Underrated Ideas Of Info About Equity Method Cash Flow Statement

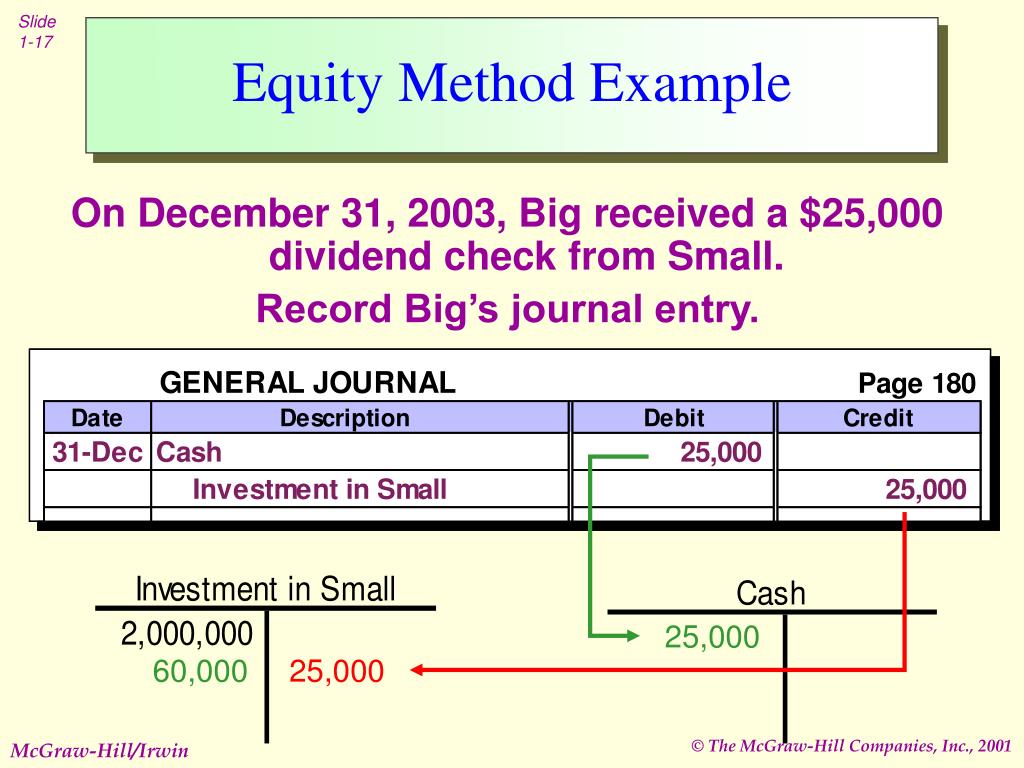

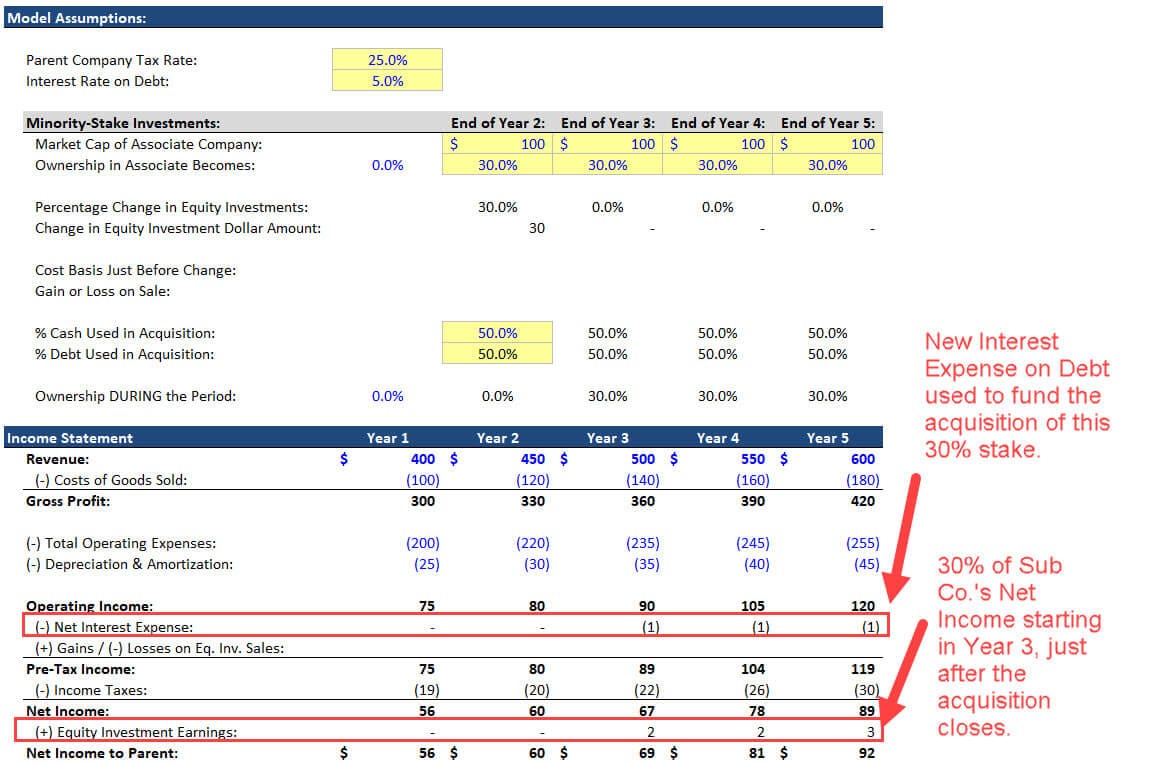

When the investor recognizes a share of the investee's net income, the investor must subtract.

