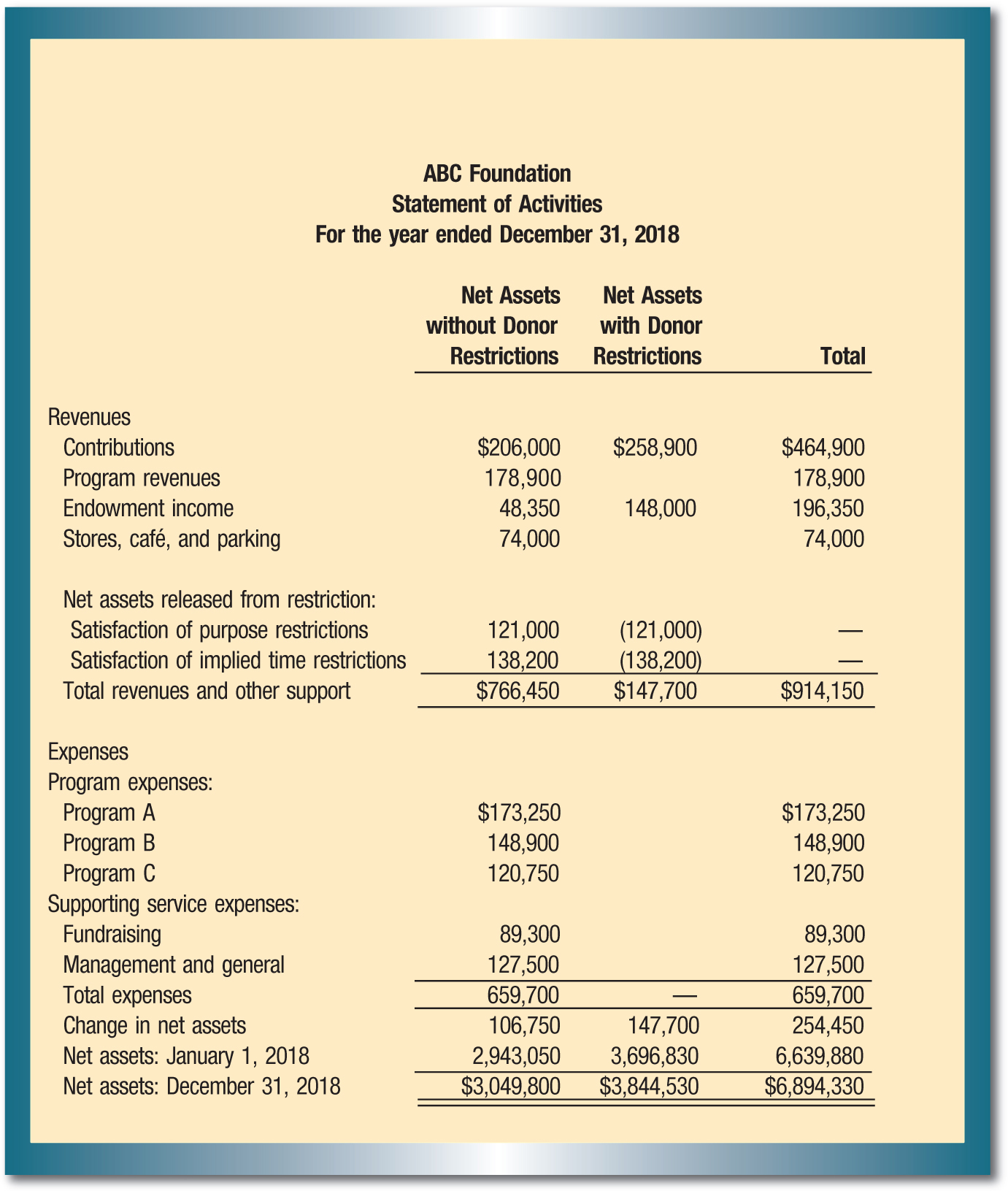

The auditor, with a mandate to directly inspect the books and records of the organization, provides an important check on the presentation of financial information by management. Everyone working in nonprofit accounting and finance, including members of the board of directors, should have a strong grasp of reading and understanding the unique way in which nonprofits present their financial statements. In this article, we’ll walk you through the five nonprofit financial statements that you’ll need regardless of your size or mission.

