Lessons I Learned From Tips About Single Audit Findings

Certifications show sub pages for certifications.

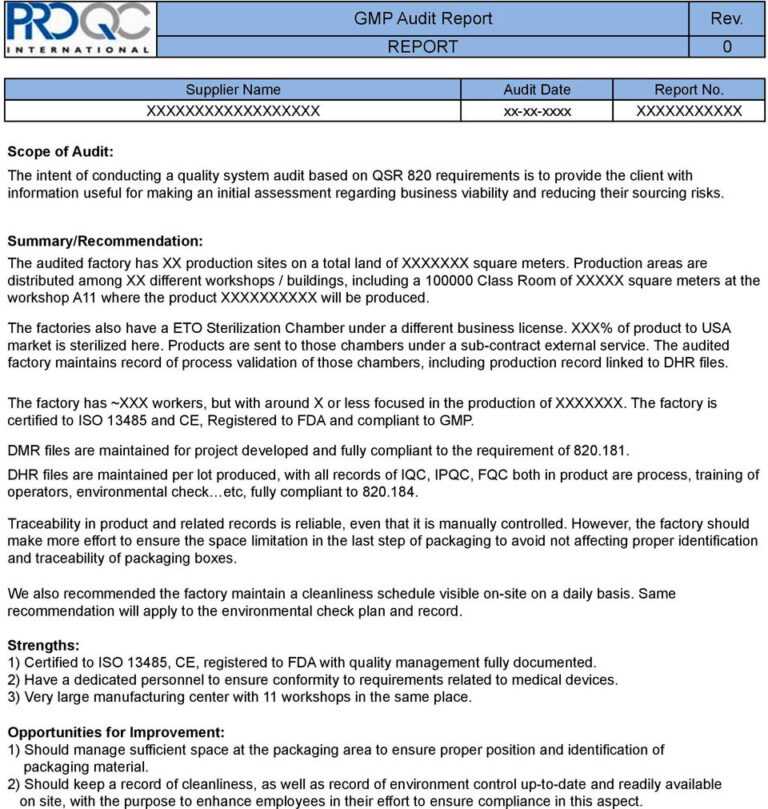

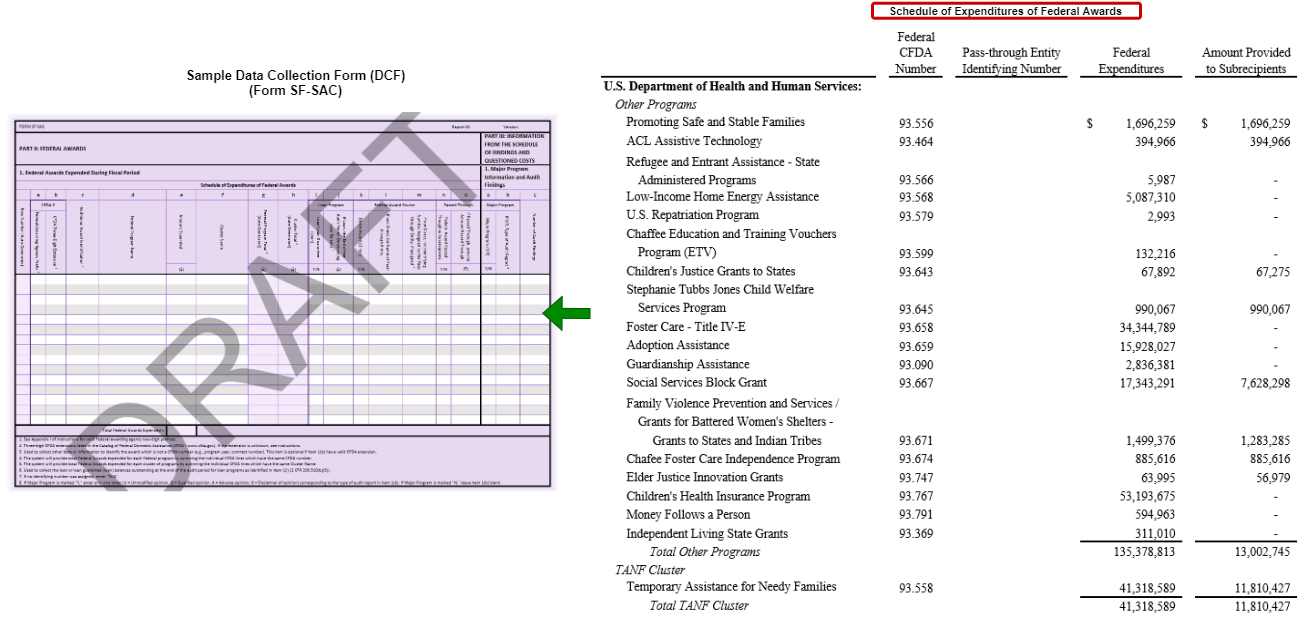

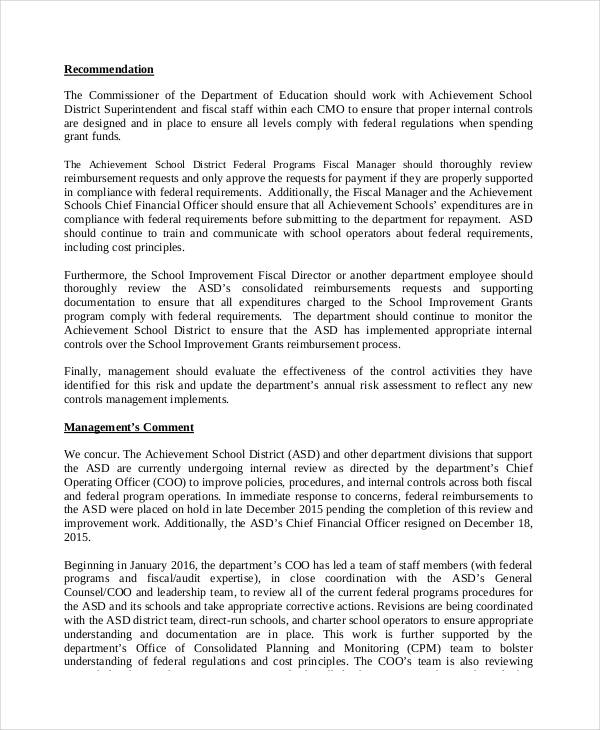

