Ideal Info About A Balance Sheet Discloses The Financial Position Of Firm P&l Spreadsheet Template

For example, here are a few instances in which a balance sheet and p&l are necessary:

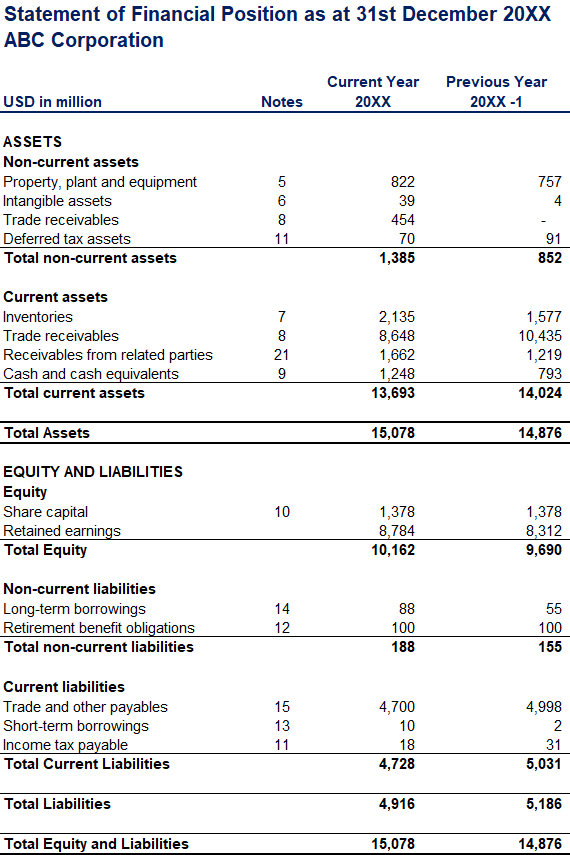

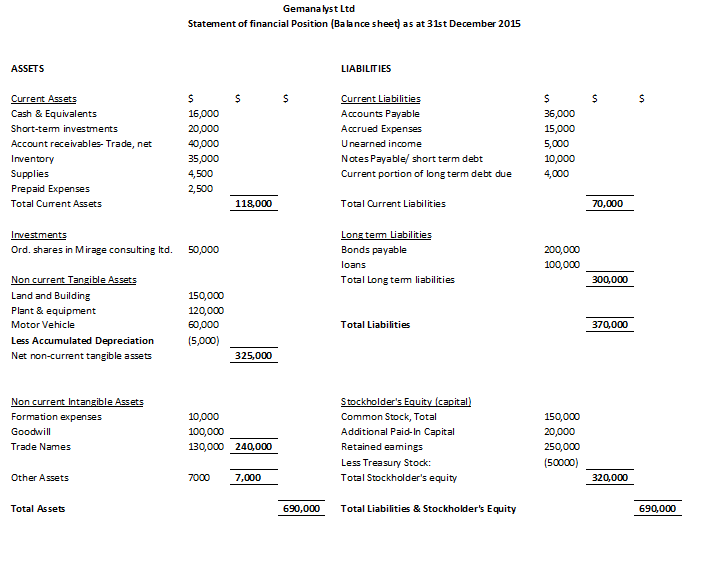

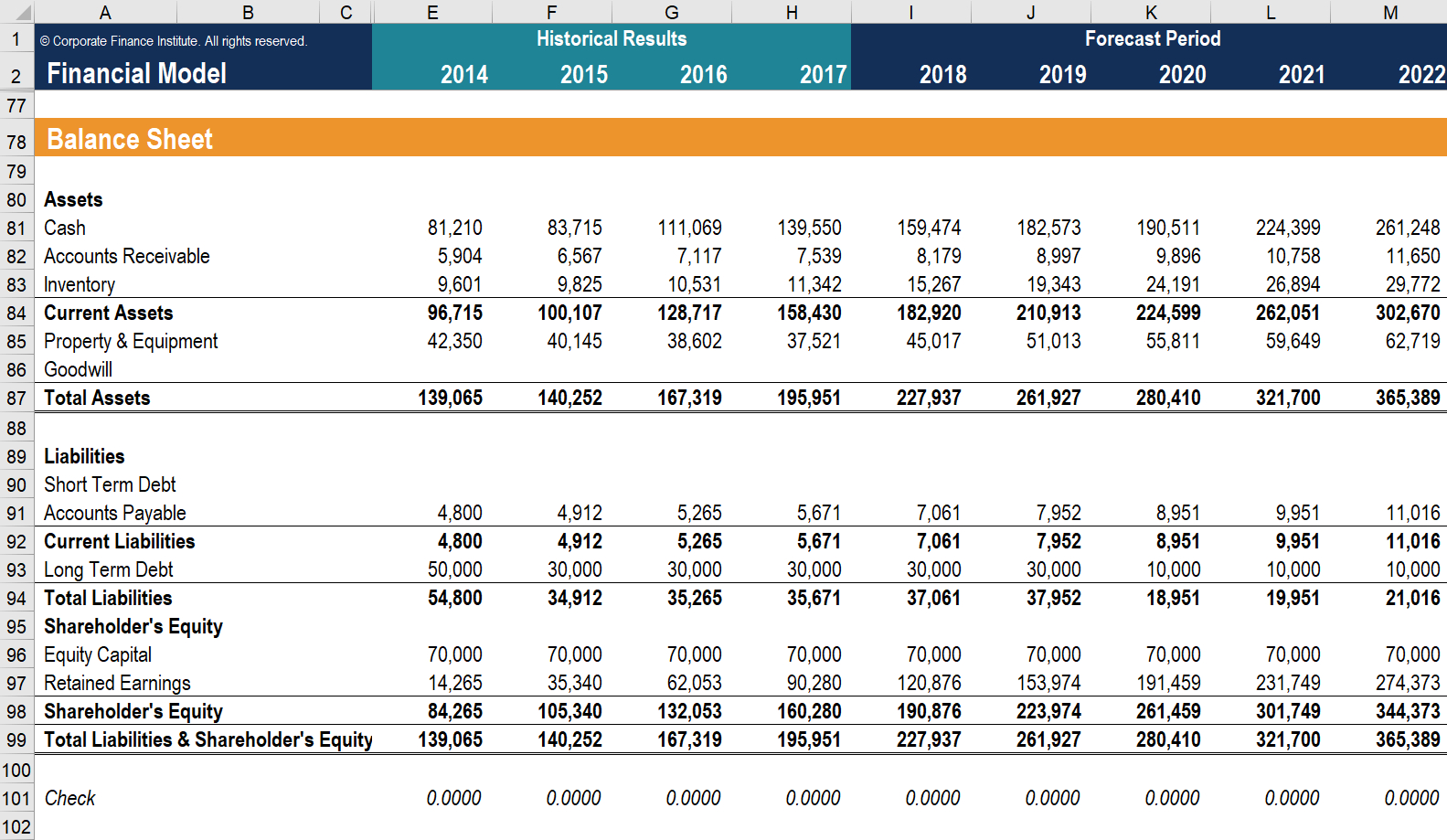

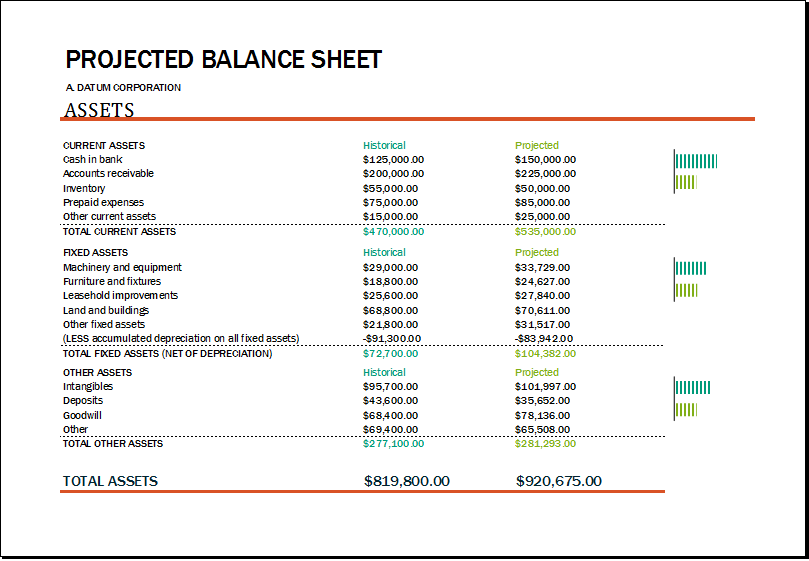

