Inspirating Info About Income Statement Gains And Losses

The civil fraud ruling on donald trump, annotated.

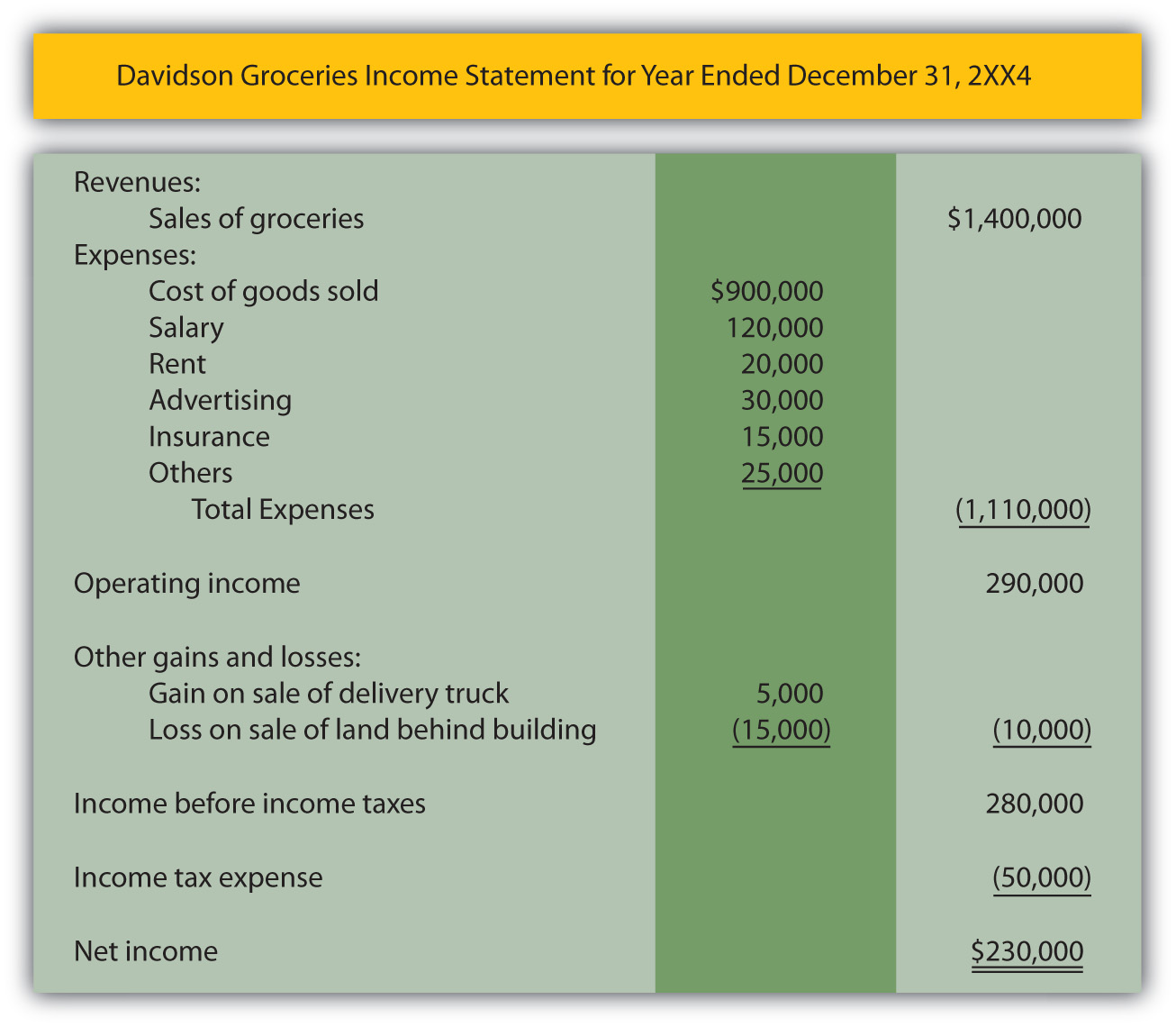

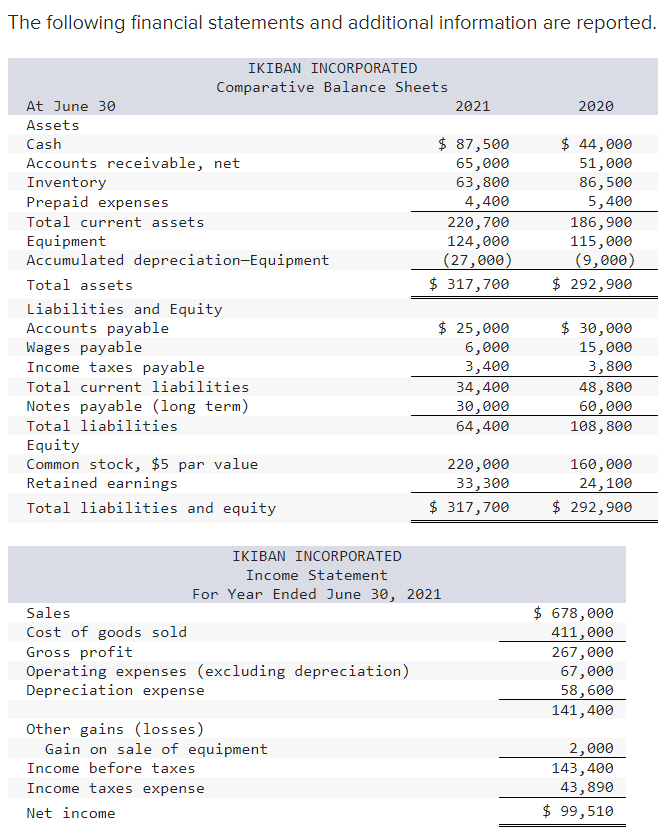

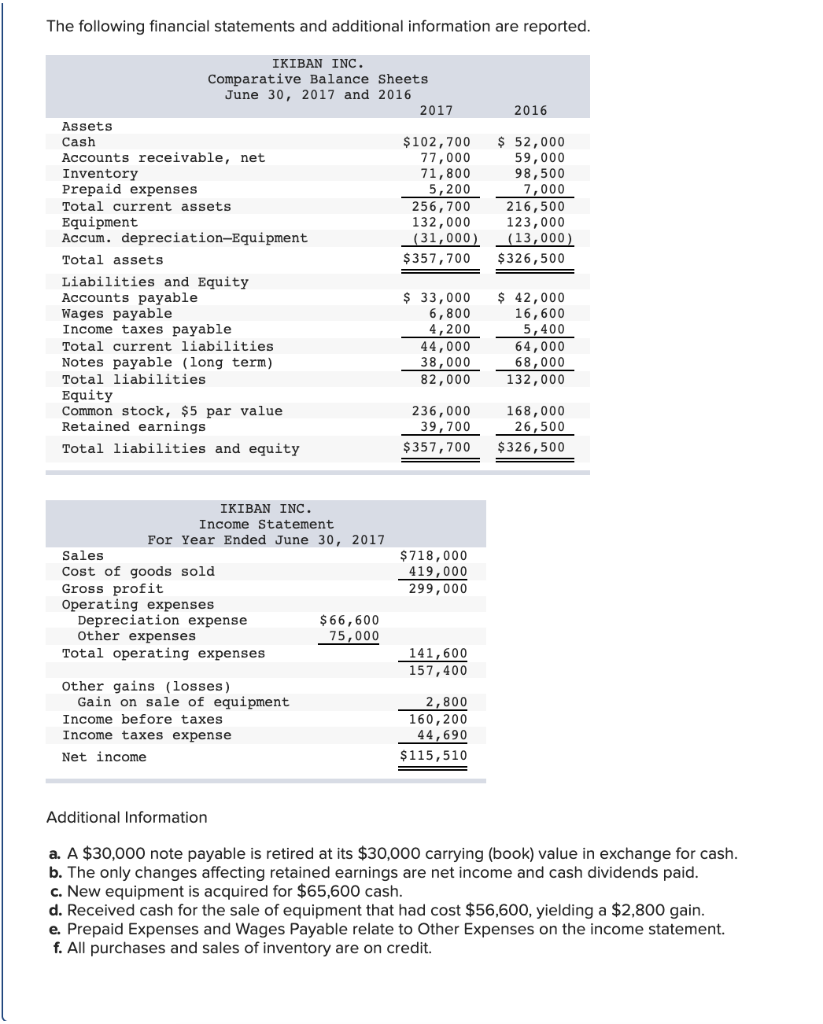

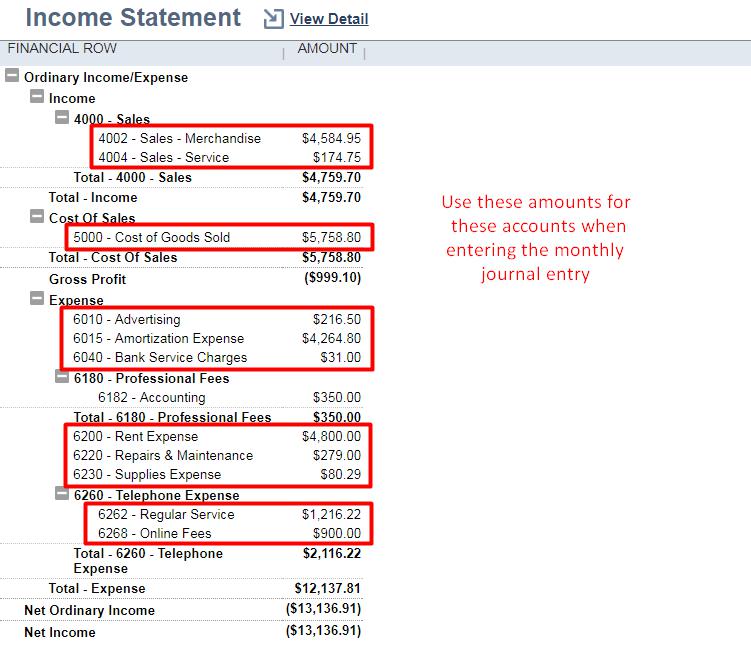

