Supreme Info About Financial Liabilities In Balance Sheet

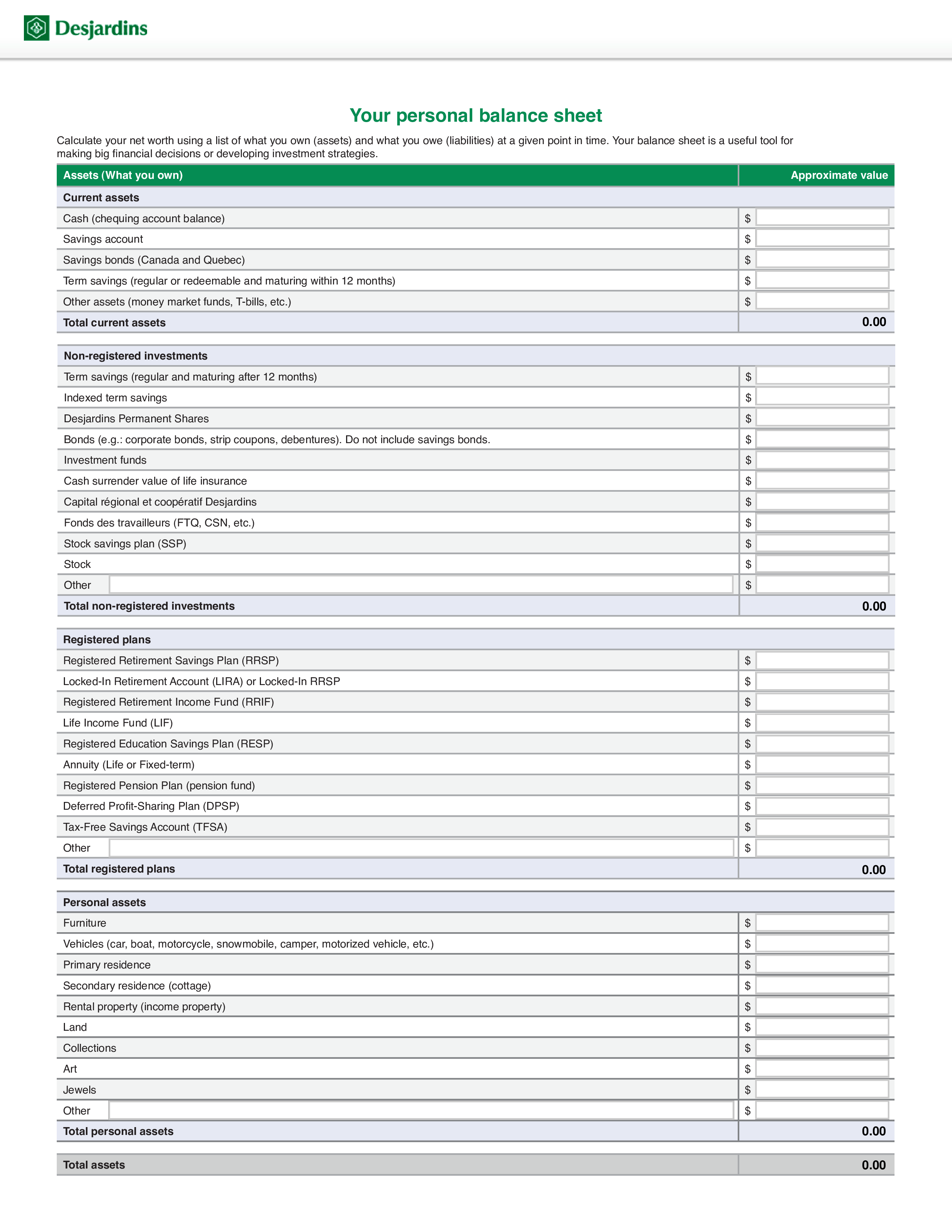

It can also be referred to as a statement of net worth or a statement of financial position.