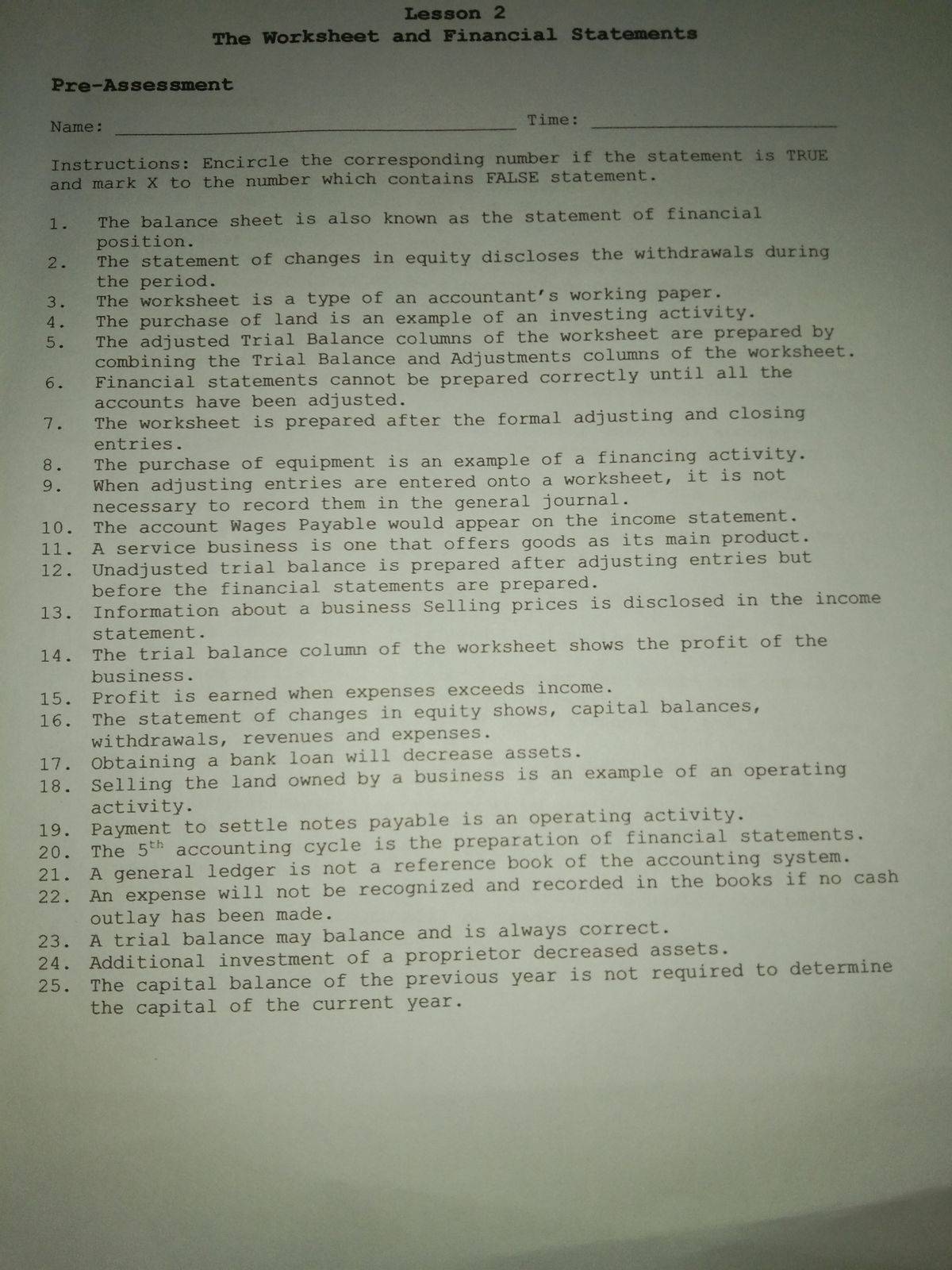

A balance sheet discloses the financial position of a firm p&l spreadsheet template. Thus, it is also called statement of financial position. A balance sheet is a financial statement that illustrates a company's financial situation. The balance sheet is one of the three fundamental financial statements and is key to both financial modeling and accounting.

Provides a snapshot of a firms financial position at one point in time. So, the assets and liabilities must be shown in such a manner that the financial position of the business can be assessed through it easily and quickly. The balance sheet is one of the three core financial statements that are used.