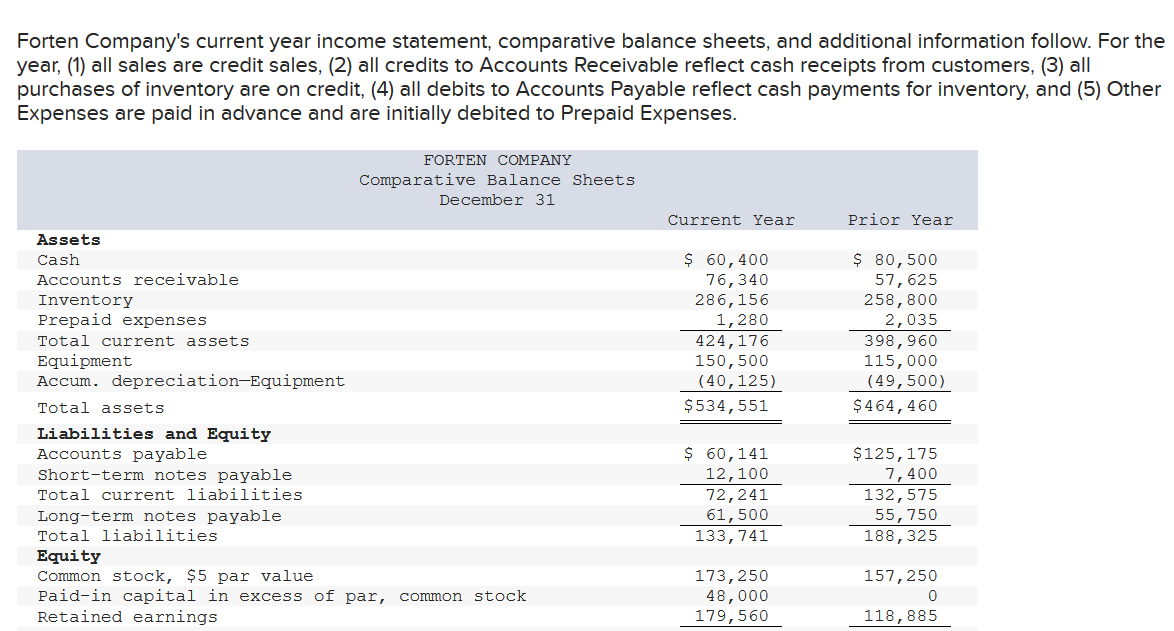

Income statement gains and losses. Gains directly impact our balance sheet and income statements, see the samples below to see how this property transaction impacts both. Trump was penalized $355 million plus interest and banned for three years from serving in any top roles at a new york. On the balance sheet, $100,000 will be subtracted from pp&e to write off the asset, while a gain of $50,000 will be reported on the income statement after taxes.