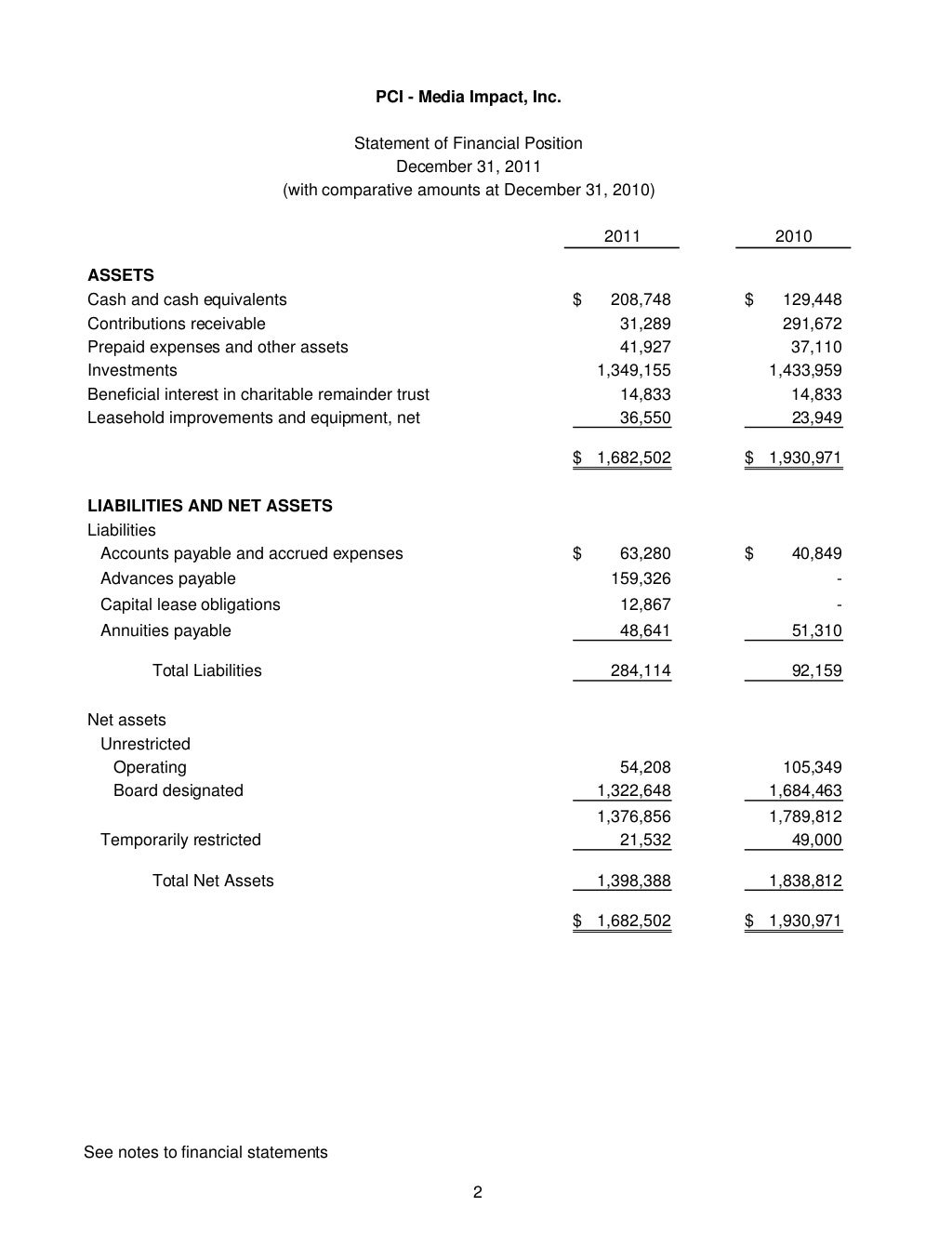

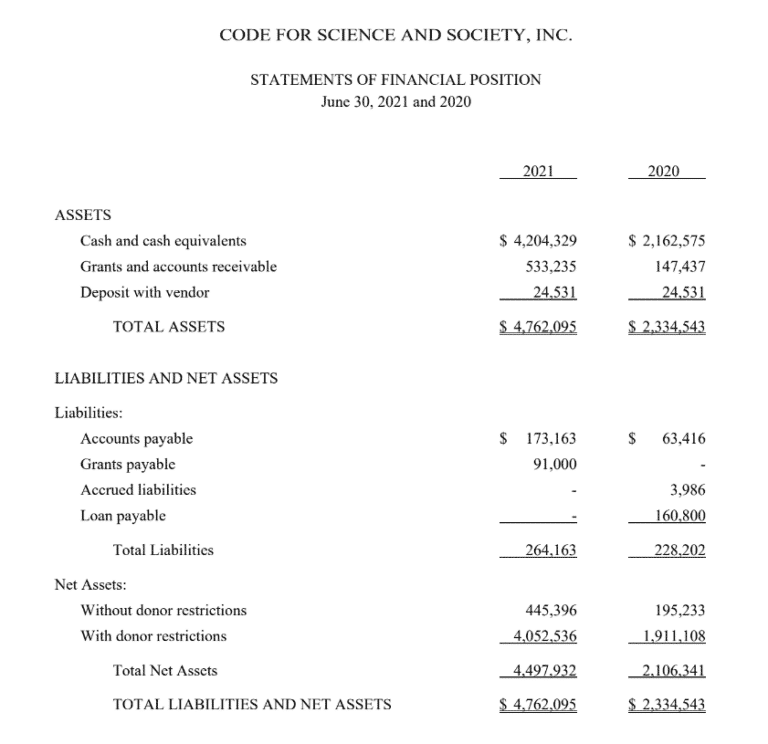

Our subsequent examples of other statements will be from this same report. Nonprofits use the statement of financial position to list their assets, liabilities, and net assets. The firm projected that the audited financial statements for 2023 and the first quarter of 2024 would be filed with the ngx on or before june 29 and july 29, 2024, respectively.

