Smart Tips About Ocboa Balance Sheet Format For Section 8 Company

Section 8 company as per companies act, 2013 (section 25 as per companies act, 1956) 2.

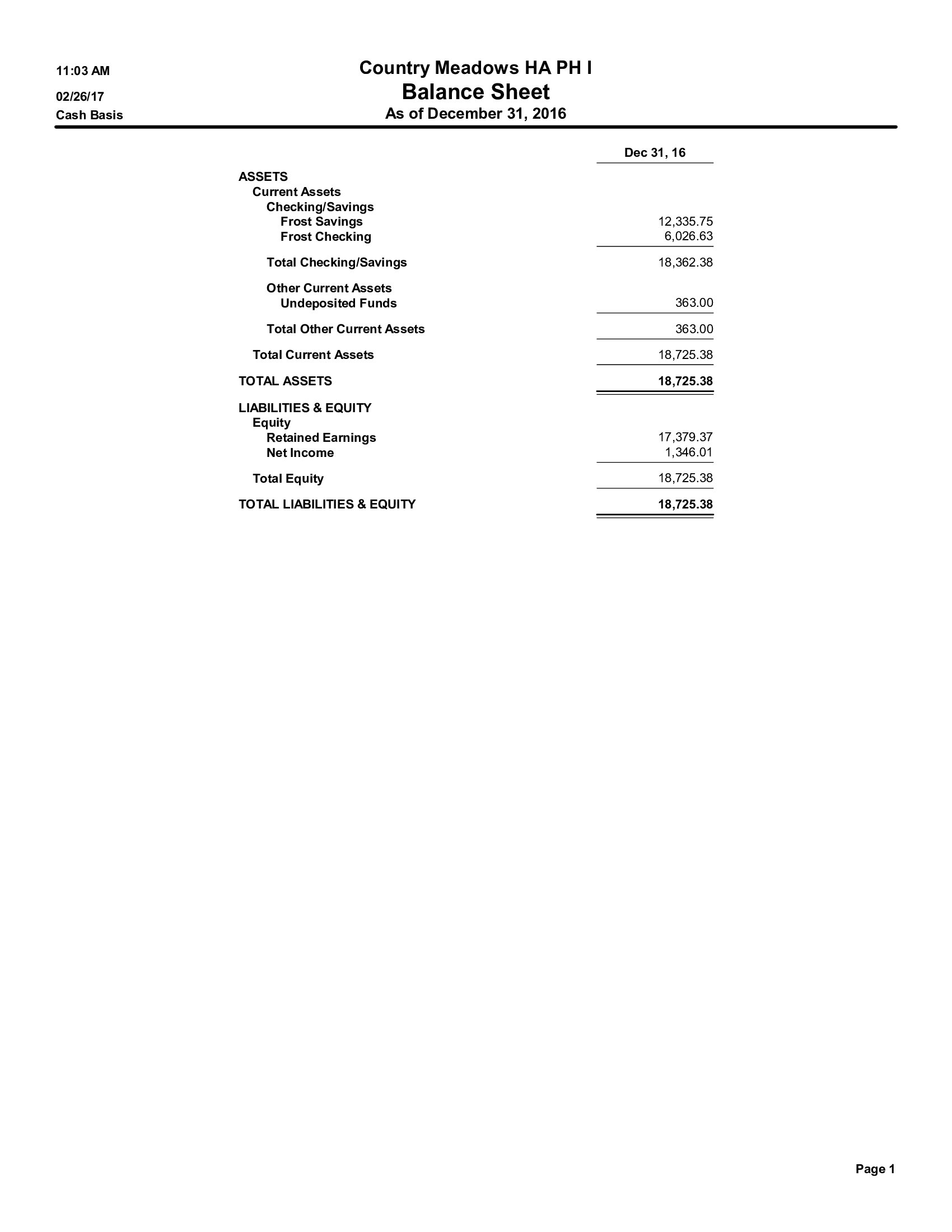

Ocboa balance sheet format for section 8 company. The book of accounts and annual returns of the company shall be audited by the statutory auditor who will be appointed for a period of 5 years. This practice aid is intended to provide preparers of cash‐ and tax‐basis financial statements with guidelines and best practices to promote consistency and for resolving the often difficult questions regarding the preparation of such financial statements. (ii) a profit and loss account, or in the case of a company carrying on any.