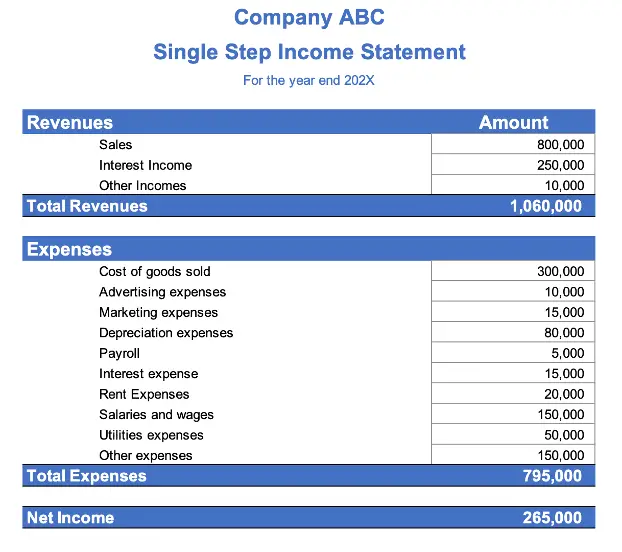

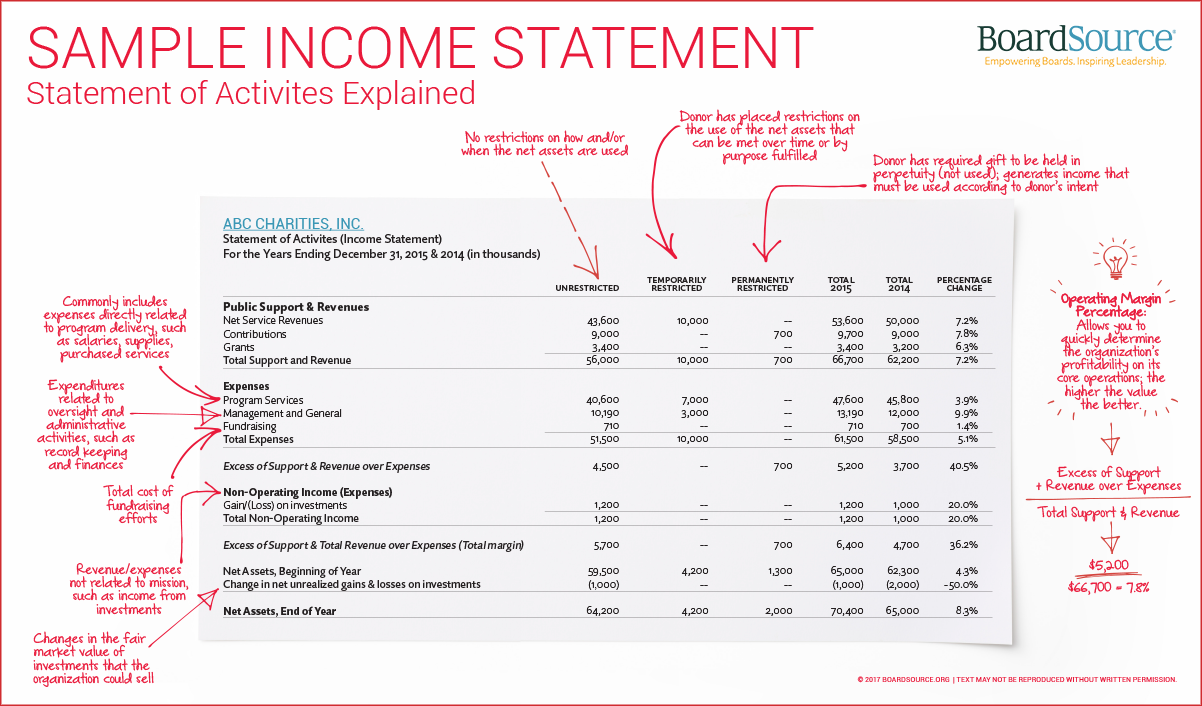

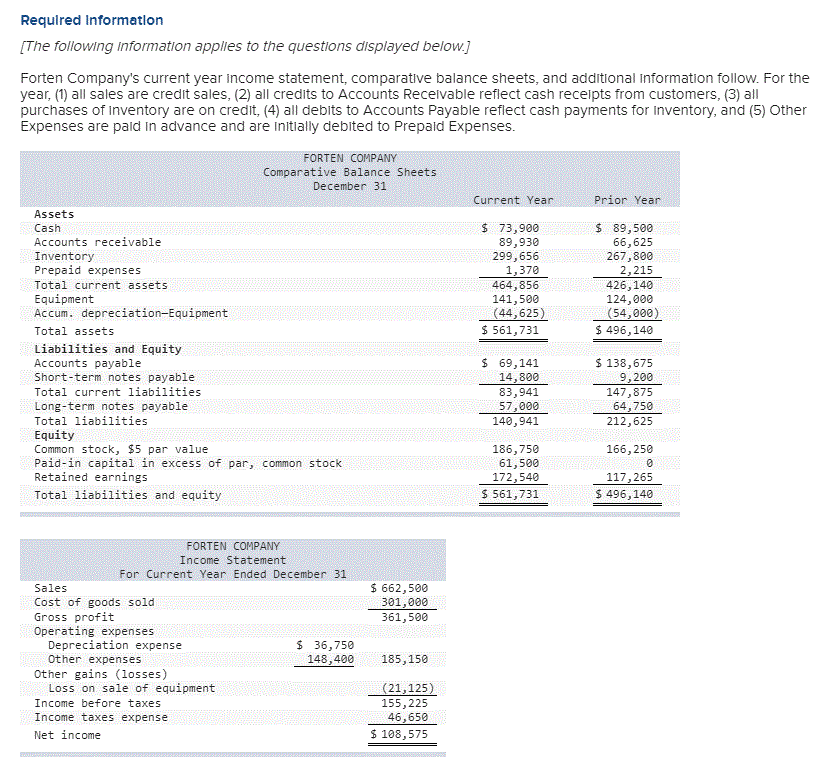

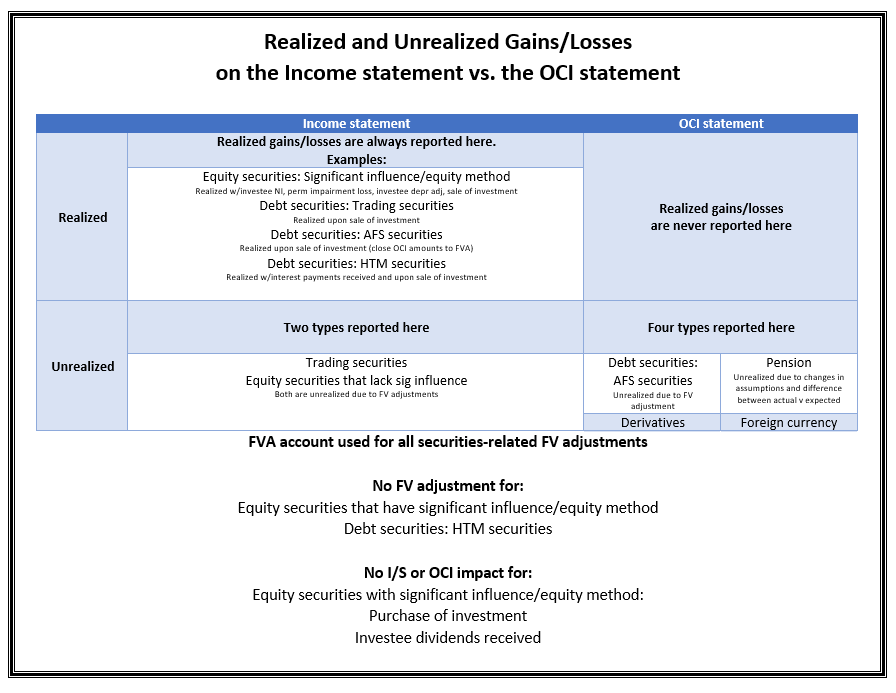

An income statement is a profitability report. It reports net income by detailing a business’s revenues, gains, expenses, and losses. When an income statement includes a second layer, that line becomes net income from continuing operations before unusual gains and.

Not only could it help determine the. An income statement is a financial statement that reports the revenues and expenses of a company over a specific accounting period. Cost of goods sold (cogs)

The purpose of an income statement is to show the profits and losses a company made over a specified period of time. Add up all your gains then deduct your losses. This year’s budget promises to be one of the most consequential in years.