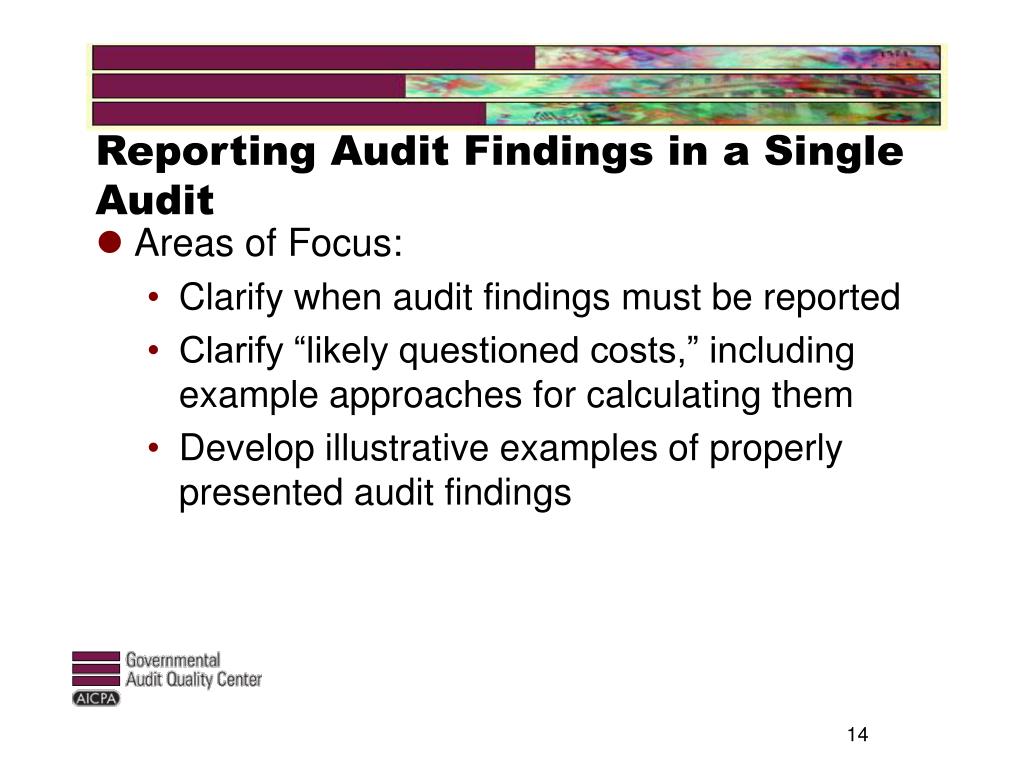

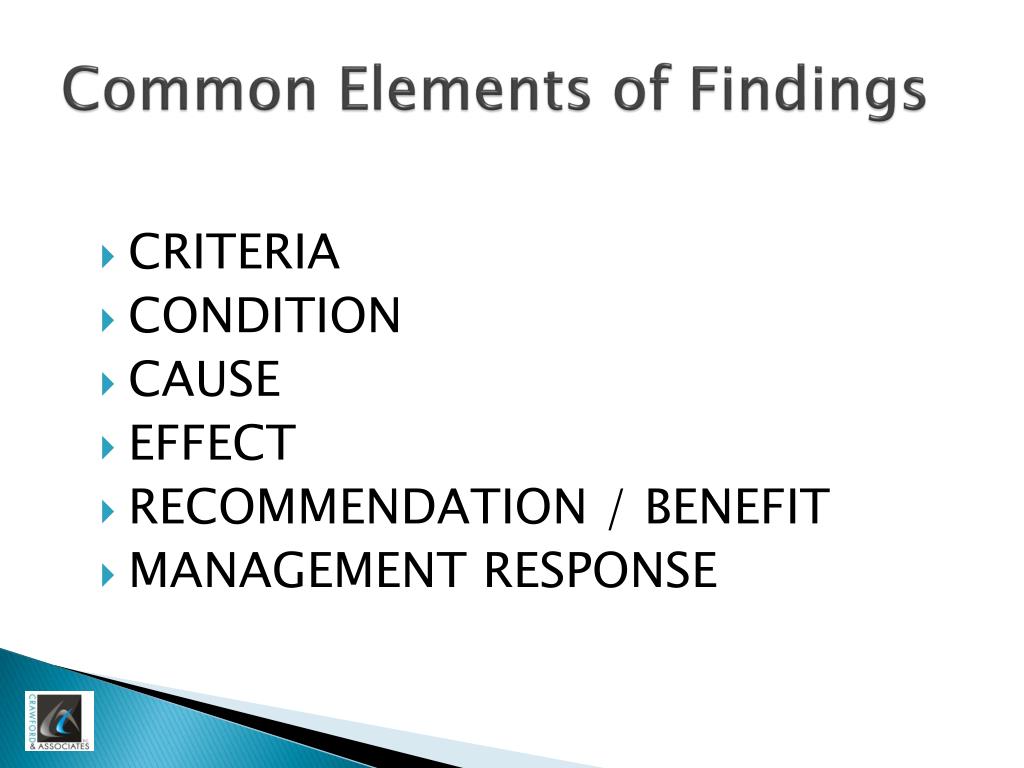

Single audit findings. In this installment of our common single audit findings and remediation series, we take a look at the importance of—and missteps in—subrecipient monitoring. Best practices and practical tips for evaluating and reporting single audit findings; Federal agencies with current or prior year audit findings on direct awards.