6 basic roles and responsibilities. Guiding principles of the audit committee. Assets = liabilities + net assets here’s an example from code for science & society’s statement of financial position from 2021.

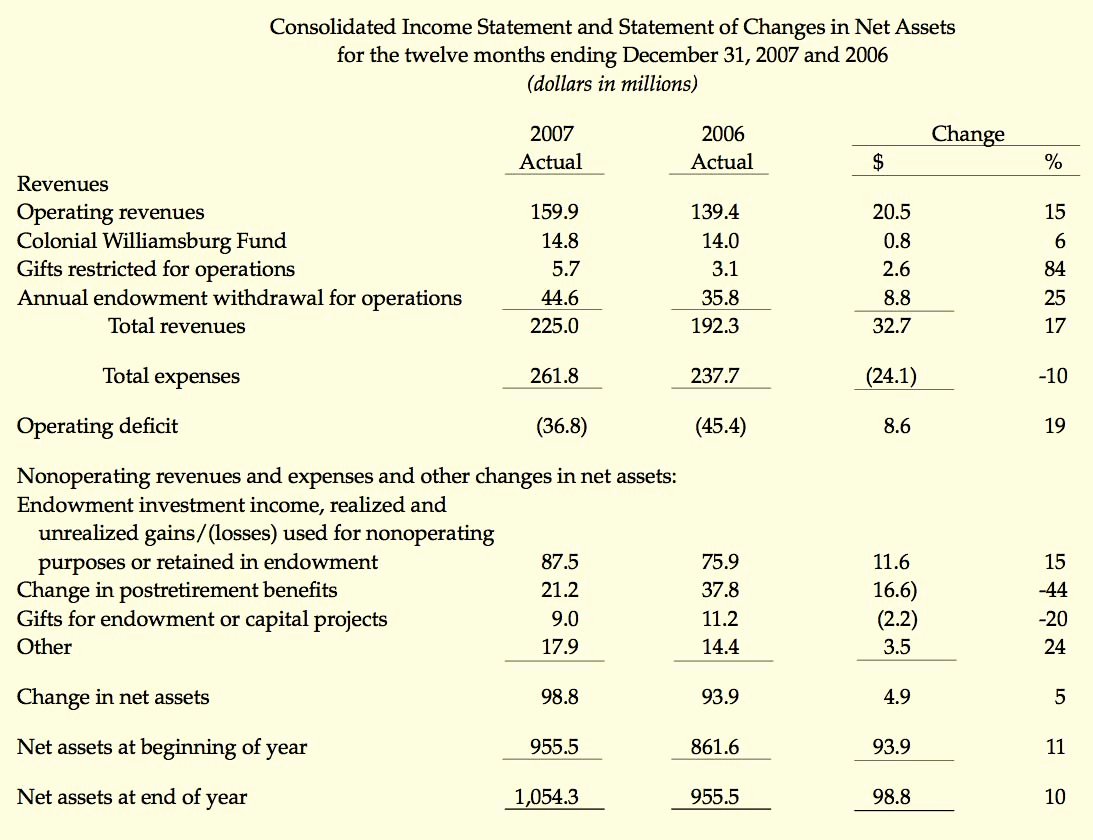

Abstract preface chapter 1 — introduction chapter 2 — general auditing considerations chapter 3 — financial statements, the reporting entity, and general financial reporting matters chapter 4 — cash, cash equivalents, and investments chapter 5 — contributions received and agency transactions chapter 6 — split. Presentation and consideration of annual activity reports and audited financial statements of kanifing municipal council for the years ended from 31. Income from operations of $652 million;

Let’s start with the basics: We have audited the accompanying financial statements of national pediatric cancer foundation, inc. In addition, nonprofit board of directors should also familiarize themselves with the unique way in which nonprofits present their financials.

Whether you are preparing or auditing them, you'll find the tools you need in this helpful resource. But, the more realistic answer is it depends. The financial statements must be prepared in accordance with the canadian generally accepted accounting principles (gaap) as set out in the cpa canada handbook.

On this site, you will find resources on accounting and financial reporting for nfps, including illustrative financial statements and various articles on accounting topics. Generally, your organization will hire an independent auditor to analyze your statements and records. Download these linked documents in excel and word to understand how the elements.

Your financial statements also play a crucial role in maintaining your nonprofit status and passing an independent audit (which you may need to keep your funding). (a nonprofit organization), which comprise the statements of financial position as of december 31, 2021 and 2020, and the related statements of activities, functional expenses, and cash flows for the years then ended, and the related notes to the financial statements. Record adjusted ebitda margin fourth.