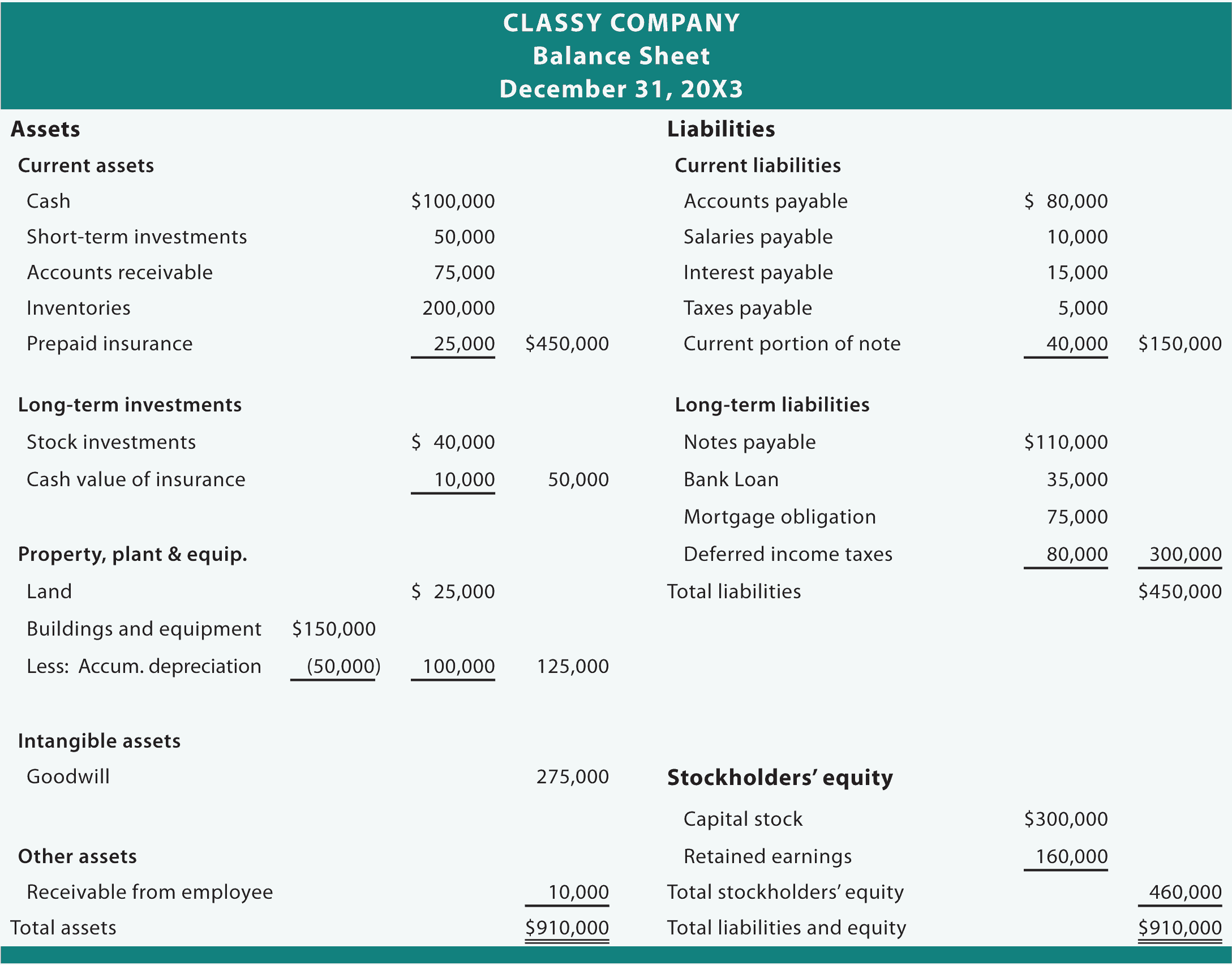

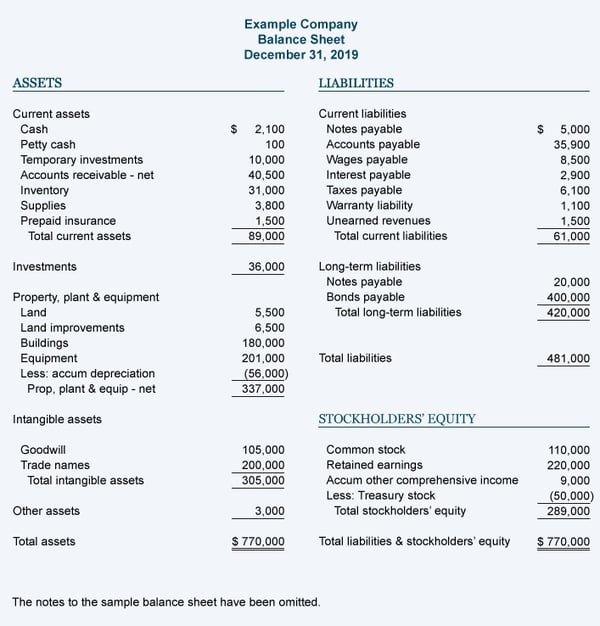

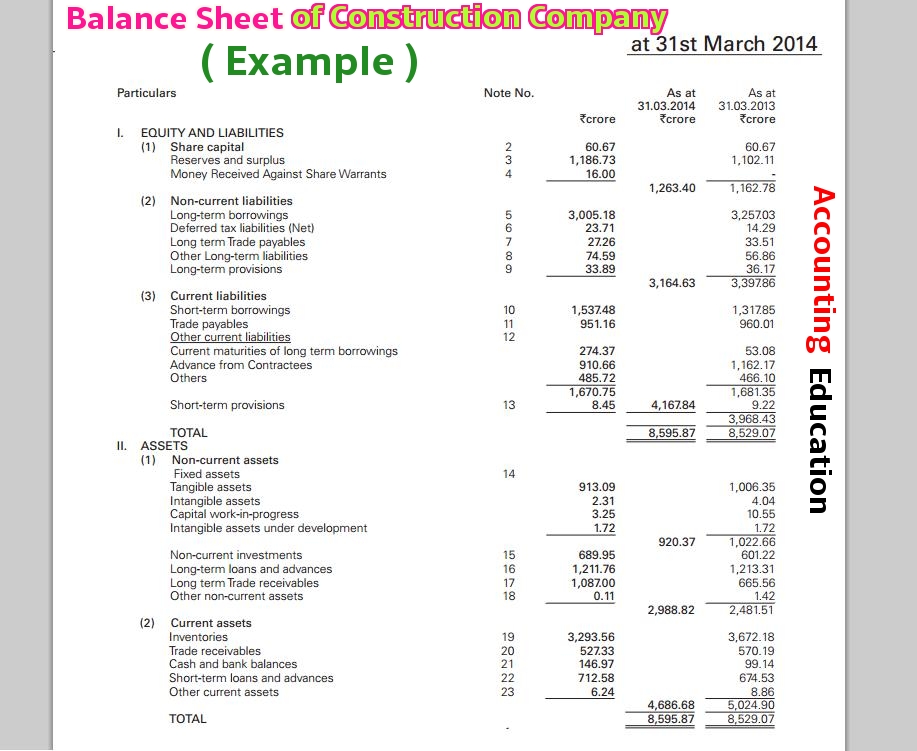