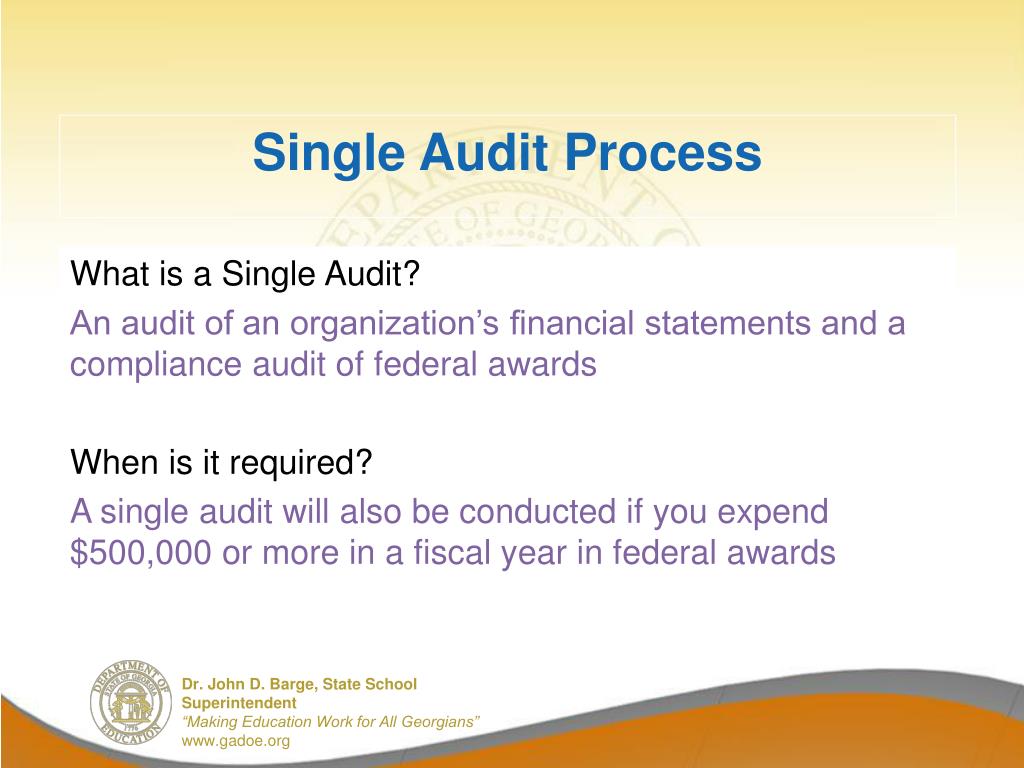

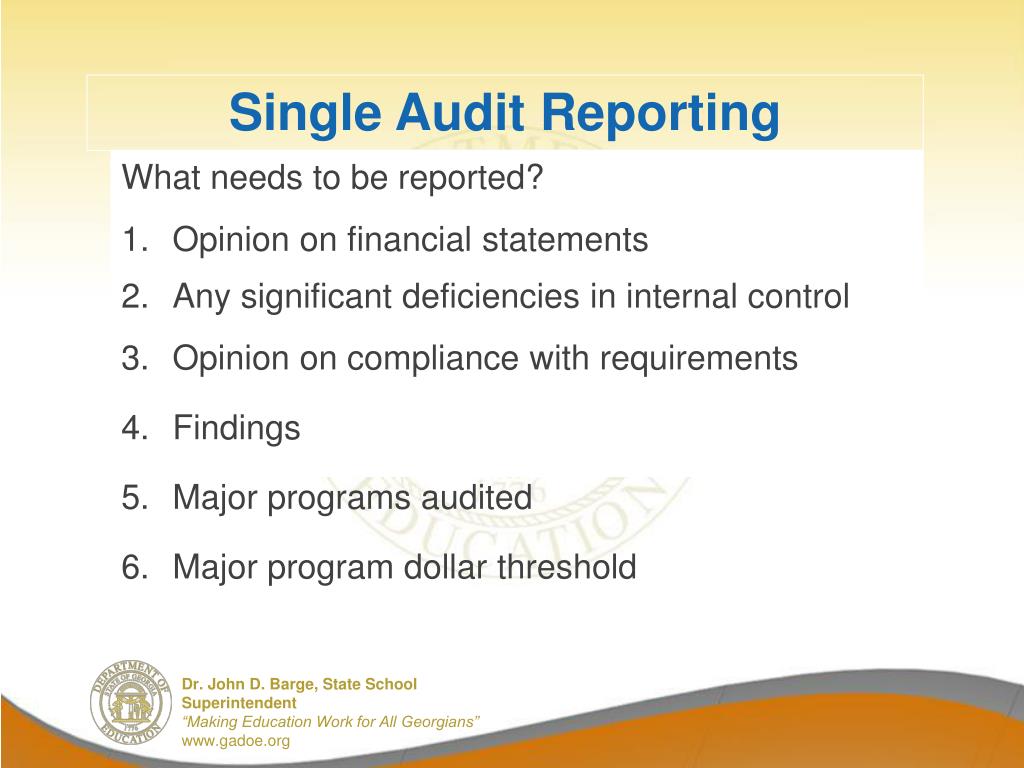

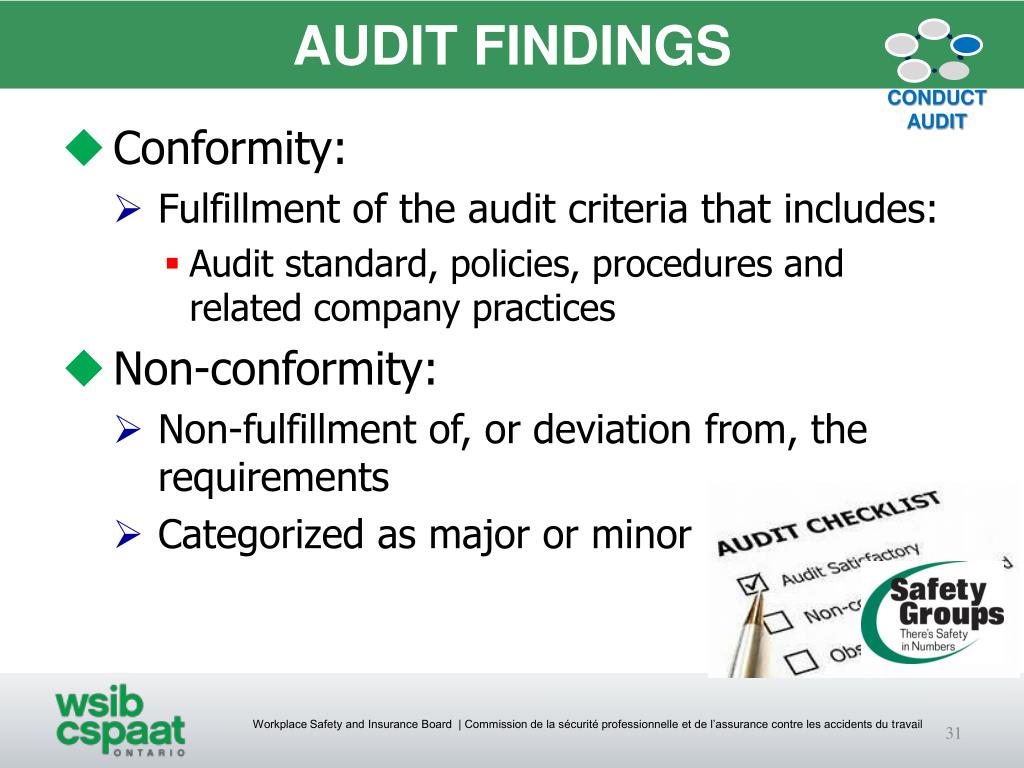

Some of the most common single audit findings fall into the following categories: A single audit is an audit of the award recipient's expenditure of federal awards and of its financial statements and can identify deficiencies in the award. Select all | unselect all.