Financial liabilities in balance sheet. Assets = liabilities + equity. Ias 32 outlines the accounting requirements for the presentation of financial instruments, particularly as to the classification of such instruments into financial assets, financial liabilities and equity instruments. Almost all of the financial liabilities can be listed on the entity’s balance sheet.

Key terms cash flow from operating activities financial statement analysis revenue gross profit gross income accounts payable The interest rates are fixed and the amounts owed are clear. The way financial assets and liabilities are classified determines how they are accounted for in financial statements, particularly how these financial instruments are measured following their.

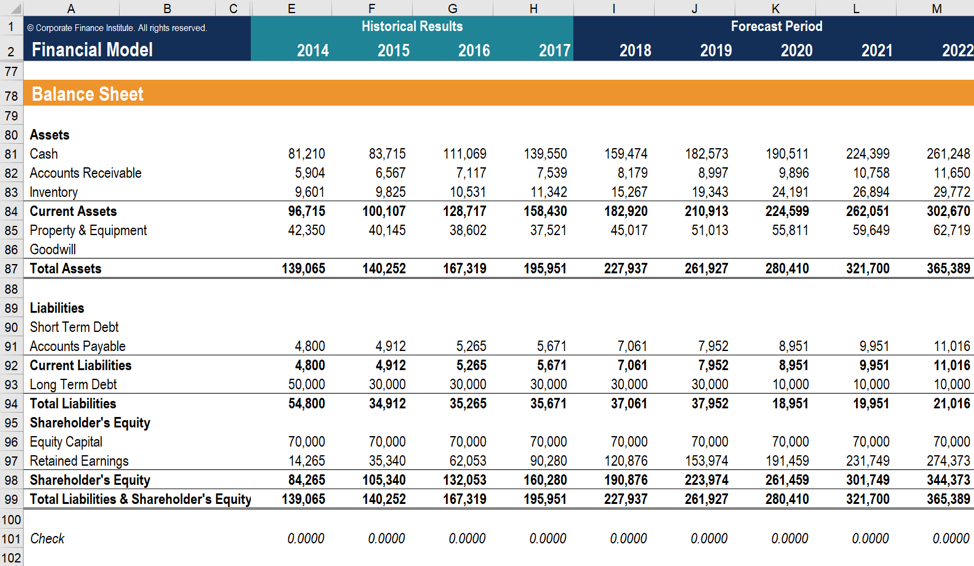

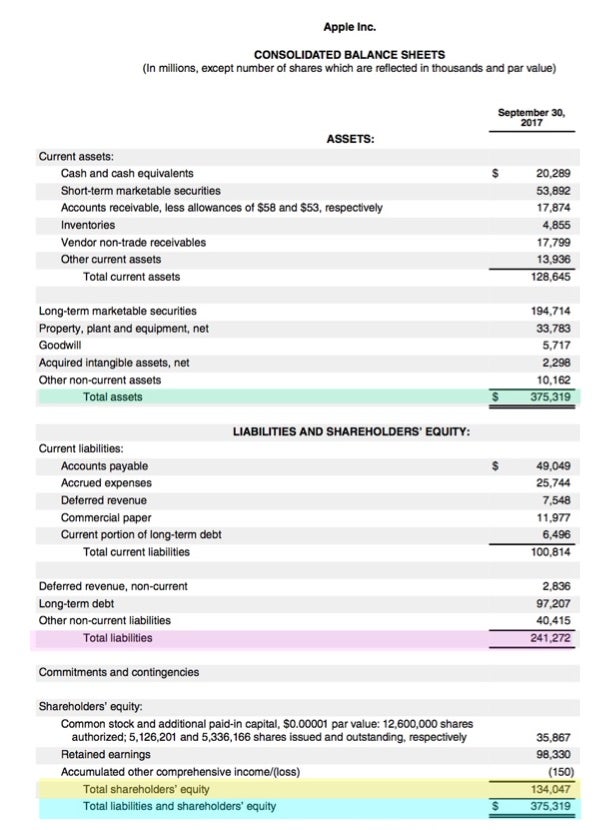

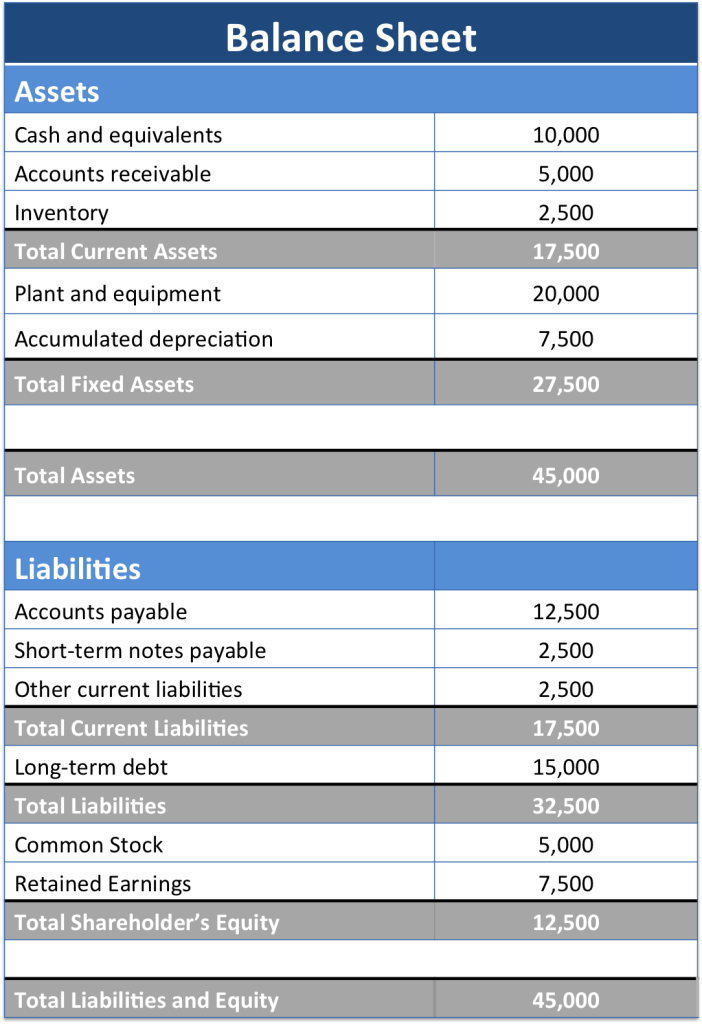

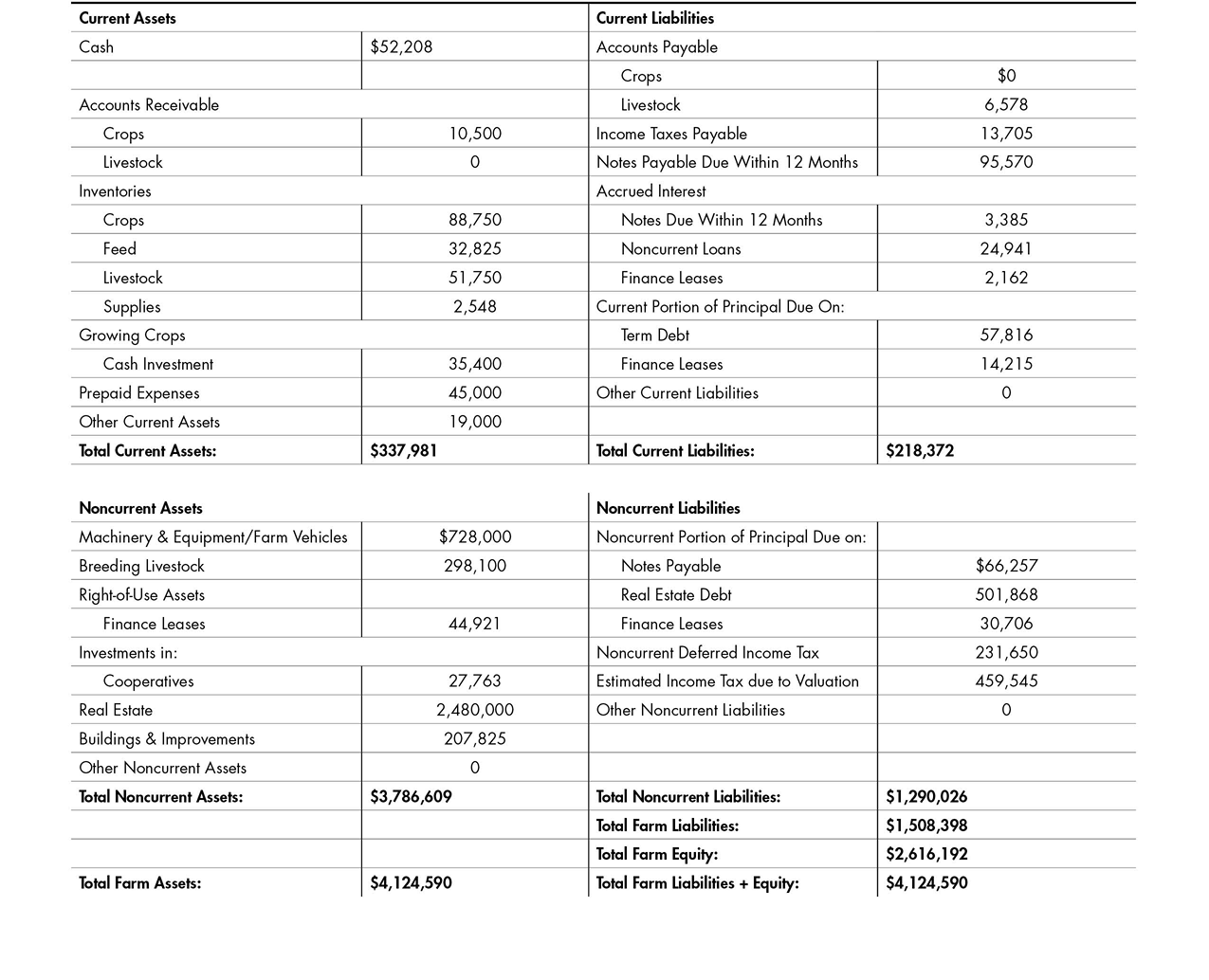