This section of the statement deals with the income or losses that are the consequences of extraordinary events. The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time. The components of the income statement include:

Income statements are also known as statements of earnings, statements of income, net income statements, profit and loss statements or simply “p&ls,” among other names. An income statement is a financial statement detailing a company’s revenue, expenses, gains, and losses for a specific period of time that is submitted to the securities and exchange commission (sec). Sales on credit) or cash.

Income from operations of $652 million; It is also called the profit and loss statement. It records revenues, gains, expenses, and losses to evaluate net income.

Typical periods or time intervals covered by an income statement include: Sales, general, and administrative expenses; The income statement can either be prepared in report format or account format.

An income statement also goes by the names statement of profit and. At the most basic level, it shows profit and loss. An overview most companies report such items as revenues, gains, expenses, and losses on their income statements.

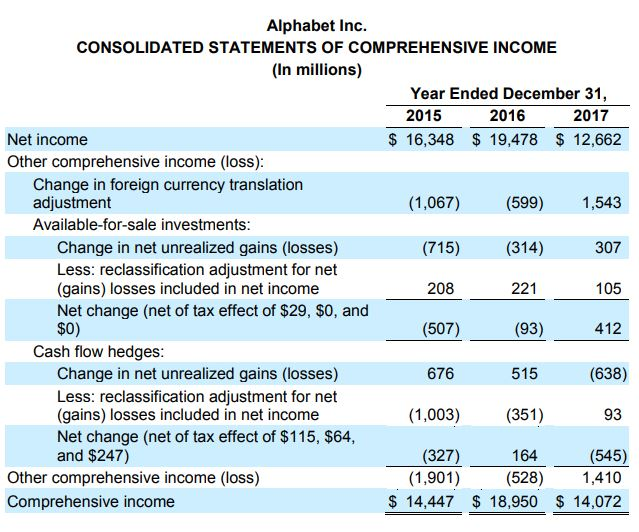

Comprehensive income is a statement of all income and expenses recognized during a specified period. It is used to ascertain the health of a business entity at a particular moment. What is an income statement?

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)