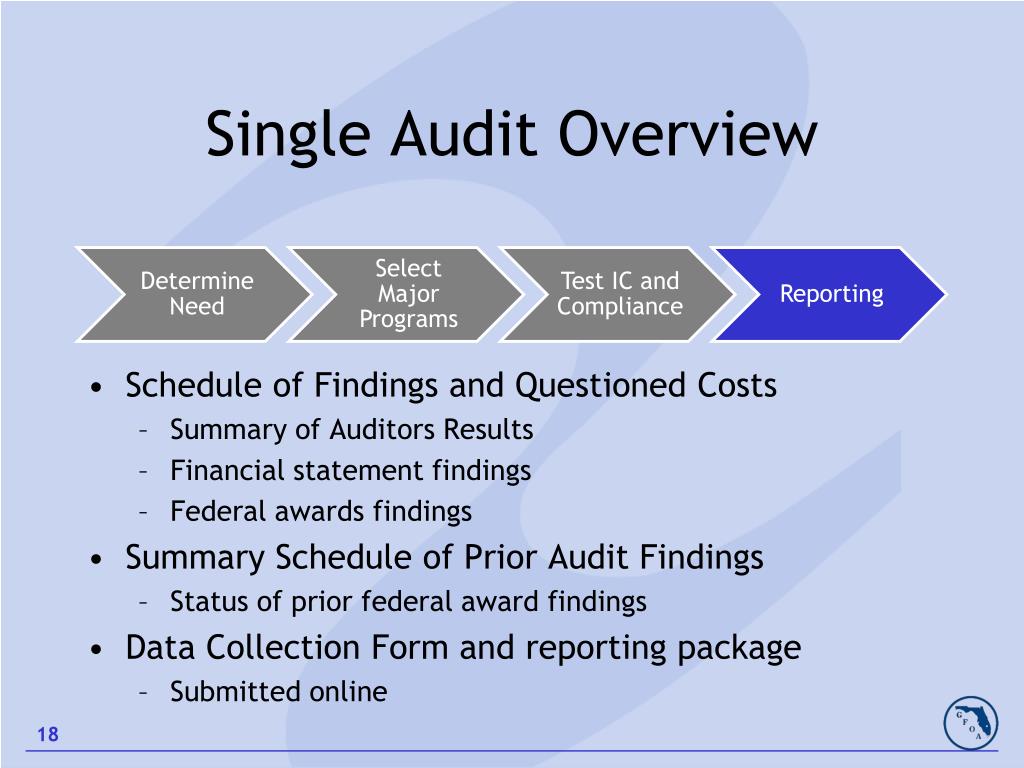

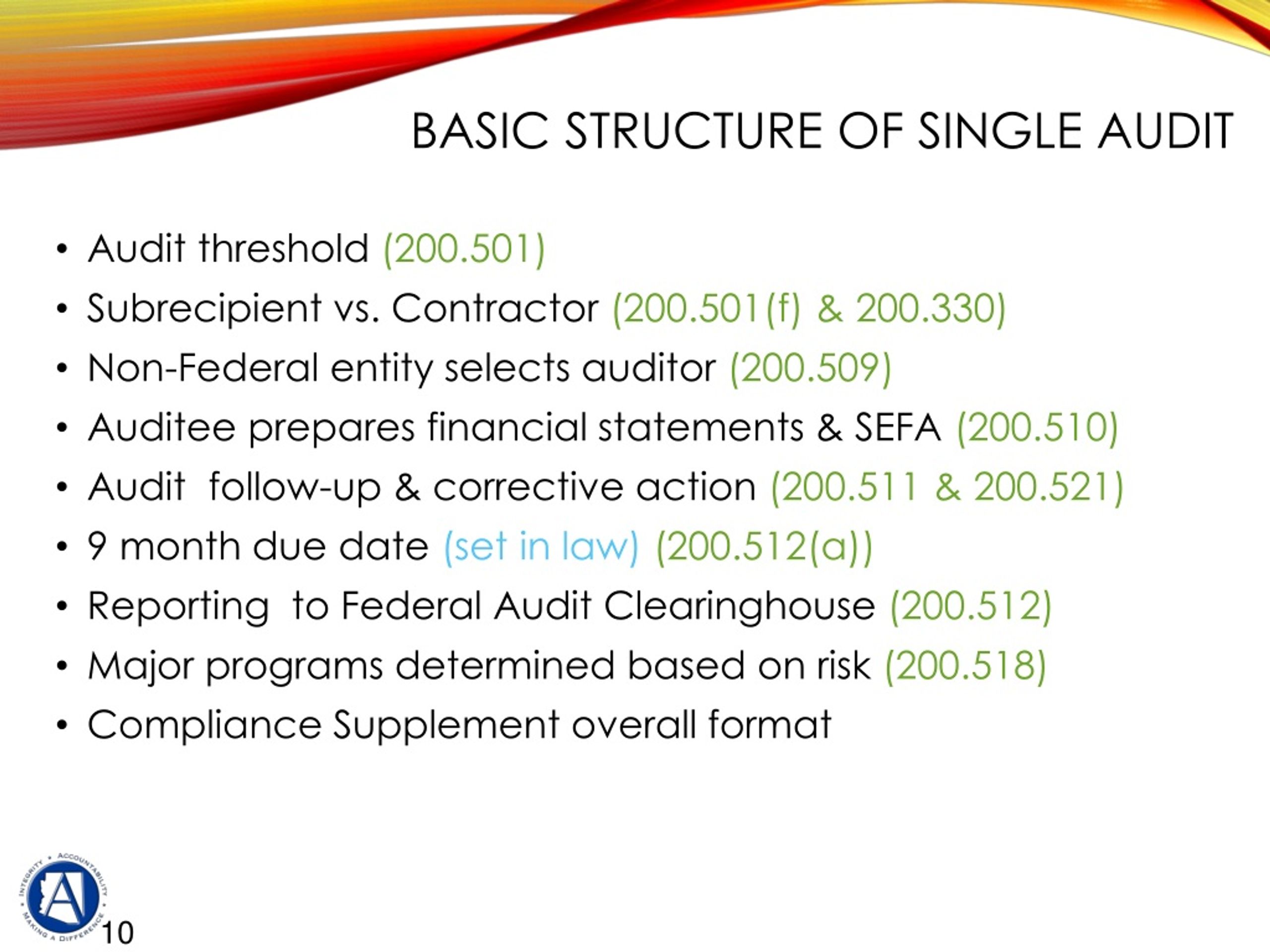

Prior audit findings, is intended to help auditees subject to a single audit to comply with the requirements of title 2 u.s. Enacted to streamline and improve the effectiveness of audits of federal awards and to reduce the audit burden on states, local. By undergoing a single audit, organizations can strengthen their financial management practices, enhance transparency, and maintain the trust of funding.