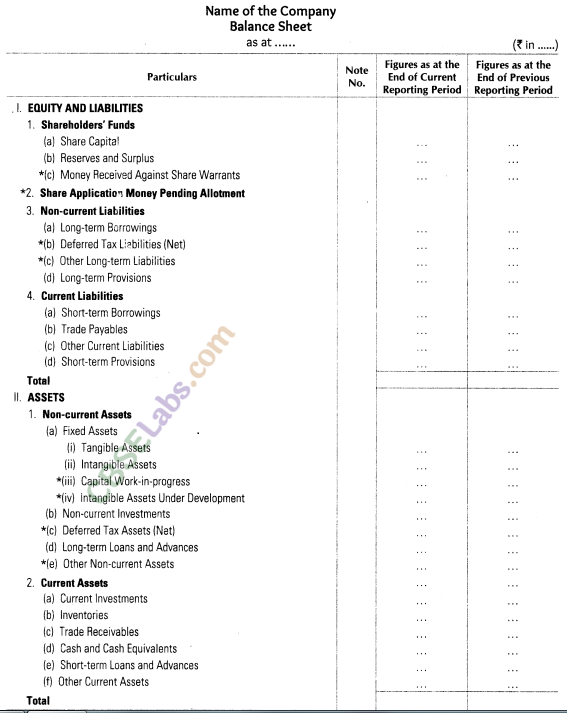

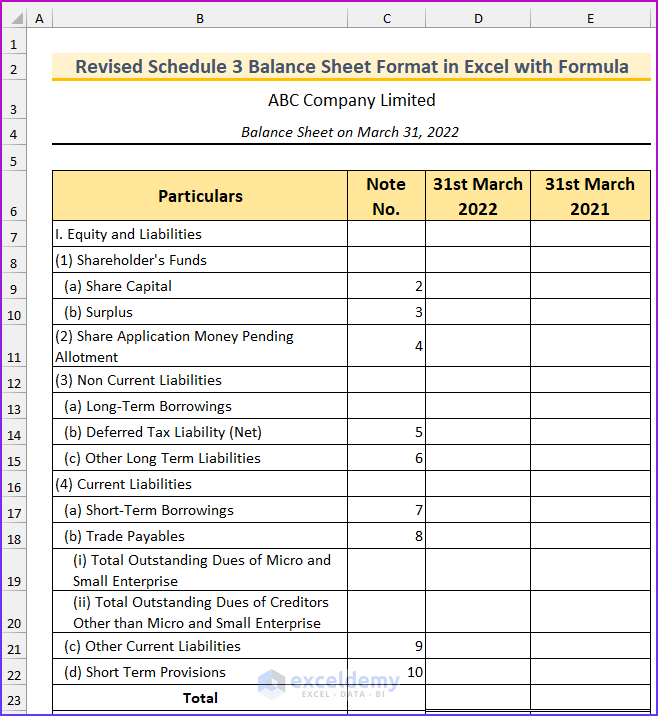

Section 8 companies should prepare its financial statements in compliance of section 2 (40) of the act. Section 8 company balance sheet format. Ocboa balance sheet format for section 8 company.