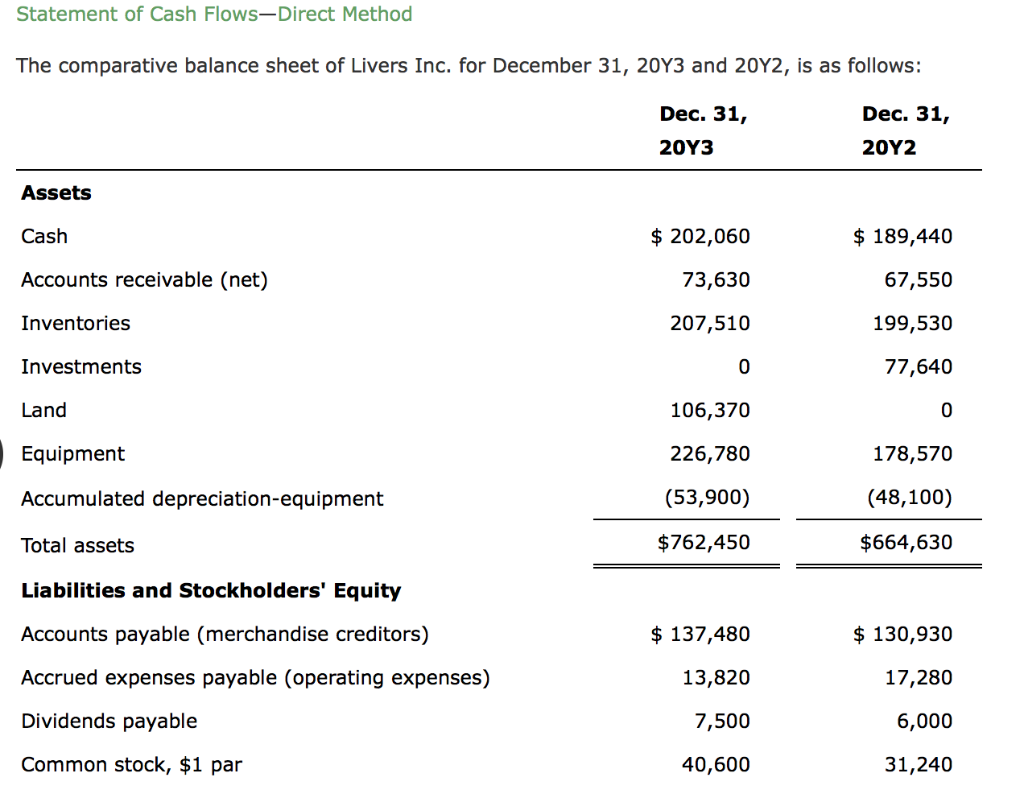

Equity method cash flow statement. Likewise, the investor’s share of earnings or. Here is one common formula for calculating cash flow to equity: Determine net cash flows from operating activities using the indirect method, operating net cash.