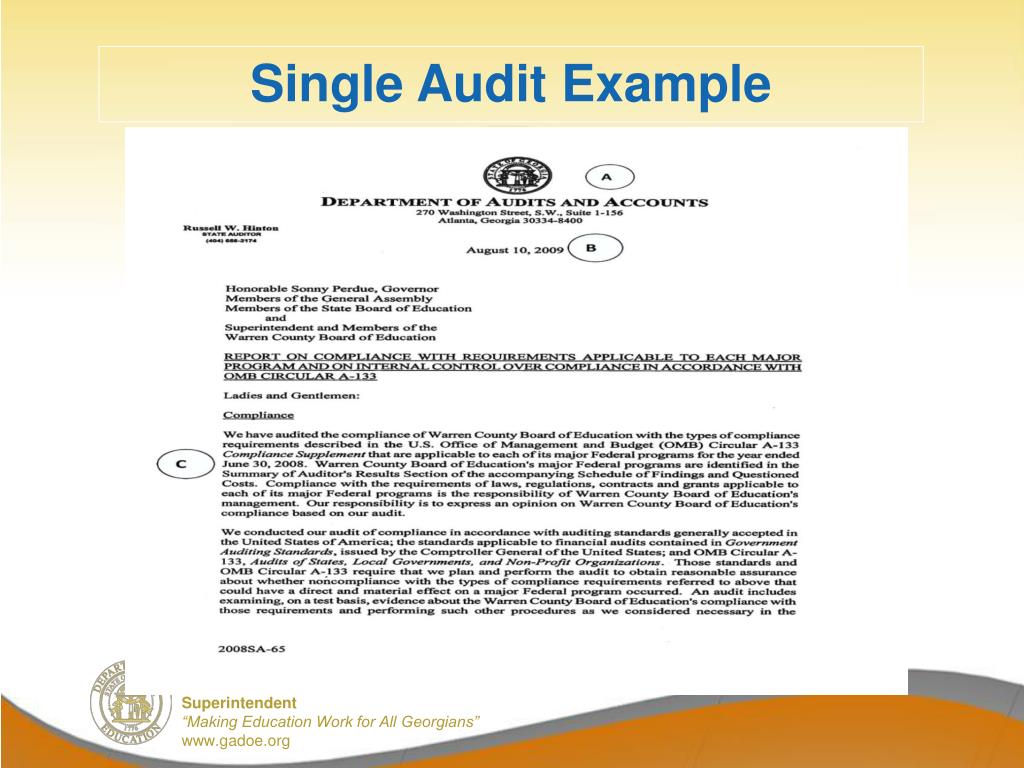

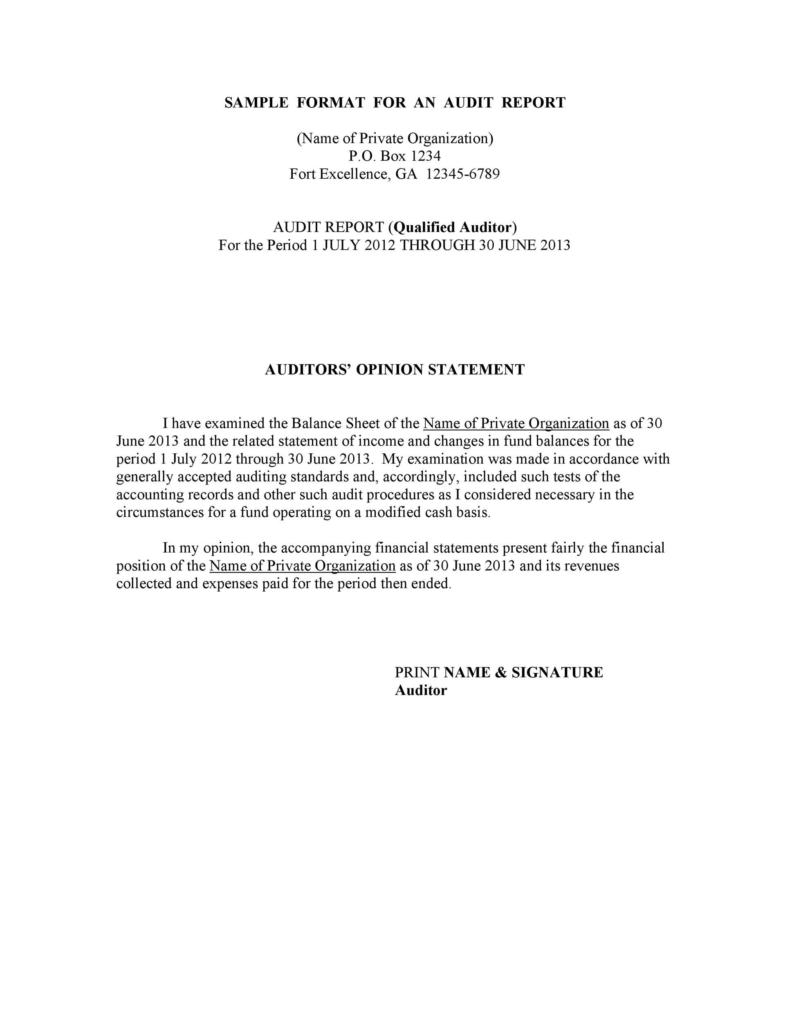

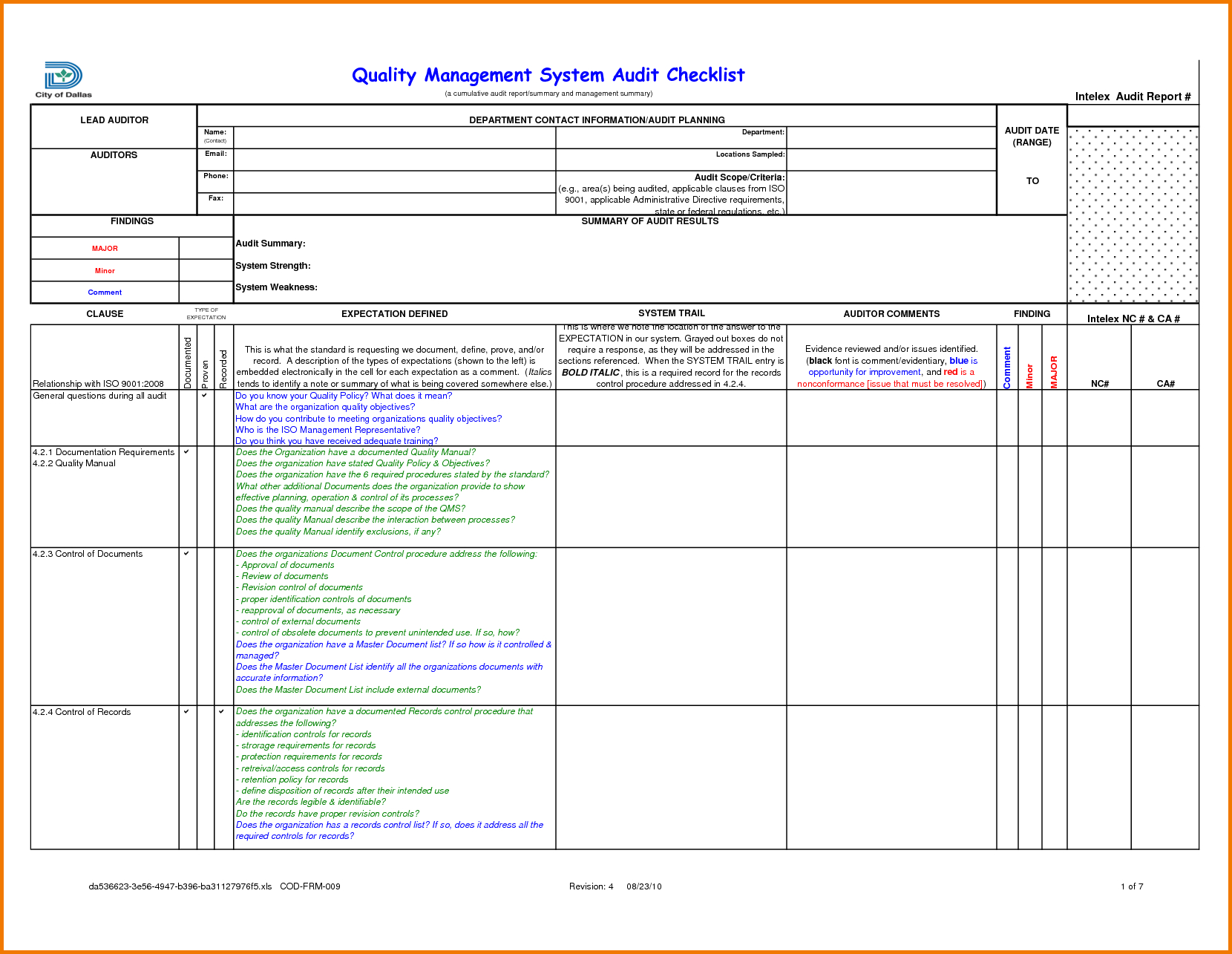

A single audit includes an audit of both your organization’s financial statements and compliance with federal award requirements for those programs identified as major. The global internal audit standards. Furthermore, our study includes the full complement of audit findings produced by the single audit, and we separately consider the impact of extreme measures of low.

Single audit act amendments of 1996. Code of federal regulations (cfr) part 200, uniform. The aicpa governmental audit quality center provides these illustrative reports for a single audit under the uniform guidance as a public service.

Our common single audit findings and remediation series outlines common single audit findings and how to ensure your entity remains in compliance. A nonprofit or governmental organization with federal expenditures in excess of $750,000 is required by law to have a single audit performed, which includes an.