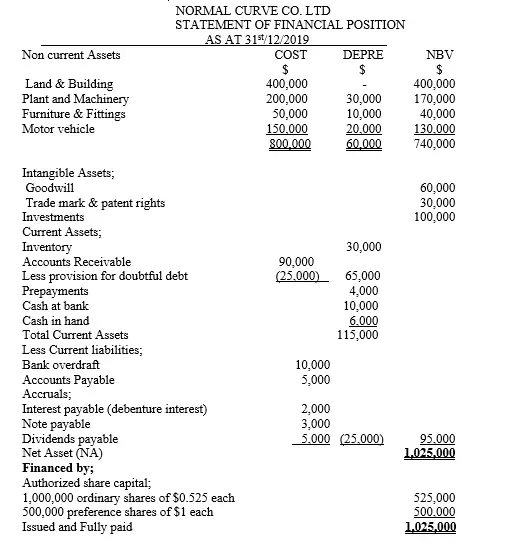

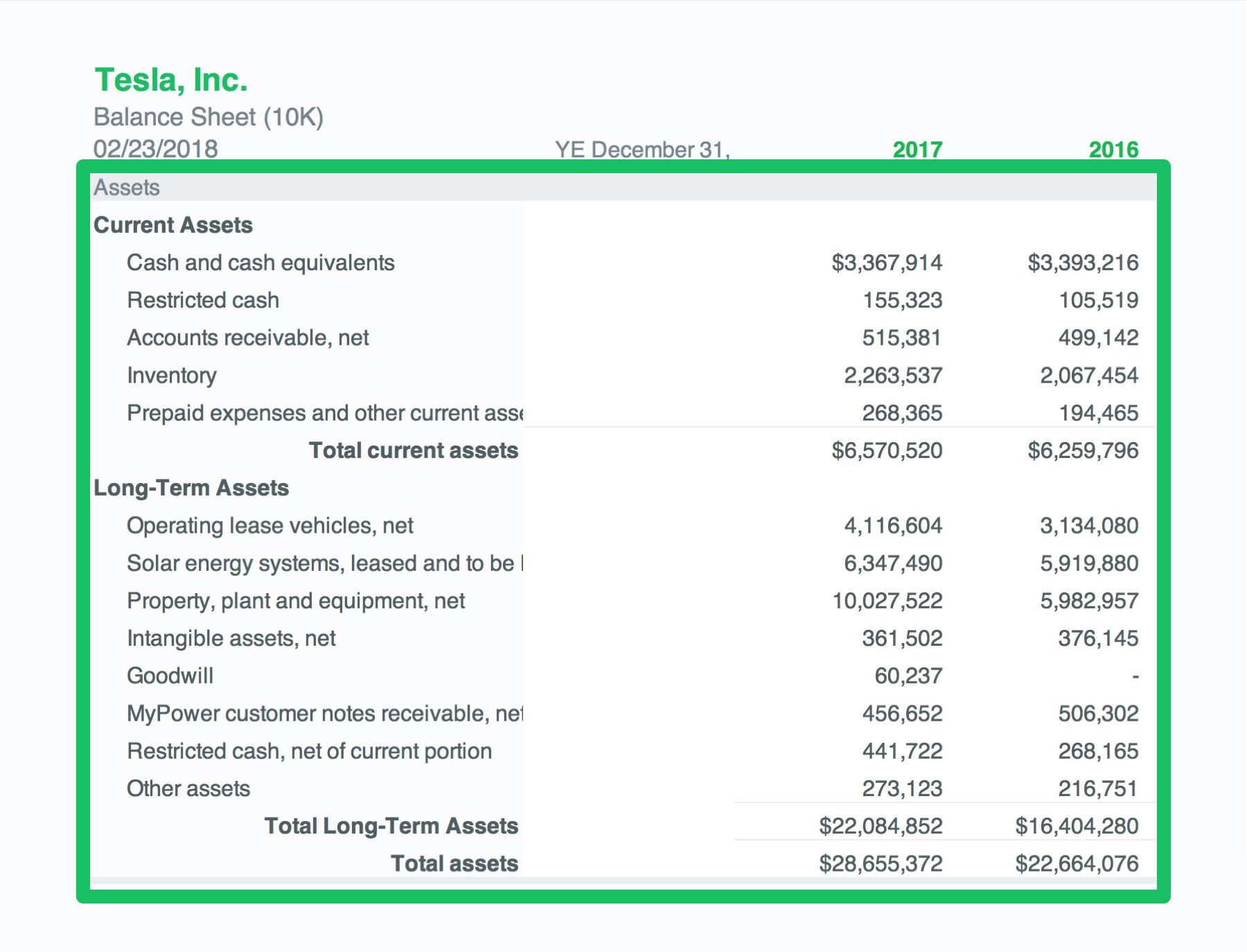

This section includes the company’s income statement, balance sheet, and cash flow statement. The balance sheet, profit and loss statement, cash flow statement, and other financial statements must be provided by the company. Of agm) annual report together with the audited statement of accounts of your company for the financial year ended march 31, 2023.

It provides a snapshot of the company’s financial health, including its. Financial statements should refer to statements on auditing standards, including au‐c section 800, special con‐ siderations—audits of financial statements prepared in accordance with special purpose frameworks (aicpa, professional standards). This includes the balance sheet, income statement (profit and loss account), and cash flow statement.

The companies (incorporation) rules, 2014. Practitioners engaged to perform a review or compilation should refer to statements Your directors have pleasure in presenting the (no.