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Here's the main one: A balance sheet is a statement that discloses the financial position of its assets, liabilities and capital on a specific date.

A balance sheet and p&l statement can and should be used in different scenarios, depending on the financial period and the need to understand your company’s financial position. After all, that’s what analysts, proprietary traders, and institutional investors do. A company balance sheet shows that the total assets of a business are $1,200,000, and its liabilities are $600,000;

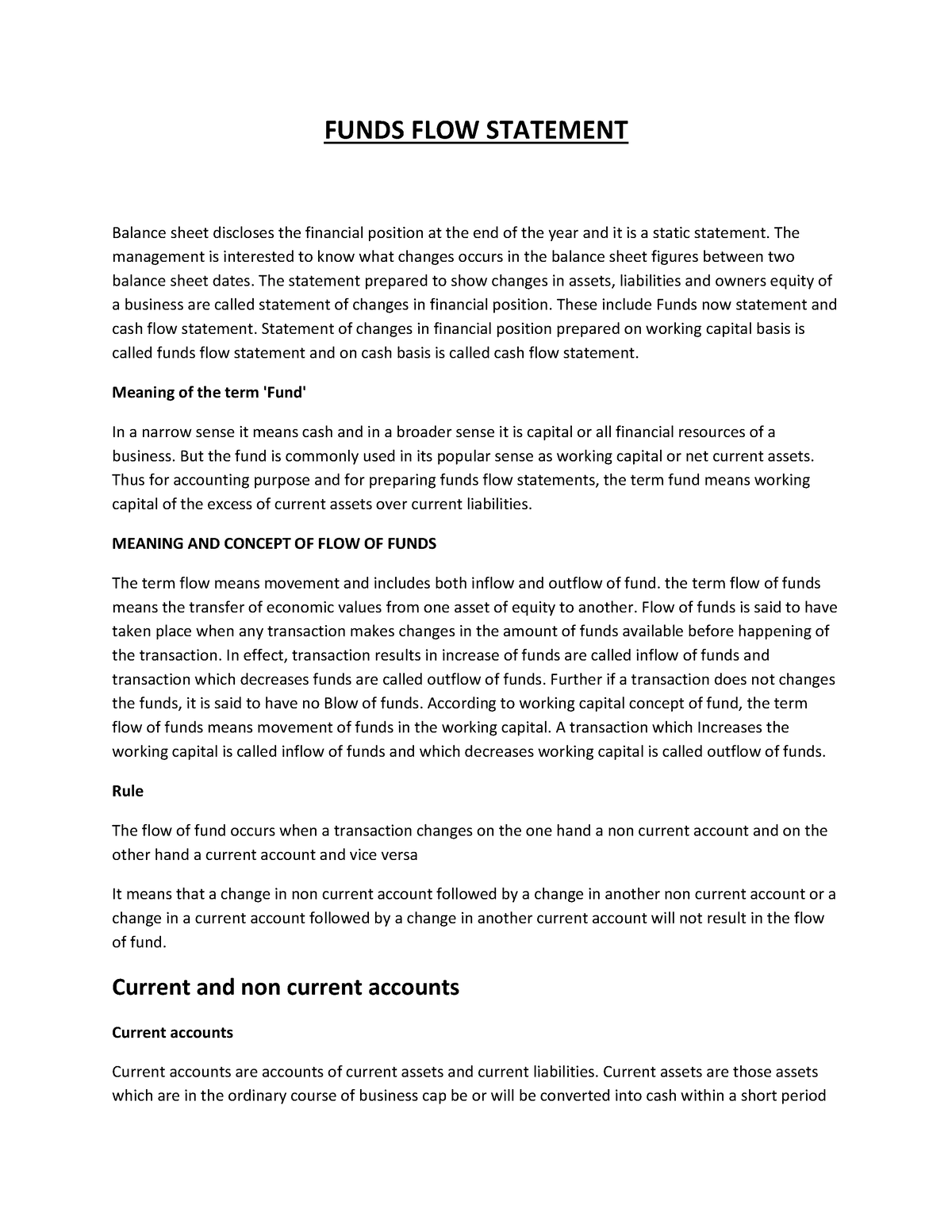

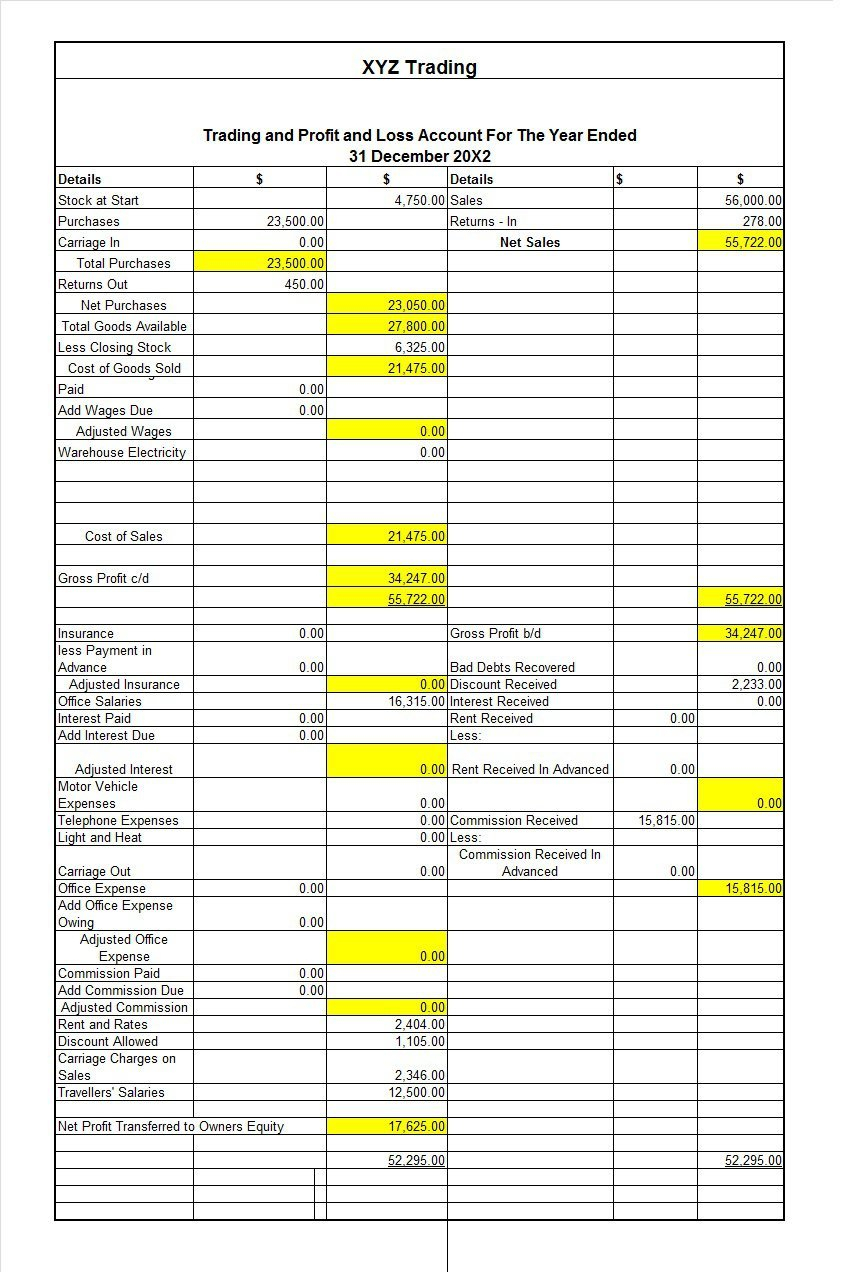

The balance sheet discloses financial position of the business it is prepared after trading and profit and loss account is prepared. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. It is based on an accounting equation stating that the total liabilities and the owner’s capital equal the company’s total assets.

A profit and loss account is an account that shows the revenue and expenses of the firm from business operations during a financial year. And the third states the date of the report. As we have discussed that the main purpose of balance sheet is to disclose a true and fair financial position of a business on a particular date.

The first line presents the name of the company; The p&l statement is one of three. A typical balance sheet starts with a heading which consists of three lines.

Then, the net worth of a. Summarizes a firms revenues and expenses over a given period of time. The balance sheet is a key financial statement that provides a snapshot of a company's finances.

Assets the assets section of the balance sheet contains the asset accounts of the business. Here are a few ratios to consider: The second describes the title of the report;

The balance sheet is split into two columns, with each column balancing out the other to net to. A company's financial position also includes shareholder. Test your knowledge on final accounts with this fun mcq quiz!

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)