Learn what a balance sheet should include and how to create your own. The main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date. The calculation of liabilities from the balance sheet can be done by breaking them up and looking at them in detail.

The opposite of assets are liabilities. Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, bonds, warranties, and accrued expenses. The standard also provide guidance on the classification of related interest, dividends and gains/losses, and when financial.

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. One of the fundamental tenets of accounting is that this relationship between assets, liabilities, and owners’ equity must always be in balance (hence the name “balance sheet”): Does the balance sheet always balance?

Assets = liabilities + shareholders’ equity. Fundamental balance sheet equation. A company's balance sheet is a snapshot of assets and liabilities at a single point in time.

With liabilities, this is obvious—you owe loans to a bank, or. The balance sheet is so named because all of the assets. Current liabilities are those that are expected to be settled within one year, or one operating cycle―whichever is longer.

Liabilities in a balance sheet are the commitments of the company to external parties. A balance sheet is a financial statement that reports a company's assets, liabilities and. There is no single method for analyzing financial liabilities.

A balance sheet gives us the financial position of a business at a particular point in time. Liabilities are what a company owes, such as taxes, payables, salaries, and debt. Fundamental analysts focus on the balance sheet when considering an investment opportunity or.

Assets = liabilities + owners’ equity. Liabilities are amounts that the company owes and will have to settle in the future. Or, if you prefer to look at it in equity terms:

:max_bytes(150000):strip_icc()/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)