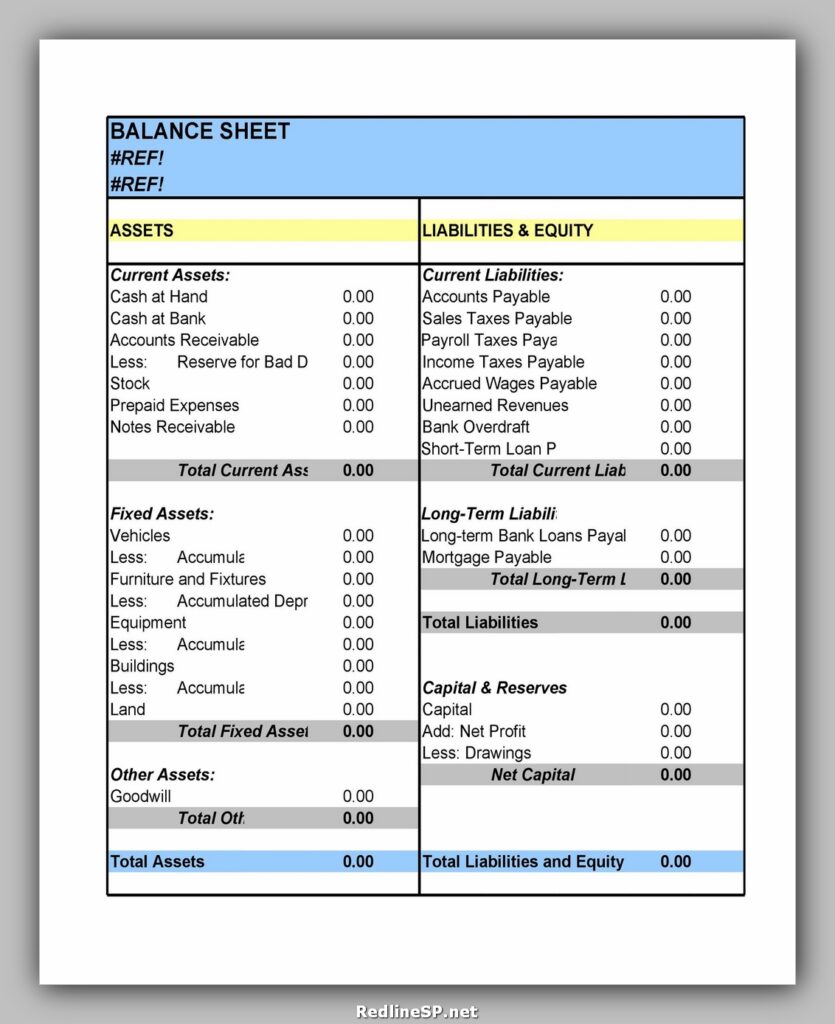

Any person or association of persons (including a partnership firm) any existing company. I am in urgent need of balance sheet format in excel for a section 8 company. Preparation of balance sheet.

Since, the agm is being held through both the modes i.e. Fn 1 paragraph 05 of arc section 90 review of financial statements aicpa professional standards and paragraph 13 of auc section 200 overall objectives of the independent auditor and conduct of an audit in accordance with generally accepted. And a statutory auditor must be appointed to audit the report, which is to be filed with th e roc.

An alternative to gaap is preparing financial statements under a special purpose framework, commonly referred to as other comprehensive basis of accounting (ocboa). One person company cannot be a sec 8 company. Trusts formed under indian trusts act 1880 however, section 8 companies are considered best due to its systematic constitutional framework.

(ii) a profit and loss account, or in case of company carrying out activity not for profit, an income and expenditure account for the financial year; Societies registered under section 20 of the societies registration act 1860 3. These statements should provide an accurate view of the company's financial health.

As per section 2 (40) of the companies act, 2013, financial statement in relation to a company includes (i) a balance sheet as at the end of the financial year; For the purpose of reckoning the quorum under section 103 of the companies act, 2013 3. The company’s financial performance for the financial year ended march 31, 2023:

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)