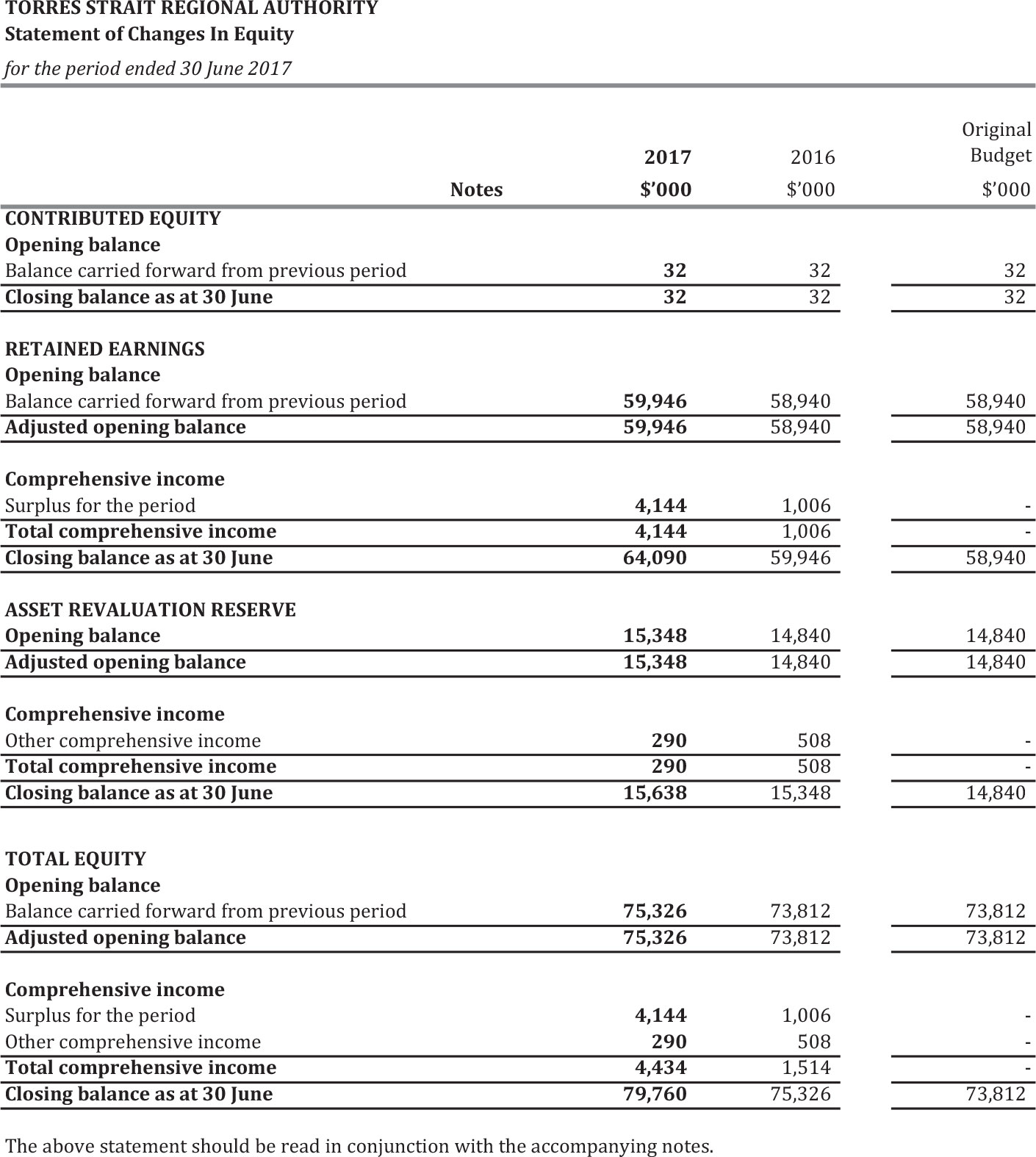

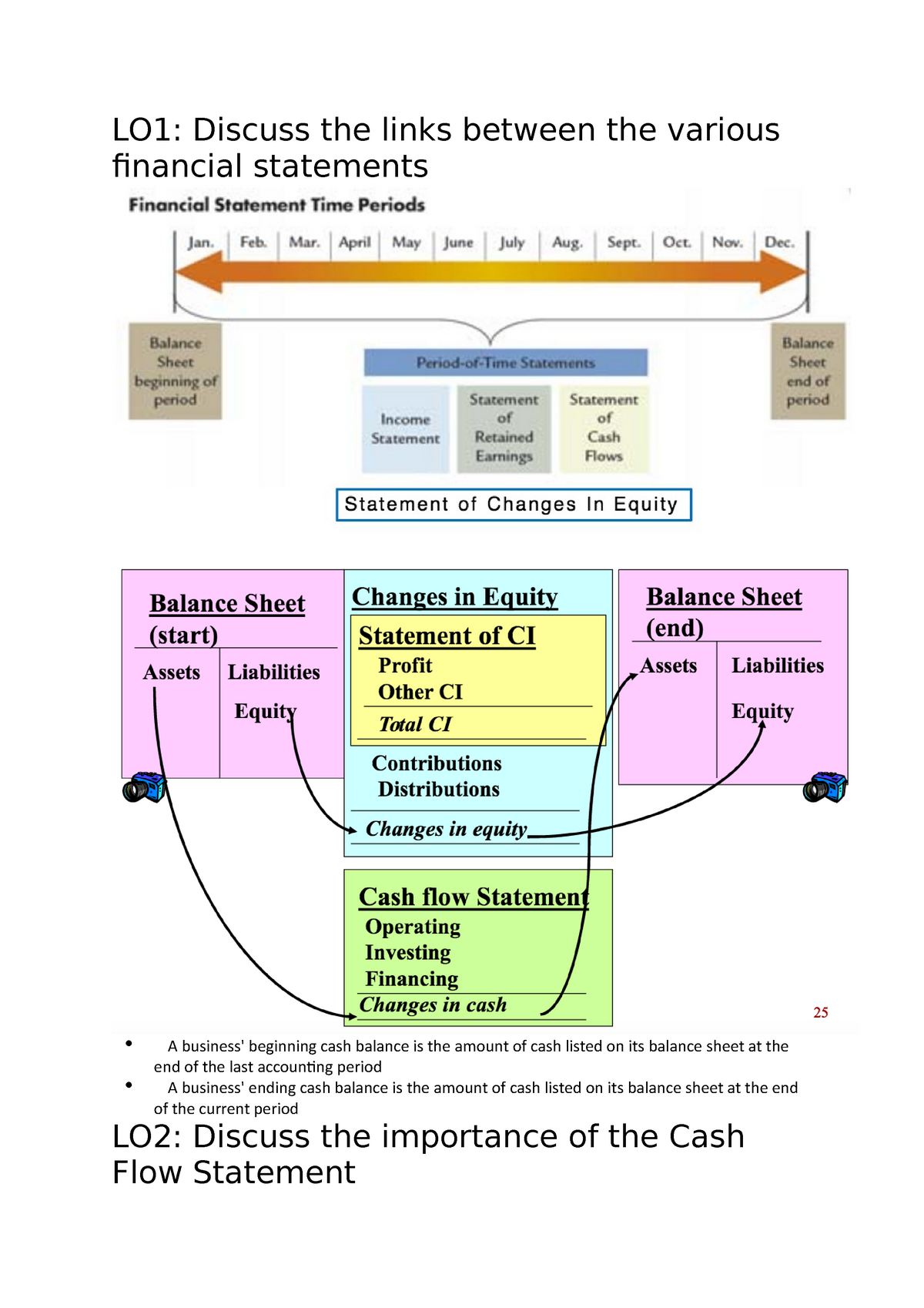

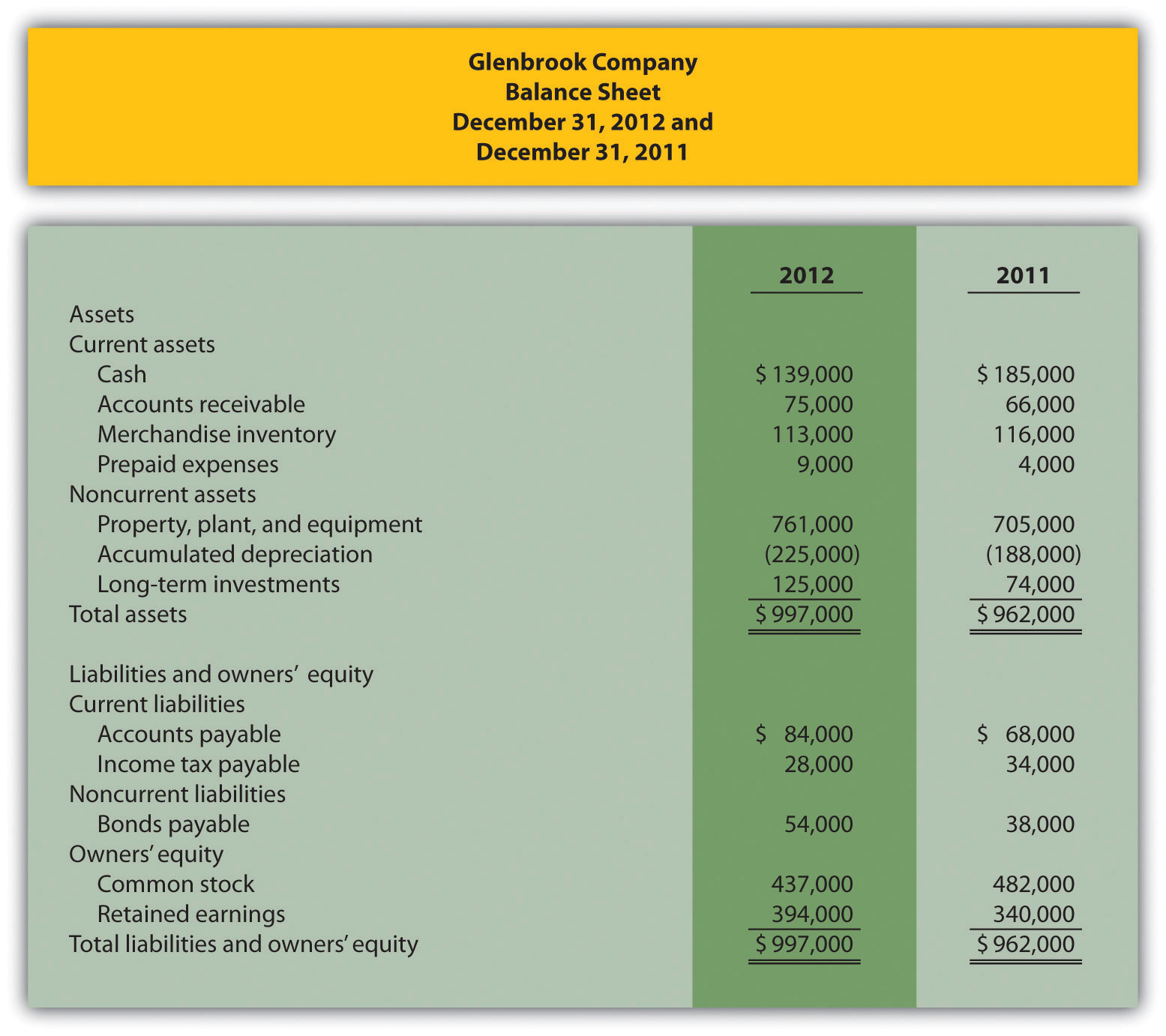

In equity method consolidation, the cash flow statement summarises the cash inflows and outflows related to the investor's equity investment in the investee. The statement of cash flows is prepared by following these steps: Generally, asc 323 requires an equity method investment to be shown on the balance sheet of the investor as a single amount.

It is used when the investor holds. Operating cash flow can be found in the cash flow statement, which reports the changes in cash compared to its static. A cash flow statement tells you how much cash is entering and leaving your business in a given period.

Start free written by jeff schmidt what is the equity method? Ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the. It can easily be derived from a company’s statement of cash flows.

The cash flow statement (cfs) is a financial statement that reconciles net income based on the actual cash inflows and outflows in a period. The equity method is a type of accounting used for intercorporate investments. The equity method of accounting, sometimes referred to as “equity accounting,” is the accounting treatment for one entity’s partial ownership in another.

Along with balance sheets and income statements, it’s one. The investor must use the equity method to report these types of investments in their financial statements; Whether it’s a rapidly growing startup or a mature and profitable company.

The cash flow statement. For example, cash flow statements can reveal what phase a business is in: A measure of equity cash usage, free cash flow to equity calculates how much cash is available to the equity shareholders of a company after all expenses,.

The direct method of presenting the statement of cash flows presents the specific cash flows associated with items that affect cash flow.